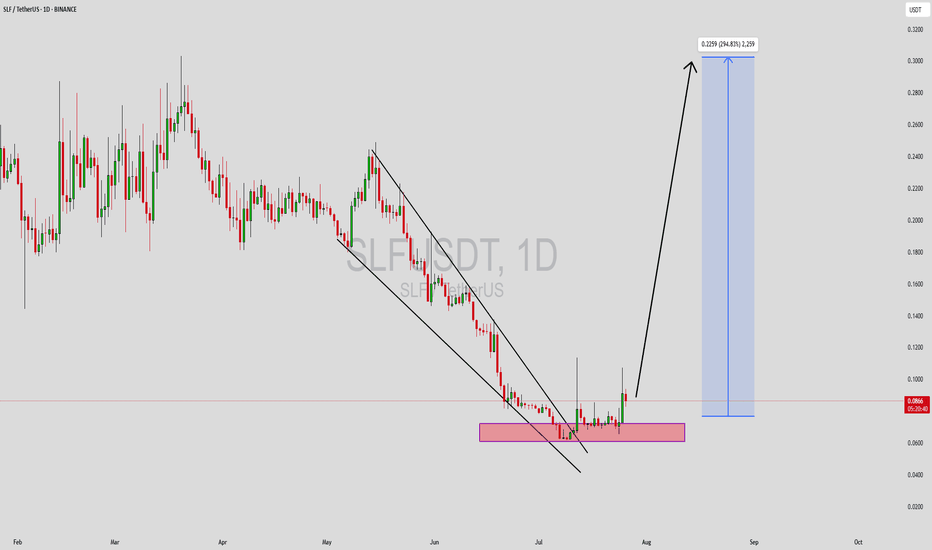

SLFUSDT Forming Falling WedgeSLFUSDT is currently exhibiting a classic falling wedge pattern, a bullish formation that typically signals a potential trend reversal. The narrowing of the wedge, combined with consistent price compression and higher lows, indicates that sellers are losing control while buyers begin to step in. This pattern often results in a strong breakout to the upside, and given the current structure, SLF is poised for a potential explosive move.

Volume levels remain healthy, which reinforces the likelihood of an impending breakout. Increased trading activity at support zones shows that investors are accumulating, anticipating a shift in momentum. Historically, falling wedges with strong volume confirmation have led to aggressive rallies, and in SLF’s case, analysts are expecting gains in the range of 190% to 200%+. This aligns well with both technical and psychological targets on the chart.

The market sentiment around SLFUSDT is turning increasingly positive as the project garners more attention in crypto communities. With on-chain metrics improving and social mentions growing, SLF is being recognized as a potential breakout play. If the price breaks out of the wedge and flips resistance into support, a sharp rally could follow—making it one of the high-reward setups currently in the altcoin market.

Traders should watch for a decisive breakout candle backed by rising volume, which could be the key confirmation to enter this trade. The structure is well-formed, investor interest is rising, and all technical indicators point toward an upcoming bullish move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SLFUSDT trade ideas

FLS (SPOT)BINANCE:SLFUSDT

#SLF/ USDT

Entry (0.080 - 0.088)

