SEI - MACD Liquidity Tracker Nailed the Long, Now Flipping ShortThe MACD Liquidity Tracker Strategy just clocked a +103% long trade on SEI before momentum flipped and a short signal fired on this 8H chart.

The previous long captured a textbook impulse — clean MACD crossover, EMA alignment, and breakout confirmation. Now price is back under the 50/100 EMA, and MACD is turning decisively bearish.

📌 What’s notable:

QTP Strategy caught the entire move from ~$0.19 to ~$0.38

Fresh short entry printing as structure breaks down

MACD histogram and signal lines aligning with bearish momentum

If trend continuation plays out, this short could target the $0.24–0.22 zone. Alternatively, a reclaim of $0.30+ would invalidate.

Built-in logic helps filter out chop, so we’re watching to see if this becomes the next clean leg — or a trap before reversal.

—

Test it yourself with our preset configs or tweak for SEI’s volatility.

Ready for this reversal?👇

SEIUSD trade ideas

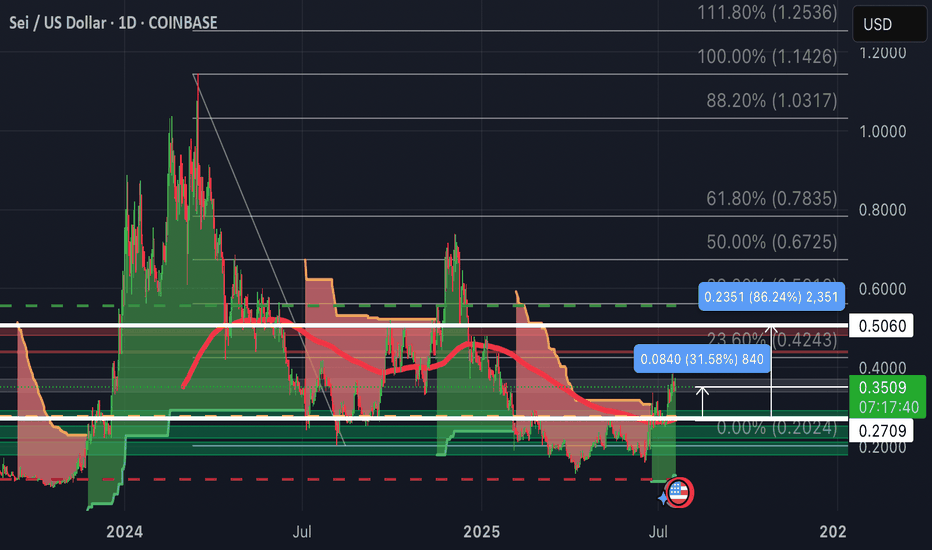

SEI-Update:Up 31% so far as we wait for the big retest back @ $1Entry was at $0.27, made a dip below this support line then recovered.

Macro retest would be 100% Fibonacci Correction back to $1.00.

First we shall break thru the $0.50 Resistance (will be a 86% gain).

Then push up past 50% Fibonacci at $0.6725, then $0.7835.

SEI - I love the look of the chart. NYSE:SEI is a new crypto I have come across. Fundamentals look great and the chart looks even better.

I have just opened my first trade on it.

It should target $0.58 to $1.23 this cycle with a few stops along the way highlight in green.

Let's see how it plays out.

Good luck to everyone involved in $SEI!

SEI up to 221% ROIFrom a total of 17 technical indicators, 12 calls to buy, and 3 to sell, the prediction sentiment short-term is bullish based on technical price analysis. The first major uptrend resistance for SEI is at the $0.3001 level, it needs to close above that level to continue to move higher, and bottom support sits at $0.2565. So if the price falls below $0.2565, we may see the price go even lower. If SEI closes above $0.3001, it could rise to the next resistance level at $0.3368.

On the daily chart, exponential moving averages show a bullish signal. Sei price currently sits above all 10,20,50,100, and 200-day EMAs.

Long entry: 0.20691

TP: 0.66447

ROI: 221.13%

SEI Turns Bullish After A Zig-Zag CorrectionSEI Turns Bullish After A Zig-Zag Correction, as we see it sharply bouncing from projected support that can send the price higher by Elliott wave theory.

SEI with ticker SEIUSD is waking up exactly from the channel support line and equality measurement of waves A=C, which is perfect textbook support for subwave (5) of an impulse into wave C of an ABC zig-zag correction. It's actually nicely and impulsively rising for wave 1, so after current wave 2 pullback, be aware of a bullish continuation within wave 3 of a five-wave bullish cycle, especially if breaks above 0.30 first bullish evidence level.

