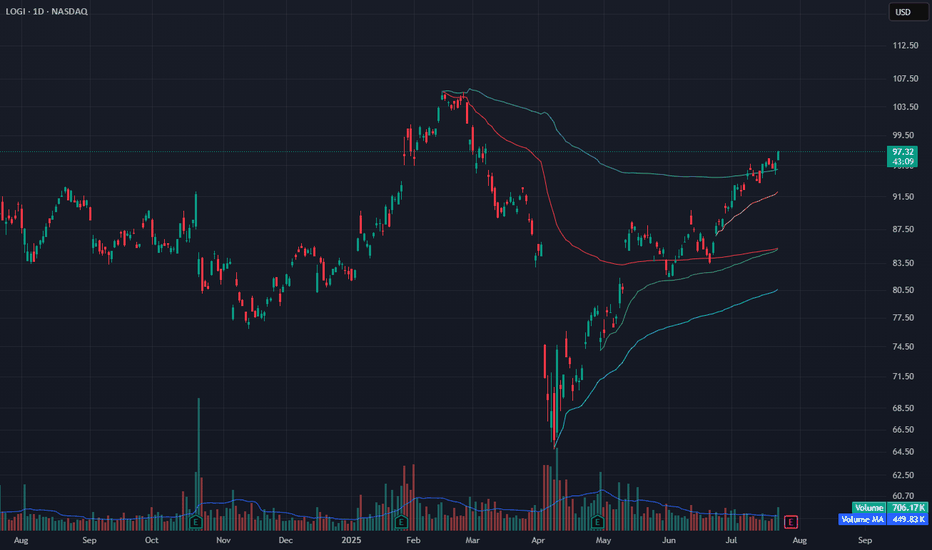

LOGI Approaching Breakout – Riding Upper VWAP ChannelLOGI continues to grind higher along the upper anchored VWAP band, trading just under $99. Volume is healthy, and price action has been clean since reclaiming the red VWAP zone in June.

The yellow VWAP (from recent swing low) is acting as dynamic support, while the upper Bollinger Band is expanding — signaling possible continuation.

If price breaks above the current range, next resistance is near $103. Downside remains protected as long as it holds above the $93 area.

Indicators used:

Anchored VWAP (support tracking)

Bollinger Bands (volatility expansion)

Volume vs. Volume MA (momentum confirmation)

Entry idea: Breakout above $98.50

Target: $103–105

Stop: Below $93.50 or trailing yellow VWAP

LOGNE trade ideas

LOGI Logitech International Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LOGI Logitech International prior to the earnings report this week,

I would consider purchasing the 80usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $1.87.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Interesting setup. 3 rising valleylooking here we can see that there is a weekly bullish engulfing candle after support was held yet again, thinking this is a rising accumulation.

Maybe we get a pullback to 30-50% of the bullish engulfing candle before more up? that would be a good entry IMO.

I like this one, even though there's not really any divergences on the MACD. I will check if there is on the RSI after i write this.

LOGI Logitech International Options Ahead of EarningsIf you haven`t sold LOGI here:

Then analyzing the options chain and the chart patterns of LOGI Logitech International prior to the earnings report this week,

I would consider purchasing the 80usd strike price in the money Puts with

an expiration date of 2024-1-19,

for a premium of approximately $11.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

LOGI Logitech International Options Ahead of EarningsIf you haven`t sold LOGI here:

Then analyzing the options chain and chart patterns of LOGI Logitech prior to the earnings report this week,

I would consider purchasing the $62.5 strike price Puts with

an expiration date of 2024-3-15,

for a premium of approximately $5.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Feels like stealing sometimesProvided again is another wild west offering of the market that others keep insisting is insane. Markets momentum is up, while everyone waits for down, with record piles of cash on the sidelines securing interest or not? Minimum 76.. hold that for a day and it's on its way to 116.

ABC/DTarget is D. Targets calculated using the length of the AB leg.

Possible stop below C.

Some multiply the ATR (Average true range) by 2 to place a stop. ATR is 1.38.

This pattern often reverses when D is met.

There may be resistance at the top of the gap down.

Average True Range (ATR) is the average of true ranges over the specified period. ATR measures volatility, taking into account any gaps in the price movement. Typically, the ATR calculation is based on 14 periods, which can be intraday, daily, weekly, or monthly.

No recommendation.

LOGI: Navigating Sub News and Market MovesBackground:

NASDAQ:LOGI has been navigating a challenging few weeks. After a well-received earnings report in May that led to a significant increase in the company's value, June has proven less favorable. The announcement of CEO Bracken Darrell's departure on June 13, a downgrade by Citibank on June 14, and news that one of its controllers was being used to operate the lost Titan sub have all contributed to a difficult period. On a positive note, LOGI's board approved a three-year $1B buyback plan, which the market does not seem to have factored in yet.

While it might be tempting to attribute the measured gap down to market overreaction to the Titan sub news, the majority of this movement reflects the impact of the CEO's departure and Citibank's downgrade. The news about the sub tested the boundaries of this range, but it did not significantly affect it.

This situation presents a potential short-term play.

