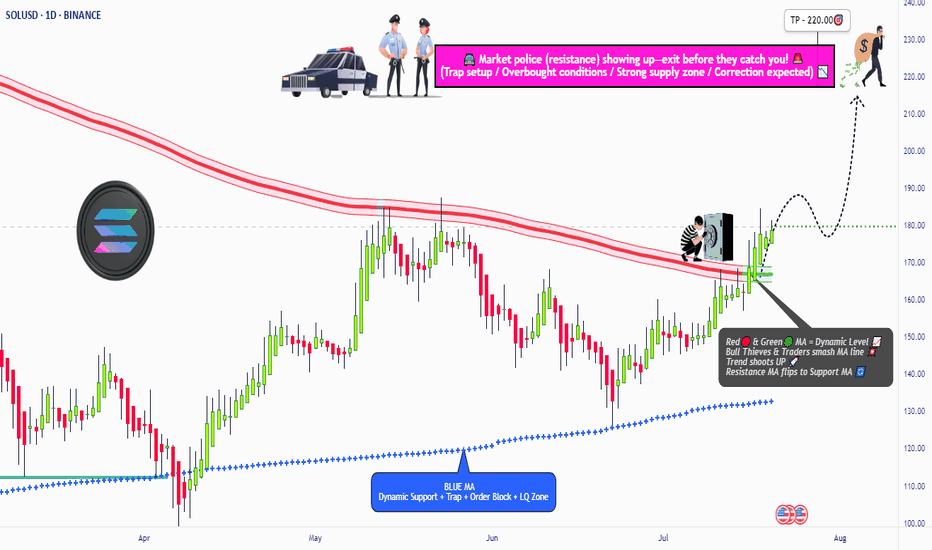

"SOL/USD BULLISH HEIST! Steal Profits Like a Pro"🏆 "SOLANA HEIST ALERT! 🚨 Bullish Loot Ahead – Thief Trading Style (SOL/USD)" 🏆

💸 Steal Profits Like a Pro – Day/Swing Trade Plan 💸

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

Hola! Bonjour! Hallo! Marhaba! 🤑 Dear Thieves & Trend Snipers, the SOL/USD vault is WIDE OPEN! Time to execute the heist with precision.

🔥 THIEF TRADING MASTER PLAN 🔥

🎯 Mission: LONG SOLANA (Escape Near Blue ATR Line)

⚠️ Danger Zone: Overbought | Consolidation | Bear Trap Ahead

🏆 Rule: "Take Profit & Treat Yourself – You’ve Earned It!" 💪💰

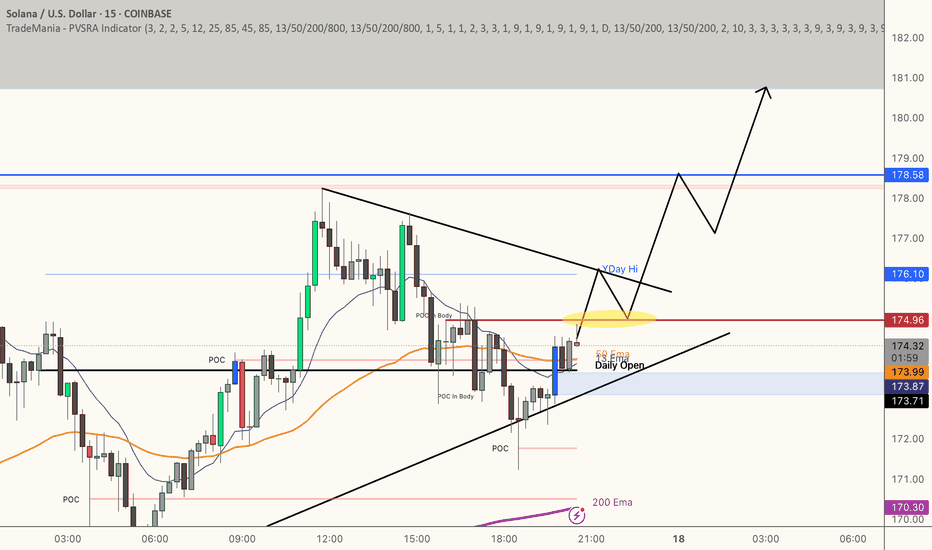

📈 ENTRY STRATEGY (The Heist Begins!)

