DBS19 trade ideas

SG DBS BREAKING DOWN DBS is very weak now. Having bounced off 25 twice in recent time, it failed to make higher highs, failed the 55EMA, and is likely to revisit 25.

MACD supportive of bearish bias.

Going for a bounce at 24.50, and to consolidate at 24 for deliberation of a possible major rally to 40.

DBS (The Sell down momentum is slowing down)View On DBS (24 May 2019)

We were in the fast and furious pull back mode in the recent week.

Now, it has approached some decent support levels. It may take some time to around but as long as it is above the price level of $24, we shall see the rise up on the price again..

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice.

We may (or) We may not take the trade. The risk of trading in securities markets can be substantial.

You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Free Telegram FX/Stock analysis at your fingertip @ t.me/sonictraders

Follow our Trading View, @ bit.ly

Visit our Webby @ bit.ly

Like our FB @ bit.ly

Looking for a good broker? Go to cmc.mk

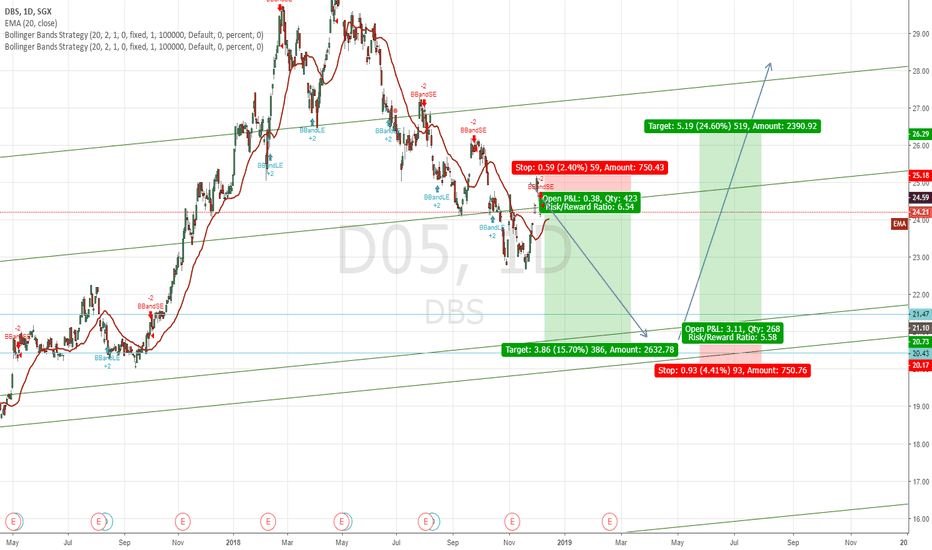

Swing: $26 easily achievable with potential for further upsideAfter a period of consolidation at $24.30 level, DBS has moved further in line with the bullish sentiment. Price has closed above both the 50D and 200D MA which spells potential further up-move ahead. It is currently sitting at prior support turned resistance zone. Should price stay above $25.19, we can see the next target at $26.06 before the next level of resistance at $29. A break below $24.30 will invalidate our analysis.

Best Regards,

Nour Capital - Tracking Smart Money Flow

Disclaimer:

The material (whether or not it states any opinions) is for educational purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Nour Capital or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

DBS (Bank Stocks are on the bull run)View On DBS (14 Feb 2019)

We have been busy since last Jan on DBS and Bank stocks are in demand right now.

The shall rise up higher.

The first easy tgt is $25.10.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

DBS back to $23?Over the last few weeks, we've seen buyers coming in and some reversal price actions have been playing out pretty well. Unfortunately, for the past week we've seen some fierce selling coming back again with the breakdown below $24 which can see further selling pressure to bring DBS down again to $23 where we can expect to see short covering.

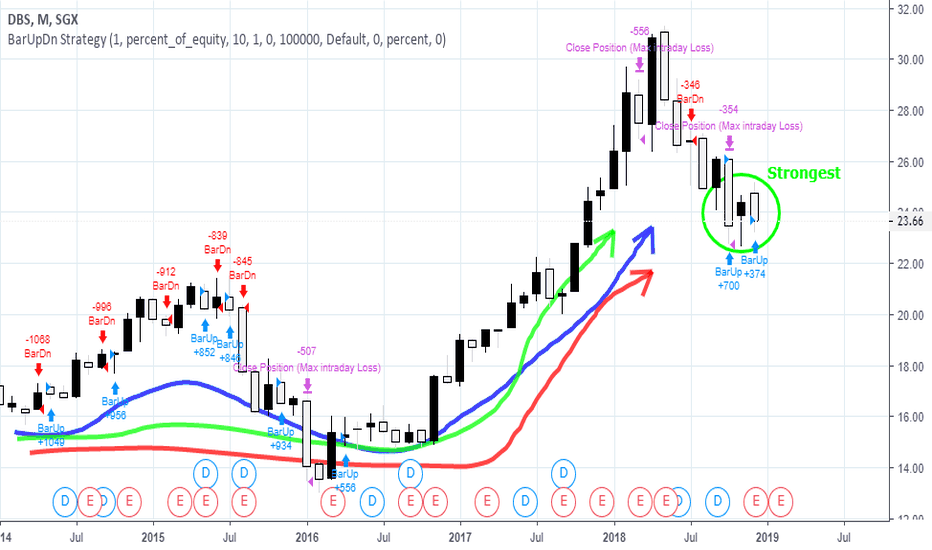

DBS During this correction, volumes were low meaning the stocks were passed from the weak mental strength herd to the hands of the smart monies. In the comparison analysis, DBS outperformed the benchmark financial index, refusing any whipsaw along the way. ODBS only gently touched the 200EMA showing why it had been the strongest bank among the 3 local banks in Singapore. If one is buying any bank stock and is spoilt for choice, then DBS is the top bank stock of Singapore.

DBS (*Flushing of the weak holders is in progress)DBS

Slight Bearish, some signs of bull but it shall go lower first.

$25 seem to get a good support to build. If you want to time properly, I will suggest you wait for the time being as the flushing is not done yet.

I expect bank stocks are to go alot higher in the future such as 1 years or more horizon.

Press "like" and Follow.

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

DBS Daily Update (15/11/17)Price is at multi-year high (Dec 1999) $24

Price could see a temporary retrace, but will not be looking to short this pair as support of 23.4 is near.

unless $23.4 is broken, short would then be considered.

Next support zone, $21.5 / $20.5

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable for your own financial situation.

SonicR Mastery team is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.