SOL vs ETH: Bleeding Until Catalyst?

SOL/ETH on the Daily

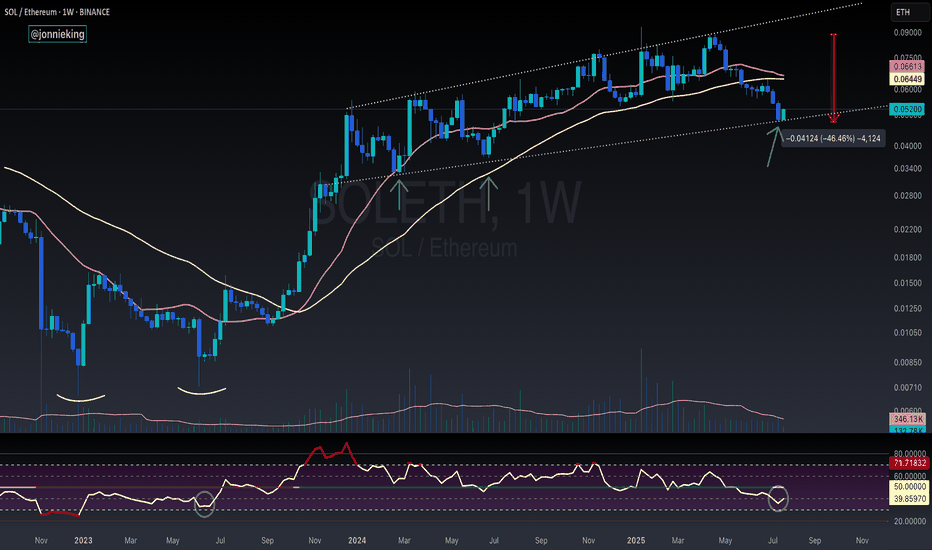

On June 17, 2025, a death cross formed — and since then, SOL has been steadily losing ground to ETH.

Attempts to pause or reverse the trend at the 0.382 and 0.5 Fib levels have failed. Momentum is strong to the downside.

The next potential support is the 0.618 Fib, around 0.04000.

In my view, this is closely tied to Ethereum’s dominance narrative: ETF inflows, real-world assets, stablecoins, Trump support, protocol upgrades — the spotlight is firmly on ETH.

Unless SOL gets its own ETF (which, to my knowledge, it currently doesn't), it’s likely to keep bleeding against ETH — just like other altcoins in similar positions.

Bias: bearish until proven otherwise.

Always take profits and manage risk.

Interaction is welcome.

SOLETH trade ideas

ETF News Meets the Charts: ETH, BTC, XRP, and SolanaFirst you probably want to watch this video:

📊 ETF News Meets the Charts: ETH, BTC, XRP, and Solana 🔥🚀

The SEC’s new in-kind ETF ruling is a macro-level reset. But as always — we bring it back to the charts 📉🧠

Here's the visual breakdown of what I'm watching and why:

🏛️ ETF Approval = Real BTC/ETH Usage Starts Now

✔️ ETF issuers can now create/redeem with actual Bitcoin & Ethereum

✔️ Real spot demand, better arbitrage, and tighter price tracking

✔️ TradFi goes crypto-native — this changes how ETFs settle

But the market? Shrugged.

That’s why we watch price structure — not headlines alone.

📈 What the Charts Are Telling Us:

🔷 Top Left – Ethereum (ETHUSD)

Breakout triangle forming after the unicorn setup at $2,912.