SL 4H close below 0.0756

T1 0.100

T2 0.120

T3 0.147

Extra Target

T4 0.165

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

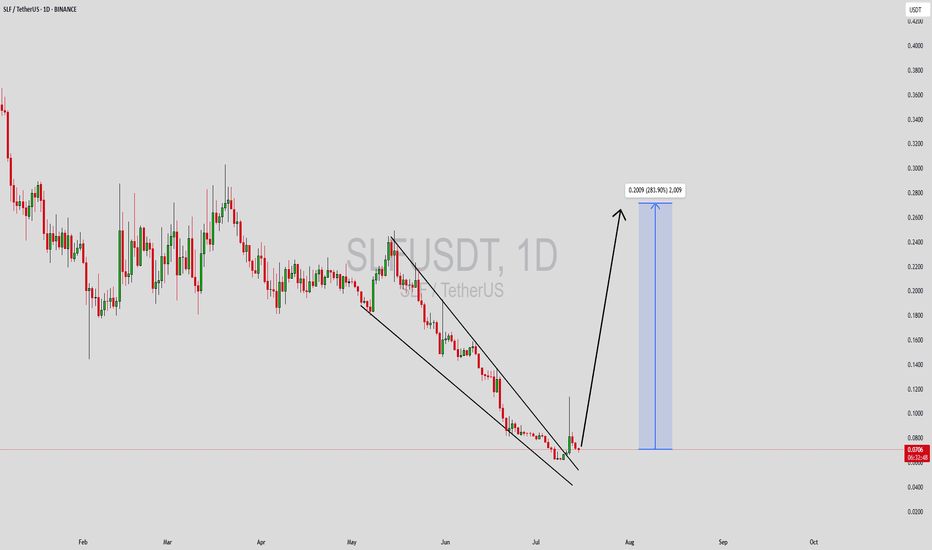

SLFUSDT Forming Falling WedgeSLFUSDT is showing an impressive technical setup that’s catching the attention of traders and investors alike. The crypto pair has formed a clear falling wedge pattern, which is known to be a bullish reversal pattern in technical analysis. This suggests that a breakout to the upside could be imminent, opening the door for a potential gain of 240% to 250%+. With volume looking strong and steady, this pattern gains even more significance, indicating that a major shift in market sentiment could be underway.

Many traders look for falling wedge patterns because they often signal the end of a downtrend and the beginning of a new bullish phase. SLFUSDT’s price action aligning with this pattern makes it a high-probability setup for swing traders and long-term holders who want to position themselves early. The crypto market’s current momentum adds further confidence that once the breakout confirms, a powerful price rally could take shape, rewarding patient investors.

It’s worth noting that investor interest in this project is growing, with more eyes turning towards SLFUSDT as it holds a promising use case and potential for future development. A breakout from this falling wedge could also attract new capital inflows, pushing prices even higher. Traders should watch for strong volume spikes and sustained price action above key resistance levels to confirm the bullish reversal. With the right market conditions, SLFUSDT could outperform many other altcoins this cycle.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Bullish Divergence SpottedPrice made a lower low, but RSI formed a higher low, signaling weakening bearish momentum. This could indicate a potential reversal or relief bounce.

Always confirm with volume and price action before entering trades. Manage risk, as false breakouts can occur.

What’s your take? Bounce or breakdown? Share your thoughts!

Technical analysis of $SLF asset: growth prospectsAt the moment SLF asset demonstrates quite promising dynamics, which is confirmed by a number of technical signals. Price trading in the green range (the area of positive dynamics) indicates stable demand and confidence of market participants in the growth potential of the asset.

One of the key factors is the price consolidation above the exponential moving average (EMA 50). This indicates a change of the short-term trend to an upward one and can be considered as a signal for further strengthening of positions. In addition, the support from the EMA 50 acts as a dynamic level, which reduces the probability of a significant pullback.

In terms of analyzing Fibonacci levels, the current market structure also provides interesting opportunities. If we consider the correction from the previous move, the nearest upside target is at 0.55 USD, which corresponds to 1.618 on the Fibonacci scale. This level historically acts as a point of attraction for price movements and may become a logical target for the current trend.

Alex Kostenich,

Horban Brothers.

SLF BINANCE:SLFUSDT

SLF / USDT

4H time frame

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

SLF/USDT- BUY SETUP BINANCE:SLFUSDT

✔︎ENTRY : 0.3258 TO 0.3148

🏓TARGETS :

✔︎T1 : 0.3685

✔︎T2 : 0.4311

✔︎T3 : 0.5248

✘STOP : 0.2811

💡Reason for this trade:

This trade gives my trading system a sign of strength:

• My trading system is based on liquidity and reversal zones.

• When the liquidity is swept from one side under certain conditions, we will wait for the price on the other side.

The liquidity will attract the price like a magnet.