Sei (SEI) is a high-performance Layer 1 blockchain designed specifically for decentralized finance (DeFi) and decentralized exchanges (DEXs). Launched in August 2023 by Sei Labs, it features innovations like Twin-Turbo Consensus for fast block finality, Optimistic Parallelization for high throughput, and SeiDB for efficient transaction handling. It supports EVM compatibility, enabling seamless deployment of Ethereum-based apps. The SEI token is used for transaction fees, staking, governance, and liquidity.

SEI breaks the downtrend targets 30cThe SEI network is currently displaying positive price movement after recently breaking out of a downward trend channel that had been in place since the peak on December 5th. On the daily chart, it has been trading sideways within the upper channel, indicating a potential retest of that breakout. However, the momentum isn't particularly strong, especially since Ethereum, the frontrunner in the altcoin resurgence, isn't exhibiting explosive upward movement either.

Should the situation shift and Ethereum regain its leading position, I believe that many struggling smart contract platforms, which have seen their prices plummet by over 80%, could also experience a robust recovery.

If Ethereum manages to climb back into the $2,000+ range, I anticipate that SEI will reach its target on the chart, which is approximately 30 cents.

SEI will reach at 1.4$

Price Movement and Trend:

The chart shows a significant upward movement starting around mid-2024, peaking at a high (likely around $1.14-$1.20 based on the vertical scale), followed by a sharp decline.

After the peak, the price enters a consolidation phase with lower volatility, fluctuating around the "Accumulation zone" marked at approximately $0.196746.

A recent upward trend is suggested, with the price appearing to approach or break above the $1.143922 level (labeled as "Target 1.4$"), indicating potential bullish momentum.

Accumulation Zone:

The "Accumulation zone" is identified around $0.196746, which seems to act as a support level where the price has stabilized after the decline. This zone likely represents a range where buyers have been accumulating the asset, potentially preparing for the next upward move.

The prolonged consolidation in this range suggests a period of low selling pressure and possible buying interest.

Target 1.4$:

The chart highlights a target price of $1.4, with the current price nearing $1.143922. This suggests that the analyst or trader anticipates a potential rise to $1.4 if the current upward trend continues.

The upward arrow and the proximity to this target indicate a bullish outlook, possibly driven by a breakout from the accumulation phase.

Volume and Candlestick Patterns:

While the chart doesn’t explicitly show volume bars, the candlestick patterns (green for bullish, red for bearish) indicate periods of buying and selling pressure. The recent green candles suggest increasing buying interest.

The sharp drop after the peak and the subsequent consolidation could indicate profit-taking followed by a base-building phase.

Timeframe and Context:

The chart covers a period from mid-2024 to March 2025, with the current date being March 14, 2025. This long-term view suggests the analysis is focused on a medium-to-long-term trend rather than short-term fluctuations.

The upward trajectory toward $1.4$ might be based on technical analysis (e.g., resistance levels, Fibonacci extensions, or historical price action), though specific indicators are not visible.

Interpretation:

The chart suggests that SEI/USDT has undergone a significant rally, followed by a correction and consolidation in the accumulation zone around $0.19-$0.20. The recent upward movement toward $1.14 indicates a potential breakout or continuation of an uptrend.

The target of $1.4$ could represent a resistance level or a projected price based on the analyst’s strategy (e.g., a measured move from the accumulation range).

Traders might interpret this as a buying opportunity if the price holds above the accumulation zone, with a stop-loss potentially set below $0.19, aiming for the $1.4 target.

SEI: Is There a Chance for an Upside Reversal? Altcoin AnalysisSEI: The price has not provided a clear indication that a substantial low has formed. A break above $0.337 is needed for an indication that a low of sorts has formed. However, as long as the rally is not in 5 waves and the foundation remains corrective and is based on 3-wave structures, any move to the upside could simply be a wider corrective rally. I do not see a clear pathway for higher prices at this point, but the area around $0.20 offers some support. Below this level, $0.136 and $0.09 are the next support levels.

SEI - good long zone, needs to flip .26 as supportSEI is in a great zone of interest right now under .26 cents.

If we can break the blue downtrend, and build .26 cents as support, we might have something here. The next milestone would be building .33 cents as support.

Right now SEI is a good swing trade to .26 cents, and .33 cents.

If we actually do get a moonshot from SEI, then I see anywhere from 1.80-ish to $3.85 as a nice super bullish profit taking zone. That's thinking ahead to later this year if BTC didn't already put its top in.

That's all for now!

Thank you!

SEI - Time to look after WLF purchased With Trumps WLF buying just under $200K worth of SEI let us take a look. Remember WLF is interested in decentralized finance protocols and lending.

www.tradingview.com

Coming off macro low support and volume profile VAL.

MACD and RSI getting more bullish.

Plenty of take profit zones evenly spaced out by $0.10 increments is very attractive.

SEI to 10XWhat Is The Sei Network?

Sei is an innovative open-source Layer 1 blockchain designed to enhance the trading experience of digital assets.

