CHF SEK SELL 1HHello Readers, I am Professional Trader Andrea Russo and today I want to talk to you about a trading opportunity on the CHF/SEK exchange rate with a 1H candle.

I invested at 11.5474, setting a Stop Loss (SL) at -0.65% and a Take Profit (TP) at +1.96%. The decision to enter this position was motivated by the technical analysis of the market and the evaluation of current trends.

The Swiss franc (CHF) / Swedish krona (SEK) exchange rate presents interesting trading opportunities, especially in this moment of market volatility. Carefully monitoring the movements of the 1H candles can provide useful insights to enter and exit the market with precision.

In this specific trade, my strategy is based on:

Technical analysis: Use of indicators such as moving averages and candlestick patterns to identify entry and exit signals.

Risk Management: Setting a SL of -0.65% to limit losses in case of unfavorable market movements.

Profit Targets: Setting a TP of +1.96% to capitalize on favorable market movements.

It is essential to maintain discipline and follow the pre-established trading plan to minimize risks and maximize potential profits. Stay tuned for more updates and market analysis!

Happy trading everyone!

SEKCHF trade ideas

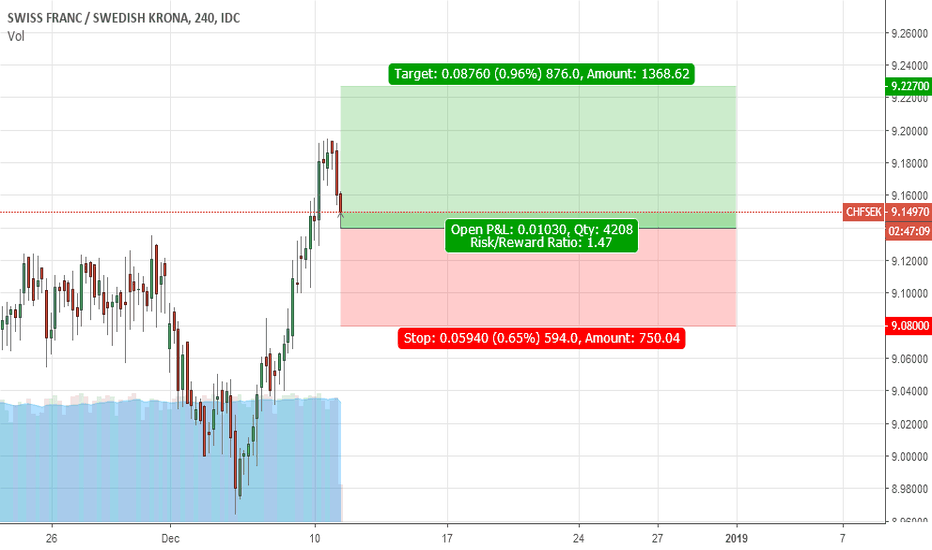

CHF/SEK: Long Opportunity on Multiple Timeframes

I decided to open a long position on CHF/SEK based on two key technical signals that occurred on multiple timeframes.

1. Breakout of Resistance on Hourly Timeframe

On the 1-hour chart, the price broke a significant resistance, signaling a possible continuation of the uptrend. This breakout was confirmed by an increase in volume and the formation of a clear bullish candlestick above the previous resistance. The breakout of these key price levels suggests strong buying pressure.

2. Upside from Oversold Level on 4-Hourly Timeframe

On the 4-hour timeframe, the stochastic oscillator shows that the price has recently broken out of the oversold zone, confirming a possible reversal to the upside. Furthermore, the price is breaking above the long-term moving averages, such as the 50 and 200 periods, further reinforcing the idea that we are in a moment of strength for the CHF versus the SEK.

Trading Strategy

Entry: After the breakout on the 1-hour chart, I set my entry above the confirmed resistance.

Stop Loss: I placed a stop loss below the most recent low to limit the risks in case of retracements.

Target: The target was calculated considering a risk/reward ratio of 3:1, in line with the favorable technical backdrop.

Fundamental Motivation

In addition to the technical signals, there is a possible fundamental support given by the relative strength of the Swiss franc in the context of economic uncertainty. This makes the CHF a safe haven and potentially appreciable in the coming days.

Conclusion

This setup represents a great long trading opportunity on CHF/SEK, supported by consistent technical signals on multiple timeframes. I continue to monitor the price behavior for any adjustments to the position.

CHFSEK $CHFSEK Initial LongCHFSEK $CHFSEK Initial Long. This is a pure momentum signal just as are every other signal I post. ZERO other factors are considered in producing this signal.

Entry reasons: CHFSEK is showing momentum and confluence of mean reversion crossing up the 70 day price mean.

Exits and SL: TP and SL on chart. Move SL on TP. After TP2, trail with 0.5xATR step and 1.5xATR offset.

CHFSEK can break the weekly support? 🦐The market after an upper move inside a channel has created a huge head and shoulder patter on the weekly chart.

On the daily chart the price after the slope has retraced till the 0.382 fib level and now retesting the weekly structure.

IF the price will manage to break and close below the structure we can set a nice short order according with our strategy.

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

A bullish Riksbank=> Here we are tracking the Riksbank meeting on Wednesday with hikes expected to come in either December or February.

=> We expect December to remain on the cards and continue supporting a bullish SEK tone.

=> On the Swiss side, as you all know from our previous ideas Swiss investors positions in foreign assets remain largely FX hedged so there is little concern for a sudden appreciation for CHF.

=> The risk to our thesis will be a Riksbank taking December and February off the table (markets are not expecting).

=> Good luck all those trading this one in live

CHFSEK daily TAML touch is highly likely for this pair before meeting the support mentioned in the monthly analysis. An interesting point is that the Stoch has been a very good signal provider throughout the entire price action in 2015, and the inner waves might be traded by crossovers therein. This should hold until the ML is hit. Thus, I am now waiting for a bullish crossover to occur in the Stoch's oversold zone, after which I will seek long entries in a lower time frame.

After all, with this one, I have 9 pairs in my lower time frame watch list. Let's hope for the best!

I wish everyone a happy trading week!

CHFSEK weekly TAEarlier I said I would choose CHFTRY as my second exotic pair, but that pair seemed pretty much like EURTRY, which shows that the primary force behind the bullish trends in those charts are coming is the overwhelming weakness of the Turkish currency, which annihilates the difference between CHF and EUR. So I skipped CHFTRY and tried another exotic, which is CHFSEK.

As is seen, the criss-cross pitchforks indicates the imminence of a strong support. It seems the downward action will continue until it reaches that point. Stoch divergence is highly likely, and has a confirming characteristic.