SHIBUSDT OLD enough to break the resistance and pump soon While the spots are waking up it seems here we have kind of sleep and dead coin named BINANCE:SHIBUSDT but this turtle🐢 usually pump later than any one else in market and kill the emotions of some holders.

So be patient + wait for breakout of red trendline = Heavy pump and profit coming.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

SHIBUSDT trade ideas

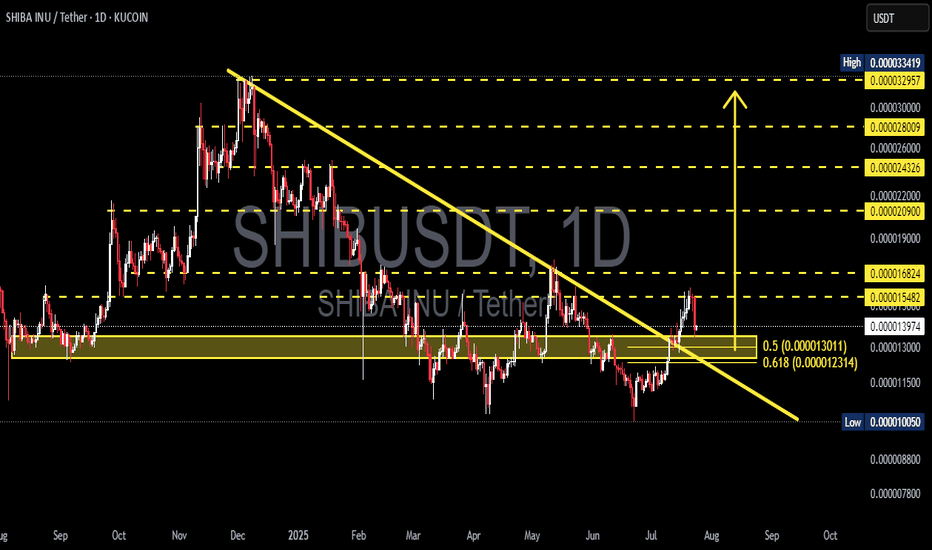

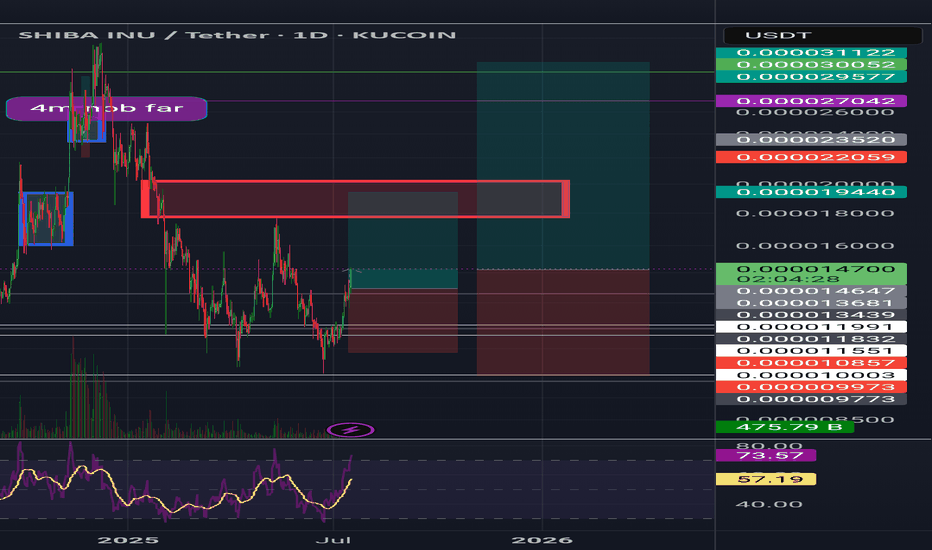

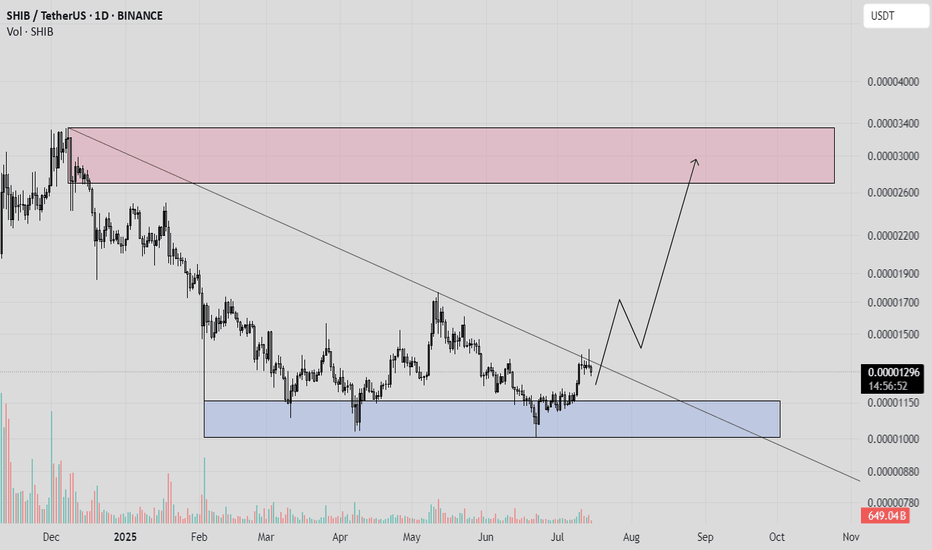

SHIBUSDT | Explosive Breakout from Long-Term Downtrend!📊 Overview:

After months of being trapped in a major downtrend, SHIBA INU (SHIBUSDT) has finally broken out of a multi-month descending trendline that has been capping price action since late 2024. But this isn’t just a minor breakout — this could mark a macro trend reversal, with bullish momentum building up fast.

---

📐 Technical Breakdown (Daily Chart – KuCoin):

🟡 Chart Pattern:

A clear Falling Wedge pattern has been forming since December 2024.

The breakout occurred mid-July 2025 with strong price action and early confirmation from volume.

Falling wedge is typically a bullish reversal pattern — and this breakout confirms that narrative.

🟨 Breakout Zone:

Price decisively broke above the descending trendline and is now consolidating just above it.

A successful retest of the breakout level strengthens the bullish case.

🟦 Key Fibonacci Support – “Golden Pocket”:

The zone between 0.000013011 (Fib 0.5) and 0.000012314 (Fib 0.618) is now acting as strong support.

Known as the “Golden Pocket”, this zone is often where high-probability reversals occur.

