SOLUSD.P trade ideas

"Solana Heist in Progress! Will the Breakout Hold or Fake Out?"🔥🚨 "SOLANA HEIST ALERT: The Ultimate Bullish Raid Plan (Breakout or Fakeout?)" 🚨🔥

🌍👋 Greetings, Market Pirates & Profit Bandits!

(English, Spanish, Portuguese, French, German, Arabic—we speak MONEY.)

💎 STRATEGY BASED ON THIEF TRADING STYLE 💎

(High-risk, high-reward—steal the trend or get caught in consolidation!)

🎯 MISSION: SOL/USD (Solana vs. Dollar) CRYPTO HEIST

🐂 Direction: LONG (But watch for traps—cops & bears lurk nearby!)

🚀 Escape Zone: ATR line (High-Risk Profit-Taking Area)

⚠️ Warning: Overbought? Reversal? Police line at resistance? TAKE PROFITS EARLY!

📈 ENTRY: "THE BREAKOUT HEIST BEGINS!"

Trigger: Wait for candle close ABOVE 148.50 (MA)

Alternative Entry: Buy stop above MA OR buy limit on pullback (15m-30m TF)

🛎️ SET AN ALERT! Don’t miss the breakout—thieves strike fast.

🛑 STOP LOSS: "DON’T GET CAUGHT!"

Thief SL: 136.00 (2H Previous structure Swing Low) (Adjust based on your risk & lot size!)

⚠️ Warning: If you ignore this, you’re gambling—your loss, not mine.

🎯 TARGET: "LOOT & BOUNCE!"

🎯 167.00 (or escape earlier if the trend weakens!)

🧨 Scalpers: Only play LONG—use trailing stops to lock in gains!

📢 NEWS & RISK WARNING

🚨 Avoid new trades during high-impact news! (Volatility kills heists.

🔒 Use trailing stops to protect profits if the market turns.

💥 BOOST THIS HEIST! (More boosts = more profit raids!)

👉 Like ✅ | Follow 🚀 | Share 🔄

💬 Comment your take—bullish or bearish trap?

🚀 Next heist coming soon… Stay tuned, bandits! 🤑

Projected Harmonic Extension Into Key Demand Zone (157–152 WatchMacro to Micro Context

SOL is currently reacting off a short-term distribution zone between 164 and 168 after an impulsive run-up from early July. While no complete harmonic has printed yet, the structure forming resembles a potential Bearish Gartley. The CD leg shown is not yet confirmed, but represents a projected path derived from the local point of value and volume geometry on the 2H chart. The area between 157 and 152 remains the primary zone of interest, given historical demand and high-volume node alignment.

Structural and Momentum Breakdown

XABCD Estimate:

XA was impulsive, AB retraced 53.2%, and BC retraced 63.8% of AB

CD projection is speculative, drawn from the confluence of the BC extension (1.757), 0.786 retrace of XA, and the local value zone around 157.5–152

Volume Profile: Substantial volume shelf aligns with projected CD completion. Above 164, volume thins out sharply, indicating inefficiency and risk of rejection

Order Blocks: 2H bullish OB from July 1–3 sits directly inside the 157–152 range, adding further structural validity to this projected leg

Momentum Signals:

RSI is stalling below mid-band (50–60), suggesting loss of buyer momentum

Price Volume Trend (PVT) shows deceleration post-surge, potentially preceding distribution

Bollinger Bands are compressing, which often leads to volatility re-expansion following trend exhaustion

Trade Plan

At this stage, the CD leg remains a hypothesis based on value structure and harmonic geometry. The trade plan focuses on preparing for potential long entries if price moves into the estimated completion zone with supportive signals.

Watch Zone for Long Setup: 157.5 to 152.5

Invalidation: Clean break below 147 suggests breakdown and invalidates harmonic idea

Take-Profit Targets on Reversal:

TP1: 161.5 to 163.0

TP2: 165.5 to 168.0

Required Confirmation:

Bullish divergence on RSI or PVT bounce

Reclaim of 2H order block zone with impulse and follow-through

SOL/USD – The War Between Discount & Premium Zones Is Heating Up📈 SOL/USD – The War Between Discount & Premium Zones Is Heating Up

Posted by: WaverVanir_International_LLC

Date: July 12, 2025

Asset: Solana (SOL/USD) | Timeframe: 1D

Strategy Stack: SMC | Fibonacci | Volume Profile | Macro | Catalyst | VolanX DSS Protocol

🔍 Technical Summary

SOL is battling near the 0.5 Fib retracement (~$167), a classic inflection zone. Price is compressing within an equilibrium band bounded by $145–$175. Despite a prior break of structure (BOS) to the downside, recent CHoCH and bullish BOS patterns suggest accumulation may be underway.

