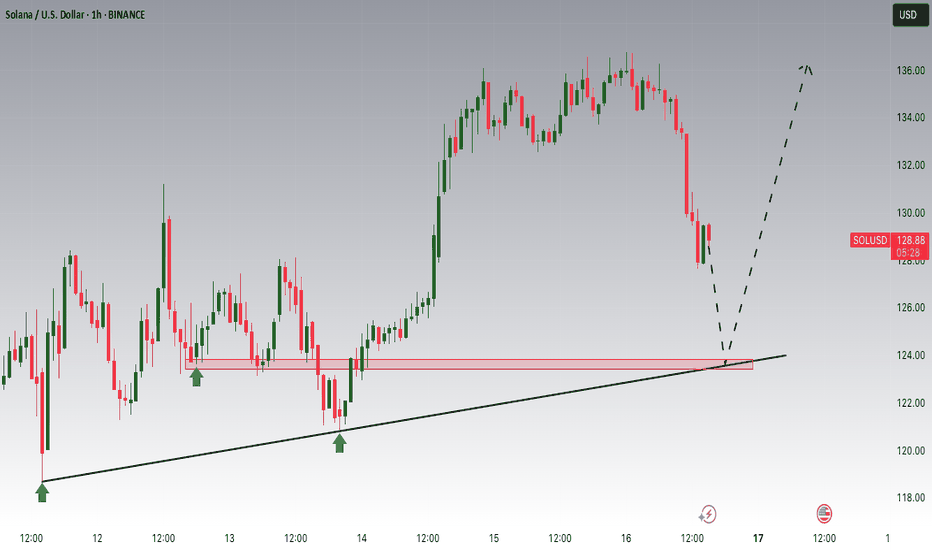

Solana Bearish oversold bounce back capped by 136.68Solana price action exhibits a bearish sentiment, driven by the prevailing downtrend. The recent price movement appears to be an oversold bounce back, forming a bearish sideways consolidation pattern. This indicates that bearish pressure remains dominant despite a temporary upward correction.

Key Level (136.68):

The critical trading level to monitor is 136.68, which marks the previous intraday consolidation zone. An oversold rally approaching this level could face bearish rejection, reinforcing the continuation of the downtrend. A failure to break above this resistance level would likely prompt further downside movement.

Support Levels:

If the bearish sentiment prevails and the price is rejected from the 136.68 level, the downside targets include:

119.80 - Immediate support level.

105.21 - Secondary support.

97.71 - Long-term support level.

Bullish Scenario:

Conversely, a confirmed breakout above the 136.68 resistance level, followed by a daily close above it, would negate the bearish outlook. This breakout could initiate further upward momentum, targeting:

142.24 - Initial resistance after the breakout.

149.90 - Subsequent resistance level.

Conclusion:

The overall sentiment for Solana remains bearish, with 136.68 acting as the pivotal resistance level. An oversold bounce approaching this level may face rejection, signaling a continuation of the downward trend. However, a breakout and daily close above 136.68 could shift the sentiment to bullish, opening the path for further gains toward 142.24 and 149.90. Traders should remain cautious and watch for confirmation signals at the critical resistance level.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SOLUSD.P trade ideas

SOLANA Stock Chart Fibonacci Analysis 032025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 129/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

SOLUSD Analysis1. Current Price Context

Price Movement: SOL has gained 7.44% recently, showing strong upside potential.

Trend Structure: The price is attempting to break above key resistance zones after bouncing from recent lows.

2. Key Support & Resistance Levels

Support Levels (Downside Risk)

$131.80–$133.80 Zone – Current short-term support. If price holds above this range, bullish continuation is likely.

$124.87 – Major support level. If SOL falls below this, the bullish momentum could fade.

Resistance Levels (Upside Targets)

$135.99 – Immediate resistance level SOL is currently testing.

$137.00–$138.00 – Next resistance; breaking this could accelerate a move higher.

$150.50 – Primary target and the key resistance in the next leg up.

3. Technical Indicators & Trend Analysis

EMA Ribbon (Dynamic Support/Resistance)

The EMA ribbon is acting as resistance, and SOL is currently battling to break above it.

A decisive close above the ribbon would be a strong bullish signal.

Trendline Analysis

The downward trendline from previous highs intersects near $150.50, meaning this level is crucial for breakout confirmation.

If price reaches $150 and consolidates, it could set up a trend reversal to the upside.

Volume & Momentum Indicators

RSI (Relative Strength Index): 39.38 – showing weak bullish momentum, but not overbought.