---

🚀 Bullish Scenario (High Probability):

As long as price stays above the Fibonacci golden pocket, SHIB is well-positioned for a continued rally. Key upside targets include:

1. 📍 Target 1: 0.000016824 → Previous key resistance

2. 📍 Target 2: 0.000022000 → February supply zone

3. 📍 Target 3: 0.000029000 → Major historical resistance

4. 🏁 Target 4 (Full Extension): 0.000033419 → Potential top of the breakout range

If momentum and market sentiment align, SHIB may be entering a new bullish cycle.

---

🔻 Bearish Scenario (Low Probability, but Manage Risk):

If price fails to hold above the golden pocket:

🔽 Support 1: 0.000011500 → Previous consolidation base

🔽 Support 2: 0.000010050 → Historical demand zone

A breakdown below 0.000010050 would invalidate the bullish structure and shift SHIB back into a prolonged accumulation phase.

---

🔍 Conclusion & Market Sentiment:

✅ The trend has flipped! This is one of the most anticipated breakouts for SHIB holders. As long as the structure holds above the golden pocket zone, the bullish outlook remains very strong.

⚠️ However, beware of potential fakeouts if volume drops or Bitcoin triggers broad market weakness.

---

📢 Trading Setup (Not Financial Advice):

For Bulls: Look for entries around 0.00001350–0.00001300

Stop-loss: Below 0.00001220

Take-profits: 0.0000168 → 0.000022 → 0.000029

For Bears: Wait for breakdown below 0.00001200 to consider short positions

---

🧠 Final Notes:

> SHIB remains a high-volatility microcap token. It's a prime pick for swing traders and momentum hunters — but risk management is key. Keep an eye on BTC for confirmation or invalidation.

