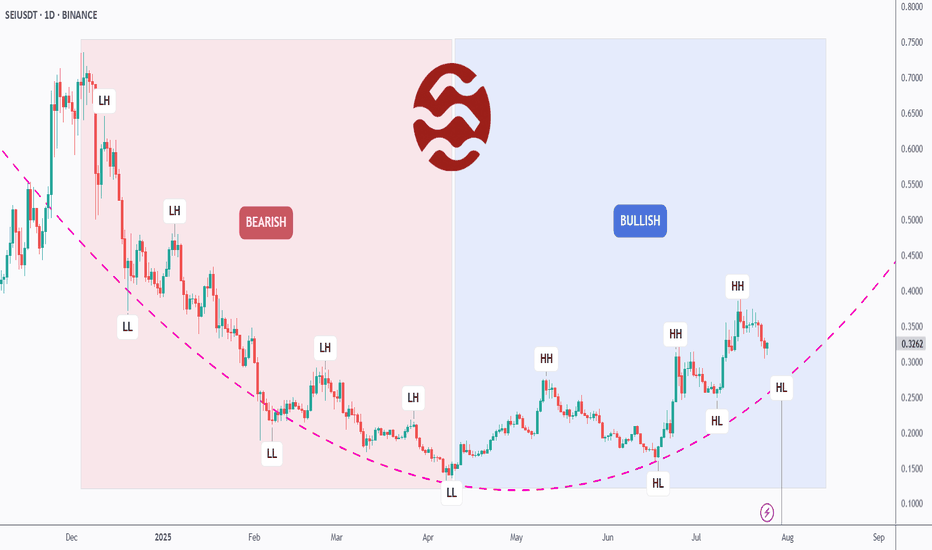

[Deep Dive] SEI – Edition 2: From Pain to Power: A Bull Cycle?SEIUSDT may have just flipped the script.

After months of consistent lower highs and lower lows, SEI has officially broken its bearish structure and is now printing clear higher highs (HH) and higher lows (HL) — a textbook sign of a trend reversal.

📉 Left Side: Bearish Breakdown

From late 2023 to Q2 2025, SEI was stuck in a painful macro downtrend. The structure was brutally clean: LH → LL → LH → LL. Each bounce was weaker than the last, reflecting exhausted buyers and relentless supply.

But something changed in late Q2…

📈 Right Side: Bullish Rebuild

Since its final low around April, SEI began to carve a new path. What started as a subtle accumulation quickly morphed into a solid structure of higher highs and higher lows.

The arc-shaped pink trendline tracks this momentum shift — and we’re now watching a potential continuation of the bullish cycle.

The most recent HL is forming exactly on that curve — a critical moment where bulls may step in for the next impulsive move.

🔥 What’s Fueling the Shift?

SEI is gaining traction as a high-performance Layer 1 designed for trading apps, with native parallelization and a focus on speed and throughput.

Its recent ecosystem growth — including projects in DeFi, gaming, and infrastructure — has started to attract both retail and VC attention.

On-chain metrics are showing increased activity, and whispers of upcoming protocol incentives could be the spark that pushes SEI toward the $0.45–$0.50 range.

🧠 What We’re Watching

- The current HL zone — will bulls defend this level?

- If SEI can break above the previous HH, the bullish structure strengthens.

- A failure to hold this HL would suggest a range or even deeper correction — so risk management is key.

Let’s recap:

- Structure has flipped bullish ✅

- SEI is riding a fresh higher low ✅

- Fundamental momentum is building behind the scenes ✅

It’s now up to the market to decide if this was just a bounce — or the beginning of a much bigger move.

💬 What do YOU think: Is SEI building steam for a breakout, or just teasing us with a fakeout?