Renowned for its remarkable speed, the Sei Network stands out as one of the fastest blockchains available, capable of executing an astonishing 12,500 transactions per second with a block finality time of just 380 milliseconds. This incredible efficiency positions Sei as an ideal platform for developing decentralized exchanges, gaming finance (GameFi) applications, and NFT marketplaces.

Built on the Cosmos SDK framework, Sei enjoys interoperability with the Inter-Blockchain Communication Protocol (IBC). This allows SEI to effortlessly transfer data and tokens across various IBC networks while maintaining its distinct foundational architecture.

KEY INSIGHTS:

— The Sei Network operates as a Layer 1 blockchain within the Cosmos ecosystem, focusing on providing robust trading infrastructure tailored for decentralized exchanges and marketplaces.

— With its innovative twin-turbo consensus mechanism, Sei enhances blockchain performance and achieves block finality in just 380 milliseconds.

— Additionally, the network features an integrated order book and matching engine, empowering developers to build scalable, efficient, and user-centric decentralized exchanges.

SEI: One of the better looking layer 1 opportunities currentlyMy apologies, as I am late posting this, but SEI does look like one of the better new-ish layer 1 opportunities currently.

The .33 level was an area of interest for me, as it was right at the bottom of this falling wedge that we are in, it is the .618 from its most recent big advance, and it is also the area where it launched its self from after retracing for its big advance from its last big upward move.

We are currently not very far from that price point sitting at .36 right now. I would buy as close to the bottom of the wedge as possible, or wait for it to break out of the wedge and gain it as support.

If the falling wedge gets invalidated, the next area that SEI would probably head to would be the .25 cent area.

If we do break out of the wedge to the upside, .39 cents needs to be established as support.

Targets: .71, 1.90, 3.00, and 4.65.

Anyway, I do think that this is one of the better opportunities for newer layer 1's right now.

Thank you!

SEI - Breakdown Target ReachedOur post on SEI from December 8th, we were monitoring a breakdown and retest from its triangle pattern. In that post, I said I would make a follow up once the breakdown target is reached and here we are! Also, Here is a link to that previous prediction:

Our measured move breakdown target was $0.44-$0.45. Price is a little lower than that now but the first target has been reached. If we do drop lower we could see $0.40 followed by support at the 200MA.

These targets were also mentioned in this post if price was to break the $0.50 level (which it did). Hope these charts help!

SEI - Important LevelSei is also at an important level. Looking at the 8H chart price is trying to from support. Price is currently being supported by the 8H 200 ma, price has created an 8H doji the could signal a reversal to the upside, price is being supported by the 0.618 golden ratio around the psychological $0.50 level, and the RSI could be forming a slight bullish divergence if we get a bounce here.

On the contrary, if price fails to hold this level as support, we could see a swift move to0 the $0.44-$0.45 level and potential a test as low as $0.40. Keep all these targets in mind if we do see a breakdown, but for now watch and see if buyers step in at this level.

[SEI] possible (+43%) to (+72%)SEI is looking very strong, it is above anchored vwap from 2024 highs and above value area high from the aug lows to now, if it stays above $0,55 will be very good to reach higher prices.

The target is between fibonacci retracement/extension levels, value area high from jan to apr 2024.

TARGET: $0,85 to $1,02 up to (+72%)

SEI - Big Move Ahead? Hi,

This is my new analysis for SEI.

After having been in this correction from mars 16th (275 days) at one point we were down 82%, we are now seeing good signs on the chart.

On the right side you see Solana from 2021 after a big correction (down 77%).

If we begin in the bottom structure we see good similarities for both SEI and Solana.

Right now we are testing big Fibonacci levels on SEI. Recently we tested the 61.8% FIB level and we got rejected (31% down). If we look at the Solana chart from 2021 we see that the same thing happened with Solana at 61.8% FIB level (yellow circle) and got rejected (down 36%).

Solana was stuck under the 61.8% FIB level for around one month and after that the price went up to 4.236 FIB level. The last resistance for Solana was 61.8% FIB.

If we expect the same thing happen to SEI so we are getting ready for targets around 4.236 FIB level and the price will probably hit 4.20-4.50$.

SEI.usd eyes on Fiddy cent: Round number + proven Golden GenesisSEI is about to retest a Golden Genesis fib at 50 cents.

Several recent PING's were heard even by the Fib-Blind.

The reaction here will say a lot to a lot of people/homey.

Looking for a PING bounce to confirm support loudly.

"Ping" is from "Give me a ping Vasili, One Ping Only".

We want an exact bounce that you can almost HEAR.

Sei ; longterm look Sei will definitely break it’s ATH in the coming months, there’s a resistance in red and in case we clear it in weekly we aim for ath , i have an accumulation box but not hundred percent sure we fill it , we got two main target which 2.4 to 3 will be our target , again let’s see how it goes and after measuring the speed I’m gonna update it .