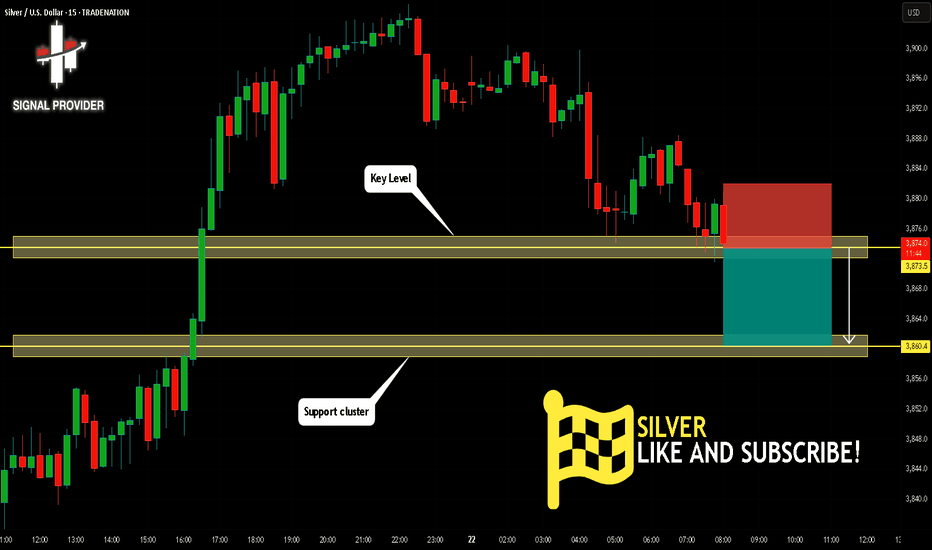

SILVER Is Going Down! Short!

Here is our detailed technical review for SILVER.

Time Frame: 15m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 3,873.5.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 3,860.4 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SILVER trade ideas

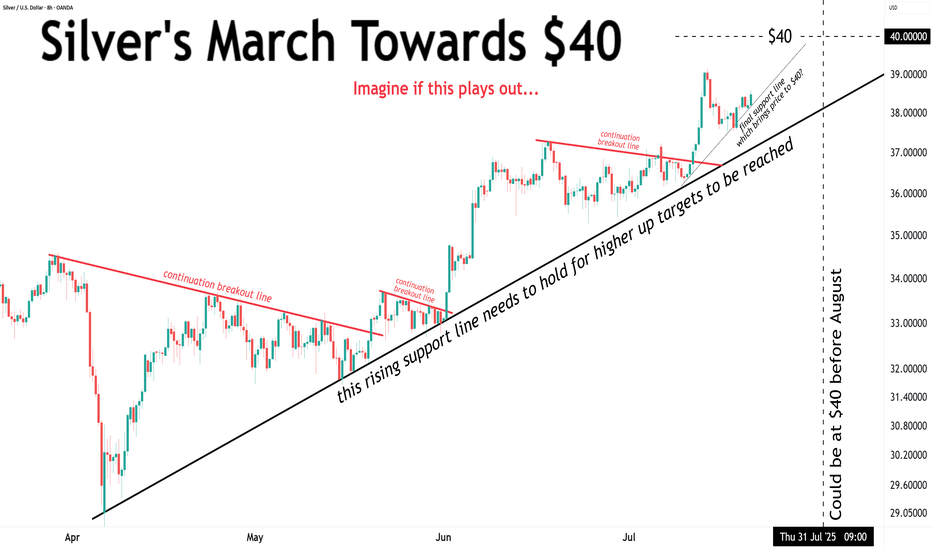

Silver Bullish continuation breakout supported at 3686The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at:

3814 – initial resistance

3865 – psychological and structural level

3920 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3686 would weaken the bullish outlook and suggest deeper downside risk toward:

3645 – minor support

3590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3686. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

