SNXUSD trade ideas

Bearish Pressure with Key Resistance at $1.00

The price is trading in the lower half of the Bollinger Bands, suggesting weakness.

Support Levels: Around $0.85 - $0.90 (Recent lows)

Resistance Levels: Around $1.00 - $1.10 (Bollinger mid-band & psychological level)

Bearish Bias: The price remains below the moving average and in the lower Bollinger Band range.

Potential Reversal: If price breaks above $1.00 with increasing volume, it could signal an uptrend reversal.

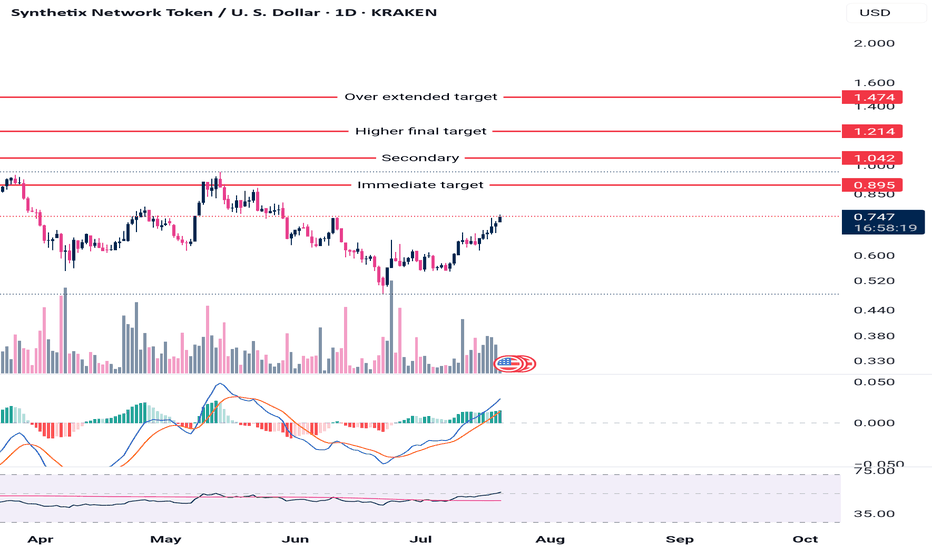

SNXUSDT BULISH I believe this coin may not experience a sharp bullish movement right now. The targets are achievable in the midterm, but if the candle closes below the stop loss, the idea will be considered invalid.

Note: My ideas are not intended for any type of scalping or scalpers!

Here are my other ideas:

www.tradingview.com

Technical Analysis of Synthetix Network Token (SNX/USD): Key LevThis analysis examines the price movement of Synthetix Network Token (SNX) on the weekly timeframe. The structure of the waves and key trendlines have been identified to help traders determine entry and exit points.

Key Highlights of the Analysis:

Strong Support Zone ($1.75–$1.429):

The price has recently reacted to a critical support zone between $1.75–$1.429, showing a strong rebound.

This zone is significant due to the completion of the fifth wave and its alignment with historical support levels, making it a crucial entry point for buyers.

Descending Trendline:

The price remains under the influence of a long-term descending trendline that has capped further upside movement.

Breaking above this trendline and holding above $2.5 could signal the beginning of a new bullish trend.

Key Resistance Level ($5.884):

The major resistance lies at $5.884, aligning with the peak of previous waves.

Reaching this level could serve as a medium-term target for buyers if the price successfully breaks the descending trendline.

Stochastic Oscillator:

The stochastic oscillator is moving toward the overbought region, suggesting a potential short-term correction.

However, further upward movement is possible, especially if the price consolidates above $2.5.

Potential Scenarios:

Bullish Scenario:

Breaking the descending trendline and surpassing the $2.5 resistance could push the price toward $5.884. This scenario is ideal for medium- to long-term traders.

Bearish Scenario:

If the price declines and retests the support zone at $1.75–$1.429, this area could provide another buying opportunity.

Breaking below this support zone could lead to further declines.