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

SEIUSDT trade ideas

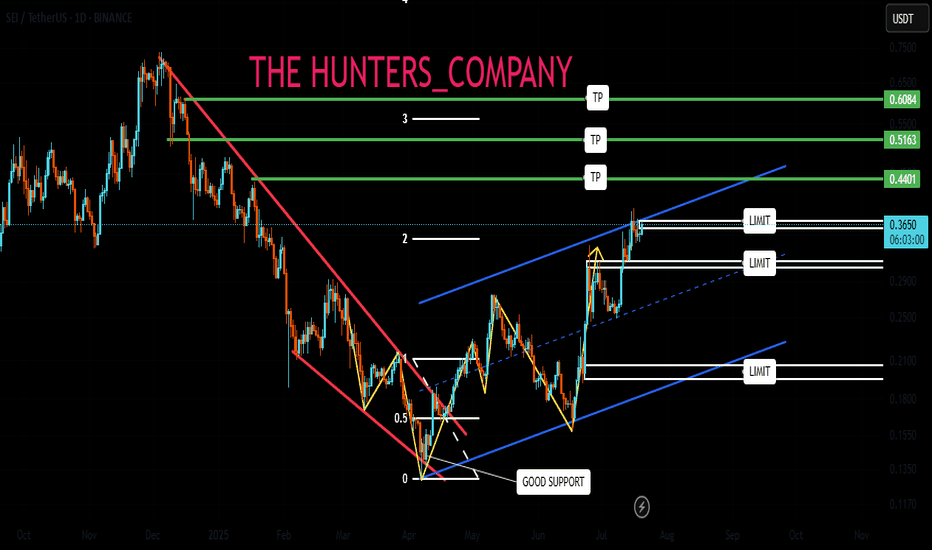

SEI BUY LIMITHello friends🙌

📉According to the downward trend we had, you can see that a reversal pattern was formed at the specified support and buyers entered and raised the price, which caused the formation of an ascending channel.

👀Now that we are at the ceiling of the ascending channel, because there is a possibility of price correction, we will place two more buying steps down and buy with risk and capital management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

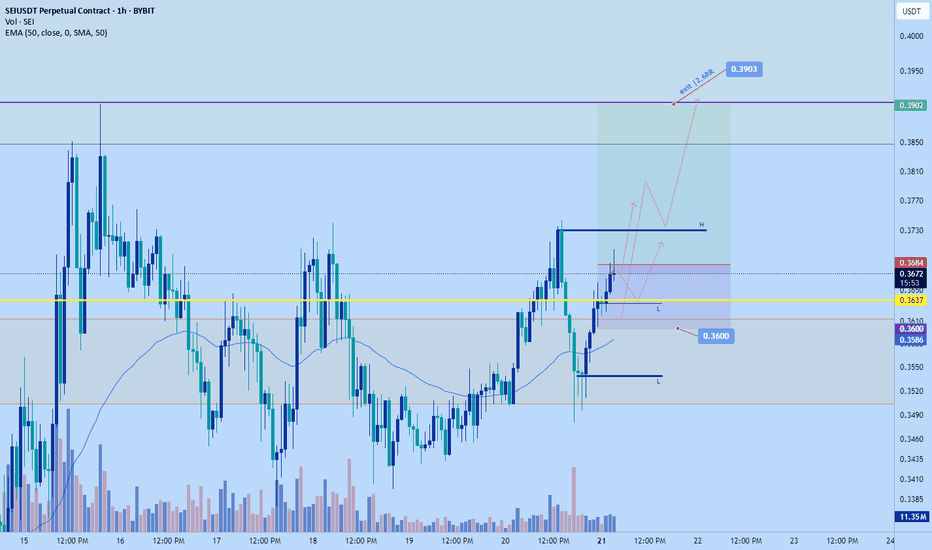

Seiusdt longWent long on sei just now. Aiming for $0.3903

Overall market is having a big bounce from weekend sell of including sei. I think the market will push and attempt to make a new HH based on my DTT analysis. Entry should have been a bit earlier but I just saw it.

SL: 0.36 or lower

Tp: 0.385-$0.39

It might correct down a bit again but base on my calculation $0.36 likely won't be revisited for now

SEIUSDT Rebounds from Key Support - Pump Loading?BINANCE:SEIUSDT Rebounds from Key Support - Pump Loading?

BINANCE:SEIUSDT just touched a major support level on the 4H chart and is now showing signs of a bullish reversal after breaking above the descending trendline. This setup looks similar to previous price actions where NYSE:SEI delivered sudden explosive moves post-breakout. If history repeats, we could be looking at another strong rally ahead.

