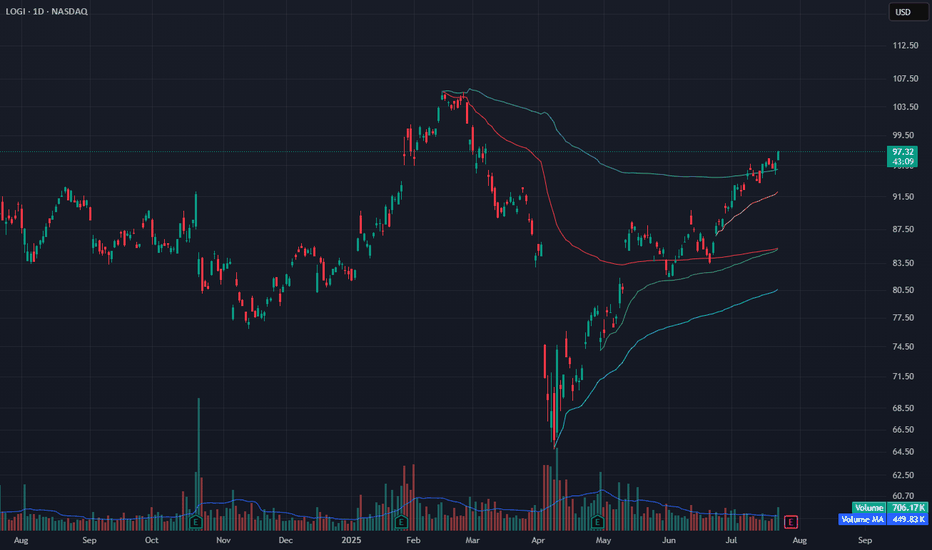

LOGI Approaching Breakout – Riding Upper VWAP ChannelLOGI continues to grind higher along the upper anchored VWAP band, trading just under $99. Volume is healthy, and price action has been clean since reclaiming the red VWAP zone in June.

The yellow VWAP (from recent swing low) is acting as dynamic support, while the upper Bollinger Band is expanding

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.70 CHF

559.95 M CHF

4.04 B CHF

130.40 M

About LOGITECH N

Sector

Industry

CEO

Hanneke Faber

Website

Headquarters

Lausanne

Founded

1981

ISIN

CH1282125983

FIGI

BBG01HQ6Q6K5

Logitech International SA is a holding company, which engages in the design of software-enabled hardware solutions. Its portfolio includes gaming, keyboards and combos, pointing devices, video collaboration, webcams, tablet accessories, and headsets. Its cloud based services includes video conferencing platforms, esports or video games, music streaming platforms, content streaming platforms, and and creativity and productivity platforms. It enhances through software, including machine learning and artificial intelligence. The company was founded by Daniel Borel, Pierluigi Zappacosta, and Giacamo Marini on October 2, 1981 and is headquartered in Lausanne, Switzerland.

Related stocks

LOGI Logitech International Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LOGI Logitech International prior to the earnings report this week,

I would consider purchasing the 80usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $1.87.

If these options prove to be profitable prior

Interesting setup. 3 rising valleylooking here we can see that there is a weekly bullish engulfing candle after support was held yet again, thinking this is a rising accumulation.

Maybe we get a pullback to 30-50% of the bullish engulfing candle before more up? that would be a good entry IMO.

I like this one, even though there's n

LOGI Logitech International Options Ahead of EarningsIf you haven`t sold LOGI here:

Then analyzing the options chain and the chart patterns of LOGI Logitech International prior to the earnings report this week,

I would consider purchasing the 80usd strike price in the money Puts with

an expiration date of 2024-1-19,

for a premium of approximately $

LOGI Logitech International Options Ahead of EarningsIf you haven`t sold LOGI here:

Then analyzing the options chain and chart patterns of LOGI Logitech prior to the earnings report this week,

I would consider purchasing the $62.5 strike price Puts with

an expiration date of 2024-3-15,

for a premium of approximately $5.25.

If these options prove to

Feels like stealing sometimesProvided again is another wild west offering of the market that others keep insisting is insane. Markets momentum is up, while everyone waits for down, with record piles of cash on the sidelines securing interest or not? Minimum 76.. hold that for a day and it's on its way to 116.

ABC/DTarget is D. Targets calculated using the length of the AB leg.

Possible stop below C.

Some multiply the ATR (Average true range) by 2 to place a stop. ATR is 1.38.

This pattern often reverses when D is met.

There may be resistance at the top of the gap down.

Average True Range (ATR) is the averag

LOGI: Navigating Sub News and Market MovesBackground:

NASDAQ:LOGI has been navigating a challenging few weeks. After a well-received earnings report in May that led to a significant increase in the company's value, June has proven less favorable. The announcement of CEO Bracken Darrell's departure on June 13, a downgrade by Citibank on J

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of LOGNE is 76.22 CHF — it has decreased by −0.21% in the past 24 hours. Watch LOGITECH N 2.LINIE stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange LOGITECH N 2.LINIE stocks are traded under the ticker LOGNE.

LOGNE stock has fallen by −1.63% compared to the previous week, the month change is a 7.17% rise, over the last year LOGITECH N 2.LINIE has showed a −3.08% decrease.

LOGNE reached its all-time high on Feb 19, 2025 with the price of 94.86 CHF, and its all-time low was 54.92 CHF and was reached on Apr 9, 2025. View more price dynamics on LOGNE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LOGNE stock is 0.84% volatile and has beta coefficient of 1.89. Track LOGITECH N 2.LINIE stock price on the chart and check out the list of the most volatile stocks — is LOGITECH N 2.LINIE there?

Today LOGITECH N 2.LINIE has the market capitalization of 11.39 B, it has decreased by −1.23% over the last week.

Yes, you can track LOGITECH N 2.LINIE financials in yearly and quarterly reports right on TradingView.

LOGITECH N 2.LINIE is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

LOGNE earnings for the last quarter are 0.82 CHF per share, whereas the estimation was 0.77 CHF resulting in a 6.25% surprise. The estimated earnings for the next quarter are 0.80 CHF per share. See more details about LOGITECH N 2.LINIE earnings.

LOGITECH N 2.LINIE revenue for the last quarter amounts to 894.41 M CHF, despite the estimated figure of 913.88 M CHF. In the next quarter, revenue is expected to reach 894.55 M CHF.

LOGNE net income for the last quarter is 129.51 M CHF, while the quarter before that showed 175.61 M CHF of net income which accounts for −26.25% change. Track more LOGITECH N 2.LINIE financial stats to get the full picture.

No, LOGNE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 7.3 K employees. See our rating of the largest employees — is LOGITECH N 2.LINIE on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LOGITECH N 2.LINIE EBITDA is 657.16 M CHF, and current EBITDA margin is 16.27%. See more stats in LOGITECH N 2.LINIE financial statements.

Like other stocks, LOGNE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LOGITECH N 2.LINIE stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LOGITECH N 2.LINIE technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LOGITECH N 2.LINIE stock shows the buy signal. See more of LOGITECH N 2.LINIE technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.