"SWIPE THE BULLISH LOOT!" – Enter at any price, but smart thieves use:

Buy Limit Orders (15-30min timeframe)

Swing Low/High Pullbacks for optimal entry

DCA/Layering Strategy (Multiple limit orders for max loot)

🛑 STOP-LOSS (Escape Plan)

📍 Thief SL: Below nearest low (Daily MA @ $160.00)

⚠️ Adjust SL based on: Risk tolerance, lot size, & DCA layers.

Pro Tip: Tighten SL if market flips bearish!

🎯 TARGETS (Profit Escape Routes)

🎯 Main Take-Profit: $220.00 (or exit earlier if momentum fades)

🧲 Scalpers: Only LONG! Use trailing SL to lock gains.

💰 Big Bank Thieves: Go all-in. Smaller Raiders: Join swing traders.

📰 WHY SOLANA? (Fundamental Boosters)

Bullish Momentum (Tech + Sentiment Driving Price)

Macro Trends, On-Chain Signals 👉 Check Liinkss 🔗

Intermarket Analysis: Crypto & equities syncing for gains!

⚠️ TRADING ALERTS (News & Risk Control)

🚨 News = VOLATILITY! Avoid new trades during major releases.

🔒 Protect Running Trades: Use trailing stops to secure profits.

💥 SUPPORT THE HEIST! (Boost & Win Together) 💥

🔥 Hit the "LIKE" & "BOOST" button to strengthen our Thief Trading Squad!

🚀 More Heist Plans Coming Soon – Stay Tuned! 🤑🎉

📌 Reminder: This is NOT financial advice – DYOR & manage risk!

SOLANA trade ideas

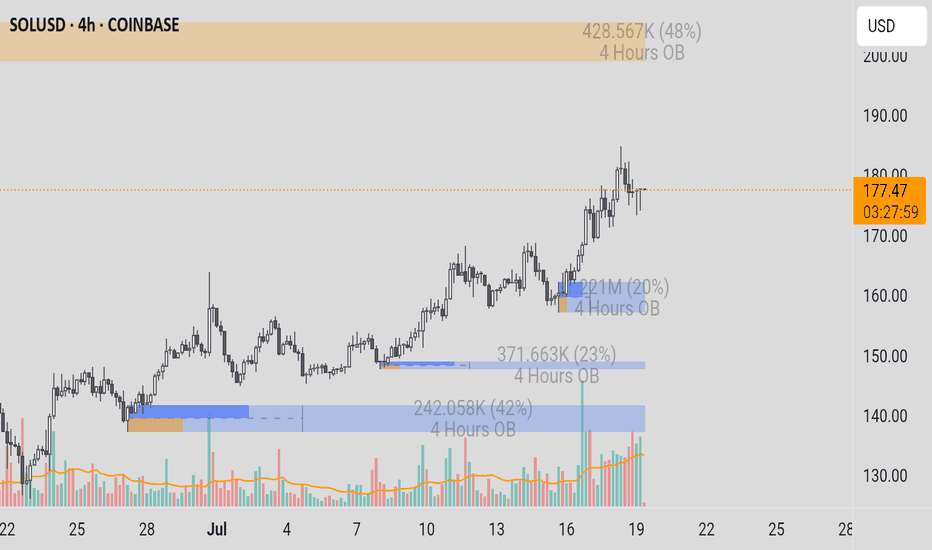

SOLUSDTSOL/USD (Solana):