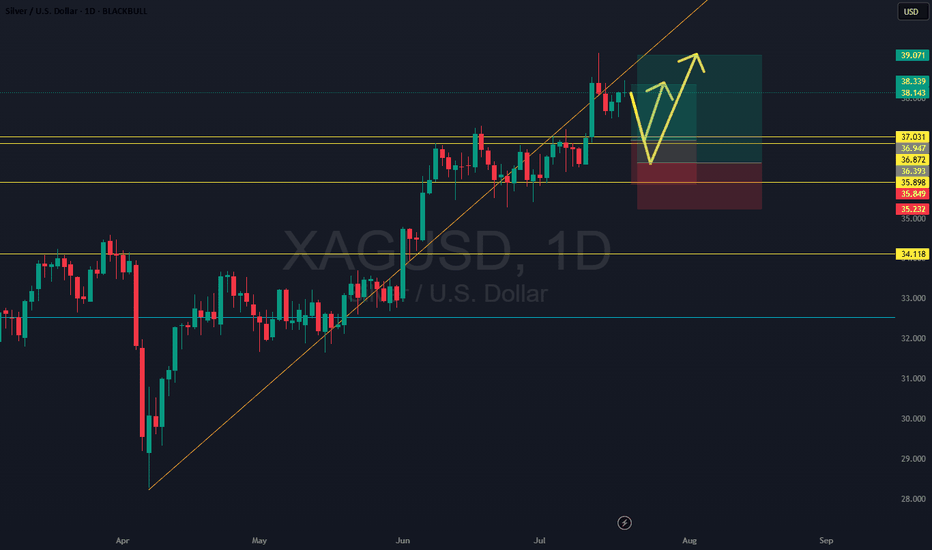

Final Phase of Circle Wave 3 XAG/USDFXOPEN:XAGUSD

We’re currently in the final stages of Circle Wave 3, which has developed through a series of 1–2–3 structures and internal ABC corrections.

Right now, we’re within the yellow count, moving from Wave 4 to Wave 5 – typically unfolding as an ABC structure.

🟡 Zooming In: Current Setup

✅ Wave A (of 4→5) is already complete – it formed as its own ABC

🔄 We’re currently transitioning from A → B

📈 A short-term move up is likely before a short entry targeting the final Wave C of 5

📏 Key Fibonacci Confluence Zone

I’ve marked the 71% extension level in green – it aligns perfectly with my broader Fibonacci target zone, where we could see the highest volume come in

My personal limit sell is at 37,700, inside this confluence zone

🛑 Stop-loss: 37,500 (below Wave 4)

🎯 Take-profit: Around 39,260, though this area could extend higher depending on momentum

💡 Trade Idea Summary

A clean, simple setup:

Look for upside push (Wave B)

Set limit short in the Fib zone (green area)

Watch for reversal into Wave C to complete Circle Wave 3

After that, I’ll be looking for mid- to long-term short setups 🔽

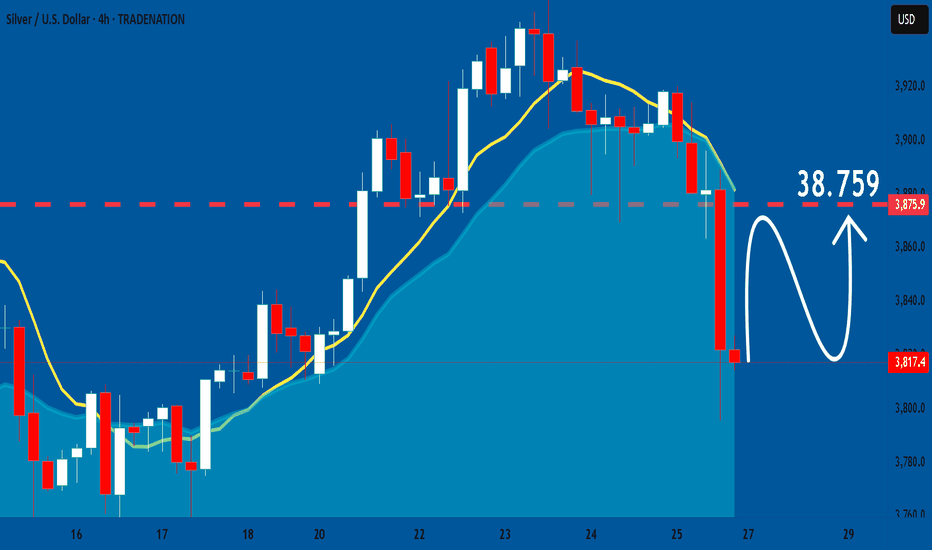

Silver Breakout: Retest & Launch? Two Entries, One Bullish BiasSilver’s uptrend is alive and kicking—with the daily breakout confirming bullish momentum. Price looks primed for a retest before a potential aggressive push toward new highs. We’re eyeing two entry scenarios: a conservative play with higher fill probability and a more aggressive setup with better structural protection but less chance of triggering. Both setups align with the same core thesis—momentum is strong, and this breakout could accelerate.