Timeline:

June 13 - Announcement of CEO Bracken Darrell's resignation

June 14 - Citibank downgrade

June 18-19 - News of missing sub trends

June 20 - Google search trend for Logitech reaches highest level in 90 days, memes about the use of the Logitech controller on the sub begin to appear

June 21 - Logitech Board approves $1B stock buyback

June 22 - Google search trend for Logitech appears to peak

trends.google.com

Fundamental and Company Outlook:

Bracken Darrell, a highly regarded figure, will be challenging to replace. As part of their succession plan, board member Guy Gecht will serve as interim CEO while LOGI conducts a search for a permanent replacement. Gecht's resume boasts strong, relevant experience.

The company experienced a surge in sales and revenue during the COVID-19 work-from-home period, followed by a steep drop-off. Their near-term plans for revenue growth and profit margin improvement were well-received by analysts during the last earnings call. However, they did not clearly articulate their strategies for navigating supply chain and chip shortage issues, or maintaining competitiveness. Despite this, their cash flow, net debt, and share buybacks suggest that this is a financially sound company. However, their Return on Invested Capital (ROIC) and the trend in enterprise value are less compelling.

Near-Term Opportunity:

The news about a Logitech controller being used on the lost Titan sub did not significantly impact the share price, but it did test the lower limit of the measured gap down that occurred when Bracken Darrell's departure was announced. The market has yet to respond to the announced $1B stock buyback, which represents 11% of the company's current $8.8B market cap.

Given the long-term downtrend in price, I'm looking at between 45-55% of prior retraces and extensions as likely overhead resistance. My planned levels are:

-$55-56 entry

-$60-62 take profit

-$51-52 stop loss

-Risk/Reward 1.2

Fundamental Analysis :Missing submersible and Logitech F710Summery of the current situation:

The OceanGate Expeditions tourist submarine is went missing with five people with about four-day emergency oxygen supply. The missing sub is being looked for by the US Coast Guard and other agencies. During the hunt for the lost Titan submersible, banging noises were heard, indicating continued hope of survivors. We are all praying and hoping for a miracle in their recue and our thoughts and prayers are with the families and loved ones of those on board

-----------------------------------------

On Sunday, word spread that a tourist submarine operated by OceanGate Expeditions with five persons on board had vanished while its route to the Titanic wreck. Soon after, information concerning the sub's non-standard design that violated laws came to light. For example, steering appears to have been controlled via a $30 wireless Logitech F710 PC game controller from 2010.

Less than a year ago, a local news channel aired a video program examining the unusual sub, in which Rush proudly revealed that the submersible was operated by a game controller. Rush announced to the audience, "We're taking a completely new approach to the design," adding, "and it's all controlled with this games controller," as he showed a controller that resembled an older Xbox controller but was marked with the Logitech logo and featured longer, pointer joysticks than an ordinary Xbox controller would.

------------------------------------------

With news breaking that the sub was being controlled by this Logitech controller it seems to have spooked investors causing the stock drop from Fridays highs and overall the stock is down from highs in may of 60.00

Social media has also had there share. Here are some review of the controller on amazon:

Technical Analysis on Logitech :

4H timeframe :

Within the next couple of hours or days there is likely to be an update on the situation of the submersible

Name of the persons onboard : Stockton Rush,Paul-Henri Nargeolet,Shahzada Dawood with his 19-year-old son Suleman

We hope for a positive outcome

LOGI Logitech International Options Ahead of EarningsIf you haven`t bought puts or shorted the stock here:

then you should know that looking at the LOGI Logitech International options chain, i would buy the $40 strike price Puts with

2022-11-18 expiration date for about

$1.18 premium.

Looking forward to read your opinion about it.

$LOGI decent fundamentals and a strong trend$LOGI has decent fundamentals with a current PE of 17 and forward PE of 12.5 while they pay a small dividend of 1.5%. As long as their growth continues at the 10-15% range there should be considerable considerable upside on this company. It does look like they could drop to $48 so I personally have only taken a small starter position. If earnings continue to lag after the covid highs and don't normalize $Logi could bounce around at these levels for awhile.

Their EPS pre-covid was 1.58, with current EPS of $4 expected to increase at a moderate rate.

LOGITECH LONG POSITIONMarket finished full Elliot wave 1-5 and ABC correction, market has to fill the gaps it made going down so that is where are targets are.

Entry: 74 (Now because we just bounced off of an demand zone and 50% fib zone)

Target 1: 97 (First gap zone)

Target 2: 116 (Second gap zone)

Invalidation: 66 (Just below demand zone)

Logitech Quick TechnicalsIf we break the current price level, (There is a large lower wick from 11/9/20 which is at the current price level.) I see the trend continuing into the purple price area/200MA marked on the weekly chart. RSI still has room to decline. I'll be watching closely over the next week or so. From there I'd be looking to enter around the purple area and DCA from there. We'll see how the current market conditions play out!

This is just looking at Logitech from a technical standpoint.

The valuations also look fairly decent.

Enjoy!

Logitech is now on the watch list. Following a beautiful reversal with class A bearish divergence on the monthly chart, Logitech has begun to creep up to the golden zone. Judging from the MACD, any reversal that is a higher low will be met with hidden bullish divergence and trend continuation.

The play is on the trend continuation. So first, i believe we need to see some exhaustion develop along a critical support. Im thinking around 48 dollars for the support. This is inbetween the .618 and .786 node. But its high traffic for sure in terms of possible supports. Stay tuned as the situation developes.