MACD (Moving Average Convergence Divergence): -11.97 – still negative, but improving, indicating potential upside acceleration.

Volume Analysis: Needs a significant increase for confirmation; if price rises with low volume, a rejection at resistance is likely.

JUST IN: First Solana ETFs to Launch in The US TomorrowThe highly functional open source project that banks on blockchain technology’s permissionless nature to provide decentralized finance (DeFi) solutions is set to debut its First Spot ETFs in the US tomorrow.

Price of Solana ( CRYPTOCAP:SOL ) surged 5% today amidst Solana ETFs set to to be launch tomorrow. A news that made Solana reclaim the $130 zone. With build-up momentum and RSI barely overbought at 53 CRYPTOCAP:SOL is set to break the 38.2% Fibonacci retracement point a level that aligns with $150- 160.

A break above this pivot point could send solana on a bullish course with eyes set on the $200- 270 price points.

Similarly, in the case of a reprieve, CRYPTOCAP:SOL might find support in the 78.6% Fibonacci retracement point before picking momentum up.

Solana Price Live Data

The live Solana price today is $130.00 USD with a 24-hour trading volume of $2,966,846,344 USD. Solana is up 5.12% in the last 24 hours, with a live market cap of $66,305,695,632 USD. It has a circulating supply of 510,033,072 SOL coins and the max. supply is not available.

An overall look at SOL with my April flash crash thesis embeddedSOL is forming a massive cup-and-handle pattern overall. However, when zooming into the short-term pattern currently unfolding, I believe we will see a false breakout leg on the fifth wave, leading to a 'flash crash' in mid to late April. After this occurs, the true breakout will likely happen on the seventh wave, taking out the pattern high and running to the top of the broadening wedge pattern—or perhaps even higher—given the bigger picture of a massive cup-and-handle formation that has been developing for over three years.

Good luck, and always use a stop-loss!

The handle is now forming on a massive cup & handle on SOL.SOL is now forming the handle of a massive cup-and-handle pattern that has taken over three years to develop. If SOL breaks out of this pattern in the coming months, we could very well see a four-digit price moving forward.

Keep your eyes on this.

Good luck, and always use a stop-loss!

Solana Wave Analysis – 18 March 2025

- Solana reversed from the resistance zone

- Likely to fall to support level 113.75

Solana cryptocurrency recently reversed down from the resistance zone lying at the intersection of the resistance level 134.65 (former support from the end of February), 20-day moving average and the 38.2% Fibonacci correction of the downward impulse from the start of March.

The downward reversal from this resistance zone created the daily Japanese candlesticks reversal pattern Evening Star.

Given the widespread bearish sentiment across the cryptocurrency markets, Solana can be expected to fall to the next support level 113.75 (the former low of wave (2) from the start of March).

BTCPrice Movement: Bitcoin's price has recently decreased by 1.43%, indicating a short-term bearish trend. The price is currently closer to the lower Bollinger Band, suggesting that Bitcoin might be in an oversold condition, which could indicate a potential reversal or support level.

Bollinger Bands: The price is near the lower band, which often acts as a support level in a downtrend. If the price rebounds from this level, it could signal a buying opportunity. Conversely, if it breaks below, it might indicate further downward movement.

Volume: The volume data suggests active trading, which can confirm the strength of the current price movement. Higher volumes at certain price levels can indicate strong support or resistance.

Historical Context: The chart spans several months, providing a broader context for the current price action. Observing patterns over this period can help in understanding long-term trends and potential future movements.

Solana’s Price Action: Aftermath of the Blow-Off TopThe recent peak for Solana, approaching $300, has proven to be a classic blow-off top. The subsequent decline has broken through three key support levels, retracing around 60% and ultimately reaching the $120 level—a price point that has acted as a strong floor over the past year, with multiple reversals from this zone.

While this may seem positive, the chart structure at the moment doesn't appear encouraging for bulls.

Current Market Structure: A Bearish Outlook

Looking at the price action, it’s clear that the market has faced significant downward pressure. Despite the bounce from $120, the overall structure suggests caution. While the $120 level is historically strong, there’s no guarantee it will hold again. The series of broken support levels and the depth of the correction point to a market that is struggling to regain its previous strength.

Optimistic vs Pessimistic Scenarios: Where Could Solana Go Next?

In my opinion, the optimistic scenario for Solana would see the price range between the $120 zone and the $180 zone. This would represent a consolidation pattern, as the market tries to establish a new equilibrium. However, given the overall trend and recent price action, it’s also important to consider a more pessimistic scenario. In the worst case, the price could fall as low as $80, especially if the broader market continues to face downward pressure.