#SHIBUSDT #SHIBA #SHIBBreakout #AltcoinSeason #BullishSetup #GoldenPocket #FallingWedge #CryptoSignals #TechnicalAnalysis #BreakoutPlay

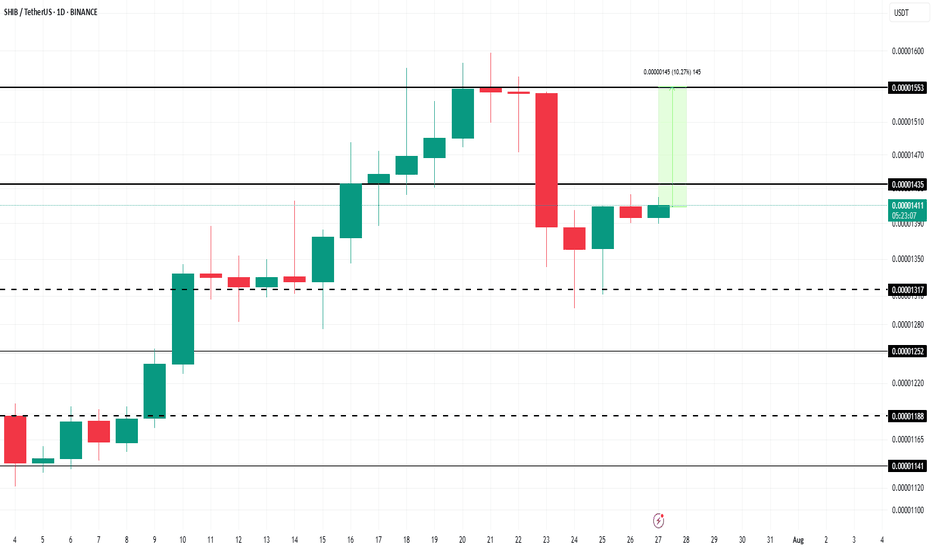

Here’s Why Shiba Inu Price’s 10% Rise Entails $50 Million LossesAt the time of writing, BINANCE:SHIBUSDT price is $0.00001407, sitting just below the resistance level of $0.00001435. The altcoin has been facing mixed signals, with both bearish and bullish factors playing a role in its price action. The key resistance level of $0.00001435 needs to be broken for a potential recovery.

The liquidation map shows a fascinating development: if BINANCE:SHIBUSDT recovers the 10% losses it has sustained by reaching $0.00001553, it could trigger over $52 million worth of short liquidations . Short sellers have been betting on a decline, but if SHIB rebounds, these traders will face considerable losses.

If BINANCE:SHIBUSDT continues to hover within the consolidation range of $0.00001435 and $0.00001317 , traders will remain safe from liquidation risks. This sideways movement will keep the altcoin within a neutral zone, avoiding drastic price changes in the immediate term.

However, if BINANCE:SHIBUSDT price manages to break the resistance at $0.00001435 and flips it into support, SHIB could potentially climb back to $0.00001553. This would mark a 10% recovery , invalidating the current bearish sentiment and shifting the outlook to a more optimistic tone.

