SIA19 trade ideas

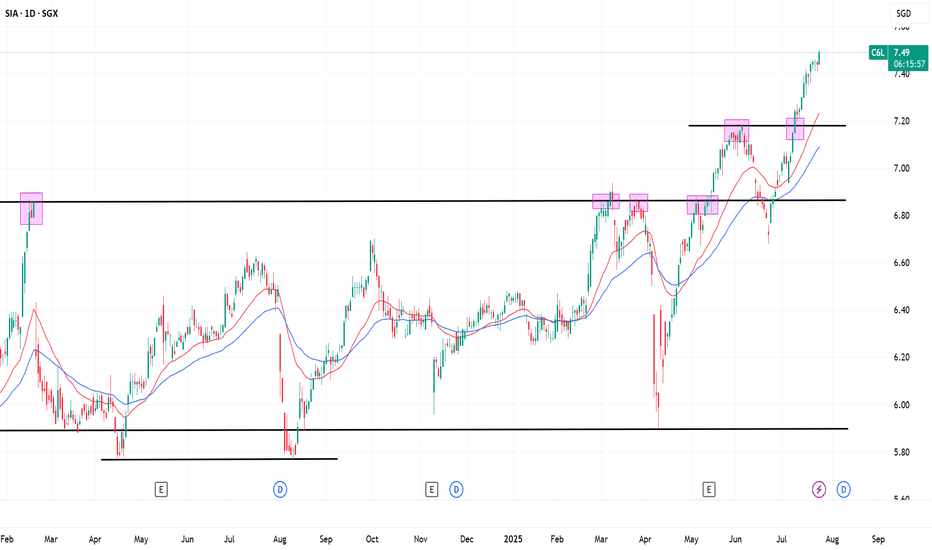

SIA Testing $6.86 Resistance Ahead of 15 May EarningsSingapore Airlines (SIA) is testing a key resistance at $6.86 as it gears up to announce its full-year results on 15 May. The drop in oil prices could give the company a boost with better margins.

If it breaks above $6.86, we might see more upside. But if it fails, a short-term dip over the next 7 trading days is likely — could be a good chance to re-enter after a pullback.

Singapore Airlines (SIA) Finds Support at 5.87 After Recent DownSingapore Airlines (SIA) has experienced a notable downturn in its share price over the past weeks, reflecting broader market concerns and a prevailing negative sentiment. After this period of decline, the stock is now finding support around the 5.87 level.

We are back!! $SIA(C6L.SI) Showing sign of bottomHas been away awhile from here! Hope everyone is doing well in the stock market! Let's dive into our analysis on SIA C6L

Recent fall shows signs of volume supporting the price at the previous low in the 5 mins chart (yellow box).

With price moving slightly higher could be a sign of short term rebound is on the way.

Our trading method:

Taking advantage to this possible short term rebound & maximizing the returns with our low exchange rate of MYR to SGD, we look into SIA's DLC issue by #societegenerale, TSX:SIA 5xLongSG250709(DZTW.SI), long position due to lower outstanding%, lower DLC price, & more sensitive to the underlying securities.

@roundnsurge

Share your view about TSX:SIA (C6L.SI) in the comment section.

About our analysis :

Utilizing the dynamic insights from a 5-minute chart. By closely examining this timeframe, we dissect the intricate volume and price transactions of significant market players. Our aim is to identify short-term support and resistance levels, enabling informed trading decisions. Through this meticulous analysis, we decipher price patterns and trends, providing valuable guidance for traders navigating the fast-paced realm of stock trading.

Disclaimer:

The information provided in this post is for informational purposes only and should not be considered as financial or investment advice. Any action you take upon the information in this post is strictly at your own risk. We are not responsible for any losses or damages that may occur in connection with the use of this information. Always do your own research and consult with a qualified financial advisor before making any investment decisions. The views and opinions expressed in this post are those of the author and do not necessarily reflect the official policy or position of any other agency, organization, employer, or company.

#shorttermtrading #SGX #demandsupplytrade #pricevolumeanalysis #roundnsurge #DLC #sia #dailyleveragecertificates

SIA shows sign of price peakRecent rebound in SIA shows multiple high volume in 5 mins chart yesterday with limited price up.

This indicates the big boys are churning at the high price to creates Fear-Of-Missing-Out to retail investors to place order in.

When there are enough buyers at the lower pricing, the big boys will start selling for profit taking.

Singapore Airlines (SIA : C6L) targets $7.00 and attempts to breLong term DOWNTREND SINCE 010908

Medium term UPTREND since 111021

Short term UPTREND since 311022

Singapore Airlines is 1 of 8 component stocks supporting the rise of the STI at the start of 2023.

The long signal for this recent run started on 311022 at the price of $5.21.

$7.00 is a significant target as it marked the start of last 7 year decline of the stock to a low of $3.20.

PIVOT 5.74

Long positions above $5.74 for $7.00 and $8.65

Short positions below $5.74 for $4.89 and $3.20

Singapore Airlines C6L Targets $7.05The long signal on the day charts at 5.29 on 180722 puts SIA on a multiple timeframe uptrend with a target of $7.05.