Momentum building for the third breakout attempt at $4,092

🔥 Fuse lit. Target: $6,036

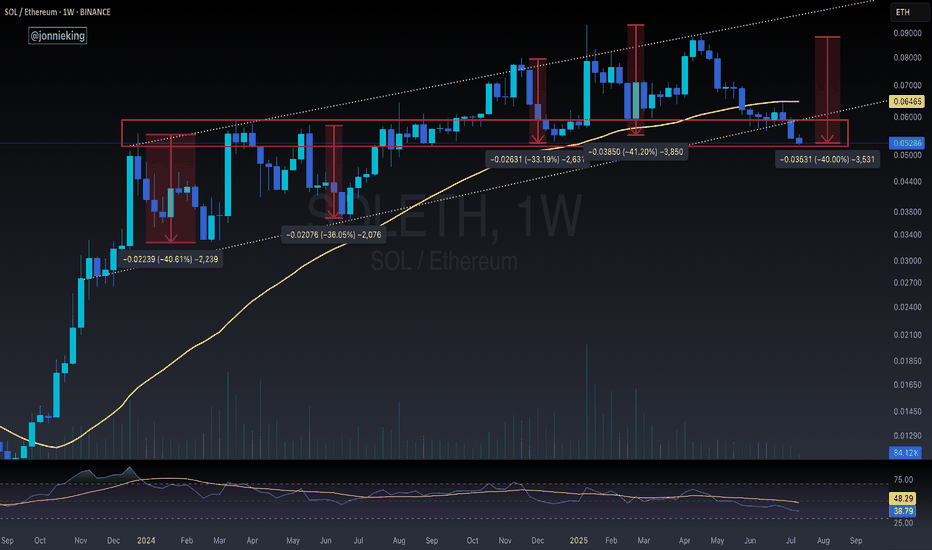

🔷 Top Right – SOLETH

Solana bleeding against Ethereum — just as forecasted months ago.

Rust tech, but memecoin dilution is hurting its institutional appeal. Solana will keep paying for their mistakes and damage done to Crypto!

🔷 Bottom Left – XRPBTC

Wedge breakdown playing out. XRP continues underperforming.

This chart was paired with a BTC dominance hedge — and dominance rose right after. XRP and dark pools is something I will cover..No, i don't like XRP, sorry.

🔷 Bottom Right – Bitcoin (BTCUSD)

Fib extension points to next possible macro leg:

🚀 0.618 = $131,736,

🟡 Final cycle target zone near $163K (or more? or 130k max?..we will find out)

🇨🇳 China: Rumor or Tumor?

Unconfirmed sources say China may be prepping a Bitcoin move. But let’s stay grounded:

🧠 It’s a rumor. Or a tumor.

There’s a 40% chance we get bad news instead — so keep your expectations realistic.

Still, if true, it could mean:

BTC in reserves

Regulated mining zones

Digital Yuan–BTC integration

🧯 Nothing official yet. But timing near the BRICS summit makes it worth watching.

🧠 Key Altcoin Narratives:

🔹 Ethereum L2s (ARB, OP, BASE) – ETF gas pressure = L2 scalability play

🔹 DeFi (UNI, AAVE, LDO) – TradFi flows into real DeFi utility

🔹 Staking Derivatives (LDO, RPL) – Institutions love yield

🔹 Oracles (LINK) – Real-time price data needed for ETF tracking

🔹 BTC Bridges (ThorChain, tBTC) – Infrastructure plays if BTC moves on ETH rails

🚫 What I’m Not Touching:

❌ Memecoins

❌ GameFi

❌ Ghost Layer 1s

📽️ Full breakdown is in my latest video — check it out from the video ideas tab for full context.

Stay sharp. Stack smart. Structure > noise.