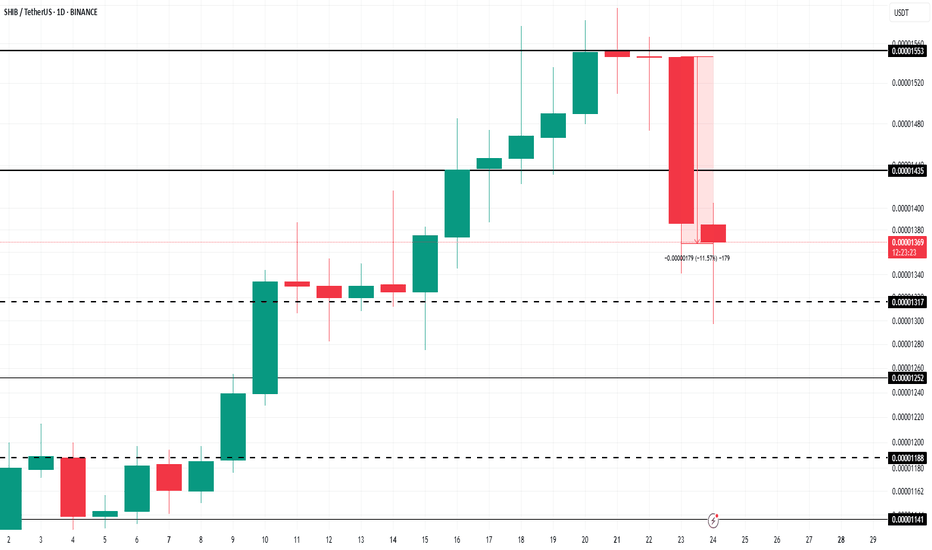

Shiba Inu Whales Amass 4.66 Trillion SHIB As Price Falls 12%BINANCE:SHIBUSDT price is currently trading at $0.00001353, down 11.5% over the past 24 hours . The altcoin is holding above the support level of $0.00001368.

The large holders' netflow for BINANCE:SHIBUSDT has recently spiked, reaching a two-month high. In the last 24 hours, 4.66 trillion SHIB were accumulated by addresses holding at least 0.1% of the circulating supply. These whales, who have collectively invested $63.7 million , are betting on a price rebound.

A successful bounce off $0.00001317 would likely pave the way for further price appreciation, potentially pushing BINANCE:SHIBUSDT to $0.00001553 . Securing this level as support could mark a recovery of today’s losses and initiate a new uptrend, provided the broader market conditions remain favorable.

On the other hand, if BINANCE:SHIBUSDT falls below the support of $0.00001317 due to profit-taking, the meme coin could slip to $0.00001188 . This would invalidate the bullish thesis and further reduce investor confidence. The next few days will be crucial in determining if SHIB can maintain its current support levels .

Shiba Inu (SHIB): Waiting For Buyers To Break 200 Moving AverageShiba had recently been rejected by 200EMA, and since getting rejected, the price has been falling and sellers are starting to show dominance, but this does not mean that we are entering yet into a bearish trend.

As we got a rejection, now we are waiting and going to monitor how the next candles will develop the structure, and based on it, we will be trading, but looking at the overall picture, we are looking for that 200EMA to be broken, after which we might be getting a good upward movement from there.

Swallow Academy

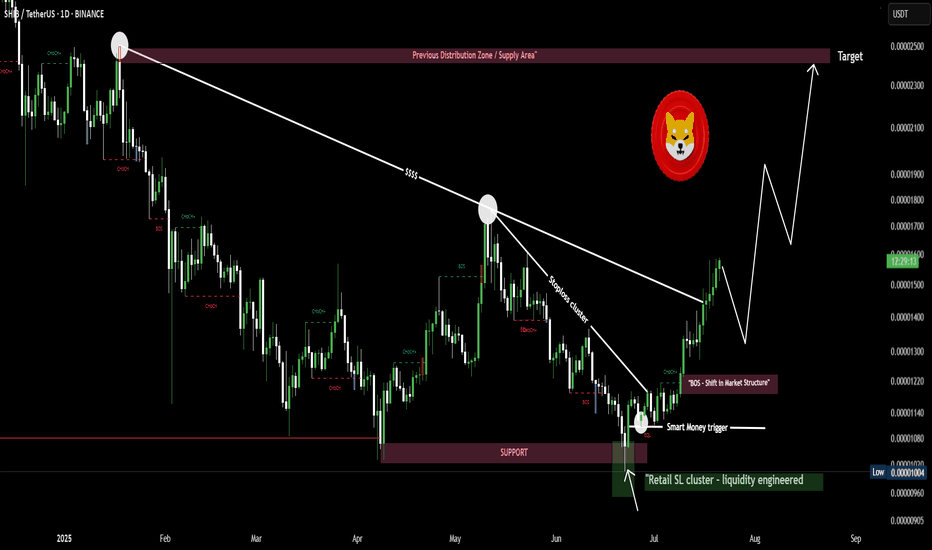

$SHIB/USDT Grabbed liquidity below key support and reversed hardSHIB just gave you a free masterclass in liquidity.

Here’s exactly what happened 👇

2/

Retail panic sold as price broke support.

That break? Engineered.

Liquidity was swept, and price instantly reversed — leaving late sellers wrecked.

3/

Smart money doesn’t chase.

They trap you first, then move the market in their direction.

SHIB is now showing momentum with clean market structure.