Solana Price Analysis: Bears in Control, Is a Rebound Possible ?

The price is trading below the midline (moving average) of the Bollinger Bands.

Lower highs and lower lows indicate a downtrend.

Immediate Support: Around $120 (lower Bollinger Band)

Volume appears moderate, with some increasing spikes during price drops, suggesting strong selling pressure.

SOLANA ANALYSIS STILL BERISH THEN RANGEAnalysis Interpretation:

Timeframe: The analysis specifically focuses on the period from Thursday, March 13, 2025, to Monday, March 31, 2025.

Market Context: The first chart suggests that before March 13, 2025, the market was predominantly bearish ("Down cycle"), with clear downward momentum. Around March 13, 2025, a reversal or pivot is anticipated, marking the transition point from bearish sentiment into neutrality or bullishness.

Significance of Dates (US flag icons): The US flags indicate important economic events or announcements originating from the United States, expected during this period (March 13-31, 2025). These could be events such as major economic data releases (e.g., GDP, interest rate decisions, employment reports) or policy announcements from institutions like the Federal Reserve. These are typically moments of increased market volatility.

Expected Market Behavior (March 13 - March 31, 2025):

Initial Reversal (around March 13):

Anticipate increased volatility as traders react to a major event or announcement, causing a shift from bearish sentiment toward neutrality or bullish momentum.

Range Cycle/Up (after March 31):

Expect the market to either consolidate within a trading range (sideways movement) or start developing bullish momentum, influenced by the outcomes of significant economic events scheduled between these date

Will Solana experience a major correction again?Hello everyone, let's look at the 1D SOL to USD chart, in this situation we can see how the price is moving in the formed downward channel, where the price is currently recovering again.

Let's start by defining the targets for the near future that the price has to face:

T1 = 133 USD

T2 = 145 USD

Т3 = 155 USD

Т4 = 167 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 121 USD

SL2 = 111 USD

SL3 = 103 USD

SL4 = 95 USD

If we look at the RSI indicator, we can see how the movement is constantly moving in the lower part of the range, where we have another downward bounce, and here we can see how we are approaching a test of the local uptrend that is close to breaking.

Solana ($SOLUSD) - Monthly Demand InboundQuick TA for Solana $SOL. Many cryptos are at inflection points and will likely break higher or roll over from current prices (I think a move down is more likely, per long-term charts, and am hoping this happens for the sake of buying opportunities). Solana, like many other cryptos, has failed to develop meaningful 1D bullish momentum (RSI holding below 50). Should COINBASE:SOLUSD get another leg down, I'll be watching its behavior as it enters lower demand zones. 101.75-78.87 = monthly demand; 74.85-51.37 = weekly demand, but there are also buy areas higher. If Solana trades lower and approaches the aforementioned levels, use LTFs for signs of exhaustion/downtrend reversal. Personally, I wouldn't use "set-and-forget" buy limit orders; higher-beta cryptos may keep selling off until majors bottom/reverse and/or prices might not trade low enough to hit your limit price. I prefer more of a "hands-on" approach to trading, but to each their own.

On the road, so truncated analysis. Will update when I can. Thank you for your interest and let me know what you think!

Jon

@JHartCharts

Golden Cross + Cup n HandleSOLANA is looking very Bullish this Saturday with price trending up and sideways now on 1HR above a fresh Golden Cross and Just out of a Cup and Handle. After weeks of blood, could we be poised for a major breakout? I I think it’s time bears Become dinner for marketmakers. I’d like to see. 250-300 SOLANA this week but Im expecting to reclaim 150-200 first. However, if we don’t get the proper volume, this could wind up being just a weekend fake out with Moore consolidation before we fly up. Cautiously playing upside with low leverage a healthy Spot!

SOLUSD Decision ZoneSolana (SOL) is currently trading around the $136 area, having recently bounced off a local bottom. There are several key resistance levels identified, notably at $140-$142 and further above at around $150 and $160.

Bearish Scenario (Short Opportunity at $140-$142):

• The price is approaching a resistance area ($140-$142), which aligns with the lower boundary of previous support-turned-resistance and a descending trendline.

• Additionally, the presence of strong overhead resistance from the EMA ribbon suggests sellers could step in at this zone.

• A rejection in this area could be an excellent short setup, targeting lower levels at $131.82 initially, then potentially retesting support at $124.87.