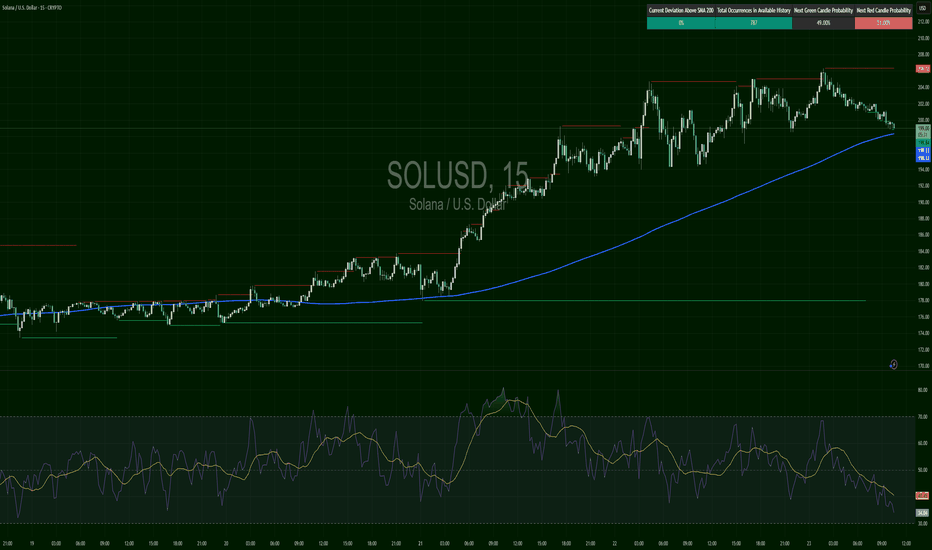

○ Trend: Very strong uptrend (exponential increase).

○ Current Conditions: Price has reached a new high above $180 after a very rapid and significant rise.

○ Entry Recommendation: Entry is strongly discouraged at this time. The risk of a deep correction is very high. Ideally, wait for a significant correction to a strong support area (e.g., $158-$162 or $148-$152) and look for a bullish reversal signal.

Cryptocurrency Futures Market Disclaimer 🚨🚨🚨

Trading cryptocurrency futures involves high risks and is not suitable for all investors.

Cryptocurrency prices are highly volatile, which can lead to significant gains or losses in a short period.

Before engaging in crypto futures trading, consider your risk tolerance, experience, and financial situation.

Risk of Loss: You may lose more than your initial capital due to the leveraged nature of futures. You are fully responsible for any losses incurred.

Market Volatility: Crypto prices can fluctuate significantly due to factors such as market sentiment, regulations, or unforeseen events.

Leverage Risk: The use of leverage can amplify profits but also increases the risk of total loss.

Regulatory Uncertainty: Regulations related to cryptocurrencies vary by jurisdiction and may change, affecting the value or legality of trading.

Technical Risks: Platform disruptions, hacking, or technical issues may result in losses.

This information is not financial, investment, or trading advice. Consult a professional financial advisor before making decisions. We are not liable for any losses or damages arising from cryptocurrency futures trading.

Note: Ensure compliance with local regulations regarding cryptocurrency trading in your region.

thanks for like and follow @ydnldn to have more information outlook and free signal.

About me :

"I am a passionate swing trader focused on analyzing financial markets to capture profit opportunities from medium-term price movements. With a disciplined approach and in-depth technical analysis, I concentrate on identifying trends, support-resistance levels, and price patterns to make informed trading decisions. I prioritize strict risk management to protect capital while maximizing profit potential. Always learning and adapting to market dynamics, I enjoy the process of refining strategies to achieve consistency in trading."