Entry looks promising, but as always, manage your risk wisely and set a proper stop loss to protect your capital.

BINANCE:SEIUSDT Currently trading at 0.265

Buy level : Above $0.263

Stop loss : Below $0.243

Target : $0.337

Max leverage 5x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

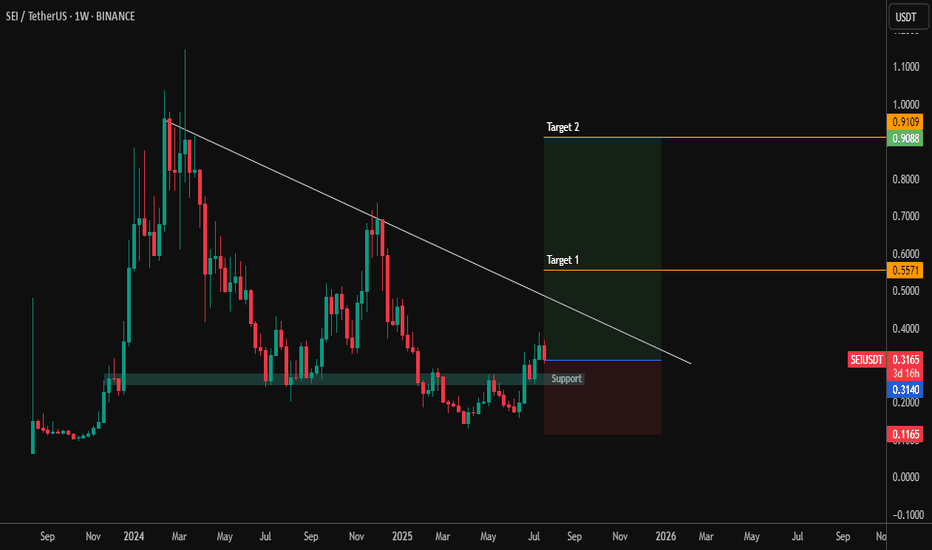

#SEIUSDT – Testing Resistance with Eyes on Breakout SEI is currently approaching a major descending trendline resistance after reclaiming the key weekly support zone around $0.20–$0.31. Price action is showing strength with a potential reversal setup building.

🔹 Key Technical Levels:

🔽 Support: $0.20–$0.31 (reclaimed zone)

📉 Resistance: Descending trendline from previous highs

🎯 Target 1: $0.5571

🎯 Target 2: $0.9109

🛑 Invalidation: Break below $0.1165 (risk zone)

📌 Technical Outlook:

Bullish structure forming above a long-held support

A breakout from the trendline could initiate a strong leg upward

Risk-to-reward remains favorable for mid-term swing setups

Watch for volume confirmation if SEI closes above the trendline. Momentum may accelerate toward the targets with bullish follow-through.

SEI | Trade-updateWe’ve almost reached our final profit target (orange). Once we get there, I’ll take out most of my margin position and let only a small portion run.

Same situation as with $ADA...

13 R/R since my call — you don’t need a strategy with an 80% win rate. A 30–50% win rate is more than enough if your risk-to-reward ratio is solid.

I don’t think any of you have taken trades based on my calls yet, but maybe in the future idk.

I’ll keep posting from time to time. Maybe I’ll get more motivated and post more often. We’ll see.

As always: don’t get FOMO now when prices are green. The time to go long was a month ago — now it’s time to hit the red button.

And thanks to @cemainickam i see that atleast one person is reading my posts. Thank you bro!

cheers, stay safe❤️

#SEI/USDT Ready to Fly? Breakout #SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.3140.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.3050, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3246

First target: 0.3381

Second target: 0.3521

Third target: 0.3673

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.3450.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.3380, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3580

