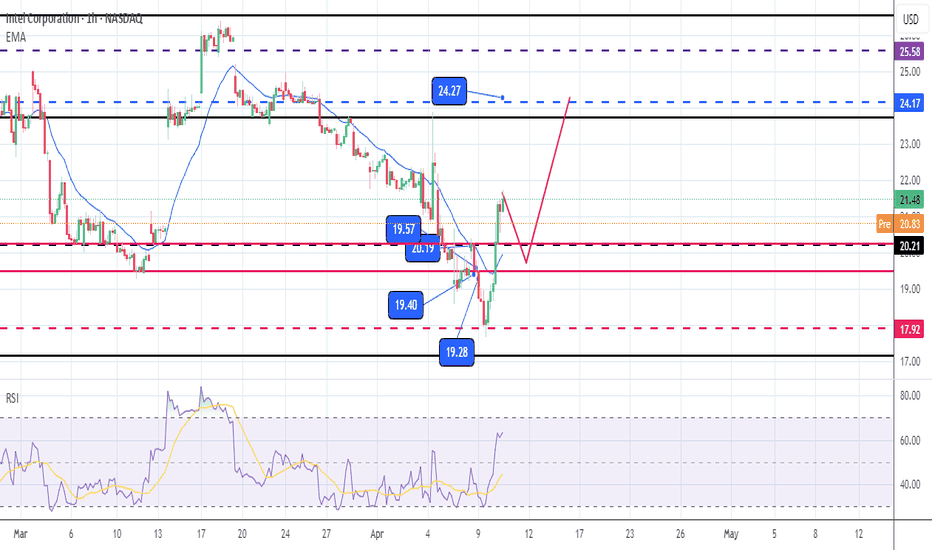

3 Day ConfluencesHere we have price residing in close proximity to a downward trendline and right under the 10 EMA and in an old demand zone. If successful break out of these areas we might have price action towards the 22.67 area the 50 EMA, failure to the 18.00 area. Hypothetically speaking. Have a safe day

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−3.96 CHF

−17.03 B CHF

48.23 B CHF

4.36 B

About Intel Corporation

Sector

Industry

CEO

Lip-Bu Tan

Website

Headquarters

Santa Clara

Founded

1968

FIGI

BBG000C9R1W9

Intel Corporation engages in the design, manufacture, and sale of computer products and technologies. It delivers computer, networking, data storage, and communications platforms. The firm operates through the following segments: Client Computing Group (CCG), Data Center Group (DCG), Internet of Things Group (IOTG), Non-Volatile Memory Solutions Group (NSG), Programmable Solutions (PSG), and All Other. The CCG segment consists of platforms designed for notebooks, 2-in-1 systems, desktops, tablets, phones, wireless and wired connectivity products, and mobile communication components. The DCG segment includes workload-optimized platforms and related products designed for enterprise, cloud, and communication infrastructure market. The IOTG segment offers compute solutions for targeted verticals and embedded applications for the retail, manufacturing, health care, energy, automotive, and government market segments. The NSG segment constitutes of NAND flash memory products primarily used in solid-state drives. The PSG segment contains programmable semiconductors and related products for a broad range of markets, including communications, data center, industrial, military, and automotive. The All Other segment consists of results from other non-reportable segment and corporate-related charges. The company was founded by Robert Norton Noyce and Gordon Earle Moore on July 18, 1968 and is headquartered in Santa Clara, CA.

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought INTC before the recent rally:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately

INTEL BUY 2030Claro, aquí tienes el texto completamente limpio, sin negritas ni símbolos especiales:

---

Preliminary Projection: Intel's Potential Workforce Transformation (2025–2030)

As Intel continues its restructuring and integrates more AI-driven systems into its operations, significant changes are expecte

INTEL CORPORATIONIntel’s stock has been falling sharply due to a combination of poor financial performance, strategic challenges, and market pressures, which have shaken investor confidence significantly.

Key Reasons for Intel’s Stock Decline

Weaker-than-Expected Earnings and Profitability Issues

Intel reported disa

Intel on the verge of a 80% plummet to $5** The months ahead **

After decades of semiconductor dominance, Intel faces unprecedented threats to its business model. AI computing revolution, manufacturing missteps, and relentless competition from AMD and NVIDIA have created what some analysts call "a potential death spiral" for the tech gian

INTC Trade LevelsI like this set up for affordable and stable LEAP's. If price can break above the range, we will see a run to 31.

