Forex gain in CNHIf you are invested in Chinese equities , then you would be happy to know that the foreign exchange gain is in your favour over the last few years. From 2022 to current period, SGD has appreciated against the RMB by more than 20%.

Compared to the US equities, it has only gone up by half, ie. 10+%. Of course, foreign exchange is only one factor in your consideration. The stocks, ETFs or other asset classes that you choose to invest/trade in also plays an important part. For example, which I made a call in Aug 2022 (not the bottom yet) and hold to now, you would have made roughly 210% profits plus a 10% gain on your foreign exchange as well.

In view of recent volatility, I will increase my exposure to HK/China equities as there are still many good stocks that are undervalued !

SGDCNH trade ideas

Time to exchange for Chinese Yuan for June Holidays !So I will be traveling to China for the upcoming June holidays and would need some hard currency (RMB). From the chart, we can see in Nov last year, it breaks above nicely only to see it falters back to the 5.10 price range .........

Will history repeats itself ? I don't know but if you put a knife on my neck and force me to make a wild guess, I would lean towards a bullish stand. Reason being China economy is improving quarter to quarter. We are just seeing the tip of the iceberg as China has just come out of its 3 years lock down. Imagine the amount of money that is held back and these Chinese are roaring to travel, to spend these money on food, themeparks, hotels, luxury products, cruises, duty free goods, etc.

JICPT| I got the move from 4.85 to 4.63 for SGDCNH!Hello everyone. It's been almost 11 months since I posted the idea titled 'Bearish view on SGDCNH(potential low 4.63)'. You can refer to the linked idea below.

Yep, I'm right about the direction and move. SGDCNH fell sharply by move then 2000bps since I published the idea. I can see the downtrend line is still well respected. Price seems to be consolidated for a while before making the decision. By measuring the move, the big fall has come to an end. SGDCNH is likely to rebound, however I need to see the confirmation on the chart.

As the inflation is going up, I don't think SG government will let the SGD depreciate further. The weakening SGD will hurt the purchasing power of the folks there.

Recap of bearish view on SGDCNH on JanuaryFirst of all, I published a bearish view on SGDCNH on Jan. end. The pair rebounded from 4.84 to hit my daily supply zone around 4.89, followed by a series of bearish candles.

Now the price is around 4.835ish. It's coming towards the previous low and very likely to break this level.

It's a momentum play and my idea was based on the long wick candle on weekly. A weak SGD may indicate a few things below:

1. Inflation: Unlike U.S. and China, central bank in SG targets exchange rate. the little red dot replies on stuff imported from other countries, e.g. food. a stronger SGD helps to control inflation issues. local people might feel stressed for the potential rising living costs.

2. Investment: A weak SGD helps to spur the economic growth. Foreign investors may find good deals, e.g. properties.

Singapore is an open economy in the world, and it suffered a lot during the Covid-19 crisis. Government spent a lot of 'savings' on its books and launched a series of schemes and packages to support local companies and people. I do hope things become better. When border opens again and international travel resumes, the little red dot will be back to normal again!

Bearish view on SGDCNH(potential low 4.63)The reason I like to review the pair is that I've in SG for 8 years. It's my second home. Most importantly I have SGD deposited in the local bank. Personally, I prefer to strong SGD.

The reality is harsh. I don't know what happened on Jan. 8th. But the long lower wick really opened the downside space. The potential low is 4.63(measured move).

Singapore got hit badly by the covid-19. The little red dot relied heavily on openness. Today, a new cluster was identified, so it's far from over.

Good news is that vaccination has started.

SGDCNH moving towards possible rebound zone on Daily ChartTechnical analysis :

1. price is approaching the year low level of 4.8627, buyers might get in at this level

2. Divergence between RSI and price is the indication that rebound will happen soon. We just don't know when.

Fundamental analysis :

1. Singapore is a small country. I lived there for 8 years and almost everything needs to be imported. So the government manages exchange rates to hedge the inflation risk. So SGD can't be too cheap.

2. The covid-19 got well contained in SG. Today is the 10th consecutive day of no local cases. As the economy started to go back to normal, it will strengthen SGD.