Bullish Scenario (Breakout to $150-$160):

• If SOL manages to close decisively above $142, breaking above EMA ribbon resistance, bullish momentum could increase substantially.

• A confirmed breakout and consolidation above the $142 resistance would set up a bullish continuation towards $150.

• Further bullish follow-through, combined with volume support, could push the price toward the next resistance levels around $157.45 and possibly $160.

Indicators Analysis:

• RSI indicates a mild upward trend, suggesting the potential for bullish momentum; however, RSI has room to rise before being considered overbought, supporting either scenario depending on price action near key levels.

Conclusion:

• Monitor the $140-$142 resistance closely; rejection here provides a clear short opportunity.

• Conversely, a breakout above this level (with confirmation) significantly increases the likelihood of revisiting $150 and possibly $160 in the short term.

SOLANA; Heikin Ashi Trade IdeaBINANCE:SOLUSD

In this video, I’ll be sharing my analysis of SOLUSD, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

SOL/USD "Solana vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the SOL/USD "Solana vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (160.00) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 1D timeframe (200.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 125.00 (or) Escape Before the Target

Final Target - 90.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

SOL/USD "Solana vs U.S Dollar" Crypto Market is currently experiencing a bearish trend,., driven by several key factors.

⚡⭐Fundamental Analysis

Blockchain Trends: Solana's blockchain growth is expected to slow down, driven by increasing competition from other blockchain platforms.

Smart Contract Activity: Smart contract activity on Solana's blockchain is expected to decrease, driven by growing competition from other blockchain platforms.

Mining Difficulty: Solana's mining difficulty is expected to decrease, driven by decreasing network hash rate.

Transaction Volume: Solana's transaction volume is expected to decrease, driven by decreasing demand for cryptocurrency transactions.

⚡⭐COT Data

Non-Commercial Traders (Institutional):

Net Short Positions: 55%

Open Interest: 100,000 contracts

Commercial Traders (Companies):

Net Long Positions: 30%

Open Interest: 50,000 contracts

Non-Reportable Traders (Small Traders):

Net Short Positions: 15%

Open Interest: 20,000 contracts

COT Ratio: 0.6 (indicating a bearish trend)

⚡⭐Sentimental Outlook

Institutional Sentiment: 40% bullish, 60% bearish.

Retail Sentiment: 35% bullish, 65% bearish.

Market Mood: The overall market mood is bearish, with a sentiment score of -50.

⚡⭐On-Chain Analysis

Network Hash Rate: Solana's network hash rate has decreased by 10% over the past month, indicating a decline in mining activity.

Transaction Volume: Solana's transaction volume has decreased by 20% over the past month, indicating a decline in network activity.

Active Addresses: Solana's active addresses have decreased by 15% over the past month, indicating a decline in network adoption.

⚡⭐Market Data Analysis

Order Book Analysis: The SOL/USD order book is showing a significant imbalance, with more sell orders than buy orders, indicating a bearish market sentiment.

Liquidity Analysis: Solana's liquidity has decreased by 10% over the past month, indicating a decline in market participation.

Volatility Analysis: Solana's volatility has increased by 20% over the past month, indicating a more unpredictable market.

⚡⭐Positioning

Long Positions: 30% of total positions

Short Positions: 70% of total positions

Neutral Positions: 0% of total positions

Leverage: 2:1 (average)

⚡⭐Next Move Prediction

Bearish Move: Potential downside to 140.00-125.00.

Target: 125.00 (primary target), 90.00 (secondary target)

Next Swing Target: 80.00 (potential swing low)

Stop Loss: 190.00 (above the 30-day high)

Risk-Reward Ratio: 1:2 (potential profit of 30.00 vs potential loss of 15.00)

⚡⭐Overall Outlook

The overall outlook for SOL/USD is bearish, driven by a combination of fundamental, technical, and sentimental factors. The expected slowdown in Solana's blockchain growth, decreasing smart contract activity, and bearish market sentiment are all supporting the bearish trend. However, investors should remain cautious of potential upside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Solana: Precision Landing?!Solana extended its sell-off and reached our blue long Target Zone between $117.73 and $40.43. The price then reacted right at the $109.89 support level, indicating that the low of the green wave 2 has been settled. Thus, the next step should involve a strong rally driven by the green wave 3, ultimately pushing SOL well beyond the $295.31 resistance and past its current all-time high. However, our Target Zone remains active, as there is a 40% chance that the price could revisit this range to complete the blue alternative wave (ii) below the $109.89 mark.