Next target: $0.000025🚀🚀

SHIB grabbed liquidity below key support and reversed hard

$SHIB Ready to Move?CRYPTOCAP:SHIB has printed confirmed weekly bullish divergence in RSI and is now attempting to overcome the weekly 200EMA resistance.

A High Volume Node lies just above but a close above this will signal a bullish trend ready to move the initial target of the weekly pivot point followed by the 0.0003579 High Volume Node.

Price completed its retracement to the 'alt-coin' golden pocket 0.786 Fibonacci retracement.

Bearish divergence is currently growing on the weekly RSI but will be diverted with a thrust high!

Is it MEME season? CRYPTOCAP:DOGE also looks ready to go!

Safe trading

Can Shiba Inu rally 20 percent to hit 0.000015?Hello✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Shiba Inu📈.

BINANCE:SHIBUSDT has decisively broken above its descending channel and key daily resistance, supported by fresh, solid volume 📈. This breakout signals strong momentum, with a projected upside of at least 20% targeting 0.000015 🚀.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

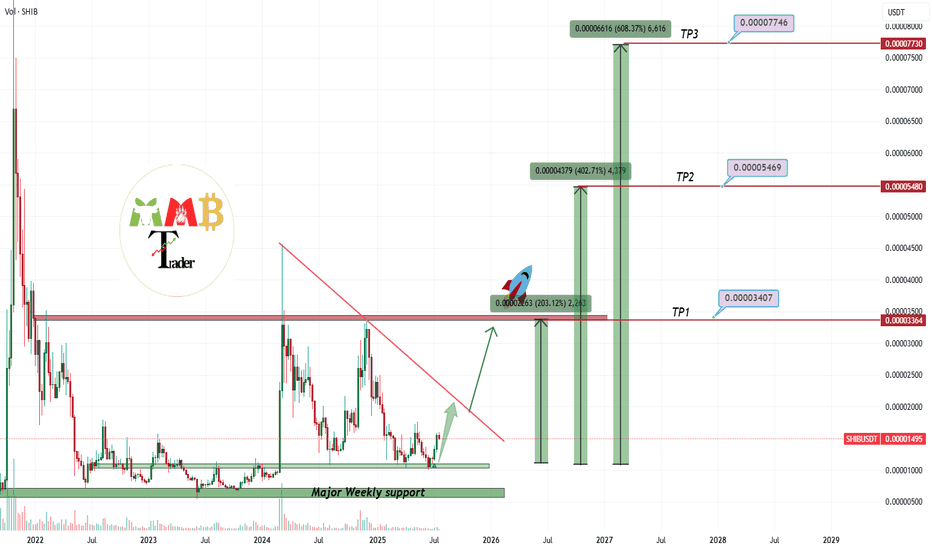

SHIBUSDT first target is +200% after years of sleepBINANCE:SHIBUSDT is not dead or sleep or it wont be any more and i think in this market soon it can see more gain and this +40% until now is just start and at least our first target which is +200% can hit soon like green arrow.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