Conclusion:

With the technical structure and key levels outlined, Synthetix Network Token is at a critical juncture. Traders should closely monitor the price’s reaction to the descending trendline and the support zone.

crypto bull's hedge pointclose below = waterfall

countertrend trade

whole market bull

this one a weakling

a good hedge point for your other crypto longs

SNX Possible Power of three. (most complete description)I think it brewing a long term power of three. As the momentum narrative is about solana and shitcoins, and as snx is bellow 8 monthly EMA, I think that it's not the best time to take it. When eth/btc reverses, and a big volume spike a good green candle, so could be a good time to entry in it.

Remember: DYOR

SNX FRVP analysisUsing the fixed range volume profile tool over the last two days, we can see we have a POC at ~1.628. The last rally from approximately the 5th-11th resulted in a POC at around 1.511 which we hovered around dipping slightly below before starting the next rally up. If we follow the same trend this weekend, we should treat 1.628 as the POC before heading higher. Breaking the 1.745 resistance line will signify a breakout to the upside. Considering that VPOC has been increasing each rally, this could point to a potential breakout within the next 16-24 hours.

Obviously, this is a short-term analysis, so we will see shortly if it is invalidated.

Synthetix Network Token

Price Action: The price has touched or moved near the lower band, which may indicate a short-term support area. However, since the price continues to move lower, it could signal bearish momentum.

Support Levels: Around $1.30: This seems to be a key level where the price found temporary support after the recent drop.

Resistance Levels: Around $1.50: The price struggled to break above this level in the recent bounce, making it a key short-term resistance.

Bearish Candles: The latest candlesticks show strong bearish momentum, with long red candles, indicating aggressive selling pressure.

Watch for Reversal Patterns: Look for candlestick reversal patterns (e.g., hammer, doji) near the current support zone to signal a potential bottoming.

Short-Term: The market is still in a clear downtrend, but the price is approaching a potential support zone between $1.30 and $1.08. A bounce from this area is possible, but further confirmation from candlestick patterns and volume is needed.

Medium-Term: A break above $1.50 and higher would be necessary to signal a potential trend reversal. Otherwise, the downtrend may continue, especially if the price fails to hold support around $1.30.

SNXUSD About to Explode: x97 Surge Imminent!Join me as I dive into the world of SNXUSD and challenge myself to predict if this x97 surge is really about to happen!

Are you ready for a potential game-changer in the cryptocurrency market? In this video, we dive deep into the SNXUSD (Synthetix) and explore why analysts believe it's on the brink of an explosive x97 surge! 🚀

Join us as we break down the latest market trends, technical analysis, and key factors driving the price action of SNXUSD. We'll discuss the underlying technology, the role of Synthetix in decentralized finance (DeFi), and what this surge could mean for investors.

Whether you're a seasoned trader or just getting started, this video is packed with valuable insights that could help you make informed decisions. Don’t miss out on the chance to learn about the potential of SNXUSD and how to position yourself ahead of this imminent explosion!

🔔 Like, Share and Subscribe for more updates on cryptocurrency trends and analysis, and hit the notification bell so you never miss a moment of the action!

#SNXUSD #Cryptocurrency #Investing #Synthetix #DeFi #CryptoSurge #marketanalysistoday #bitcoin #cryptocurrencyprediction #investing #cryptoprediction #trading #altcoins #marketanalysis

SNX mid-term analysisSNX is trading below a bearish trend line.

The big SNX structure is completely bearish.

It is expected to reach the demand range in the medium term and then move upwards.

We are looking for buy/long positions in the demand range.

Closing a weekly candle below the demand range will violate the analysis.

Note that the financial market is risky, so:

Do not enter a position without setting a stop and capital management and confirmation and trigger.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

$SNX to $13-$25NYSE:SNX looks like it's about to make a big move higher.

Price broke out from the bottom, tested $4.73 multiple times and now has retested the breakout level as support. It looks set to move higher here.

Should price break above the $4.73 level, there's pretty clear skies until $13. If price can break over that $13 resistance, then the next level higher would be $25.

Overall a beautiful chart.

