Forex gain in CNHIf you are invested in Chinese equities , then you would be happy to know that the foreign exchange gain is in your favour over the last few years. From 2022 to current period, SGD has appreciated against the RMB by more than 20%.

Compared to the US equities, it has only gone up by half, ie. 10+%.

Related currencies

Time to exchange for Chinese Yuan for June Holidays !So I will be traveling to China for the upcoming June holidays and would need some hard currency (RMB). From the chart, we can see in Nov last year, it breaks above nicely only to see it falters back to the 5.10 price range .........

Will history repeats itself ? I don't know but if you put a knife

JICPT| I got the move from 4.85 to 4.63 for SGDCNH!Hello everyone. It's been almost 11 months since I posted the idea titled 'Bearish view on SGDCNH(potential low 4.63)'. You can refer to the linked idea below.

Yep, I'm right about the direction and move. SGDCNH fell sharply by move then 2000bps since I published the idea. I can see the downtrend

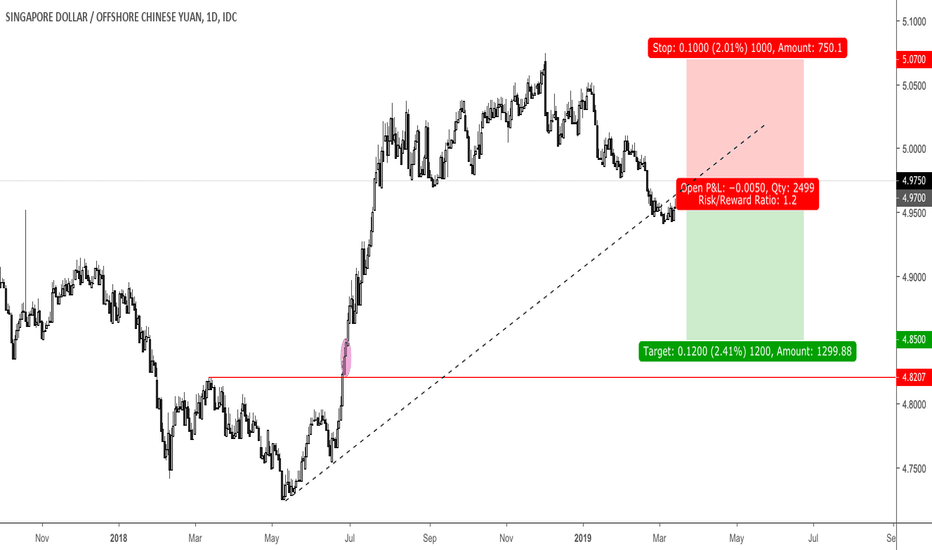

Recap of bearish view on SGDCNH on JanuaryFirst of all, I published a bearish view on SGDCNH on Jan. end. The pair rebounded from 4.84 to hit my daily supply zone around 4.89, followed by a series of bearish candles.

Now the price is around 4.835ish. It's coming towards the previous low and very likely to break this level.

It's a mome

Bearish view on SGDCNH(potential low 4.63)The reason I like to review the pair is that I've in SG for 8 years. It's my second home. Most importantly I have SGD deposited in the local bank. Personally, I prefer to strong SGD.

The reality is harsh. I don't know what happened on Jan. 8th. But the long lower wick really opened the downside s

SGDCNH moving towards possible rebound zone on Daily ChartTechnical analysis :

1. price is approaching the year low level of 4.8627, buyers might get in at this level

2. Divergence between RSI and price is the indication that rebound will happen soon. We just don't know when.

Fundamental analysis :

1. Singapore is a small country. I lived there for 8 ye

Year of the Bull? Not according to the fundamentals...With large account deficits, disinflation and widening interest rate differentials there are many reasons to not be bullish China.

Whilst on the political side there is a desperate need to keep CNY stable and stronger because China needs to attract capital inflows for the second half of 2019.

W

YUAN, YUAN, YUANAfter breaking out 3 times, first in March this year from the 61.8 FIB level, the SGDCNH pair seems to be suffering from the winter chill of China. It is resisted once again at the 61.8 FIB level. Not once, but again 3 times.

This is good for me as I return to China each year in June. The higher i

SGDCNH - 5-0 pattern setting upThis is a currency pair that I hold close to my heart.

As someone who travels to Shenzhen china almost monthly, I am pretty interested to put what I learn into good use to gain an advantage in life.

I change SGD to CNH every single month.

Keeping this post short, I am expecting SGDCNH to go down

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.