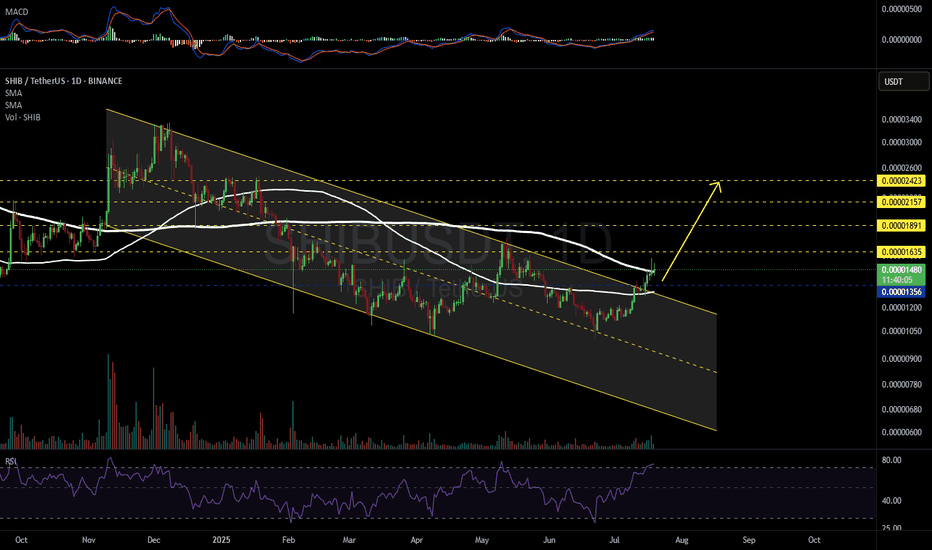

SHIBUSDT 1D#SHIB has broken above the descending channel and the SMA100 on the daily timeframe. It is now facing the daily SMA200, and it seems likely that we may see a minor correction toward the support level around $0.00001356. In case of a successful retest, the targets are:

🎯 $0.00001635

🎯 $0.00001891

🎯 $0.00002157

🎯 $0.00002423

⚠️ Always use a tight stop-loss and apply proper risk management.

SHIBUSDT🕯 The key resistance level, identified as the best resistance for a break and pump, stands at 0.0000135, with a potential price increase to 0.00001567 if breached, serving as the next target (Pullback level). On the support side, the main level is observed at 0.0000115, and should the price fall below this, it may decline further to the lower Major Level of 0.0000100.

🔽 Resistances:

Main resistance level: 0.0000135 (potential break for pump)

Next target (Pullback level): 0.00001567

🔼 Supports:

Main support level: 0.0000115

Lower level (Major Level): 0.0000100

⚠️Contorl Risk management for trades.

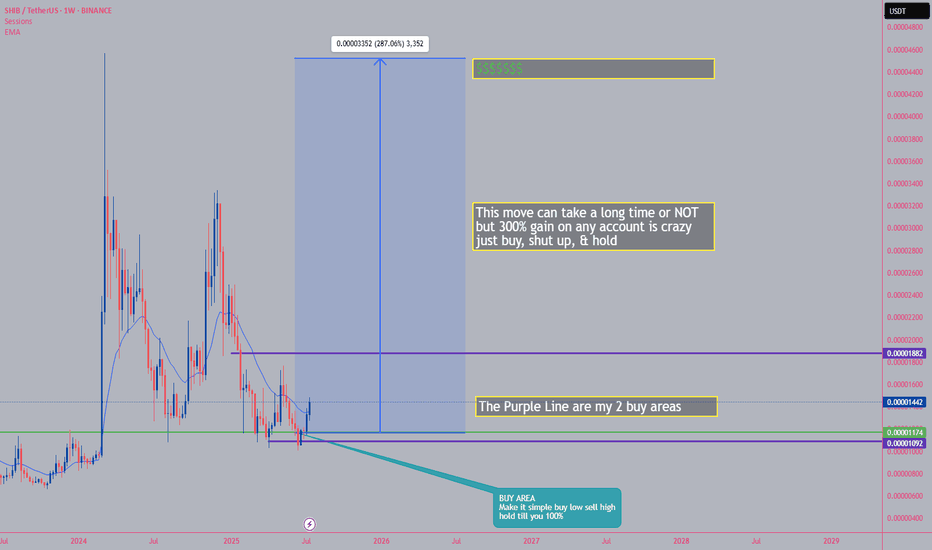

#SHIBUSDT Weekly Outlook — Mid-Cycle Reversal or Final Retest?🐾 #SHIBUSDT Weekly Outlook — Mid-Cycle Reversal or Final Retest?

🗓 Published: May 10, 2025

📊 Timeframe: 1W | Exchange: Binance

Author: @HamadaMark

🔍 Market Structure Overview

SHIB has completed a multi-year macro compression phase and is currently retesting the mid-cycle support zone, holding above critical levels for now. The chart now reflects two scenarios merging:

A descending macro channel

A forming double bottom reversal near key historical demand

📌 Observed Patterns:

✅ Macro descending channel

✅ Higher low structure vs. 2022–2023 base

✅ Failed breakdown attempt below $0.00001073

✅ Fibonacci levels and price memory still respected

🟦 Key Support Levels:

Main Support Zone: $0.00001103 – $0.00001073

Last Defense / Panic Level: $0.00000535

📛 Breakdown here = cycle invalidation, opens risk for full reset

Lower Historic Floor: $0.00000510 (cycle base)

