Key stats

About SPDR S&P500 US$

Home page

Inception date

Jan 22, 1993

Structure

Unit Investment Trust

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

State Street Global Advisors Trust Co.

Distributor

ALPS Distributors, Inc.

SPY is the best-recognized and oldest US listed ETF and typically tops rankings for largest AUM and greatest trading volume. The fund tracks the massively popular US index, the S&P 500. Few realize that S&P's index committee chooses 500 securities to represent the US large-cap space - not necessarily the 500 largest by market cap, which can lead to some omissions of single names. Still, the index offers outstanding exposure to the US large-cap space. It's important to note, SPY is a unit investment trust, an older but entirely viable structure. As a UIT, SPY must fully replicate its index (it probably would anyway) and forgo the small risk and reward of securities lending. It also can`t reinvest portfolio dividends between distributions, the resulting cash drag will slightly hurt performance in up markets and help in downtrends. SPY is a favored vanilla trading vehicle.

Related funds

Classification

What's in the fund

Exposure type

Electronic Technology

Technology Services

Finance

Stock breakdown by region

Top 10 holdings

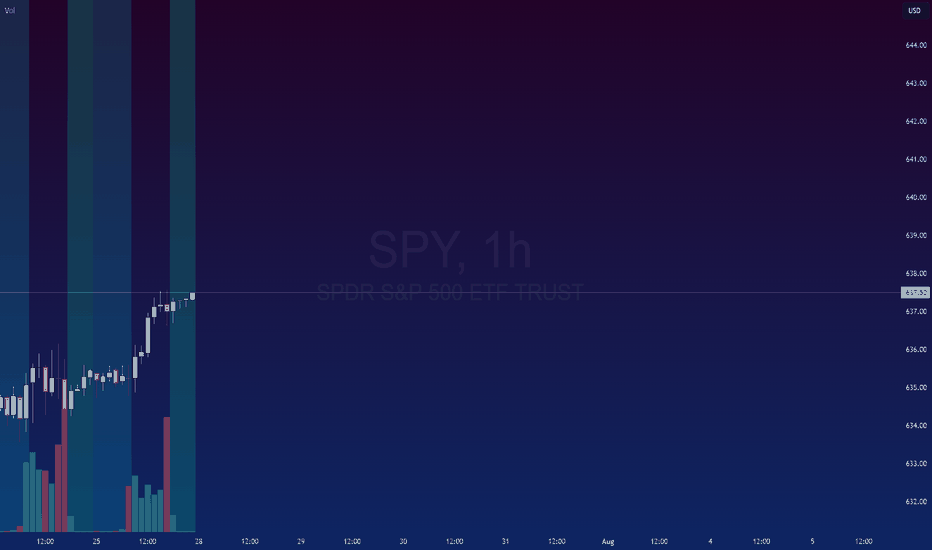

Spy.. 650 topLooking for a top this week

The top of this monthly trendline dating from 2009 should be tagged this week around 643-645.00. As you can see price can grind up here for weeks until the BIG drop.

That grind would possibly be distribution with

A range trade of 620-640 for the month of august. hi

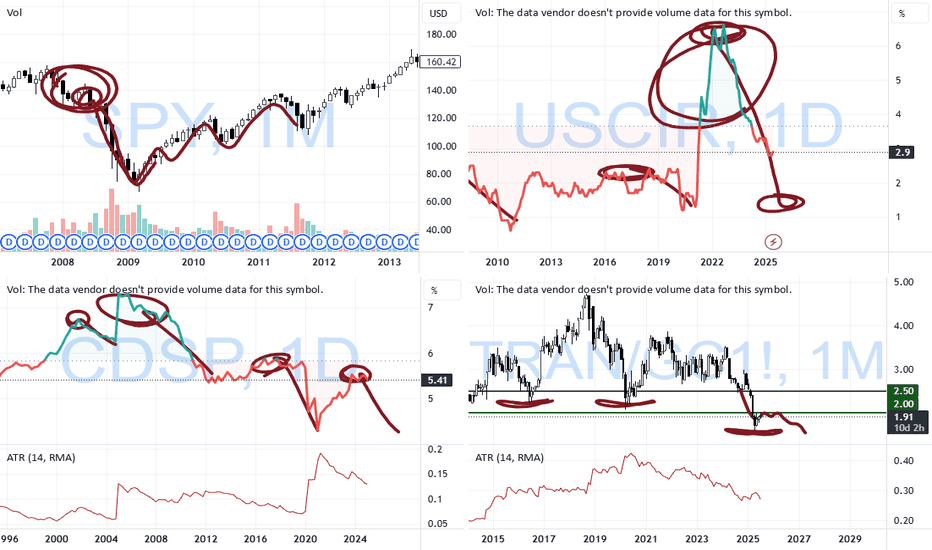

July 21 Special Update : Metals, SPY & More. What's Next.This special update is to highlight why I continue to believe traders should stay very cautious of this rally in the SPY/QQQ/BTCUSD.