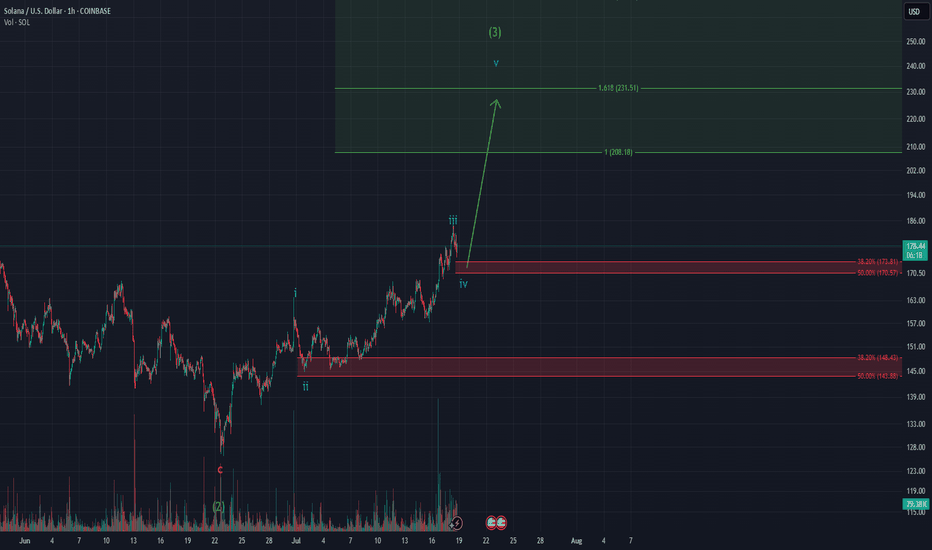

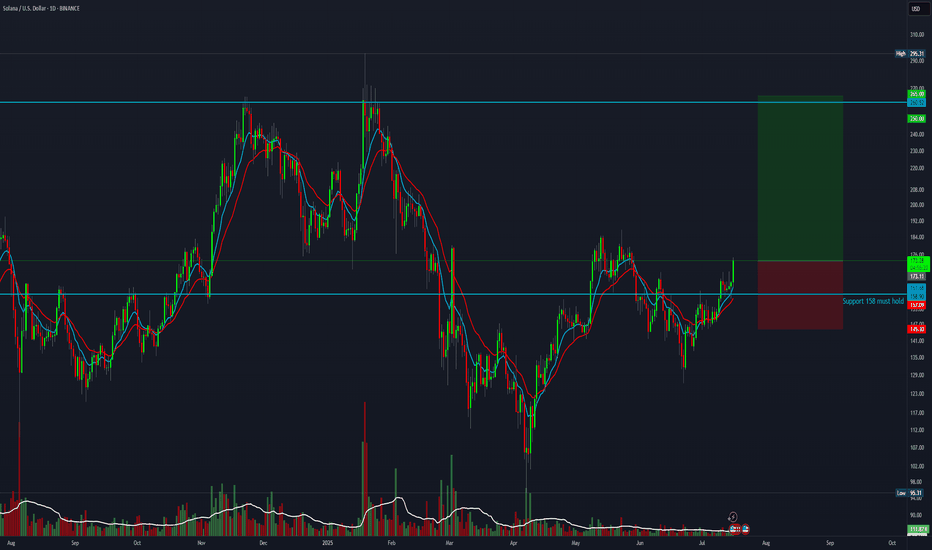

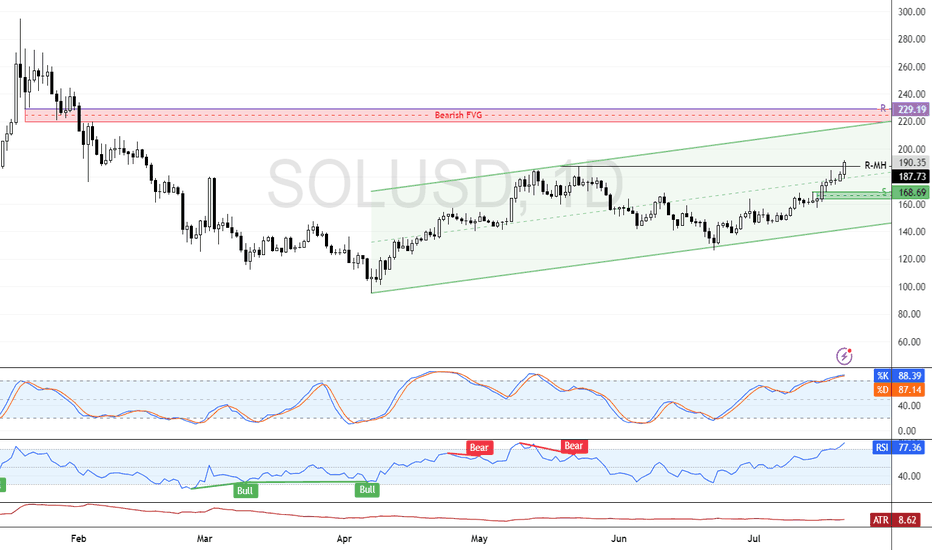

Solana’s Breakout Setup is Loaded — Bullish Structure IntactSolana is pressing into key resistance after holding its higher low structure and climbing out of the golden pocket. With a breakout forming just under the descending trendline, bulls are watching for confirmation to ignite a move toward $220 — and potentially $290+.

