Nightly $SPY / $SPX Scenarios for April 1, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 ISM Manufacturing PMI Release: The Institute for Supply Management (ISM) will release its Manufacturing Purchasing Managers' Index (PMI) for March. A reading below 50 indicates contraction in the manufacturing sector, which could influence market sentiment.

🇺🇸🏗️ Construction Spending Data: The U.S. Census Bureau will report on February's construction spending, providing insights into the health of the construction industry and potential impacts on related sectors.

🇺🇸📄 Job Openings Report: The Job Openings and Labor Turnover Survey (JOLTS) for February will be released, offering a view into labor demand and potential implications for wage growth and consumer spending.

📊 Key Data Releases 📊

📅 Tuesday, April 1:

🏭 ISM Manufacturing PMI (10:00 AM ET):

Forecast: 49.5%

Previous: 50.3%

Assesses the health of the manufacturing sector; a reading below 50% suggests contraction.

🏗️ Construction Spending (10:00 AM ET):

Forecast: 0.3%

Previous: -0.2%

Measures the total value of construction work done; indicates trends in the construction industry.

📄 Job Openings (10:00 AM ET):

Forecast: 7.7 million

Previous: 7.7 million

Provides insight into labor market demand by reporting the number of job vacancies.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

S27 trade ideas

SPY/QQQ Plan Your Trade EOD Update : Rejecting The BreakdownDoes this big rejection bar mean the selling trend is over?

I doubt it.

In my opinion and experience, big rejection bars like this reflect a critical price level where the markets will attempt to REVISIT in the near future.

Normally, when we get a big rejection bar, like today, we are testing a critical support/resistance level in price and you can see the difference between the SPY, DIA and QQQ charts.

The QQQ price data is already below the critical support level and barely trying to get back above the rejection level. Whereas the SPY and DIA are still above the rejection lows.

I see this as a technology driven breakdown and because of the continued CAPTIAL SHIFT, we may move into a broader WAVE-C breakdown of this current trend.

I see the SPY already completing a Wave-A and Wave-B. If this breakdown plays out like I expect, we'll see a bigger breakdown in price targeting $525-535, then possibly reaching $495-505 as the immediate ultimate low.

If you follow my research, there is a much lower level near $465-475 that is still a likely downward target level, but we'll have to see how price reacts over the next 2+ days before we can determine if that level is still a valid target.

Watch for more support near recent lows tomorrow, then a potential breakdown in the SPY/QQQ/DIA.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY timing for low Tgt $585My short idea target was hit (and blown yesterday, tho QQQ idea was almost perfect), and if you saw the last idea, I mentioned the date of the 11th was in play. This seems accurate from what I'm getting now with my dowsing work.

I am quite pumped that the timing was so good. The upside target (repeating) is around $585. When I ask what date this hits by, I get 3/25. We shall see if lightning can strike twice!