One 💙 Love,

The FX PROFESSOR

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

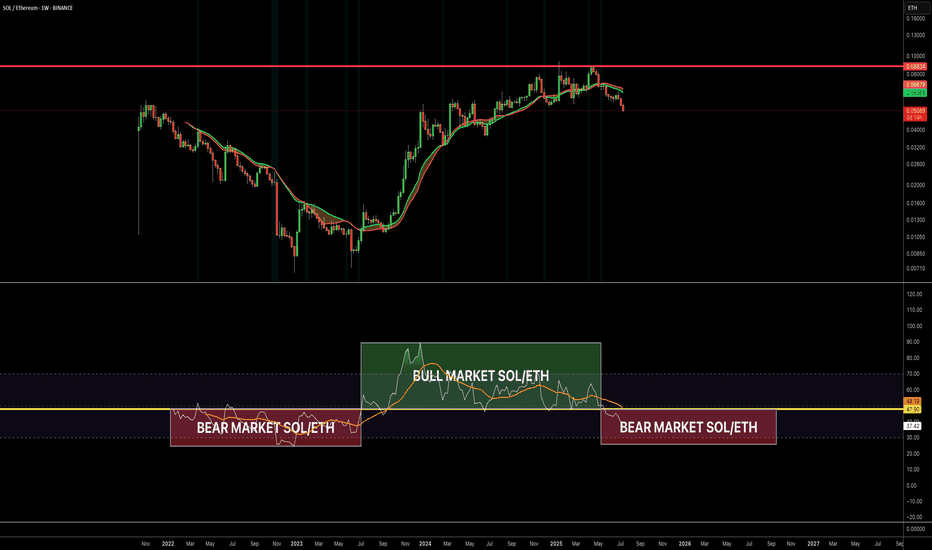

SOL / ETH - Reversal Signs FormingI suspect CRYPTOCAP:ETH has a bit more gas in the tank, but the early signs for the real Alt Season are nearing.

RSI on the weekly is nearing the June 2023 bottom which kicked off the massive bull flag formed on SOL / ETH for the next 2 years.

Still too early to call at this point tho.

Need volume to really burst through in the next week or two.

I’d also like to see BOATS:SOL close the week with a massive bullish engulfing candle.

The bearish cross on the 20 / 50WMA should mark the bottom when it occurs soon.

SOL / ETH at Critical Inflection PointSOL / ETH loses the 50WMA.

Has been trading below it for the past 7 weeks, something we haven't seen since 2021.

Has also broken down from the 8 month bull flag / parallel channel. Retesting the key POI I've been eyeing.

HOPIUM: We've seen great rallies after CRYPTOCAP:SOL goes down ~40% vs CRYPTOCAP:ETH , which it is at now. We SHOULD see a turnaround here soon.

And I still believe SOL will greatly outperform ETH this cycle, especially when the ETF launches and Alt Season kickstarts.

Right now we're seeing a typical market cycle BTC > ETH > Large Caps > Mid Caps > Micro Caps

Ethereum is outshining Solona- Ethereum is finally outshining Solona

- ETH/SOL pair has broke down from the raising wedge pattern indicating clear bearish sentiment

- with the current bearish trend, we can expect the SOL/ETH pair to drop further down to 0.02630 range..