📈 Elevate Your Portfolio with Synthetix (SNX) - Long Awaits!Hello, fellow traders and blockchain enthusiasts! Today, I'm diving deep into the undercurrents of the crypto sea to fish out a gem—Synthetix (SNX). But before we set sail, let’s anchor down on some recent trends and data analytics that signal a wave of potential profits! 🌊💸

Current Landscape and Analyst Insights on Synthetix (SNX)

Recently, Synthetix has been bustling with activity, especially with the launch of Synthetix V3 on the Base network. This upgrade introduces significant enhancements such as increased liquidity provider limits, up to $21.92 million USDC, and an enriched user experience with better incentives and transaction fee structures.

Here’s what you need to know:

Governance and Community Engagement: Synthetix is actively engaging its community for governance decisions. For example, to participate in the PYTH governance distribution, users need to actively participate through the Synthetix Discord by April 22nd. This shows Synthetix’s commitment to decentralized decision-making.

V3 Launch and Liquidity Impacts: The recent shift to Synthetix V3 on the Base network has successfully increased the liquidity cap and introduced a system where users can earn transaction fees and LP incentives by providing USDC collateral.

Diving Into Data: The Big Picture

Hold on to your hats, because the winds of change are blowing! Recent analyses using sophisticated big data tools have surfaced some compelling indicators:

Transaction Value Native: Recently hit a trough at $3,232.41. Historical data suggests that such lows are often followed by significant price surges. 📉➡️📈

On-Chain Metrics: Indicators are in a downturn. However, don't be misled—this is when the magic happens! Past patterns show a potential median price increase of a whopping 43.89% over the next month. Mark your calendars! 📅

Such a configuration of data previously marked 22 similar historical episodes with a staggering 87% of those signaling an upswing post-condition met.

Cyclical Surge: Timing is Everything

And guess what? SNX is just revving at the bottom of its composite price cycle. This isn't just a quick sprint but a marathon with the cycle projected to rise through July. Ready, set, go long! 🏁

Targets:

Entry Point (Long Position): Leverage the low transaction value native and on-chain metrics downturn as entry signals.

Target Prices (TP) and Stop Loss (SL):

TP: $4.0108 🎯

SL: $2.1757 🛑

Price Predictions for Upcoming Periods

Based on the current analysis and market cycles:

1 Week: $2.9748

2 Weeks: $3.2584

1 Month: $3.9659

3 Months: $8.6669

6 Months: $10.8558

To Conclude: Why Ride the Synthetix Wave?

High historical hit rate and accuracy

Consistent relationship between observed drivers and market movements

Attractive risk-reward balance with minimal drawdowns

So, why wait? Dive into the Synthetix tide and let the currents guide you to profitable shores. Let's catch this wave together—follow for more deep dives and treasure troves!

P.S. Don't forget to subscribe to this ideas flow right now😂

$SNX typical market cycle (psychology)Pretty clean chart for $SNX.

- years of wyckoff accumulation

- higher lows

- riding weekly MAs

in my opinion it appears to be a typical market cycle progressing within the defi space. it's kind of doing its own thing while retail speculates on other coins. This is one of those set it and forget it type of charts. Looks like it wants to break out in the coming months. I recommend more of a position trader mindset.

invalidation under 3 bucks (if it decides to turn back over).

doesn't hurt to give this one a chance.

will you take it?

Synthetix(SNX) Can Pump 🚀➕20%🚀👋Hi, I hope you have a Great Weekend🥳.

📈Today, I want to share with you an analysis of the Synthetix(SNX) project , which can increase the price by more than 🚀➕20%🚀 in the short-term .

📚 What Is Synthetix (SNX)❗️❓

Synthetix is building a decentralized liquidity provisioning protocol that any protocol can tap into for various purposes. Its deep liquidity and low fees serve as a backend for many exciting protocols on both Optimism and Ethereum. Many user-facing protocols in the Synthetix ecosystem, such as Kwenta (Spot and Futures), Lyra (Options), Polynomial (Automated Options), and 1inch & Curve (Atomic Swaps), tap into Synthetix liquidity to power their protocols. Synthetix is built on Optimism and Ethereum mainnet. The Synthetix Network is collateralized by SNX, ETH, and LUSD, enabling the issuance of synthetic assets (Synths). Synths track and provide returns on the underlying asset without requiring one to directly hold the asset. This pooled collateral enables an array of on-chain, composable financial instruments backed by liquidity from Synthetix. Some of the most exciting upcoming releases from SNX are Perps V2, which hopes to enable low-fee on-chain futures trading through the usage of off-chain oracles, and Synthetix V3, which aims to rebuild the protocol to achieve its earliest goal, being a fully permissionless derivatives protocol.

