SOLUSD.P trade ideas

Solana (SOL) Bullish Rebound Alert! Targeting $303 Solana (SOL) has bounced off a critical support level and is forming higher lows, indicating a potential bullish reversal. The price is consolidating near the lower end of the range, preparing for a breakout toward the key resistance level at $303.22, offering a significant upside opportunity. The strong uptrend from previous higher highs and the Ichimoku cloud acting as dynamic support strengthen the bullish case. This setup suggests a potential rally as buyers regain control, making this a key moment to watch. Stay tuned for a breakout! 📈🔥

Sol breakdown A month ago I gave a breakdown on Solana based on the higher timeframe. I was not comfortable holding a large position.

Hopefully this month volatility comes back into the market and I can catch long term swing trades.

The market is a bit confusing with different assets classes moving in the same direction when they shouldn be.

I am ploting my buy orders, I would like to see a horrific sell-off that will get retail out of the market and rid the coming alt season.

Why I Went Long on Solana $SOLUSDCI entered a speculative long trade on Solana, considering several key factors that suggest a potential rebound in the coming days.

Reasons for Entering Long

1. Fundamental Factor – On Saturday, the U.S. announced tariff hikes on China, Canada, and Mexico, causing market turbulence. After the initial sell-off, markets often see a partial recovery.

2. Technical Factor – SOL is in an oversold zone, increasing the likelihood of a bounce.

3. Short-Term Potential – Solana remains technically strong, and if the crypto market recovers, SOL could outperform.

Trade Parameters

• Entry Price: $213.79

• Stop-loss: $210.08 (trigger), $210 (limit)

• Take Profit: $242

• Risk Level: High, as this is a speculative trade.

I expect Solana to recover in the short term if market conditions improve.

SOL Weekly chart analysisWe are likely in a wave 2 orange at the moment as part of a final wave (5) of ((5)). The reason I don't think the ATH at $295 being the top of this cycle is because of the 4 yr cycle for BTC. Historical, the top of the cycle would be atleast Q4 of this year with ETH and SOL having gained multiples over previous cycles' high. Overall, macro environment is still bullish. Current move down is due to this trade war and it's unclear if it will have a long term impact.

Last leg down for $SOLThis correction for CRYPTOCAP:SOL has been textbook EWT. The wave counts are spot on and this is the last portion of the dip (wave 5 of C). Should sweep the lows of wave A/~$220 and could go as low as $200. Regardless, if you are a long term bull then dca below $220. If you're a trader then no need to catch a falling knife. Wait for the $230 lvl to be re-claimed on the higher tf charts >4hr and go long. This is the 'pivot' lvl, bullish above $230 and bearish below it.

Solana Retests Golden Fib Levels – Next Leg Up?CRYPTOCAP:SOL has successfully retested the golden Fibonacci levels (0.618 - 0.5) and is now showing signs of strength.

The price has bounced from a strong demand zone, indicating potential for another bullish leg.

DYOR, NFA

Please tap the like button to show your support.

Thank you!

SOL’s Golden Zone: $217-$213 The Perfect Long Setup?SOL is still in a corrective phase, with the 0.618 Fib retracement of the entire wave at $217.27 yet to be tested. This level aligns with key technical confluences, making it a critical zone to watch.

Recent Price Action & Short Trade Recap:

Today, SOL retested the pwdOpen, aligning perfectly with the Point of Control (POC) and the 0.618 Fib retracement of the smaller downward wave, making it an ideal short entry

The reaction was significant, but now the focus shifts to whether $217 will finally be tested

Long Trade Setup:

Entry Zone: $217 - $213

Stop Loss (SL): Below $210

Take Profit (TP): $260, targeting the next major resistance level

Why This Setup is High-Probability:

1.) Fibonacci Confluence:

The 0.618 retracement of the full wave at $217.27 is a key level where buyers may step in

Weekly Support at $213.35 adds strength to this demand zone

2.) Liquidity Sweep Potential:

A dip into $217-$213 could liquidate long positions, setting up a strong reversal if buyers reclaim control

3.) Upside Targets:

2021 all-time high (ATH) and beyond

Final Thoughts:

Key Levels to Watch: $217-$213 for long confirmation

Look for volume confirmation and bullish reaction before entering

If SOL holds above $217, this setup could provide an excellent R:R trade

This could be a golden opportunity for a high-conviction long. Let’s see how SOL reacts! 🚀🔥

Trading Signal : SOLANA ($SOL) - 1D - PULLBACK IN UPTRENDTechnical Analysis:

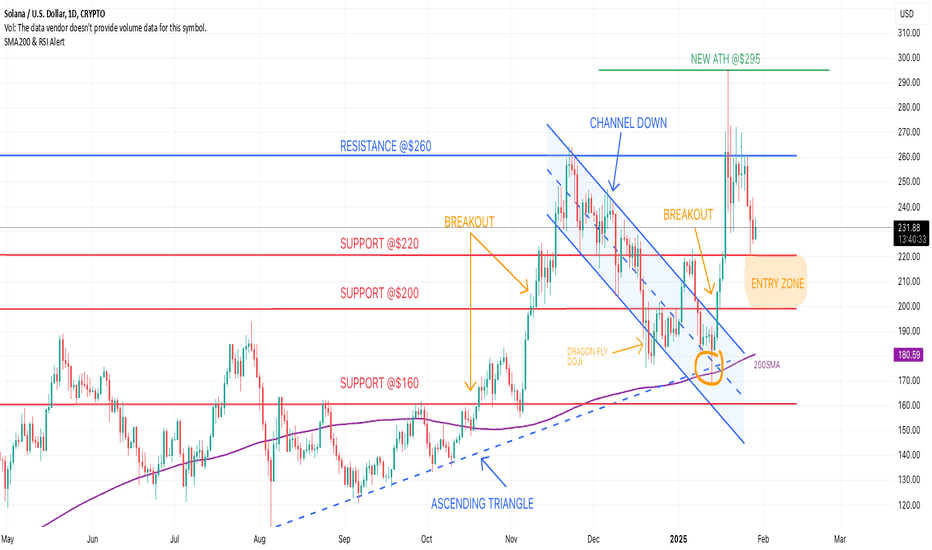

The price broke out of a Channel Down pattern and reclaimed the $200 key level, confirming bullish momentum. A pullback to the $200 - $220 support zone could offer a strong re-entry point within the uptrend. If support holds, the price could resume its advance toward the next resistance at $260 (TP1), with potential upside to $300 (TP2), representing a +30% gain.

Momentum indicators remain neutral, with the RSI-14 in a balanced range (between 30 and 70), suggesting that the asset is neither overbought nor oversold, leaving room for further upside.

Entry Zone:

Enter within the $200 - $220 support zone, following the breakout.

Targets (Take Profit):

TP1: $260 (+20%).

TP2: $300 (+30%).

Stop Loss:

Below $190 to minimize downside risk.

This notification constitutes a marketing communication. The information provided does not constitute a recommendation, offer, or solicitation to buy or sell any crypto-asset. It is not intended as investment advice, and no consideration has been given to the specific investment objectives, financial situation, or individual needs of any recipient. Any decision to act on the information provided is made at the sole discretion of the recipient. SwissBorg disclaims any liability for losses arising from the use of this material. Recipients should consult their own professional advisors before making investment decisions.

Trump Coin Marked the top in Solana - Bullish again at 1000maEver since the hype and network crowding caused by Trump coin on the weekend before Inauguration Day, Solana seems to have peaked and had trouble breaking out higher.

Add to that the new uncertainty from DeepSeek ai into tech, and the mood has soured in speculative assets.

In my opnion, short is the way for me for now, as solana and bitcoin are above all moving averages. And I will go neutral below 200 day moving aveages, and very bullish below 1000 da ema.

SOL/USD: Approaching Resistance After Recovery🔥 FinCaesar Strategy:

🩸 Short: Below $228, targeting $220 and $210. MACD remains weak, and the price is struggling to hold above key moving averages.

🩸 Long: Above $232, aiming for $240 and $260. Bulls need strong momentum and volume to confirm a breakout.

🔥 FinCaesar Commands:

🩸 Resistance: $232 — A breakout above this level could push SOL toward $240 and beyond.

🩸 Support: $228 — Losing this level may result in a pullback to $220 or lower.

Solana has rebounded from key support levels but remains in a consolidation phase. The MACD is showing a slight recovery, but price action indicates hesitation. A decisive move above $232 could lead to strong bullish continuation, while failure to hold support at $228 may signal another decline.

👑 "Momentum is built on decisive action—hesitation is defeat." — FinCaesar

Solana 5th WaveThis is my updated view on SOL

Returns may be lower than ETH from 2021 because of the lack of QE + shorter cycle

I don't think Solana will flip Ethereum, but there will be plenty of talk when it's trading $500

As always this is a temporary guess, anything can happen at any moment to change the actual outcome

I rather wait to buy the strength for trading (not investing)My overall bias for Solana is super bullish. I like the weekly price setup. Weekly MACD, RSI and Stochastic are all showing the clear (not strong enough) bullish momentums.

If you are interested in investing in Solana for the duration of the current crypto cycle, it is a good time to buy. However, if you are interested in swing trading (medium term), I will wait for daily stochastic to reset and move to the upside, and 4H MACD lines cross and enter the bull zone (0 level). Last week, there were three occasions where 4H MACD lines almost crossed but failed and ended up moving downside. A strong bullish trend usually happens with MACD moving upside in the bull zone.

It is tempting to buy the dip, but I will wait to buy the strength.

Still a Buy for SolanaWe see that Solana experienced a correction following the Trump token, which is completely normal as many investors wanted to realize their profits. Now that this phase is over , we have already observed strong support at the resistance zone. We remain optimistic about reaching the target.

Solana 3rd WaveElliott Wave can be very hit or miss, but when used within crypto and technological innovations it actually works a lot of the time.

There is no way to properly value these assets so they trade very much in line with waves of price appreciation and technical retracements.

I believe we are standing on the edge of entering the frenzy phase, the 3rd wave of a larger 3rd wave price advancement.

Get ready to hear all of your friends and family talking about crypto once again.