Momentum is coiled, and the chart is clean. If price holds above $142, this could be the beginning of a multi-leg run.

#SOLUSD #SolanaBreakout #CryptoTrading #QuantTradingPro #BacktestYourEdge #TradingView #AltcoinSetup

Solana breakout setup: why I am watching this level closelySolana is forming a clear ascending triangle. We already saw one breakout earlier, followed by a few hard retests. Now price has stalled. This might frustrate some, but I see opportunity. A clean break could deliver 14% upside. I also discuss Bitcoin, false moves, and why time stops matter in this environment. Watch closely.

Solana: Still bullish about this cryptoHello,

I see the current price is at a great value price for Solana investors. The market has corrected by over 22% over the recent 36 days. The MACD is also showing signs of bullish zero crossover further reinforcing that the price is at a good place for bullish investors to begin coming in.

We urge investors who would like exposure to this coin to consider entering at the current price. Please have your stop loss below the trendline and your short-term target at $191.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

"Solana Heist in Progress! Will the Breakout Hold or Fake Out?"🔥🚨 "SOLANA HEIST ALERT: The Ultimate Bullish Raid Plan (Breakout or Fakeout?)" 🚨🔥

🌍👋 Greetings, Market Pirates & Profit Bandits!

(English, Spanish, Portuguese, French, German, Arabic—we speak MONEY.)

💎 STRATEGY BASED ON THIEF TRADING STYLE 💎

(High-risk, high-reward—steal the trend or get caught in consolidation!)

🎯 MISSION: SOL/USD (Solana vs. Dollar) CRYPTO HEIST

🐂 Direction: LONG (But watch for traps—cops & bears lurk nearby!)

🚀 Escape Zone: ATR line (High-Risk Profit-Taking Area)

⚠️ Warning: Overbought? Reversal? Police line at resistance? TAKE PROFITS EARLY!

📈 ENTRY: "THE BREAKOUT HEIST BEGINS!"

Trigger: Wait for candle close ABOVE 148.50 (MA)

Alternative Entry: Buy stop above MA OR buy limit on pullback (15m-30m TF)

🛎️ SET AN ALERT! Don’t miss the breakout—thieves strike fast.

🛑 STOP LOSS: "DON’T GET CAUGHT!"

Thief SL: 136.00 (2H Previous structure Swing Low) (Adjust based on your risk & lot size!)

⚠️ Warning: If you ignore this, you’re gambling—your loss, not mine.

🎯 TARGET: "LOOT & BOUNCE!"

🎯 167.00 (or escape earlier if the trend weakens!)

🧨 Scalpers: Only play LONG—use trailing stops to lock in gains!

📢 NEWS & RISK WARNING

🚨 Avoid new trades during high-impact news! (Volatility kills heists.

🔒 Use trailing stops to protect profits if the market turns.

💥 BOOST THIS HEIST! (More boosts = more profit raids!)

👉 Like ✅ | Follow 🚀 | Share 🔄

💬 Comment your take—bullish or bearish trap?