🏃♂️ Synthetix (SNX) has been moving in a Descending Channel for about 40 days and is currently moving near the 🟡 Potential Reversal Zone(PRZ) 🟡, ⚫️ Time Reversal Zone(TRZ) ⚫️, and Support line .

💡Also, we can see Regular Divergence(RD+) between two Consecutive Valleys .

🔔I expect Synthetix (SNX) to start rising soon and go UP to at least the top of the descending channel after breaking the Resistance line and possibly breaking this channel.

--------------------------------------------------------------------------------

SNXUSD 👉( SPOT )

🟢Position: Long

✅Entry Point: 3.280 USD (Stop Limit Order)

⛔️Stop Loss: 2.880 USD

💰Take Profit:

🎯 3.679 USD RR==1.00

🎯 3.987 USD (Over ➕20%)

Risk-To-Reward: 1.77

Please don't forget to follow capital management ⚠️

Please pay attention to the style of opening the position.⚠️

--------------------------------------------------------------------------------

❗️⚠️Note⚠️❗️: An important point you should always remember is capital management and lack of greed.

Synthetix Analyze (SNXUSD), 4-hour time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Synthetix parabolic move coming!!Synthetix is preparing for a Parabolic move in the next few weeks.

The CM ULTIMATE MA MTF on the weekly chart shows a very a clear and distinct pattern. Once it turns green from red the move that follows is fairly substantial. Price action is still fairly low in SNX while the the ULTIMATE MA has already turned green.

Down below we have the RSI and it is around the 42 level. Once the RSI gets above The yellow resistance/support line at 50 then price action will move quickly and will continue to do so will it stays above or finds it as support.

The key to this chart is the CM ULTIMATE MA turning green (Circled) that is most likely for shadowing the parabola.

Thanks for looking! Please like and follow!

SNX Bullish long term outlookSNX is showing a clear bullish accumulation structure.

After breaking above resistance and confirming it as support our next real target is 7.7 dollars.

The chart is really simple, and I wouldn't enter a leveraged long here. However, if you have a long term goal of holding certain tokens this one has tremendous upside and looks incredibly bullish.

I'll see you at $7.7

SNXUSD (4H) - Bullish wave We2Hi Traders

SNXUSD (4H Timeframe)

A high probability, entry signal to go LONG will be given with the upward break of 4.53 after the market found support at 3.93. Only the downward break of 3.93 would cancel the bullish scenario.

Trade details

Entry: 4.53

Stop loss: 3.93

Take profit 1: 5.65

Take profit 2: 6.72

Score: 8

Strategy: Bullish wave We2

Is SNX Ready For A Jump TO $7.5?Range Breakout Rally Potential: SNX (Synthetix) price action hints at a range breakout rally that could lead to a significant trend reversal.

Challenging 23.60% Fibonacci Retracement: The coin is challenging the 23.60% Fibonacci retracement level, indicating a possible bullish breakout.

Target of Surpassing $4.29: Crossing the $4.29 mark could propel the Synthetix market value towards $6.

Long-term Consolidation and Comeback: After a long period of consolidation in 2023, Synthetix is making a notable comeback.

Current Market Pullback: A recent market pullback poses a challenge to the bullish momentum.

135% Increase in Two Months: Synthetix has seen a significant rise, increasing by 135% in the past two months.

Potential Evening Star Pattern: The presence of a long-range Doji candle suggests a potential evening star pattern.

Current Trading Price: SNX trades at $4.220, facing intraday losses.

Technical Indicator - MACD: The MACD in the weekly chart shows a sustained bullish trend with growing bullish histograms.

Possibility of Reaching $7.485: If SNX crosses the 23.60% Fibonacci level, it could potentially reach $7.485, a 78% increase.

Risk of Retesting $4 Level: A reversal could lead to a retest of the $4 breakout point.