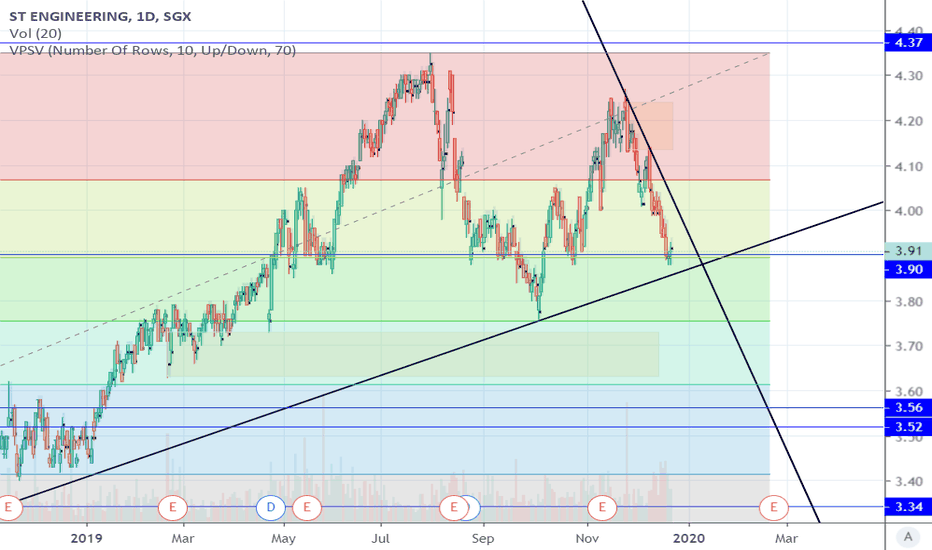

ST Engineering Break $4 - Is it a Good Buy?ST Engineering's share price finally breaks $4, records a 52-week high at $4.04 today.

From what I saw on Moomoo forum. The break out signals has captured investor attention excited them for a trading opportunity.

In fundamental speaking, ST Engineering has demonstrated robust performance. Its an

0.6 THB

18.54 B THB

297.75 B THB

About ST ENGINEERING

Sector

Industry

CEO

Sy Feng Chong

Website

Headquarters

Singapore

Founded

1967

ISIN

TH8483120102

FIGI

BBG01LKX5N92

Singapore Technologies Engineering Ltd. is an investment holding company, which engages providing solutions and services in the aerospace, electronics, land systems, and marine sectors. It operates through the following business segments: Commercial Aerospace, Urban Solutions and Satcom, and Defence and Public Security. The Commercial Aerospace segment refers to the airframe, engines, and components maintenance. The Urban Solutions and Satcom segment relate to smart mobility, smart utilities, and infrastructure. The Defence and Public Security segment is involved in defence, public safety and security, critical information infrastructure solutions, and others. The company was founded in 1967 and is headquartered in Singapore.

S63 - new trend formation - possible bullish biasTarget as shown - with stop loss indication.

Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

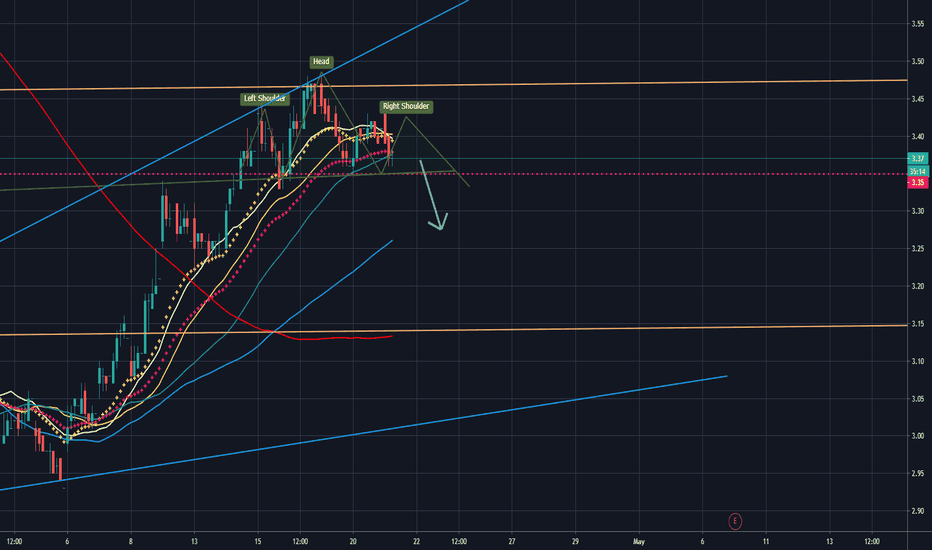

S63 - Is it possible in formation of Head & Shoulder?With the current oil crisis, market is in sort of jitters right now... this counter seems to follow the down trend (possibly) as well. Will the head & shoulder formation plays out in short term duration? or will it break out of the current formation and become bullish?

Feel free to share your thou

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TMJC5405185

STE TransCore Holdings, Inc. 3.75% 05-MAY-2032Yield to maturity

4.86%

Maturity date

May 5, 2032

SEUS5596916

STE TransCore Holdings, Inc. 4.125% 23-MAY-2026Yield to maturity

4.46%

Maturity date

May 23, 2026

TMJC6073261

ST Engineering RHQ Ltd. 4.25% 08-MAY-2030Yield to maturity

4.34%

Maturity date

May 8, 2030

TMJC5405183

STE TransCore Holdings, Inc. 3.375% 05-MAY-2027Yield to maturity

4.29%

Maturity date

May 5, 2027

See all STEG19 bonds