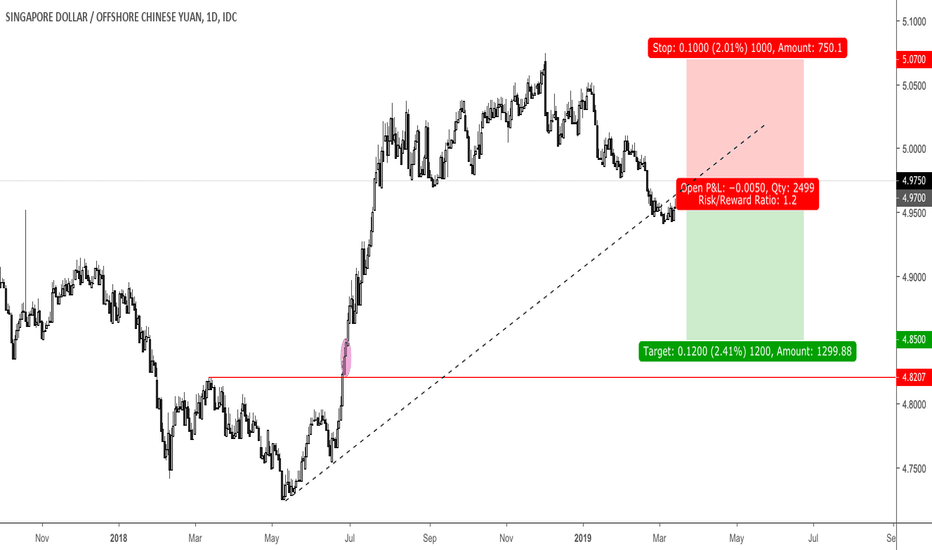

Year of the Bull? Not according to the fundamentals...With large account deficits, disinflation and widening interest rate differentials there are many reasons to not be bullish China.

Whilst on the political side there is a desperate need to keep CNY stable and stronger because China needs to attract capital inflows for the second half of 2019.

Why?

Because they are trying to facilitate the process of inclusion in equity and bond indexes to make China more attractive for FDI.

Risks to this trade are for deterioration in Chinese macro data and if equity markets sell-off.

Best of luck all and thanks for keeping the support coming with likes, comments, follows and etc.

YUAN, YUAN, YUANAfter breaking out 3 times, first in March this year from the 61.8 FIB level, the SGDCNH pair seems to be suffering from the winter chill of China. It is resisted once again at the 61.8 FIB level. Not once, but again 3 times.

This is good for me as I return to China each year in June. The higher it goes, the more yuan I get and that increases my purchasing power in China. But costs of living has gone up especially in Tier 1 cities like Beijing and Shanghai especially the property prices where many young couples could not afford to buy without their parents' support.

The global QE effect has artificially inflated many assets including properties and that benefits the top income earners//investors who have a portfolio of properties but hurt those who need to get a roof. As the wages are not increasing in tandem, their dream of having their own home gets further and further away.

From a psychological perspective, I sometimes wonder could this have an effect on consumer spending? Living in a small rental flat with many roommates to share the costs of escalating rental, what can singles/couples do after work/on weekends? They need an outlet and shopping, entertainment and largely food become a driving force to pull them away from their "pain point" and provide relief. With online buying, they can get things cheaply and satisfy their needs in clothing, home and decor and many others.

To influence actions, you need to give people a sense of control. Eliminate it and you get frustration, anger and resistance. Expand people’s sense of influence over their world and you increase their motivation and compliance.

I am reading "An influential mind" by Tali Sharot. I think it makes a lot of sense. What do you think ?

SGDCNH - 5-0 pattern setting upThis is a currency pair that I hold close to my heart.

As someone who travels to Shenzhen china almost monthly, I am pretty interested to put what I learn into good use to gain an advantage in life.

I change SGD to CNH every single month.

Keeping this post short, I am expecting SGDCNH to go down to 4.7 before rebounding.

For those of you who are planning to visit China in the next few months, I will suggest either changing more CNH this month or wait until it rebounds from 4.7,completing a 5-0 harmonic pattern before it charges towards $5. Do not change your sgd to cnh when it is around 4.7, either change it early or wait to change after it rebounds.

I cannot predict how long it will take but my conclusion is I will see the SGD weakening against the CNH over the next few months.