Key Zones:

Support (Discount): $123.46 → $103.18 → $82.91

Resistance (Premium): $189 → $235 → $263

High-Conviction Targets:

Bullish Extension: $295 → $360 → $402

Bearish Sweep Zones: $103 → $80 (liquidity pockets)

Structure Readout:

CHoCH (Mar–Apr 2025) suggests reversal potential.

BOS (May–June 2025) confirmed demand stepping in.

Current: Price testing equilibrium mid-zone, low conviction until a clean break of $175 or a flush into $130.

🌐 Macro Context (Q3 2025)

🏦 Federal Reserve Policy

FOMC paused in June, signaling data-dependency.

Market pricing 30–50bps cut by Q4 2025.

Liquidity-sensitive assets like crypto are forward-looking, already attempting to front-run easing.

💰 Global Liquidity Shift

US M2 money supply stabilizing after 2022–2024 contraction.

Global CBs (e.g., ECB, BOJ) showing coordinated signals of easing.

Risk-on flows resurging into high-beta assets → Crypto stands to benefit on the second leg of liquidity wave.

💻 Tech/Crypto Catalysts

Solana Ecosystem rebounding on strong developer metrics, NFT integration, and institutional onboarding (Visa, Shopify integrations).

Tokenization narrative gaining momentum with TradFi firms exploring SOL-based infrastructure.

Regulatory Clarity: US & EU moving toward crypto-safe harbor legislation; positive for altcoin allocation.

⚠️ VolanX DSS Signal Matrix

Module Signal Confidence

Trend Structure Transitional (CHoCH → BOS) Moderate

Fibonacci Levels Compression (0.5–0.618) High

Volume Profile Thin above $175, HVN near $145 High

Macro Liquidity Rising global flows Moderate

Catalyst Tracker Positive (SOL-specific) Moderate

🎯 Execution Framework (2 Scenarios)

🔵 Bullish Bias (Continuation):

Entry Zone: $157–$162 (with SL below $145)

Trigger: Break + close above $175

Targets: $189 → $235 → $263

Invalidation: Daily close below $141.5 BOS zone

🔴 Bearish Bias (Rejection):

Short Zone: $175–$189

Trigger: Rejection w/ CHoCH + imbalance fill

Targets: $145 → $123 → $103

Invalidation: Clean break above $195 with volume

📜 WaverVanir Risk Advisory

This outlook is generated under the WaverVanir DSS (Decision Support System) and is shared strictly for educational and analytical purposes.

We do not manage outside capital, and none of this constitutes investment advice. All systems are probabilistic and adaptive, not deterministic.

🧠 Final Notes:

Solana is at a macro hinge point. Either the liquidity-driven expansion phase begins with force — or we get one more sweep into deeper discount zones before lift-off. With global liquidity expanding and catalysts aligning, the next few weeks will define the rest of 2025’s structure.

💬 Drop your thoughts below.

🔁 Follow @WaverVanir_International_LLC for high-conviction, system-generated macro + SMC trading insights.

🌍

SOL - Liquidity Sweeping Evening Star Plenty of rotations in altcoins with SOL rotating to weakness in this area.

This is while Bitcoin breaks the ascending line; and we'll have to see what type of dip it is...

This slightly higher high and Evening Star candle pattern is quite a bearish look.

If Bitcoin was more bearish, you could look at this and consider that it may be a major pivot before a significant downtrend.

Perhaps it will somehow recover if the overall market is bullish, but this is not at all a technical hold here.

Only hodlers need apply.