INTC's fundamentals are still a bit iffy, BUT the chip industry is hot. This would make a great sympathy play- I'd lean towards buying equity over options contracts.

For Day Trades-

Support to Buy Intel-All stocks rallied after Trump declared a pause on tariffs. Intel is showing good momentum and may continue to rise.The support On My chart is a good support to going long if the price make a pullback. Invalid if The Price break the support area. This is not a buy call, just sharing idea. Thanks

[INTC] Crashing to $1-$5—Bankruptcy Ahead?Intel has underperformed recently, trapped in a bear market since 2019 while broader equities soared. Since 2000, shareholders have seen no gains—even with dividends included—leaving long-term investors increasingly frustrated. A market-wide 2008-style crash (see related ideas) could push Intel towa

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US458140BK5

INTEL 20/60Yield to maturity

8.52%

Maturity date

Feb 15, 2060

US458140BX7

INTEL 21/61Yield to maturity

8.44%

Maturity date

Aug 12, 2061

US458140BW9

INTEL 21/51Yield to maturity

8.38%

Maturity date

Aug 12, 2051

INTC4914060

Intel Corporation 3.25% 15-NOV-2049Yield to maturity

8.14%

Maturity date

Nov 15, 2049

US458140BV1

INTEL 21/41Yield to maturity

8.00%

Maturity date

Aug 12, 2041

INTC4633368

Intel Corporation 3.734% 08-DEC-2047Yield to maturity

7.76%

Maturity date

Dec 8, 2047

US458140AV2

INTEL CORP. 16/46Yield to maturity

7.76%

Maturity date

May 19, 2046

US458140AY6

INTEL CORP. 17/47Yield to maturity

7.74%

Maturity date

May 11, 2047

US458140AP5

INTEL CORP. 12/42Yield to maturity

7.47%

Maturity date

Dec 15, 2042

US458140BM1

INTEL 20/50Yield to maturity

7.37%

Maturity date

Mar 25, 2050

INTC5456466

Intel Corporation 4.9% 05-AUG-2052Yield to maturity

7.30%

Maturity date

Aug 5, 2052

See all INTC bonds

Curated watchlists where INTC is featured.

Related stocks

Frequently Asked Questions

The current price of INTC is 47.68 CHF — it hasn't changed in the past 24 hours. Watch INTEL stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange INTEL stocks are traded under the ticker INTC.

We've gathered analysts' opinions on INTEL future price: according to them, INTC price has a max estimate of 82.67 CHF and a min estimate of 11.57 CHF. Watch INTC chart and read a more detailed INTEL stock forecast: see what analysts think of INTEL and suggest that you do with its stocks.

INTC reached its all-time high on Nov 2, 2000 with the price of 85.00 CHF, and its all-time low was 0.54 CHF and was reached on Dec 16, 2002. View more price dynamics on INTC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

INTC stock is 0.00% volatile and has beta coefficient of 1.78. Track INTEL stock price on the chart and check out the list of the most volatile stocks — is INTEL there?

Today INTEL has the market capitalization of 73.01 B, it has increased by 2.53% over the last week.

Yes, you can track INTEL financials in yearly and quarterly reports right on TradingView.

INTEL is going to release the next earnings report on Jul 24, 2025. Keep track of upcoming events with our Earnings Calendar.

INTC earnings for the last quarter are 0.12 CHF per share, whereas the estimation was 0.01 CHF resulting in a 1.81 K% surprise. The estimated earnings for the next quarter are 0.01 CHF per share. See more details about INTEL earnings.

INTEL revenue for the last quarter amounts to 11.21 B CHF, despite the estimated figure of 10.89 B CHF. In the next quarter, revenue is expected to reach 9.96 B CHF.

INTC net income for the last quarter is −726.79 M CHF, while the quarter before that showed −114.43 M CHF of net income which accounts for −535.12% change. Track more INTEL financial stats to get the full picture.

Yes, INTC dividends are paid quarterly. The last dividend per share was 0.11 CHF. As of today, Dividend Yield (TTM)% is 2.47%. Tracking INTEL dividends might help you take more informed decisions.

As of May 6, 2025, the company has 108.9 K employees. See our rating of the largest employees — is INTEL on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. INTEL EBITDA is 6.52 B CHF, and current EBITDA margin is 12.56%. See more stats in INTEL financial statements.

Like other stocks, INTC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade INTEL stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So INTEL technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating INTEL stock shows the neutral signal. See more of INTEL technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.