🚀 Next heist coming soon… Stay tuned, bandits! 🤑

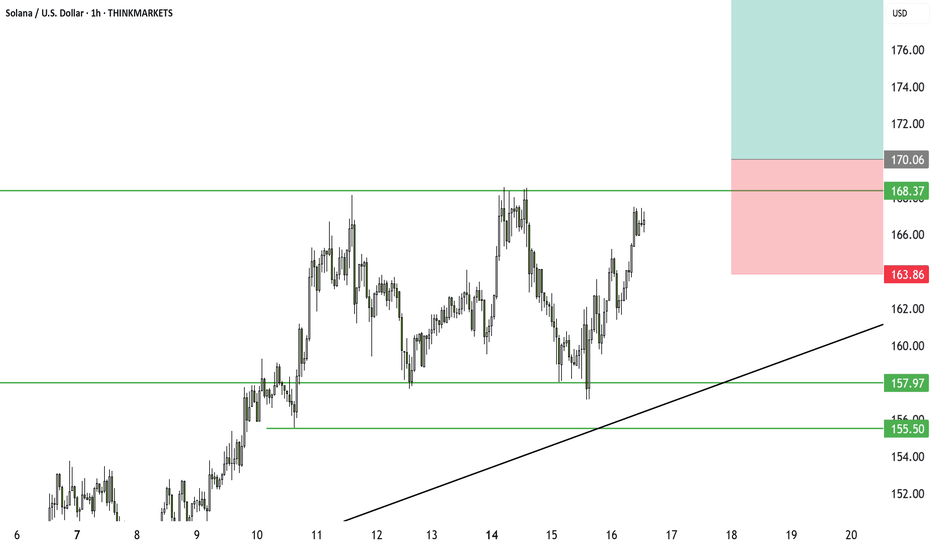

SOLUSD – Coil in DeclineSOL rallied fiercely from $146 into $170, then sold off aggressively. The chart shows a classic mid-trend distribution, followed by lower highs forming into a descending wedge. Support at $158 has held for now. A breakout over $161–162 could shift structure, but below $157 = trouble.

SOL DOWN TO 146 ? Is this possible? Good evening trading family

Based on what we are seeing here is a typical correcting of any good bull mark needed to sustain our movement upwards. Currently we have spotted 3 levels down to the 146 marker with a these of a bullish move upwards if they hold.

Happy trading folks

Kris/ Mindbloome Exchange

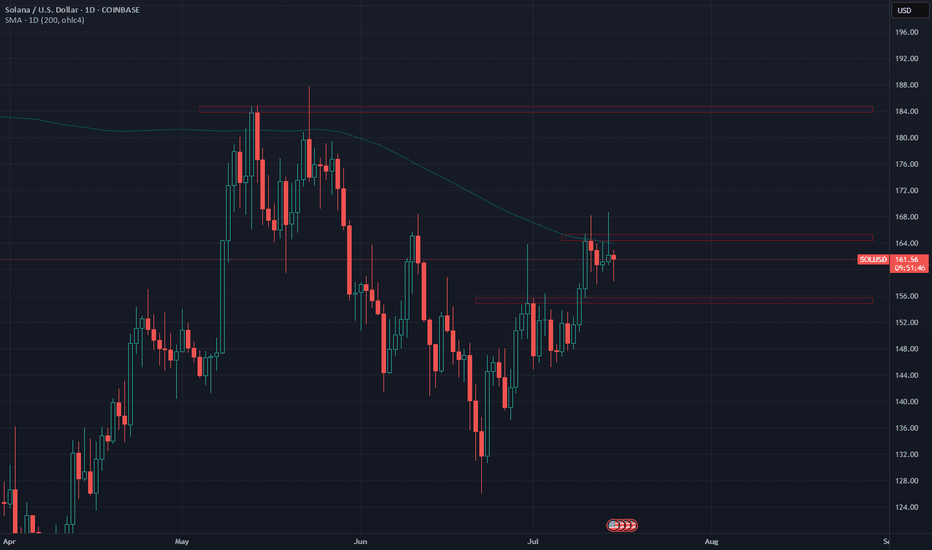

Solana's battle continues. But for how long?The battle for Solana to overcome the 1D 200MA continues.

A daily closed above $166 could signal a push towards May Hs around $185.

The last time SOL traded above 1D 200MA was in Feb. Since then, the daily 200MA has been acting as resistance.

If Solana can finally start trading above the 200MA and reclaim $185, it could signal higher prices and a test of January Hs around $270.

In the short term, support can be expected around $156 should price start to show some weakness... Losing it wouldn't be nice...

What do you expect from Solana in the short term?