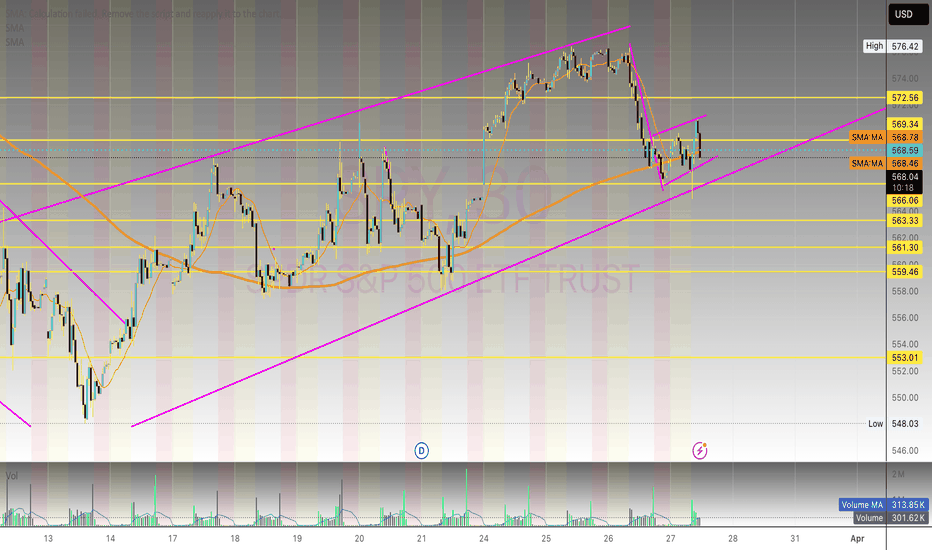

SPY - Macro-Market Overview and what the algorithms are sayingCurrently we are being guided by a strong selling teal on the LTF but we must keep in mind the HTF algorithms of red and white (which are bullish liquidity builders). Right now, we need to see who wins out in this fight between teal and red - if we break red and prove teal guidance, we are definitively in strong selling and can easily make our way toward the HTF white at the low $500's.

As always, let the algorithms guide you!

Happy Trading :)

SPY/QQQ Plan Your Trade For 3-31 : Carryover PatternToday's pattern suggests the SPY/QQQ will attempt to carryover Friday's selling trend.

I do believe the SPY/QQQ will attempt to find some support as we move into a Temp Bottom pattern tomorrow. So be aware that the SPY/QQQ may attempt to find support near 535-540/450-455 over the next few days.

I would also urge traders to not get very aggressive in terms of trying to pick a bottom in this downtrend.

In my opinion, I don't see any reason why anyone should be buying into this breakdown unless you are prepared to take a few big lumps. Just wait it out - wait for a base/bottom to setup.

Gold and Silver are moving higher and I believe this trend will continue for many weeks/months.

BTCUSD should continue to move downward - trying to establish the Consolidation Phase range.

As we move into trading this week. Be aware that Tuesday/Wednesday of this week are more ROTATION type days. They may be wide-range days - but they are still going to be ROTATIONAL.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$Spy Road To $544well in summary this is the same chart i made 2 in a half weeks ago with no changes i never changed my thesis to bear lol allocating funds to the downside for my Short thesis!!! Lets see if we hit $544 this week Market sentiment is Bearish Terrif Reactions will most likely be priced in shortly so the market can actually choose its direction short bear market or bear market this week, this week will give a lot of insight and valuable information as always safe trades good luck traders and yes i will update this thread when in my theory and assessment analysis of $544 hits where i think the market go from there!!!!!

Weekly $SPY / $SPX Scenarios for March 31 – April 4, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 Anticipated U.S. Jobs Report: The March employment data, set for release on Friday, April 4, is expected to show a slowdown in job growth, with forecasts predicting an increase of 140,000 nonfarm payrolls, down from 151,000 in February. The unemployment rate is projected to remain steady at 4.1%. This report will be closely monitored for signs of economic momentum and potential impacts on Federal Reserve policy.

🇺🇸💼 President Trump's Tariff Announcement: President Donald Trump is scheduled to unveil his "reciprocal tariffs" plan on Wednesday, April 2, dubbed "Liberation Day." The announcement is anticipated to include a 25% duty on imported vehicles, which could significantly impact the automotive industry and broader market sentiment. Investors are bracing for potential volatility in response to these trade policy developments.

🇺🇸📊 Manufacturing and Services Sector Updates: Key indicators for the manufacturing and services sectors are due this week. The ISM Manufacturing PMI, scheduled for Tuesday, April 1, is expected to show a slight contraction with a forecast of 49.5%, down from 50.3% in February. The ISM Services PMI, set for release on Thursday, April 3, is projected at 53.0%, indicating continued expansion but at a slower pace. These reports will provide insights into the health of these critical sectors.

MarketWatch

📊 Key Data Releases 📊

📅 Monday, March 31:

🏭 Chicago Business Barometer (PMI) (9:45 AM ET):

Forecast: 45.5

Previous: 43.6

Measures business conditions in the Chicago area, with readings below 50 indicating contraction.

📅 Tuesday, April 1:

🏗️ Construction Spending (10:00 AM ET):

Forecast: 0.3%

Previous: -0.2%

Indicates the total amount spent on construction projects, reflecting trends in the construction industry.

📄 Job Openings (10:00 AM ET):

Forecast: 7.7 million

Previous: 7.7 million

Provides insight into labor demand by measuring the number of job vacancies.

📅 Wednesday, April 2:

🏭 Factory Orders (10:00 AM ET):

Forecast: 0.6%

Previous: 1.7%

Reflects the dollar level of new orders for both durable and non-durable goods, indicating manufacturing demand.