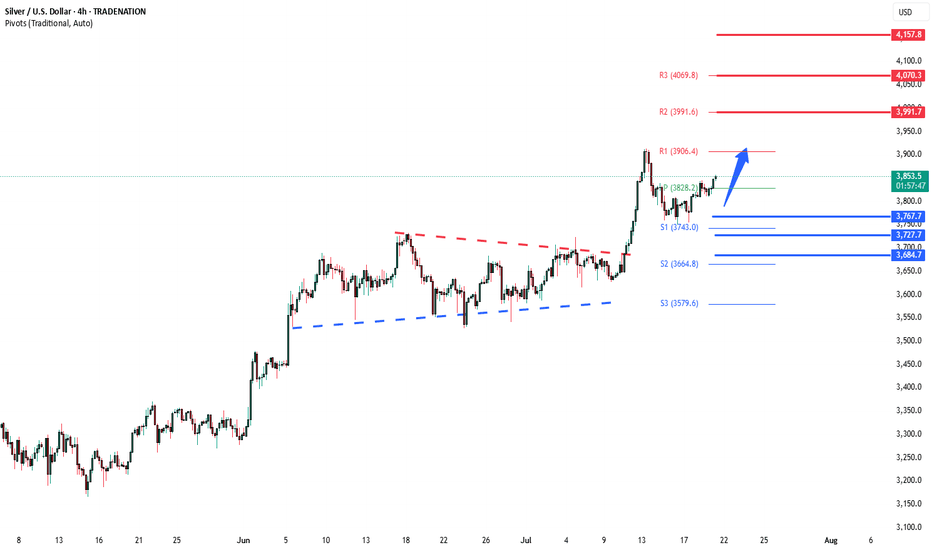

SILVER ( XAGUSD ): Still Bullish! Take The Buy Setups!In this Weekly Market Forecast, we will analyze the XAGUSD (SILVER) for the week of July 21-25th.

Silver remains a Strong Buy rating. There is no technical reason to look for shorts. Only buys right now, until we see a bearish break of structure. Then sells can be considered.

That having been said, like Gold, there is a 4H +FVG that we are watching. If it holds, higher prices will ensue. If it fails, the lows become the draw on liquidity.

We'll soon see how it plays out.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

SILVER Move Down Ahead! Sell!

Hello,Traders!

SILVER is about to retest

A horizontal resistance level

Of 37.21$ and its a strong

Key level so after the retest

We will be expecting a

Local pullback

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver against many world M2 supplies.Here we see silver divided by many global m2 supplies...

We can see silver is JUST STARTING ITS MOVE to catch up to gold.

We corrected for the 1.4 quadrillion in M2, and see silver's targets all over $100!

This confirms silver is ready to move again, after gold's run, and perhaps make an explosive move higher!

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The market is at an inflection zone and price has now reached an area around 37.036 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 36.788..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

Silver The Week AheadKey Support and Resistance Levels

Resistance Level 1: 3756

Resistance Level 2: 3855

Resistance Level 3: 3915

Support Level 1: 3600

Support Level 2: 3544

Support Level 3: 3480

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

silver correction patternThere has been no close above 38.52 in the last 4 weeks, i.e. every weekend has closed below 38.52. The weekend candle of 7 July is an important candle, apart from this this week's candle has also closed below the low of 14 July, which also indicates a down sign, over all a resistance zone is shown from 37.42 to 37.95. This pattern can go down to 34.1 or 33.67. But use a strict weekend Stop loss of 38.52.

SILVER WILL FALL|SHORT|

✅SILVER is going up now

But a strong resistance level is ahead at 37,60$

Thus I am expecting a pullback

And a move down towards the target of 36,69$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

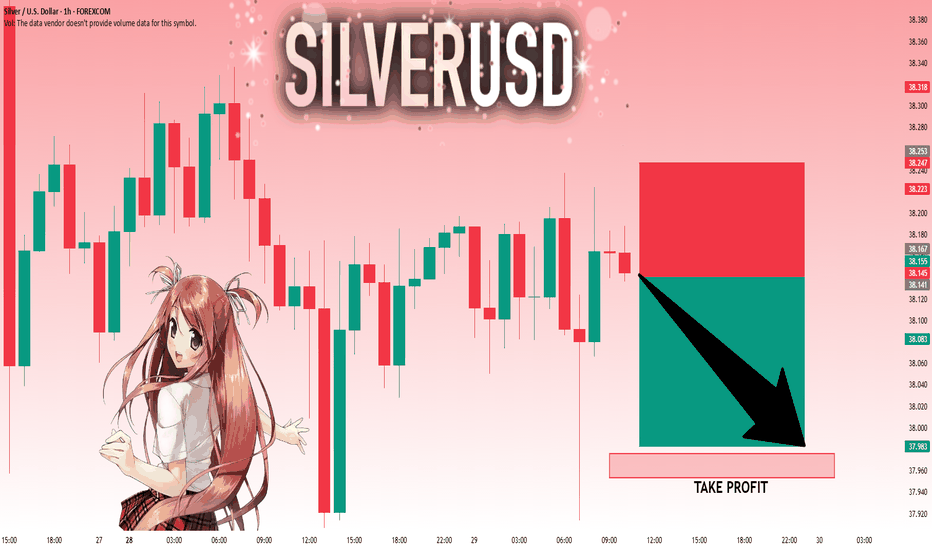

SILVER: Move Up Expected! Long!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 38.054 will confirm the new direction upwards with the target being the next key level of 38.107 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 38.167 will confirm the new direction downwards with the target being the next key level of 37.976 .and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