Underlying economic data suggest that this is one big speculative rally following the April Tariff collapse.

And, the economic data I see from my custom indexes sugg

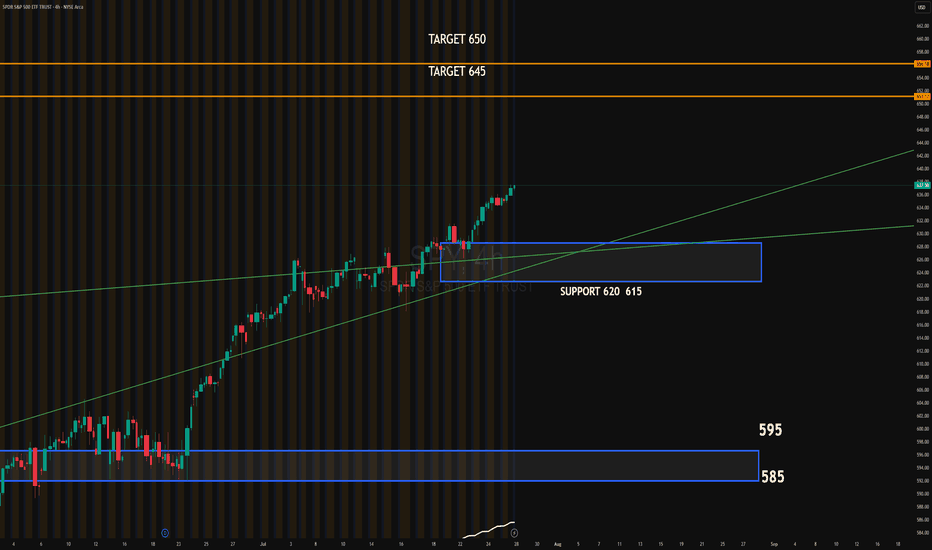

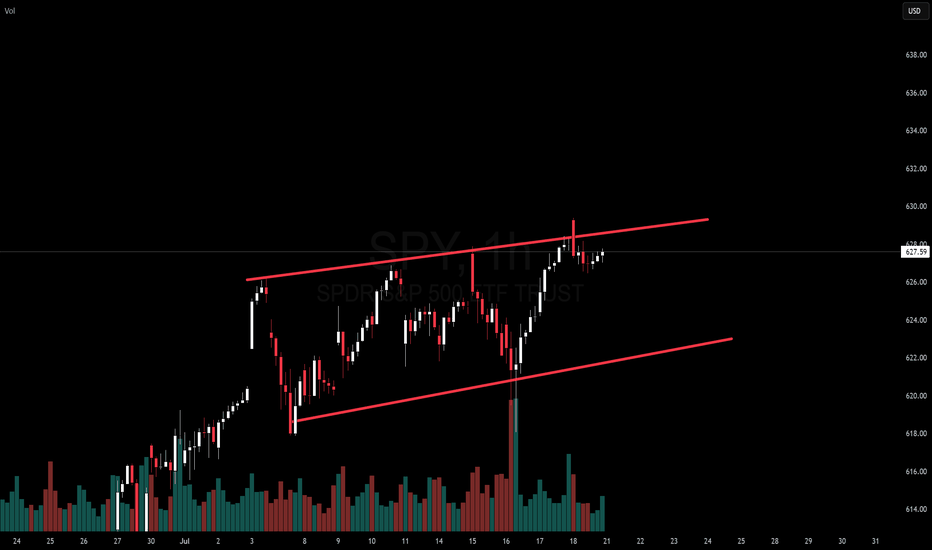

SPY 4HSSPY continues its bullish trend after breaking above the ascending channel. The recent breakout shows strong momentum, supported by institutional absorption around the 620–615 zone. This area now acts as key support.

