SGDCHF trade ideas

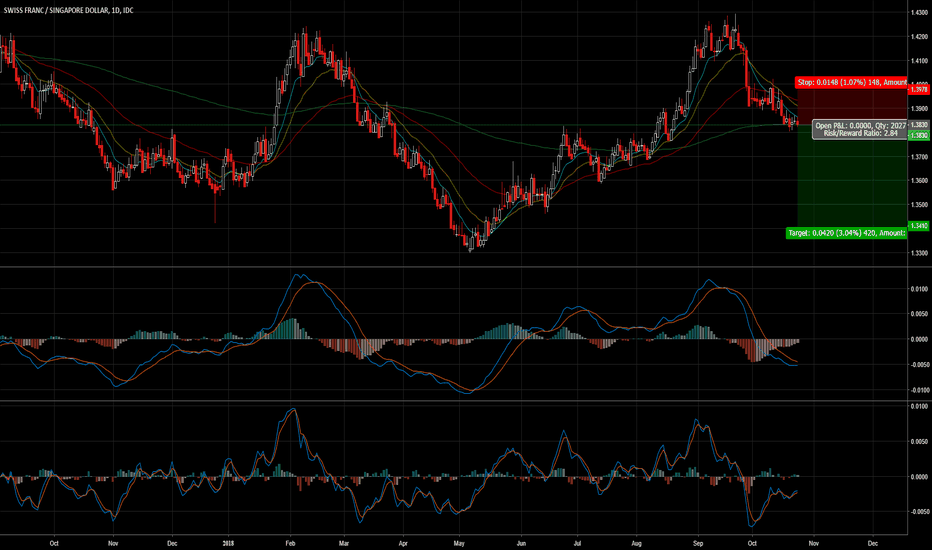

CHF/SGD - 250 Pips + Opportunity LONG TERMCHF/SGD is weak and we can expect it to continue it's bearish trend further below on the long term this next few weeks *as long as the 50 EMA holds as resistance on the daily timeframe.

It may make some pullbacks up but it is nothing to worry about as long as it never finds support. The reasonw why I leave my SL higher than the 50 EMA just in case.

This is a long term trade and the TP target may get changed during the run as the pair makes its move and let's us know how it's doing.

The full range and duration of the trade could be up to 2 months.

I personally have risked 3% on this pair.

Remember, you're not in trading for the quick profits but for the long term gains.

Trade safe.

CHF/SGD 1H Chart: Two scenarios likelyThe Swiss Frank has been appreciating against the Singapore Dollar after the currency pair reversed from the lower boundary of a medium-term ascending channel at 1.3890.

As apparent on the chart, the exchange rate is supported by the 55-, 100– and 200-hour SMAs, currently located near the 1.3950 mark. From a theoretical point of view, the pair might move upwards. Potential upside target could be the weekly R3 at 1.4110 mark.

Otherwise, it is expected that the currency pair might re-test the ascending channel. If given trend does not hold, a breakout might occur. In this case, the pair will aim for the Fibonacci 61.80% retracement at 1.3865.

CHF/SGD 1H Chart: Short-term increase expectedThe CHF/SGD exchange rate has been trading in an descending channel for a week now. This gradual decrease in price began when the pair reversed from the upper boundary of a medium-term ascending channel at 1.4180.

As it apparent on the chart, the pair is being supported by the 55– and 100-hour SMAs on the 1H time-frame. It is expected that the pair breaches junior channel and re-tests senior trend in the nearest future.

It is the unlikely case that some bearish pressure still prevails in the market, the Swiss Franc should not exceed the monthly PP at 1.4009.

CHF/SGD 1H Chart: Franc breaks trend-lineThe CHF/SGD currency pair has been consolidating in the 1.3665/1.3790 range for a month now. Thus, the Swiss Franc failed to accelerate against the Singapore Dollar and approach the upper boundary of the senior channel.

On Friday, the pair was still trading in the aforementioned range. However, it did break to the upside a downward-sloping trend-line and the 50.00% Fibonacci retracement at 1.3780.

The rate is supported by the 55-, 100– and 200-period SMAs on both the 1H and 4H time-frames. This is likely to add some bullish pressure in the market and consequently result in appreciation of the Franc. An important resistance level is the monthly R2 at 1.3950. The upper boundary of the senior channel is likewise located nearby circa 1.4045.

CHF/SGD 1H Chart: Awaits confirmation of surgeThe Swiss Franc is appreciating against the Singapore Dollar in a short term ascending channel. This gradual increase in price began on July 13 when the rate reversed from the senior channel in the 1.3580 area.

This junior patter was breached today, thus indicating that a decline may be possible in the nearest time. However, it should be noted that the Franc faces a strong support level formed by the 55-, 100– and 200-period (4H) SMAs and the monthly PP near 1.3690. This strong cluster is likely to activate bulls, thus resulting in further appreciation towards the upper boundary of the senior channel.

In this scenario, upside potential is apparent until the 61.80% Fibonacci retracement and the monthly R1 at 1.39.

CHF/SGD 1H Chart: Pair is rangingThe CHF/SGD exchange rate has been trading in the 1.3470/1.3625 range for three weeks.

If looking at the pair’s movement from the larger perspective, this movement sideways follows a surge which started mid-May when the pair reversed from the senior channel at 1.33. Thus, it is likely that the Swiss Franc eventually breaches the upper range line and continues to appreciate in line with the aforementioned long-term pattern.

The same surge is likewise expected in the short term in case the 1.3550 area is breached. Apart from all three SMAs on the hourly chart, the 55-day, the 55– and 100-period (4H) SMAs are likewise located there. The rate surpassing this resistance cluster should add the necessary bullish momentum to break out from the current ranging motion.

CHF/SGD 4H Chart: Medium-term appreciation in sightThe dominant pattern which as constrained the CHF/SGD exchange rate for the last three years is a descending channel. Its upper boundary near 1.33 was tested early in May following a three-week period of depreciation. During this fall, the Swiss Franc was trading in a neat and narrow channel down. The same trading pattern has also been maintained now.

By and large, it is expected that the pair maintains its bullish momentum and thus approaches the downward-sloping trend-line located in the 1.40/41 territory within the following two months.

In the short term, however, its seems that the Franc might have exhausted its upside momentum and thus should enter a minor period of decline. This fall might end either at the senior channel or the monthly S1 at 1.3300 and 1.3240, respectively.