Not advice

Not advice

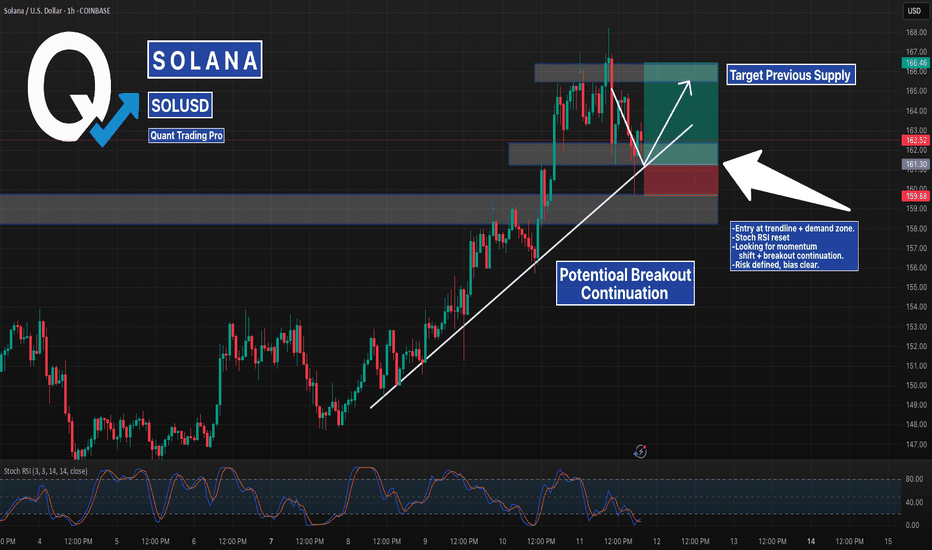

Solana Bounce Setup – Trendline + Demand Zone ConfluenceSOL is testing a confluence zone between rising trendline support and a key demand block around $161–$162. This zone has acted as a springboard for the last leg up and now overlaps with a full Stoch RSI reset on the 1H timeframe.

If price holds this structure, a continuation toward the previous supply zone at ~$166 is in play. Breakdown below $159.68 would invalidate the setup.

📉 SL: Below structural low

📈 TP: Prior high / liquidity zone

📊 Watching candle structure for entry confirmation

#SOLUSD #Solana #PriceAction #TrendlineSupport #CryptoSetup #QuantTradingPro #TradingView

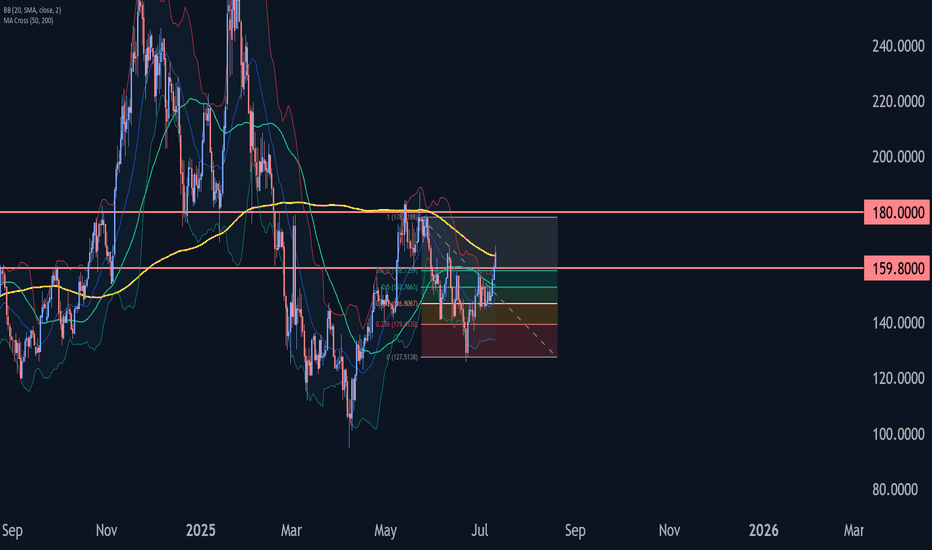

Solana Wave Analysis – 11 July 2025- Solana broke resistance zone

- Likely to rise to resistance level 180.00

Solana cryptocurrency recently broke the resistance zone between the resistance level 159.80 (which has been reversing the price from the start of June) and the 61.8% Fibonacci correction of the ABC correction (2) from May.

The breakout of this resistance zone should accelerate the active impulse waves 3 and (3).

Given the strongly bullish sentiment seen across the cryptocurrency markets today, Solana can be expected to rise to the next resistance level 180.00.

LONG - I am going to add more position when this happensI currently have a small size of long position but I am planning to add more (please see my previous article for my first trade set up), but I am waiting for a certain set up to come up:

Daily:

1) all momentum indicators are entering the bull zone, so there is a plenty of room to move to the upside.

2) The candle has crossed and closed above both EMA 21 and 55, but EMA 200 is currently working as a resistance.