📅 Thursday, April 3:

📉 Initial Jobless Claims (8:30 AM ET):

Forecast: 226,000

Previous: 224,000

Measures the number of individuals filing for unemployment benefits for the first time, providing insight into labor market conditions.

📊 Trade Balance (8:30 AM ET):

Forecast: -$123.0 billion

Previous: -$131.4 billion

Indicates the difference between exports and imports of goods and services, reflecting the nation's trade activity.

📅 Friday, April 4:

💵 Average Hourly Earnings (8:30 AM ET):

Forecast: 0.3%

Previous: 0.3%

Measures the change in earnings per hour for workers, indicating wage inflation.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

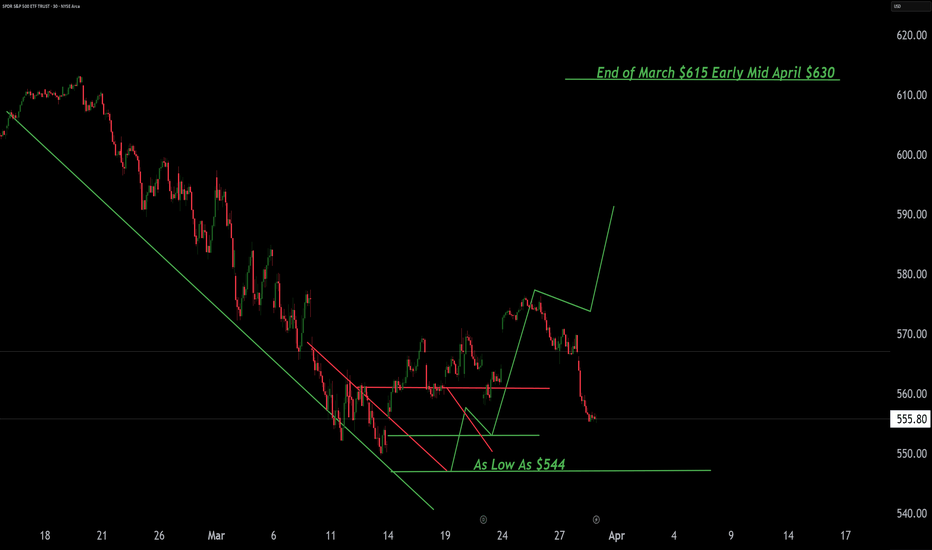

SPY $545 Downtrend ContinuesSymbol: SPY

Timeframe: 30-minute chart (for your analysis)

Bias: Short (after the anticipated bounce)

Prediction: I anticipate a short-term bounce in SPY from Friday's sell-off towards the upper level of the weekly regression channel, around 560. I plan to look for a short entry at this level, expecting the price to then continue its downtrend towards the monthly regression channel support around 545.

Analysis:

Weekly Trend Channel (Blue Double Lines): The blue double lines on my chart represent a weekly trend channel for SPY. This channel was determined by performing a linear regression on the price action over the past week. The upper and lower boundaries of the channel are set at two standard deviations away from this linear regression line. This method helps to identify the statistically probable range within which the price is likely to trade over the weekly timeframe.

Monthly Trend Channel (Yellow Double Lines): Similarly, the yellow double lines indicate a monthly trend channel. This channel is derived from a linear regression of SPY's price action over the past month, with the boundaries set at two standard deviations. I expect SPY to eventually find support within this monthly channel, with the lower boundary currently around the 545 level. This is my primary downside target.

Recent Price Action and Anticipated Bounce: The aggressive 2% downtrend on Friday likely pushed SPY towards the lower end of the weekly channel, potentially creating oversold conditions in the short term. I am anticipating a bounce from this sell-off towards the upper boundary of the weekly channel, which I estimate to be around 560. This level is expected to act as resistance.

Short Entry Opportunity: I will be closely watching price action around the 560 level, which coincides with the upper boundary of the weekly regression channel. If I observe signs of rejection or bearish confirmation at this resistance, I will look to enter a short position.

Contributing Factors: President Trump's aggressive tariff policies continue to contribute to market uncertainty and the overall bearish sentiment, supporting the technical outlook for further downside.