• the first side that has been swept:

1- flip zone

2- range low

3- price reclaim HVN volume profile

• Opposite side targets:

1- FVG

2- range high

3- mid range

💡Entry setup

1- reclaim HVN + FLIP ZONE

⚠️WARNING:

• I'm not a financial advisor.

• Do your own research (DYOR).

SLFUSDT: %500 VOLUME SPIKE | HUGE OPPORTUNITYSLFUSDT has experienced a 500% daily volume increase, indicating heightened interest. However, the price is declining rapidly, and buyers have not yet shown significant activity.

🔵 Demand Zones: The blue boxes on the chart represent potential areas for a price reaction.

📊 Entry Strategy: Monitor for upward breakouts in these zones on lower time frames before considering entries.

⚠️ Risk Management: Exercise caution and manage your risk carefully, as the market remains volatile.

Patience is crucial let the market confirm buyer activity!

Follow me for tracking the crypto volume spikes and trading points. You can see my accuracy below.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

Slf/UsdtBINANCE:SLFUSDT

**Current Price**: **$0.4442** 📉

**Resistance Area**: **$0.5600** 🔴 (Price has been rejected from this area, so it's a key resistance level to watch)

---

**Key Support Areas**:

- **First Support**: **$0.3800** 🟢 (This is the level to watch for a potential bounce 🚀)

- If the price doesn't hold at **$0.3800**, the next support level is at **$0.3200** 🔴.

---

In summary:

- **Resistance**: **$0.5600** 🔴 (Keep an eye on this area!)

- **First Support**: **$0.3800** 🟢 (Watch closely for a potential bounce!)

- **Next Support**: **$0.3200** 🔴 (If the price drops further, this could be the next stop!)

---

If the price holds at **$0.3800**, we could see a nice recovery 🌱🚀. But if it breaks, keep **$0.3200** on your radar as the next key level to watch. 👀

**Not financial advice!** Always do your own research and make informed decisions! 📊💡

SLF/USDT: Poised for a Breakout at Key Trendline SLF/USDT: Poised for a Breakout at Key Trendline 🚀

SLF/USDT is preparing for an exciting move as it approaches a crucial trendline resistance 📉➡️📈. The price is consolidating within a tight range, signaling potential energy for a breakout 💥. If confirmed, we could see a strong bullish rally unfold 📊. Keep an eye on this pair for key signals 👀.

Key highlights:

1. Trendline resistance: SLF/USDT is testing a trendline that has acted as a barrier in the past. A successful breakout could trigger a notable upward trend 🔑.

2. Volume confirmation: A surge in trading volume during the breakout will indicate strong buying pressure 🔥.

3. Momentum indicators: RSI and MACD suggest growing bullish momentum ⚡, hinting at the possibility of a breakout.

How to confirm the breakout:

- Wait for a clear 4H or daily candle close above the trendline resistance 📍.

- A visible increase in volume during the breakout is a strong bullish signal 📊.

- Watch for a retest of the broken resistance, turning it into support ✅.

- Stay cautious of false breakouts, such as sudden reversals or wicks above the trendline ⚠️.

Potential targets (if breakout succeeds):

- Initial resistance:

- Next key zone:

Risk management strategies:

- Use stop-loss orders to safeguard your capital 🛡️.

- Ensure your position size aligns with your overall risk tolerance 🎯.

This is for educational purposes only and not financial advice. Always do your own research (DYOR) 🔍 before making trading decisions.

SLF WYCKOFF WYCKOFF accumulation/distribution pattern on the SLF chart. Could this be the start of a reversal and a move up?? I think it could.

My reason is as a fresh new coin this is good for a Bullrun, little to no selling pressure as price rises due to no bag holders selling at break even from previous bull cycles.

A rounded bottom structure can provide a base for price to rally from, it proves a growing confidence from buyers, once the top of this mini range gets breached and accepted above it's a great breakout play.

ATH is at +156% from current price, and as I stated before there is little to no selling pressure on the way up either which will help this to grow quickly once it gets going. A project that is in its first Bullrun in price discovery is a great combination!