Upside target: 645

Extended target: 650

Downside target if momentum fails: 620–

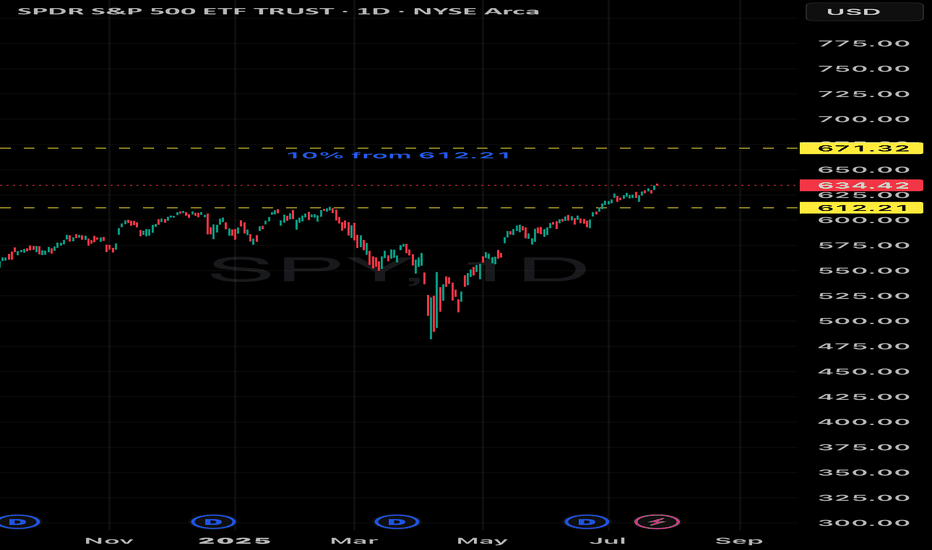

SPY "SP500 ETF" 1️⃣ Market Structure Overview

Change of Character (CHoCH) – Level: 626.19

The market printed a clear CHoCH at 626.19, breaking below a recent higher low. This shift signals the end of bullish dominance and marks the first warning of potential trend reversal. It’s a critical structure break indicatin

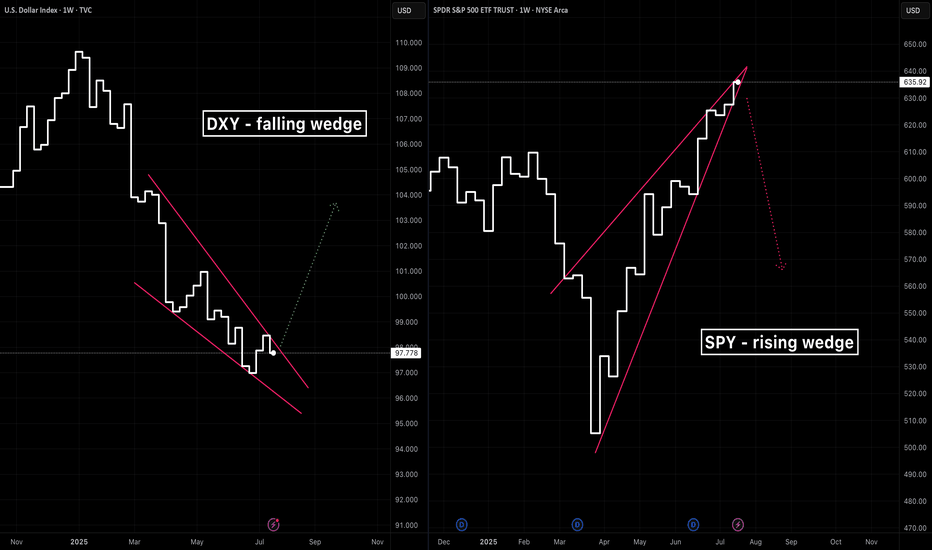

A tale of two wedgesIn early 2025 we’ve seen two classic wedge patterns on two of the market’s most watched charts: a falling wedge on the U.S. Dollar Index ( TVC:DXY ) and a rising wedge on the S&P 500 ETF ( AMEX:SPY ). Alone each tells its own tale—but together they sketch a tug‑of‑war between a fading dollar and