Conclusion:

I am predicting a short-term bounce in SPY to approximately 560, which aligns with the upper level of the weekly regression channel. I will be looking for a short entry at this level with the expectation of a subsequent move down towards the monthly regression channel support around 545. This strategy aims to capitalize on a potential retracement within the established downtrend, guided by regression-based trend channels and influenced by fundamental concerns regarding tariff policies.

Disclaimer: This is my personal analysis and not financial advice. Please conduct your own research before making any trading decisions.

The Greatest Opportunity of Your Life : Answering QuestionsThis video is an answer to Luck264's question about potential price rotation.

I go into much more details because I want to highlight the need to keep price action in perspective related to overall (broader) and more immediate (shorter-term) trends.

Additionally, I try to highlight what I've been trying to tell all of you over the past 3+ years...

The next 3-%+ years are the GREATEST OPPORTUNITY OF YOUR LIFE.

You can't even imagine the potential for gains unless I try to draw it out for you. So, here you go.

This video highlights why price is the ultimate indicator and why my research/data is superior to many other types of analysis.

My data is factual, process-based, and results in A or B outcomes.

I don't mess around with too many indicators because I find them confusing at times.

Price tells me everything I need to know - learn what I do to improve your trading.

Hope you enjoy this video.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

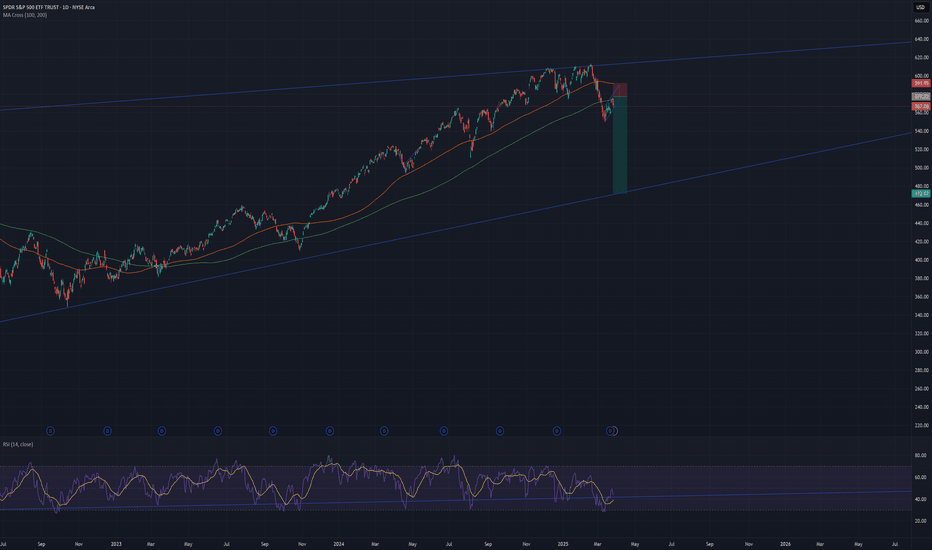

$SPY - Keep It SimpleAll about trend lines. Since 2020 to today, there have been three major trends. The first was the bull run from covid bottoms to the 2022 highs; a very distinct trend line being drawn. The second was the correct in 2022; another distinct trendline drawn. Recently, we have a break of the uptrend associated with a bear flag continuation pattern. Keeping it simple, we take the pole of the flag and we measure it; 515-520 is a potential target. It lines up with prior lows and also the 0.385 fib level.

SPY: Bulls Will Push

The price of SPY will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

SPY Price Projection: Mid-2025 TargetRevealing Market Trends: Logarithmic Regression Analysis Indicates Bullish Path for SPY

In the ever-evolving realm of financial analysis, the search for reliable predictions remains ongoing. Logarithmic scale regression analysis, coupled with potent indicators, has emerged as a promising tool for discerning trends, particularly regarding assets like the SPY.

This analysis delves into the utilization of logarithmic scale regression alongside two robust indicators, offering insights into the potential trajectory of the SPY's price movement. It's essential to note that the interpretations and predictions presented are based on my analysis alone and should not be construed as financial advice. As with any market analysis, uncertainties persist, and actual outcomes may diverge from projections.