- This is clear sign the holder are preferring ETH or SOL

Stay tuned for more updates

Cheers

GreenCrypto

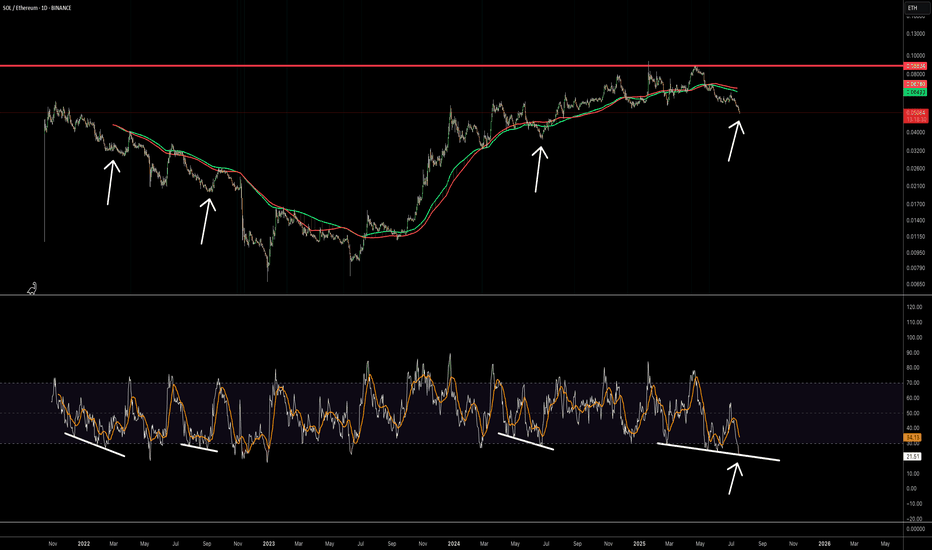

Solana v EthereumSOLETH 1day shows a beautiful longterm upward trend for SOL against ETH If you are in the race with Solana and Ethereum and can't decide where to park your bags you might get some insight from a chart like this one Price is now at/below the bottom of the bullish trend range against ETH but that could change with a fresh tailwind in the market and we should start to head into the top of range again There is no confirmation to bias SOL against ETH yet so our bet is on ETH until that changes We will be watching a few indicators to show the change in direction Green candles and green dots maybe a green momentum arrow the rsi has double bottomed in the oversold area and needs to show us a way back to 42 and the macd also needs to cross and begin to track upwards towards the 0.0 You can scan charts like this to 'follow the money'

You brought the narrative, now you pay the price. SOL/ETHSOL/ETH (Binance) is forming a clear ascending wedge on the weekly chart, a bearish pattern signaling a potential reversal after an uptrend. The price recently hit 0.087 near the wedge's apex, but momentum is fading as trading volume decline, a classic sign of an impending breakdown. RSI is sitting above 70, indicating overbought conditions and supporting the likelihood of a correction.

Key support lies at 0.075-0.080, but if that breaks, we could see a sharp drop targeting 0.03-0.04, aligning with historical lows and the wedge’s measured move. Keep an eye on RSI for confirmation of weakening momentum and watch for a clean break below support to enter a short position.

SOLANA has obliterated ETHERIUM in this bull market.We now know that approximately 70% of all daily blockchain fees are collected on Solana chain. This reminds us of Etherium in the previous cycle. Solana's being faster and cheaper, ETH L2's cannibalizing their mother chain in activity and fees, and complexity of execution in Etherium chain might be seen as the main reasons here (please comment if any more).

When we look at the price action, we see that CRYPTOCAP:SOL has outvalued CRYPTOCAP:ETH 1200% since the start of 2023. The interesting fact is that this uptrend has been intact since then. While ETH maxis, like a religious revelation, claim that ETH will rise from its ashes and beat BTC eventually, the fundamentals and technicals do not support this idea. I predict that unless dramatical fundamental changes happen, this trend will continue throughout the final stages of this bull market. So I continue to be long SOLETH

HTF SOLETH bullish thesis has strengthened. Flippening possibleWe previously made a medium time frame analysis on SOLETH and predicted a reversal of SOL v ETH

we have successfully reached those targets and now have reassessed.

Based on the metrics, technicals, not even mentioning a variety of onchain indicators and whale accumulation we believe SOL is going to continue on its upward movement against ETH.

Charts don't lie. We used to be very bullish and supportive of ETH and charts looked promising (see prior analyses), but ETH is now definitely in weak bullish mode at best or neutral mode at worst, while SOL is in a strong bullish mode.

Based on fib and some other indicators we can expect SOL to outperform ETH by 2.5-3x this cycle.

We are now convinced that the flippening long-awaited by the Ethereum community is bound to happen this cycle. However, not the way they wanted. Instead of ETH flipping BTC, it seems ETH will be flipped by SOL.

Position yourself accordingly.

SOL vs ETH. Who is Winning the Generational Battle for DeFi?Since September of 2023, Sol has crept up on ETH dominance, gradually and for the first time in 5 years broken the previous ATH before the current one.

Following that it immediately retraced and bounced from the resistance. A classic pattern indicating that the wind is behind it's sails, to use a metaphor.

It seems SOL here is ready to take off massively.

Next key levels to watch for:

0.079 next key resistance to watch for

0.096 possible profit taking

0.122 possible profit taking

SOL to lead ETH again? A possibilitySOL broke down its long term growth trend against ETH and entered a correction

that did not however preclude it from recovering

will SOL lead ETH again

and make vitalik seethe?

Charts show that upward continuation for SOL is possible

Maybe it will make a double top against ETH there

and start dumping against ETH for good

for now, the game is on and SOL outperforming ETH YTD already