Long term REBOUND since 01 March 2021

Medium Term UPTREND since 11 Oct 2021

Short term REBOUND since 18 Jul 2022

PIVOT 5.17

Long positions above 5.17 for 7.05 and 8.68

Short positions below 5.17 for 4.96 and 3.98

rise up

SINGAPORE (May 6): Sunningdale Tech, the precision plastic manufacturer, reported 1Q2020 earnings of $2.4 million, up 205.3%.

Excluding the impact from foreign exchange, retrenchment costs, and other items, Sunningdale’s core net profit would have been $0.3 million for 1Q20, down 86.3% y-o-y.

SIA amongst 8 STI components in UPTREND, next target $7.05SIA gapped up to hit an intraday high of 5.62 on 111021 and is now in a multiple timeframe uptrend.

Long Term BASEFORMING since 150321

Medium Term UPTREND since 111021

Short Term uptrend since 041021

PIVOT 5.22

long positions above 5.22 for 7.05 and 8.65

Short positions below 5.22 for 4.80 and 3.58

SIA VTL : Singapore Airlines looks for $5.72The short term charts are long $5.05 on the dailies on 041021 with a target of $5.72, the week supertrend resistance in the near term.

A break of $5.72 above will confirm the recovery bounce on the Monthly Charts that seeks to move back to $7.05, the break down level since 3rd August 2018 putting SIA into a 3 year downtrend.

Long Term BASEFORMING since 150321

Medium Term BASEFORMAING since 100521

Short Term uptrend since 041021

Pivot 4.84

Long positions above 4.84 for 5.72 and 7.05

Short positions below 4.84 for 3.32

SIA targets targets $5.72Long Signal at $5.15 on 060721 holds valid as long as the daily supertrend pivot at $4.81 supports the range. The short signal on the weekly charts on 100521 at $4.77 will be negated if $5.72 is broken and held to the upside. A break of $5.72 will test $7.05, the breakdown level of SIA shares since 030815.

Long Term BASEFORMING since 150321

Medium Term BASEFORMING since 100521

Short Term uptrend since 060721

PIVOT 4.81

Long positions above 4.81 for 5.72 and 7.05

Short positions below 4.81 for 3.32

[Analysis] SIA, Too big to Fail?Struggling airlines have always been the target of bottom picking from Traders; simply because "It's cheap now!"

But is the risk worth it?

There is a saying in the stock market "Buy Low, Sell High".

Sadly though, the reality is usually "Buy high, sell higher" or "Buy low, sell lower"

We have seen from examples such as Sembcorp Marine that traders who chose to buy at $1.00 or even $0.500 because it is cheap, are facing rights issues and paper losses.

SIA is a national carrier. The government will not let it fall. But, they will only support it so much it keeps it alive. This means there is a high probability for future financing events such as more rights issues, new shares replacement, perpetual bonds, etc.

This would mean SIA is indeed too big to fail but, it will have a very very hard time seeing its glory days of $14/share ever again.

Too big to fail does not equate to higher share prices. In fact, it could continue to plunge in order to raise money to keep it alive.

Major resistance is at 7.00. We do not believe SIA will ever go back to pre-covid19 prices anytime in the next 5 years.

If you wish to have some stakes in SIA, you may do so in a safer way by proxy of STI ETF.

SIA at $4.54 supportThe short signal on 150421 at $5.45 has reached its down side target at $4.88 and has now broken the weekly pivot support with a short at $4.77 on the medium term targeting $3.23 on the monthly pivot support.

LONG TERM BOUNCE SINCE 150321

MEDIUM TERM DOWNTREND SINCE 100521

SHORT TERM DOWNTREND SINCE 150421

Pivot $4.97

Short positions below 4.97 for 4.54 and 3.23

Long positions above 4.97 for 5.69 and 7.00

youtube link :

C6L BUY/LONG 4.40 - 6.20! Market could fall back after thisTICKER CODE: C6L

Company Name: Singapore Airlines Ltd.

Industry: Passenger Airlines | Transportation/Logistics | Singapore

Technical Analysis

1. Large Pennant / Falling Wedge Pattern Brokeout and Retraced already

2. Large Head & Shoulders

3. Fibonacci Retracement at 0.786 ( Silver Zone)

4. Fibonacci Expansion Safe Take Profit Level 1 (Grey Zone) Also the length of Flagpole

Entry: Now Ready - 4.40 - 4.70 (The market could reach 4.40)

1st SAFE Partial Take Profit: 6.20

EXPECTED Take Profit in September - December

SIA BREAKS 5 YEAR DOWNTRENDSingapore Airlines broke the long term downtrend that started in Aug 2015 with a close at $5.70 surpassing our target at $5.46.

PIVOT 5.27

Long positions above 5.27 target 5.75 and 7.05

Short positions below 5.27 target 4.91 and 4.63

Long Term UPTREND since 190321

Medium Term UPTREND since 161120

Short term UPTREND since 051120