Logarithmic scale regression accounts for the exponential nature of price movements, providing a nuanced perspective on long-term trends. When combined with indicators such as moving averages or momentum oscillators, the analysis gains depth, revealing not only the direction but also the strength of the trend.

After meticulous examination of historical data and the application of analytical tools, our analysis suggests a bullish trajectory for the SPY, with a projected price nearing 620 EUR by mid-2025. This projection implies a significant uptrend from the current date, with a potential increase of approximately 20% over the specified timeframe.

However, it's crucial to approach such forecasts with caution, recognizing the inherent risks associated with financial markets. While our analysis indicates a positive outlook, market conditions can change rapidly, leading to deviations from expected trends.

In summary, logarithmic scale regression analysis, supported by robust indicators, offers valuable insights into market trends and potential price movements. While our analysis suggests a bullish sentiment for the SPY, investors should conduct thorough research and seek professional advice before making investment decisions.

Disclaimer: The analysis provided is based on personal interpretation and should not be considered financial advice. Investing in financial markets carries risks, and actual outcomes may differ. Readers are encouraged to conduct their own research and consult with financial professionals before making investment decisions.

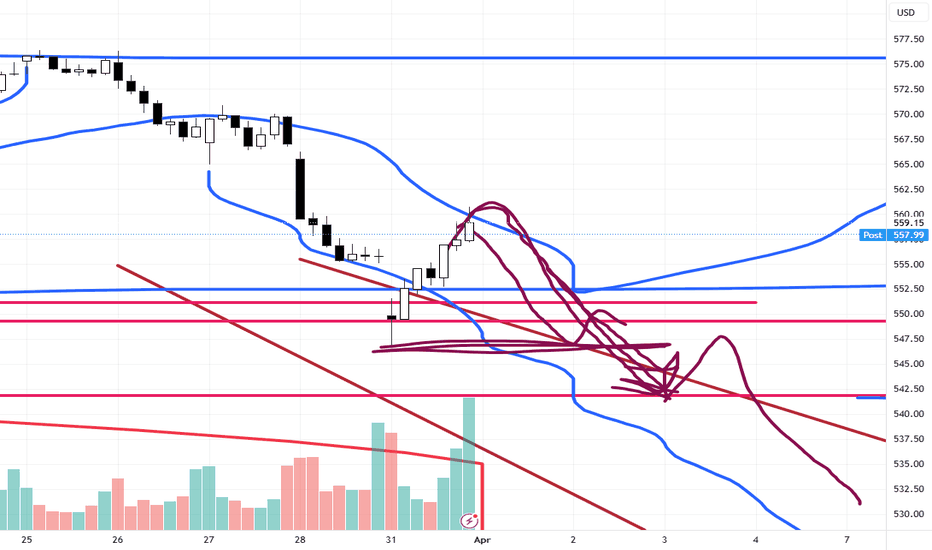

SPY: End of March/Start of April Hey everyone,

Going to keep this short because I feel like, between projections and levels, I have a good idea of what is going to happen next week.

The chain of events seem to be gap down/ or sell towards 550 / 549, then up to 557 (which is also our reference target, that yellow line in the chart) where we see rejection to sub 550.

I am a little shook that this is moving super quick, but the last correction in a Trump era was fairly swift, tumbling over 20% in the span of maybe 3 months if I remember correctly (2018). But it was a complex market because there was an initial collapse, then a choppy grind up to highs, then an even deeper sell. I am hoping that this does not repeat because that would be annoying.

Here is the forecast:

The red line is the best fit projection.

Looking at the forecast overlaid with the levels for next week it does really align well with the move to 557.

If we are to break over 557, then I would be looking for a cap at 559.

The best fit low is 546, which means dropping below previous support.

The ultimate target as of right now is a move back to the quadratic mean in the 490s. Though we could find support on the upper confidence level.

If we are doing a very fundamental correction, 472 is SPY's mean based on the US money supply:

As of right now the target to really just care about is 546.

And as a side note, there was a ton of volume uptick in that 555 range. We only hit it on Friday, but over the last 5 days, 555 comprised the HIGHEST volume, all selling, to the point of being SPY's 5 day POC. That is pretty intense for a new low on the week achieved Friday a few hours before market closed for the weekend to comprise the most volume and it being 95% in one direction. This stark EOW volume generally would lead to gap in the direction of the volume, which was bearish, so hence I do expect a bit of a gap down.