First target: 0.3684

Second target: 0.3850

Third target: 0.4016

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

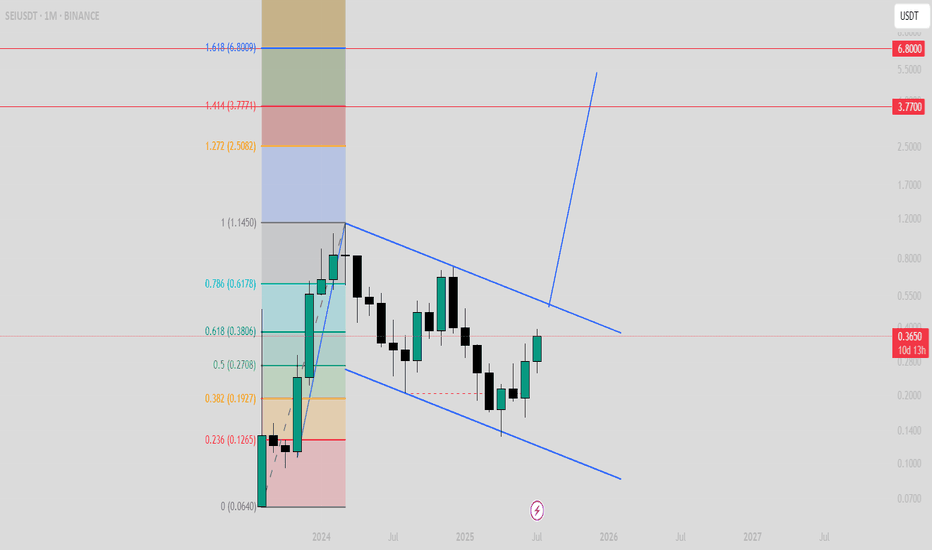

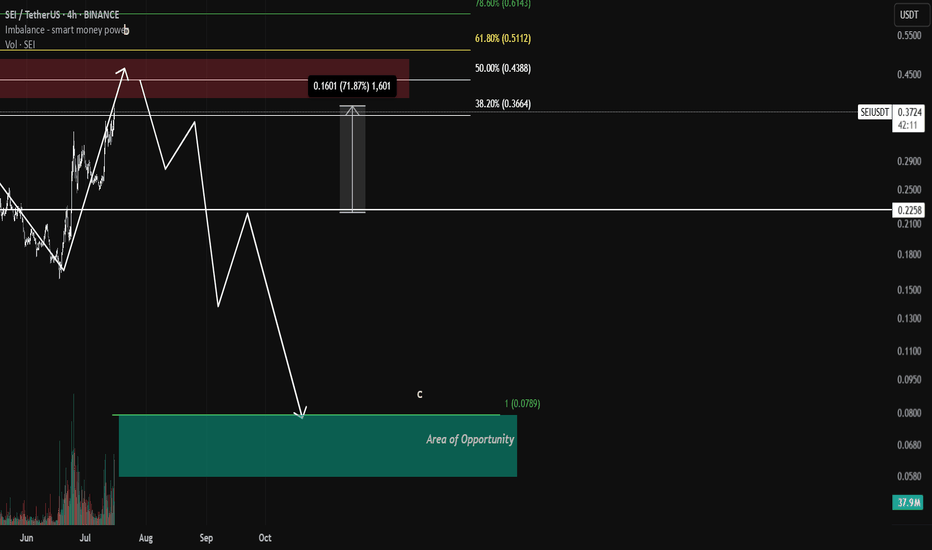

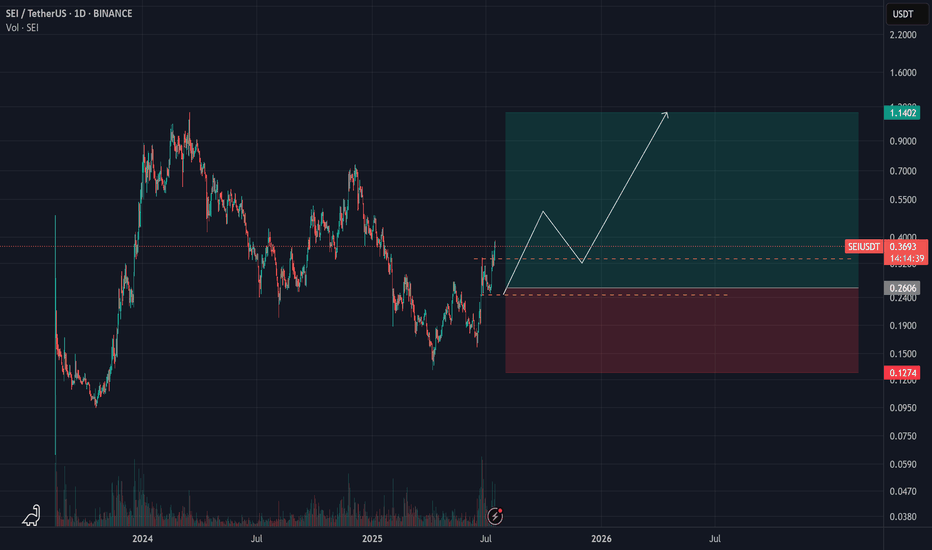

Sei Analysis – July 15, 2025

Sei appears to be forming a clear classic corrective pattern.

After rallying from $0.09 to $1.10,

it seems to have completed its correction through two downward legs.

🔁 The recent price action shows a bullish reaction near the previous low,

suggesting that Sei might now be in a strong accumulation zone.

📌 For a more conservative entry, waiting for price to approach $0.25 could provide a better risk/reward setup.

🎯 With a confirmed rebound, a move toward the $1.12 level — roughly a 300% gain — becomes a realistic target.

SEI Bulls Target 38% Gains — Are You In?📈 SEI/USDT – 4-Hour Chart Technical Analysis

SEI has developed a constructive bullish pattern on the 4-hour chart. After a prolonged sideways phase, price broke out of the consolidation range and climbed above the prior swing high around $0.3359, now sitting just under the critical resistance near $0.3435.

This region has been tested multiple times historically, with clear rejection wicks and prior sell pressure, marking it as an important threshold. The recent breakout momentum suggests buyers are gaining confidence, especially after the sharp impulse from the $0.3120 support zone.

If the market holds this level on a closing basis and confirms with some follow-through volume, the setup remains primed for further upside.

Even if a retracement occurs back toward $0.3120, the overall structure stays bullish while price trades above $0.2750, which has been the broader accumulation range for several weeks.

________________________________________

🟢 Trade Setup Summary

Entry Zone: $0.3359–$0.3435 (on breakout confirmation)

Stop Loss: Just below $0.3120 support

Target 1 (TP1): $0.3553 – Initial reaction zone

Target 2 (TP2): $0.4247 – Mid-term resistance

Target 3 (TP3): $0.4769 – Extended target

Risk: Approx. 9.17% downside if invalidated

Reward Potential: Up to 38.84% upside if the extended target is reached

Risk-Reward Ratio: ~4.23

________________________________________

From a broader perspective, this is a well-balanced setup with a tight invalidation point and clear upside roadmap. As long as the price continues to respect the $0.3120 floor, any short-term pullbacks can also be considered for spot reaccumulation or DCA entries.

Should the market push through $0.3435 with strong momentum, SEI will likely test the $0.3553 area quickly, followed by attempts to reclaim the higher ranges near $0.42–$0.47 over the coming sessions.

Let me know if you’d like to refine this further or prepare a version for publication or sharing with your community. 🚀