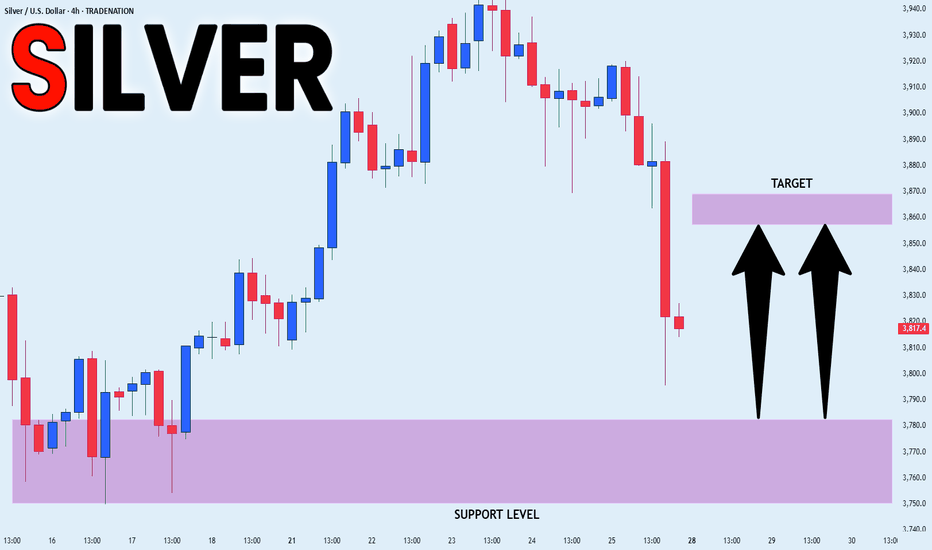

SILVER Will Grow! Buy!

Please, check our technical outlook for SILVER.

Time Frame: 8h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 3,817.6.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 3,930.1 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SILVER: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse SILVER together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 38.099 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

SILVER SUPPORT AHEAD|LONG|

✅SILVER has been falling recently

And Silver seems locally oversold

So as the pair is approaching

A horizontal support of 37.80$

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER: Expecting Bullish Continuation! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the SILVER pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

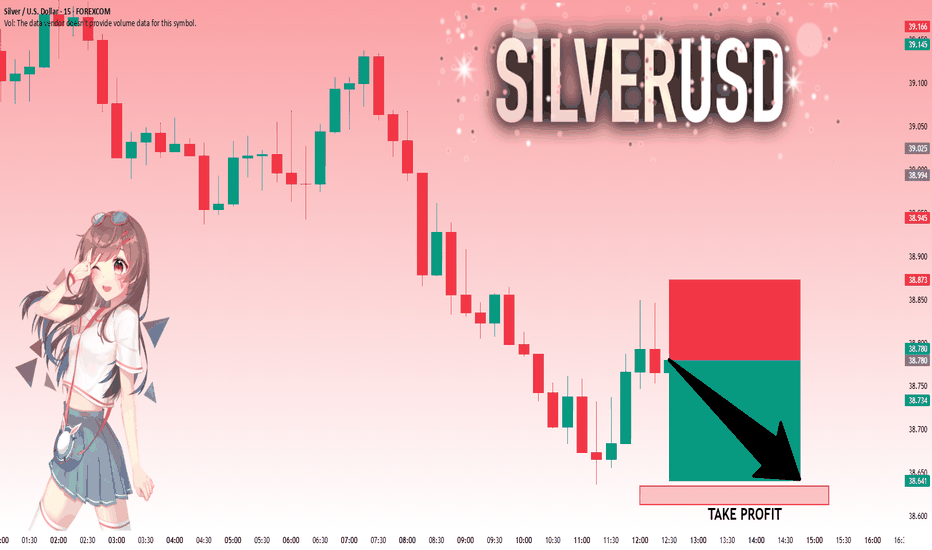

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 38.780 will confirm the new direction downwards with the target being the next key level of 38.635.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️