Anyway, those are my thoughts, keeping the idea fairly simple this week because I'm tired haha.

Safe trades, enjoy your weekend!

P.s. Thank you as always to Tradingview for allowing people to do plots with pinescript on public ideas! 🙏🙏🙏

SPY Set To Grow! BUY!

My dear friends,

SPY looks like it will make a good move, and here are the details:

The market is trading on 555.80 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 569.99

Recommended Stop Loss - 549.79

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SPY is still on thin iceA month back I wouldn't have believed this post though I did expect 10% correction and exited my major position at the top. I post this as pure academic purpose and my own record. I find volume profile the most important tool in technical analysis. Whatever I present here is an educated guess and not pure speculation. Before doing the profile I did a VP study on major stocks, since VP shows more clarity on the stocks

Based on Volume profile the sellers will have little resistance breaking through thin ice zone. We could still be looking at 514 easily. Then it starts facing some resistance

Market is still breaking through bubble territory. The reason I call bubble territory is because the volume became significantly lower after May 24. Most of the large investors and funds had bought their major holding by then. If fact based on news Warren Buffet and Michael Burry started selling USA market in August and kept selling till end of Dec. WB sold his entire holding of American express, one of his favourite company Berkshire was holding largest cash balance in is history by Dec. Smart guy. So I just followed him. Then I ask If these heavy weights are selling will they back after 10% correction? No way, they would wait for at least 20% or more markdown

This give me confidence in my analysis and economic environment supports that too

The market will quick fall through low volume region or imbalances. These act like magnets for the price and stop or pause for a breath at High volume nodes and even bounce back to take back some the low volume nodes. These can create a flag structure. This what happened when the market bounced back from 5500 to 5790 and reversed again. I correctly said in a previous post it was a bear flag

When the market is euphoric and in FOMO stage it will leave lots of volume gaps which attracts the market back to those levels

$SPY Short position.To add context, I am an average joe in his 20's who graduated high school with a 1.6 GPA.. Prior to my current employment at a financial institution, I worked as a gas station clerk. I am not someone who sees himself as a genius, but I am somebody who identifies patterns not only in people, but charts as well. I've worked for a bank on the credit card side coming up on 5 years. Day in day out, people are struggling to keep up with their credit card payments. 750-830 FICOs struggling to keep up with bills. Keep in mind, I only work with what we deem our 'high value', cliental. If our card holders who we deem to be good or great consumers are struggling to keep up, I can only imagine what it looks like for those who don't qualify to get to my department (which is a rather big pool of people). This thesis is centered around a possible correction in the short term, that may lead to a long-term reset based off of 4 things: human behavior, Federal Reserve Data, inflation, and credit.

The market as we know it has been propped on lies, fraud, and negligence. This is not a political post, but if you look at Federal Reserve Reports through FOMC under the previous administration, over 48% of job reports specifically, were revised downwards. During the duration of March of 2021 to September of 2024, approximately 808,000 jobs were "added", to the economy. One can make the argument that these numbers were there to, 'fluff, reportings to hide one of the worst economies in history.

The Dollar has been a concept and an asset since 1785. Since 2020, we've printed over 60% of all dollars circulating. Over 200 years and it only took the U.S. a little under 5 years to print over 60% of all U.S. currency circulating. The inflation never left; it was hidden by false or fraudulent data. Americans have been squeezed from their hard-earned dollar for the last 4 years, between higher interest rates, higher inflation and cost of living. Remember how I mentioned I work for a bank on the credit card side? Minimal payments, easily $6500 dollar balances on average, being carried month to month between 24-27% APR. Americans DO not have money. Over the last month, one of the most common statements I've heard is, "The only way I can pay this off is I cash out on assets.". Delinquencies are sky rocketing to levels not seen since '07 - '08. People are slowly getting the same thought.

The first week of April in my opinion is do or die. Trump is set to announce new tariffs as of April 2nd. If Trump decides to really lay down the tariffs and kick off a real trade war, markets will react in a manner of uncertainty. If in that same week, the Federal Reserve forecasts a lower GDP, a higher CPI, a decrease in forecast in employment, that could be the kick that takes the stool out from under the market.

If you've made it this far, thank you for taking the time to consider my first publication.

-ScG