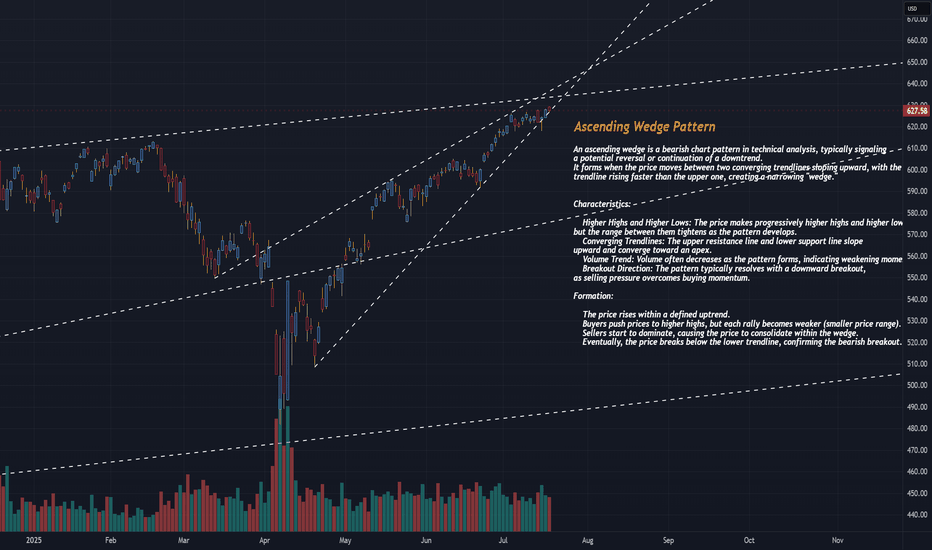

SPY CONTINUES IN AN ASCENDING WEDGE PATTERNThe SPDR S&P 500 ETF Trust (SPY) is currently exhibiting an ascending wedge pattern on the 30-minute chart, a bearish technical pattern that often signals a potential reversal or selloff when confirmed. Below, I’ll explain the ascending wedge pattern, identify key levels to watch for a potential sel

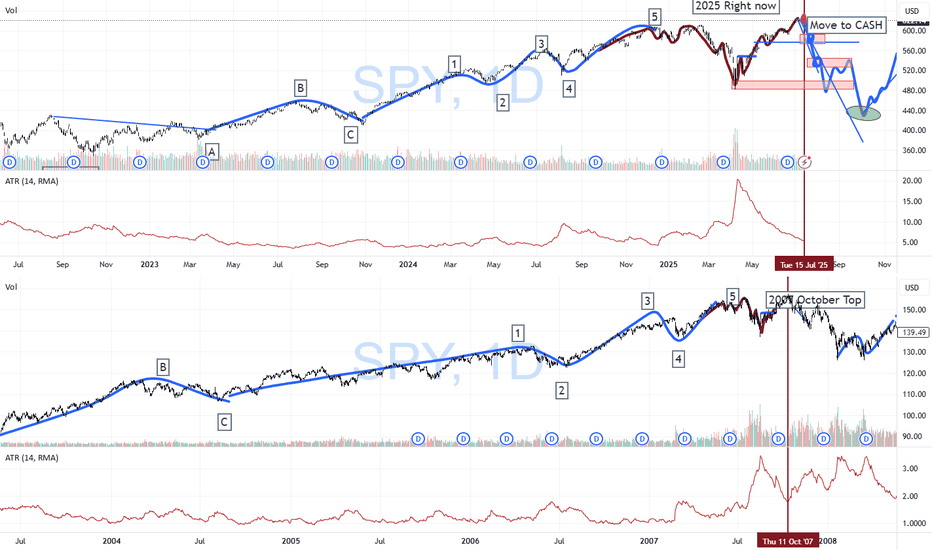

SPY/QQQ Plan Your Trade Special Update : BUCKLE UPThis video is a special update for all TradingView members. I felt I needed to share this information and present the case that I believe poses the most significant risk to your financial future - and it's happening right now.

Several weeks ago, I identified a very unique mirror setup in the SPY an

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

S27 trades at 641.27 USD today, its price has risen 0.13% in the past 24 hours. Track more dynamics on S27 price chart.

S27 net asset value is 636.83 today — it's risen 4.11% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

S27 assets under management is 655.87 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

S27 price has risen by 4.83% over the last month, and its yearly performance shows a 18.23% increase. See more dynamics on S27 price chart.

NAV returns, another gauge of an ETF dynamics, have risen by 4.11% over the last month, showed a 15.97% increase in three-month performance and has increased by 19.18% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by 4.11% over the last month, showed a 15.97% increase in three-month performance and has increased by 19.18% in a year.

S27 fund flows account for 5.23 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

S27 invests in stocks. See more details in our Analysis section.

S27 expense ratio is 0.09%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, S27 isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, S27 technical analysis shows the strong buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating S27 shows the strong buy signal. See more of S27 technicals for a more comprehensive analysis.

Today, S27 technical analysis shows the strong buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating S27 shows the strong buy signal. See more of S27 technicals for a more comprehensive analysis.

Yes, S27 pays dividends to its holders with the dividend yield of 1.13%.

S27 trades at a premium (0.08%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

S27 shares are issued by State Street Corp.

S27 follows the S&P 500. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Jan 22, 1993.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.