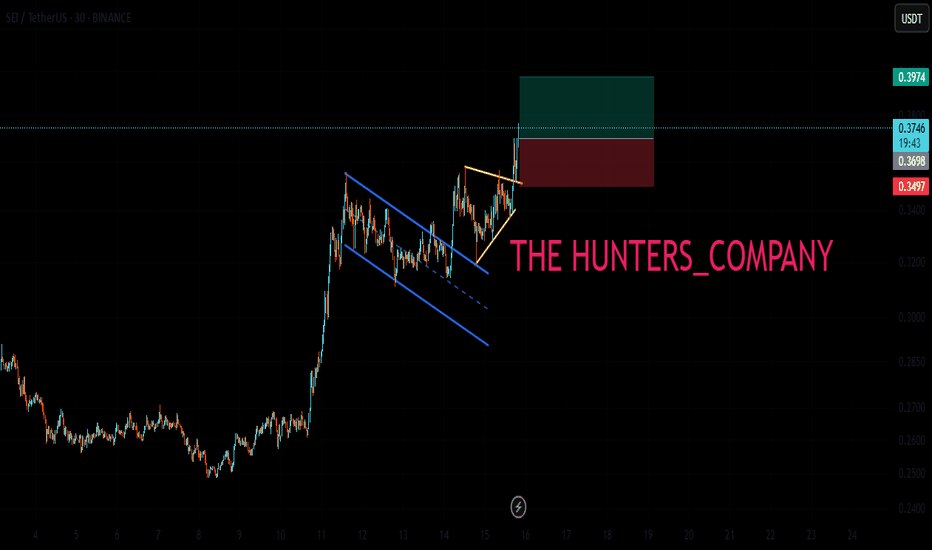

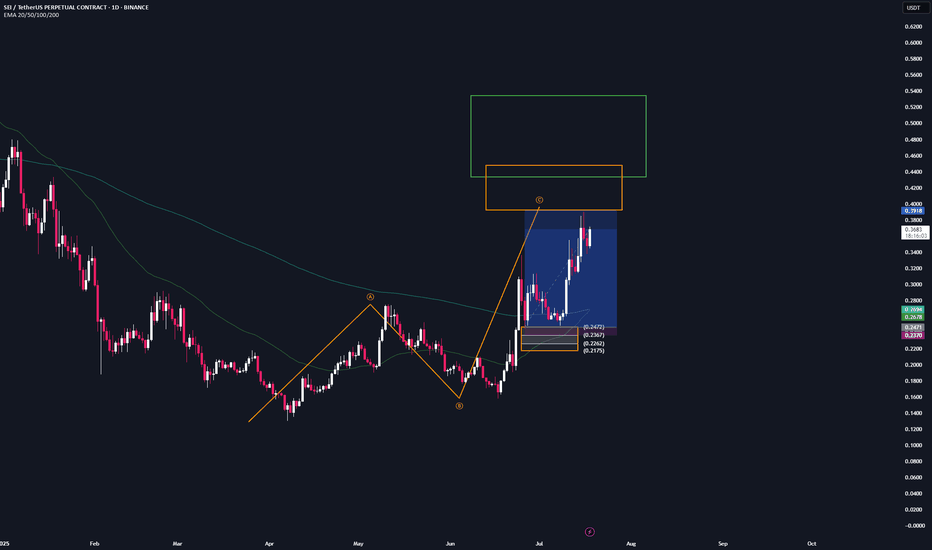

SEI - One More Bullish Impulse Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈After surging by over 75% last week , SEI is currently in a correction phase.

However, it is approaching the intersection of the previous high marked in orange and blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SEI approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

SEI/USDT Ready to Fly? Breakout from Accumulation Zone Signals🧠 Market Overview:

SEI/USDT has just delivered a powerful technical signal — a clean breakout from a major accumulation zone that has been holding price action for several months. With increasing volume and bullish price structure, this breakout could mark the beginning of a sustained upward trend.

The $0.24–$0.27 zone acted as a strong accumulation base. Now flipped into support, this area could serve as the launchpad for the next leg higher if price continues to hold above it.

📌 Pattern Breakdown:

🔸 Pattern: Accumulation Base Breakout

SEI traded sideways for nearly 6 months within a tight consolidation range.

This behavior is typical of institutional accumulation (smart money phase).

A strong bullish breakout above $0.27 has occurred.

Price has successfully retested the breakout level, confirming it as new support.

📈 Bullish Scenario (Primary Bias):

As long as SEI holds above the breakout zone ($0.26–$0.27), bullish continuation is likely.

🎯 Upside Targets:

$0.3521 → Minor resistance and key breakout validation.

$0.4715 → First major historical resistance.

$0.5900 → Strong price memory zone.

$0.5936 – $0.7025 → Key supply zone from previous market cycle.

$0.9407 up to $1.1450 → Long-term extension targets if bullish trend accelerates.

💡 Potential ROI from support to top target: Over 300%

📉 Bearish Scenario (Alternative View):

If price falls back below the breakout zone:

It could signal a false breakout (bull trap).

Price may re-enter the previous range and lose bullish momentum.

Downside levels to watch:

$0.21 (mid-range)

$0.17 (range low)

Failed breakout retest = bearish warning for long positions.

⚖️ Validation & Risk Strategy:

Breakout occurred with strong bullish volume → confirmation signal.