3) EMAs have not crossed and lined up for the bull trend - 21> 55> 200

4H:

1) EMA55 has finally crossed above EMA200!! But when they cross, the price very often has a decent pull back before taking off.

2) Stochastic and RSI are already in the overbought territory which tells me the pull back is likely to happen.

The chart is looking really good for the bull but I am going to wait for the price to retrace to Fib0.5-0.618 zone (see blue rectangular box in 4h chart).

If the price rebounces from that zone and momentum indicators reset to move to the upside, I am prepared to go big on long.

SOL Triangle Breakout + Fib Confluence – Aiming for $190+Solana (SOLUSD) just broke out of a multi-month triangle on the 8H chart, signaling a potential reversal and continuation toward previous highs.

Key Highlights:

🔹 Break of Structure (BOS): Price broke through descending resistance, flipping momentum in the bulls’ favor.

🔹 Fibonacci Confluence: Bounce came cleanly from the 0.5–0.618 zone ($129–$140), adding high-probability support.

🔹 Triangle Apex Break: Consolidation is over — the arrow is launched.

🔹 Targeting Previous Highs: $185–$190 range is in sight, with historical resistance marked.

🔹 Risk Defined: Stop idea near the previous low and triangle base (~$115).

⚠️ Watch for confirmation candle closes and volume follow-through — the move is just beginning.

$SOL | Triple Top or Launchpad?Macro to Micro Context:

SOL is now testing a third rejection in the upper 153s, forming a textbook triple top just under a multi-month descending trendline and major Fib resistance. This ceiling has held firm since late June, despite higher lows grinding up from below. Price is now squeezed tightly between compressing demand and stacked supply, with volatility contraction apparent across the board.

The structure is coiling hard but momentum and volume must confirm resolution before positioning aggressively.

Structural & Momentum Breakdown:

Resistance Layering (Reinforced):

Triple Top: Price has repeatedly failed to break above the upper 153s.

Fib Overlap: 50%–61.8% retracement range aligns with both trendline resistance and OB stack.

Order Block Stack: Resistance from mid-153s to low-154s is now reinforced across timeframes (30M → Daily).

Momentum Shifts:

RSI Divergence: Lower highs on RSI across 2H/1H, despite flat or slightly higher price.

PVT Flattening: No fresh accumulation during recent tests.

Volume Decline: Progressive volume deterioration on each retest distributional tone building.

Demand Shelf:

Key demand and support range from low-150s to mid-151s has held through three separate dips.

This is the immediate pivot zone — lose it and vacuum effect likely down into the upper 140s.

Updated Trade Plan:

Rejection Short Setup:

Entry: Breakdown through mid-151s with confirming sell volume.

Stop: Above low-154s to account for potential deviation wicks.

TP1: Upper 148s (first OB cluster).

TP2: Mid-146s (Fib + minor support).

TP3: Low 140s (macro demand + wedge base).

Bear Confirmation: RSI breakdown + volume expansion + OB flips into resistance.

Breakout Setup (Only on Clear Validation):

Entry: Strong candle close above low-154s with breakout volume.

Stop: Below low-151s — invalidation of reclaim.

TP1: Upper 157s (Fib zone).

TP2: Low 160s (swing high area).

TP3: Upper 160s (macro breakout expansion).

Bull Confirmation: RSI > 62 on 2H, strong PVT rise, and flip of local OB into demand.

Risk Warning:

Triple tops near macro resistance are high-risk unless clearly broken. This zone is overloaded with historical rejection. Don't front-run the breakout — volume will show you who's in control.

Closing Thoughts:

With a confirmed triple top now visible, SOL is facing its most important rejection zone in weeks. Bulls must reclaim with strength or this becomes a clean setup for rotation into the mid to low 140s. Patience and confirmation are key here. Keep risk asymmetric.

SOL/USD in Clear Downtrend – Short Setup in PlayHi traders! , Analyzing SOL/USD on the 30-minute timeframe, price is currently moving within a defined descending channel, respecting lower highs and lower lows. A recent rejection from the channel top suggests continuation to the downside.

🔹 Entry: 150.09

🔹 Take Profit (TP): 145.47

🔹 Stop Loss (SL): 154.51

The price failed to hold above the 200 EMA and has resumed its downward trajectory. The RSI shows a recent bounce from overbought levels, supporting the bearish momentum. This short setup offers a favorable risk-reward ratio within the context of the broader downtrend.