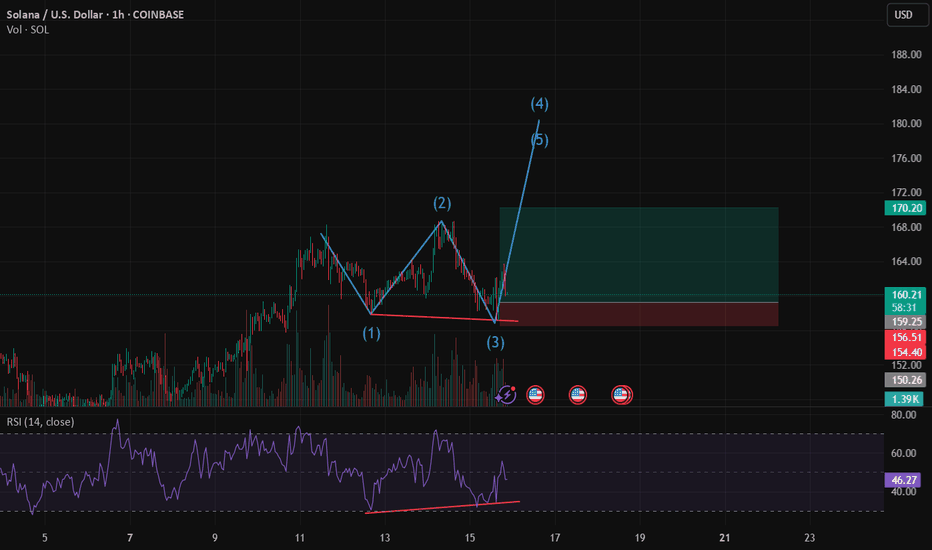

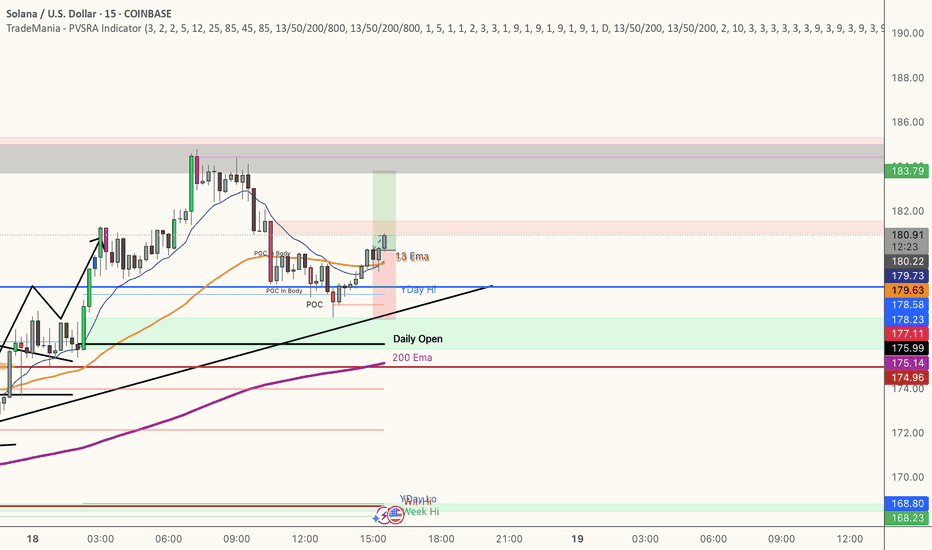

Projected Harmonic Extension Into Key Demand Zone (157–152 WatchMacro to Micro Context

SOL is currently reacting off a short-term distribution zone between 164 and 168 after an impulsive run-up from early July. While no complete harmonic has printed yet, the structure forming resembles a potential Bearish Gartley. The CD leg shown is not yet confirmed, but represents a projected path derived from the local point of value and volume geometry on the 2H chart. The area between 157 and 152 remains the primary zone of interest, given historical demand and high-volume node alignment.

Structural and Momentum Breakdown

XABCD Estimate:

XA was impulsive, AB retraced 53.2%, and BC retraced 63.8% of AB

CD projection is speculative, drawn from the confluence of the BC extension (1.757), 0.786 retrace of XA, and the local value zone around 157.5–152

Volume Profile: Substantial volume shelf aligns with projected CD completion. Above 164, volume thins out sharply, indicating inefficiency and risk of rejection

Order Blocks: 2H bullish OB from July 1–3 sits directly inside the 157–152 range, adding further structural validity to this projected leg

Momentum Signals:

RSI is stalling below mid-band (50–60), suggesting loss of buyer momentum

Price Volume Trend (PVT) shows deceleration post-surge, potentially preceding distribution

Bollinger Bands are compressing, which often leads to volatility re-expansion following trend exhaustion

Trade Plan

At this stage, the CD leg remains a hypothesis based on value structure and harmonic geometry. The trade plan focuses on preparing for potential long entries if price moves into the estimated completion zone with supportive signals.