🎯 Bullish Reversal Targets (Fib-Based):

TP1: $0.00001761 – Previous neckline zone

TP2: $0.00002828 – Channel midpoint / Fib 0.786

TP3: $0.00004176 – Macro W-pattern measured move

TP4: $0.00005842 – Fib 1.618 (Breakout extension)

TP5: $0.00008555 – 2.618 (2021 ATH retest territory)

📈 Potential upside: +200% to +400% if structure holds

🧠 Strategy Insight

• Long-term buyers may DCA in the blue zone

• Higher probability entries on reclaim of $0.000017–$0.000020

• Full confirmation only if SHIB breaks above $0.00002828 with volume

• Panic below $0.00000535 = invalidation of long-term accumulation thesis

💡 SHIB has historically delivered explosive returns after long consolidations — the current zone mirrors past setups.

🗣 What’s Next?

If bulls hold $0.000011–$0.000015 and reclaim mid-range resistances, we enter the next cycle phase.

A W-reversal is forming — neckline breakout will flip sentiment across the market.

📢 This is SHIB's final test — hold the base, and meme season returns. Lose it, and lights go off for a while.

we ask Allah reconcile and repay

SHIBA | Bullish Breakout ABOVE Ideal Buy ZoneBINANCE:SHIBUSDT

Shiba is know to make big increases in short periods of time... that's why we love it!

The tricky thing about SHIBA is that the pumps can be unpredictable so the best way to ensure a position is to buy as low as possible to the ideal buy zone.

In the weekly timeframe, the technical indicators are not quite bullish yet. The moving averages is still above the price, meaning the bulls have yet to take full control of the price in lower timeframes.

The same can be said for the daily, although we are seeing progress as the 200d moving averages have been reclaimed:

SHIB: Keep an eye on this level! Trading Setup

If you’re considering trading SHIB, here’s a quick setup that may help you.

The idea is: Buy when the price breaks above $0.000014 and take profits at the levels shown in the chart.

Targets:

1. $0.0000153

2. $0.0000183

3. $0.000021

4. $0.0000235

-------------------------------------------

About our trades:

Our success rate is notably high, with 10 out of 11 posted trade setups achieving at least their first target upon a breakout price breach (The most on TW!). Our TradingView page serves as a testament to this claim, and we invite you to verify it!

Shiba Inu (SHIB): Looking For Breakout | Do Not Miss It...Do not miss the breakout that we might see about to happen. We are looking for a breakout on SHIB coin where once we get that breakout from the zone of accumulation (sideways channel), we are going to look for further movement to upper target zones from there!

Swallow Academy

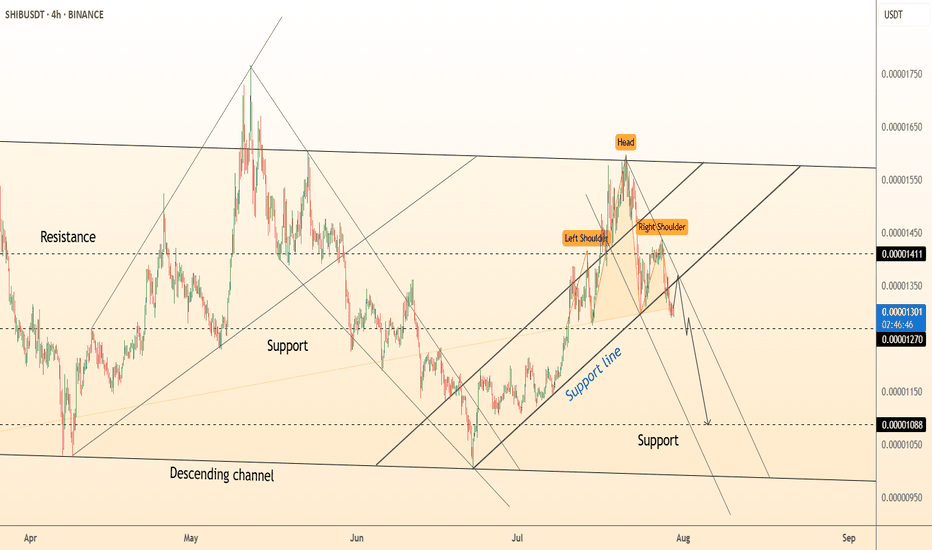

DeGRAM | SHIBUSD fell below the support line📊 Technical Analysis

● A classic Head and Shoulders pattern has formed below resistance at 0.00001411, confirming a bearish reversal with neckline break.