Ideal stop-loss: just below $0.25 to protect against invalidation.

Strategy: Buy on successful retest → Add if price breaks and holds above $0.35.

🧠 Pro Tip for Traders:

This setup is ideal for swing traders and mid-term investors.

The current breakout pattern is consistent with the Markup Phase in the Wyckoff Cycle.

Monitor market sentiment and volume to validate trend continuation.

If Bitcoin remains stable or bullish, altcoins like SEI may strongly outperform.

#SEI #SEIUSDT #BreakoutTrade #CryptoSignals #AltcoinAnalysis #ChartPattern #VolumeBreakout #TechnicalAnalysis #PriceAction #CryptoTraders

SEIUSDT on the Brink of a Major Explosion… or Total Breakdown?Yello Paradisers! Are you prepared to act with precision—or will you get trapped like the rest before the real move begins? #SEI has entered a highly reactive price zone where one wrong candle could invalidate the entire bullish structure. The market is whispering its next move, but only those who understand structure and timing will be ready to capitalize.

💎#SEIUSDT has completed a significant transition from a bearish trend structure to a more bullish one. Earlier, the price formed consecutive Lower Lows (LL) and Lower Highs (LH), confirming bearish momentum. However, that trend shifted once the market printed a Market Structure Break (MSB) around the 0.2121–0.2253 range. This area—previously acting as resistance—has now flipped into a confirmed support zone, marking a critical bullish development.

💎The structure strengthened further when SEI broke above the prior Higher High (HH) and created a Break of Structure (BOS). That move catapulted price into the red resistance zone between 0.2929 and 0.3152, just beneath the last major swing high at 0.3471. This zone is now acting as a ceiling, containing bullish pressure—but the underlying structure remains intact unless we see an invalidation close below key levels.

💎High probability, SEI i retracing back into the 0.618 Fibonacci level at 0.2269, which aligns precisely with the flipped support zone. This is a textbook bullish retest, and as long as the price holds above 0.2121, the probability for continuation remains high. The coming candles will be decisive: they will either confirm strength and fuel continuation—or fail and lead to a complete structure breakdown.

💎If buyers manage to hold the key support zone between 0.2269 and 0.2121, the probability of a bullish continuation increases significantly. The first major target on the upside is 0.3471, which marks the previous swing high and is likely to act as the initial area of resistance. A clean break above that level could open the path toward 0.3812, followed by 0.4086, both of which align with higher timeframe supply zones and represent strong historical resistance. These levels are expected to attract profit-taking and short-term volatility, making them critical decision points for continuation or rejection in the next phase of SEI’s move.

💎However, traders must be alert: any candle close below 0.1554 will serve as a hard invalidation level for this bullish thesis. If that happens, the structure flips bearish, and we would anticipate a deeper correction toward 0.1361 or even lower. That’s the line we are not willing to ignore—structure and discipline come first.

This is not the time to trade emotionally, Paradisers . Retail traders will act impulsively—either FOMOing at the highs or panic-selling at the lows. The smart move here is to observe how price reacts and only execute if there’s clear confirmation and structure support. No guessing. No gambling.