Watch Zone for Long Setup: 157.5 to 152.5

Invalidation: Clean break below 147 suggests breakdown and invalidates harmonic idea

Take-Profit Targets on Reversal:

TP1: 161.5 to 163.0

TP2: 165.5 to 168.0

Required Confirmation:

Bullish divergence on RSI or PVT bounce

Reclaim of 2H order block zone with impulse and follow-through

Solana/Ethereum Pair Flipping?$SOL/ CRYPTOCAP:ETH ratio may soon decline as Ethereum shows relative strength. ETH's new upgrade on scaling solutions and DeFi dominance could outpace Solana's momentum. Watch for ETH outperformance! #Crypto #Ethereum #Solana

Chart pattern is now showing a classic Elliot wave bearish ending diagonal pattern which will be confirmed when ratio breaks back below the prior all time high of 2022

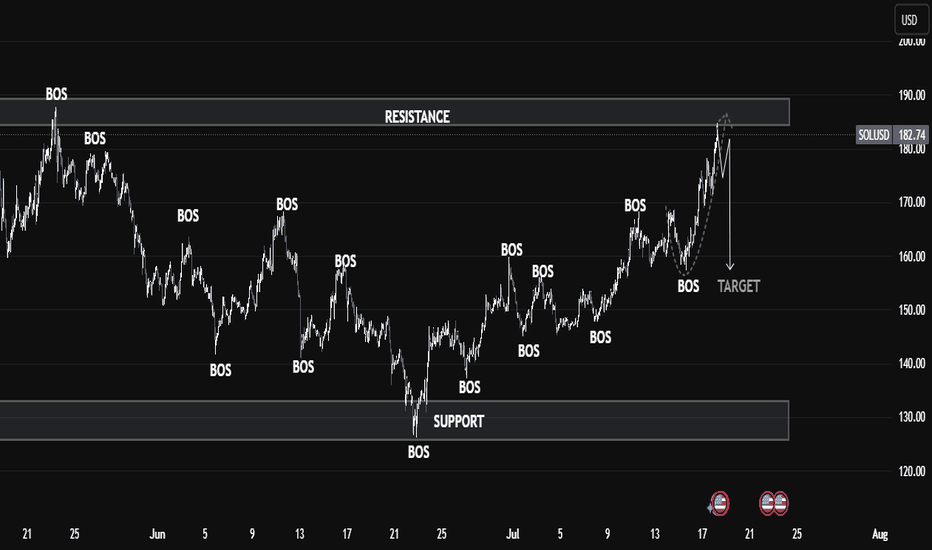

SOLANA Smart Money Breakdown 🔍 SOLANA (SOL/USD) Technical Analysis – July 18, 2025

Solana (SOLUSD) is currently reacting to a major resistance zone around the $185–$190 level, as shown in the chart. Price has rallied strongly from the support area near $130, breaking several market structures (BOS – Break of Structure) on its way up.

🧠 Smart Money Insight:

Multiple BOS events indicate strong bullish momentum that pushed price into a premium zone.

Current price action shows exhaustion near resistance, suggesting possible distribution.

🧱 Key Levels:

Resistance Zone: $185 – $190

Support Zone: $125 – $135 (untapped liquidity beneath)

Target Zone: $155 – $160 (where liquidity likely rests)

⚠️ Expectation:

A potential short-term retracement or pullback is expected toward the target area, as indicated by the downward arrow.

This aligns with a classic liquidity sweep setup, where smart money often engineers a false breakout before reversing.

📌 Conclusion:

If SOL fails to close strongly above the resistance zone, it could signal a reversal pattern toward lower support, offering an opportunity for short-term swing traders.