A clean rejection at resistance and confirmation of the trendline add confluence to this trade idea. Keep an eye on the 145.47 zone, where buyers may attempt to defend the support.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

SOL/USD 2H chart PATTERN.SOL/USD 2H chart, the price is forming a bullish ascending triangle breakout, and it's approaching the upper resistance trendline. If it breaks out with volume, a strong move upward is expected.

📈 Bullish Target Points:

1. First Target:

✅ $157.80 — This is the first horizontal resistance and initial breakout target.

2. Second Target:

✅ $162.00 — A higher resistance level based on previous highs and projected breakout momentum.

---

🔎 Additional Notes:

Support Level: Around $149.90 — also near the ascending trendline.

A confirmed breakout above the triangle with a daily candle close and strong volume would validate these targets.

Consider using a stop-loss below $149.00 if you're trading this setup.

Let me know if you want a trade entry suggestion or risk management strategy.

SOLUSD – Snapped Back FastSOL broke down hard from $154 into $146 before staging a V-shaped rebound. After reclaiming $151, price surged back into $153+ and is now consolidating near highs. Short-term trend is strong, but $153.80–$154.20 is a key resistance zone. Above it opens door to $156+. Break below $151 = caution.

SULUSD Cup & HandleHi All, SOLUSD in a textbook cup & handle pattern. It might break sooner than indicated. Current price is a steal imo. Keep an eye for a strong breakout. Not financial advice. If you enjoyed the content of this analysis, please do leave a like for future updates. Lets crush this market. Be safe.

Solana - *Bullish* Macro Count EW-Analysis#SOL

This is my preferred and most bullish scenario for Solana. We're currently in a higher-degree Wave 2 correction following a completed Wave 1. The micro count remains unclear for now, further price action should bring more clarity. It’s possible the X-wave has already completed, suggesting additional downside ahead. The only problem I see with this scenario is that, unlike Solana, other coins like XRP and BTC do not appear to be undergoing a larger corrective phase.

Disclaimer: This analysis is for informational and educational purposes only and should not be considered financial or investment advice. All trading involves risk, and you should perform your own due diligence before making any trading decisions. The author is not responsible for any losses that may arise from reliance on this content. Always trade at your own risk.

SOL Short Trading Setup: The Alligator Awakens!

Wave 4 wedge forming — watch for breakdown. Neely rules and Alligator indicator confirm setup.

SOL Trading Setup: The Alligator Awakens! 🐊

The Chart Breakdown

Looking at this SOL/USD hourly chart, we’ve got a textbook Elliott Wave setup using the Williams Alligator and Neely’s NeoWave rules .

The Wave Count Story

ABC : That larger three-wave rally? Done and dusted. ✅

1-2-3-4-(5) : We're now in a five-wave decline, currently sitting in wave 4.

Neely Rules Check ✔️

Price & Structure:

Wave 3 is not the shortest: travels farther than wave 1 and exceeds projected wave 5 → ✅

Alternation: Wave 2 was a sharp ABC; Wave 4 is a flattening wedge/triangle → textbook alternation ✅

No overlap: Wave 4 doesn’t enter wave 1 territory → clean as a whistle ✅

Equality guideline: The green box shows −2.74 %, mirroring wave 1 → picture-perfect ✅

Time Rules (Neely’s most overlooked):

Wave 4 has taken ~25 bars vs. wave 2’s ~15 bars → passes the time-ratio test ✅

Wave 5’s projected end falls within the vertical marker from wave 4’s high → on schedule ✅

Alligator & AO Confirmation 🐊

Alligator lines compressing during wave 4 → energy is building

AO divergence: red bars deepen in wave 3, shrink in wave 4 → classic wave 5 setup

The Trading Plan 🎯

Entry Strategy:

• Stop-limit sell just below wedge support (~$147)

Risk Management:

Stop Loss: One ATR above wave 4 high — protects against a throw-over

Time Stop: Exit at market if not in profit after 70 bars

Profit Targets:

TP-1: 100 % of wave 1 length (green arrow)

TP-2: Trail stop if AO shows bullish divergence near target zone

The Caveat ⚠️

If wave 4 drags on much longer (>2× its current length), it could evolve into a complex correction. Time is key — watch that clock.

Bottom Line

This setup checks all the NeoWave impulse boxes. The structure is clean. The Alligator is asleep. And we’re approaching a wedge break.

Short the break, target the equality zone, and respect your time stop.

Good traders follow rules. Great traders follow Neely rules. 😉

Agree or disagree? Drop a comment or share your chart!