● Price is descending inside a bearish flag and is testing prior support at 0.00001270, with the next major level near 0.00001088.

💡 Fundamental Analysis

● Risk sentiment weakened after latest FOMC minutes signaled persistent inflation risk, fueling a defensive tilt in crypto.

● Whale outflows from SHIB wallets and declining DEX volumes suggest bearish positioning and fading demand.

✨ Summary

Bearish reversal confirmed below 0.00001411. Break of 0.00001270 opens path to 0.00001088. Watch neckline retests for renewed selling pressure.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

SHIBUSDT major weekly support of 0.000010$ is strong!!Two weekly supports which are 0.000010$ & 0.000007$ are strong enough to hold price like past years and i think soon those weekly +100% candles will surprise us here on BINANCE:SHIBUSDT too.

all major supports and resistances are all also mentioned on the chart too.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

SHIBA INU Heist Plan | Layered Buy Limits + SL Strategy🏴☠️💸**SHIBA INU Heist Blueprint: Rob the Bulls, Outsmart the Bears | Thief Trading Style Strategy (Swing/Scalp)**💸🏴☠️

🌍Hola! Hello! Marhaba! Bonjour! Ola! Hallo!🌍

💰Calling All Market Pirates, Profit Seekers, and Silent Thieves... the vault is open!💰

This is a special market mission for SHIB/USD (SHIBA INU), based on the notorious "Thief Trading Style" — a method designed to sneak in, grab profits, and vanish with style. 💼✨

🧠Backed by a spicy combo of technical, fundamental, on-chain, and sentiment analysis, this strategy is crafted for both swing and day traders ready to infiltrate volatile zones and escape with gains.

🎯The Robbery Plan:

We're targeting a high-risk, high-reward breakout with our eyes on the ATR police trap zone, where market makers often lure and trap traders. Our focus? The sweet spot where consolidation ends, fakeouts begin, and true reversals take off. ⚠️🐍

📥ENTRY (The Break-in):

"The Vault is Unlocked!"

Sneak in using buy limit orders at swing lows or support zones—opt for the 15m or 30m chart to catch pullbacks.

We're stacking orders like a professional thief using DCA (Layering Method) to reduce entry risk. 📊💼

🔎 Entry Zone: Market or limit entries near structure lows—be precise, not greedy.

🛑STOP LOSS (Escape Hatch):

Use the 2H swing low around 0.00001150 as your escape signal.

Risk management is your armor: adjust SL based on your lot size, order count, and trade exposure.

🔒Thief Tip: Never trade without your getaway plan!

📈TARGET (The Safe Zone):

🎯 Primary Target: 0.00001290

Optional: Use trailing SL and scale out profits as the robbery gets hotter.

Scalpers—only join the long side of the heist! If you're packing a big bag of capital, jump in earlier; if not, ride with the swing team. 🚁💸

📊THIEF FUNDAMENTAL FUEL:

SHIB bullish momentum is rising due to macro sentiment shifts, market rotation, whale accumulation, and on-chain volume flow.

Check related macro reports, intermarket insights, and crypto futures data before loading your bags. 🧠📈🔗

🛎️HEIST WARNINGS – Stay Safe!:

🚨 During major news releases, volatility can explode. Don’t get caught!

❌ Avoid fresh entries during news

✅ Use trailing stops to lock gains on existing positions

💖LOVE THIS PLAN? SUPPORT THE CREW:

💥Smash that Boost button💥 to keep the Thief Trading Crew alive and plotting!

We drop fresh heist plans regularly—help us spread the love, grow the crew, and keep stealing profits from the noise. 🚀

📌Disclaimer: This analysis is for educational purposes only—not financial advice. Always DYOR and adjust based on your personal risk profile.

📌Stay tuned for more heist missions. Let’s outwit the markets—one trade at a time.

🤑🐱👤💎 #ThiefTradingStyle #SHIBHeist #CryptoStrategy #MarketRobbery #SmartMoneyMoves