MyCryptoParadise

iFeel the success🌴

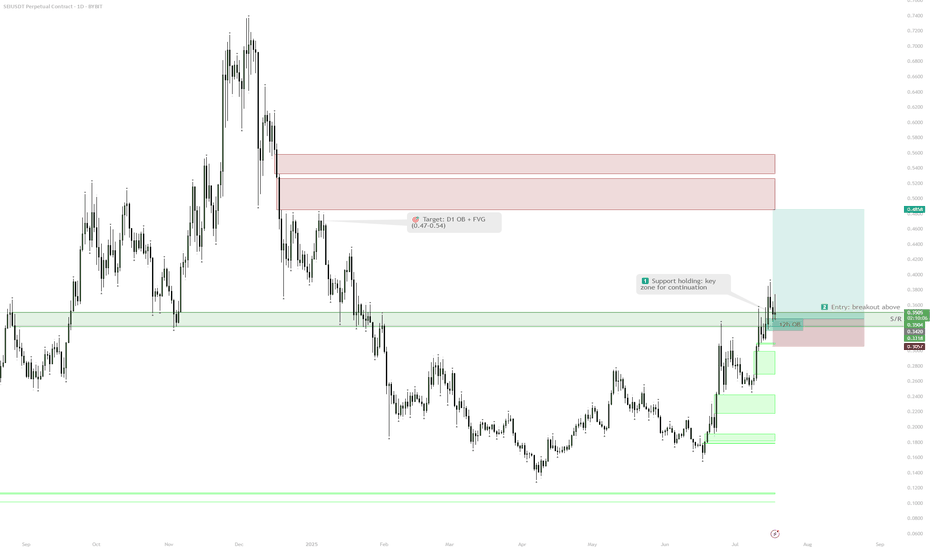

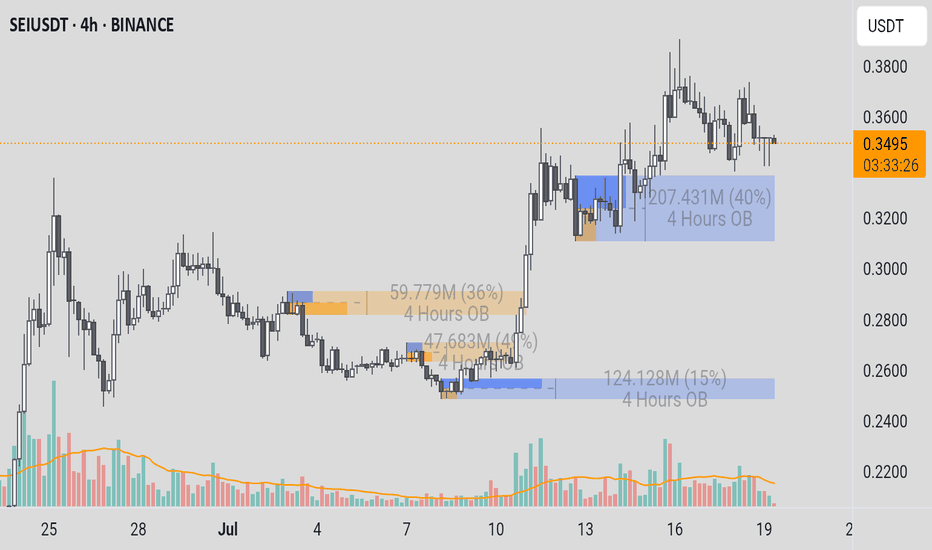

SEIUSDTSEI/USDT (SEI):

○ Trend: Strong uptrend.

○ Current Condition: Price is consolidating around $0.35, above strong Order Block support ($0.30-$0.32), but below the previous high ($0.37-$0.38). Volume appears to be decreasing during the consolidation phase.

○ Entry Recommendation: Not optimal for entry at this time. It is better to wait for a correction to Order Block support at $0.30-$0.32 and seek bullish confirmation for a safer entry, or wait for a clear breakout above $0.37-$0.38 with convincing volume.

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.2745.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.2710, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2813

First target: 0.2887

Second target: 0.2983

Third target: 0.3112

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEIUSDT Forming Falling WedgeSEIUSDT is showing a highly attractive setup with the formation of a classic falling wedge pattern, a structure known for indicating a strong trend reversal. The price action has respected the wedge boundaries, consolidating with lower highs and lower lows before a decisive breakout appears imminent. With the volume profile confirming increased buying interest, this pattern suggests the potential for an 80% to 90% upside move, capturing the attention of traders searching for breakout opportunities in altcoins.

SEI, the native token for the Sei Network — a sector-focused Layer 1 blockchain built for trading — has been drawing steady investor interest thanks to its unique positioning and growing ecosystem. As more projects adopt Sei’s fast and efficient trading infrastructure, market sentiment around SEIUSDT remains positive. This strong fundamental narrative combined with the bullish wedge breakout strengthens the case for significant gains in the near term.

From a technical perspective, traders should watch for confirmation candles and sustained buying volume above the resistance trendline. A successful breakout with retest could trigger a powerful rally, potentially unlocking the anticipated gains. Keeping an eye on key support zones within the wedge will help manage risk while maximizing the reward potential on this promising setup.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!