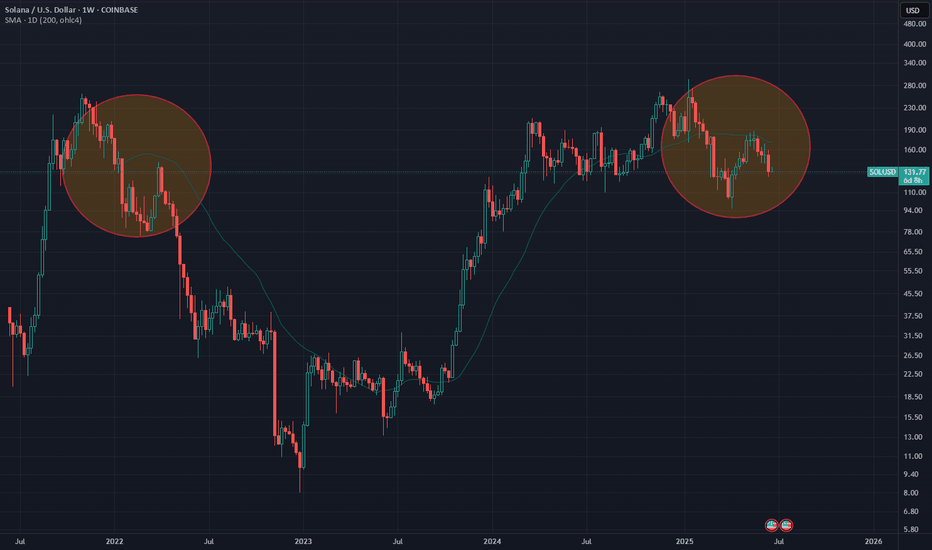

solusdtThe breakout area has been successfully tested and we will see the next step, the drop to the shaded area.

*In principle, I am not a supporter of any direction, but I am only giving my point of view, which may be right or wrong. If the analysis helps you, then this is for you. If you do not like this analysis, there is no problem. Just ignore it. My goal is to spread the benefit. I am not one of the founders of the currency.

SOLUSD trade ideas

Sol searching, for an entry. If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

The Elliottician’s Paradox: 12-12 or Zigzag? Bias Is the Key

Ever stare at a chart and ask, “Is that a 12-12 or a classic zigzag?” Yeah… welcome to the paradox we Elliotticians live in. Pattern recognition’s a blessing and a curse because context is everything, but confidence can get you wrecked.

This one’s got me on the edge.

What’s Happening Here

We’re currently watching a move that could be either:

- A corrective zigzag (5-3-5), or

- A 1-2, 1-2 setup, gearing up for a blastoff

That’s the core dilemma — two valid options, both technically legal. So what tips the scales? Bias.

The Line in the Sand: 152

Here’s what I’m watching for:

Key Level: 152

- That’s the bull/bear line for me.

- A strong impulsive reclaim above 152 flips the script. I’d reconsider the bearish view if price surges with intent.

- But if we return to 152 in a sluggish, corrective way? I’ll be eyeing continuation lower, aligned with a more traditional zigzag structure.

Elliott View

This is where the paradox plays out:

If we’re looking at a 1-2, 1-2 setup, expect:

- A powerful Wave 3 soon (should not be shy)

If it’s a Zigzag ABC:

- Then we should expect a corrective internal retracement and continuation to the down side, at minimum past the origin of the initial move.

The chart will speak loudest. But structure and strength of this next leg will confirm the story.

Final Thoughts

Trading isn’t about being right. It’s about managing scenarios — and this one’s a classic fork-in-the-road moment. I’ve got a plan for both directions.

152 is my trigger. Stay below it and fade the rally. Break above it impulsively, and I’ll flip my bias with it.

The Elliottician’s paradox isn’t a trap — it’s an invitation to stay sharp.

Your Turn

How are you reading this structure? Do you favor the zigzag or the 1-2 setup? Drop a comment and let me know.

Trade safe, trade clarity!

Solana Bullish Outlook Above $140.0Solana's decline from 163.9 eased near the $148.4 support. However, this demand zone expands to $140.0, which is backed by the high volume node.

From a technical perspective, the outlook is bullish as long as Solana trades above $140.0. In this scenario, we expect the price to target at least 50.0% of its previous range, which is approximately $155.38.

Getting close to go long!

Solana bullish momentum is building up from both technical and fundamental perspectives.

Daily chart:

1) A daily candle decisively moved and closed above EMA21 on Sat 28th June.

2) RSI and MACD are still in the bear zone but the lines are crossed and now moving upwards.

3) RSI line is now above 50. When the RSI line moves above 50 and EMA21 closes above 21 at the same time, it is often (not always) an early sign of bullish momentum (see blue vertical lines in daily chart).

4H chart:

1) EMA21>EMA55, but EMA200 is still moving horizontally.

2) All momentum indicators have entered the bull territory. However, when the candle finally broke outside the descending parallel channel and broke and closed above EMA200, momentum indicators reached the overbought territory. It means the price is likely to consolidate first before taking off.

I plan to open a long position when:

1) Wait for the momentum indicators to come down and flip to the upside in the 4H chart.

2) A candle to retest, either EMA 21, 55 and/or 200 and forms a strong green (bullish) candle in the 4H chart.

3) A candle stays above EMA 21 in the 4H chart.

SOL Ready To Breakout?SOL had a decent move this weekend overcoming descending resistance and now testing as support.

Price appears to have a completed a wave (2) at the .618 Fibonacci retracement and S1 daily pivot and a larger degree wave 2 at the channel bottom, High Volume Node support and .618 Fibonacci retracement.

If a wave (3) of 3 is underway then we should expect a strong move sooner rather than later with an initial target of the swing high resistance a/ R2 daily pivot $208-$216 range

Safe trading.

Solana Heading to 112 or 330+Hey fam

So for Solana if we hold under 148 then a drive down to 112 makes sense. However if we drive above 148 then we can possibly hit weekly targets of 330

Make sure you adjust accordingly in a smaller time frame to ensure your in the right move

Happy tradings folks

Kris Mindbloome Exchange

Trade Smarter Live Better

Under 148 we go to 112 if we break 148 we can see a drive up to 338

SOL/USDT - Visible double top formationAfter hitting the projected reversal zone near 144–145, SOL/USDT has now formed a clean double top, reinforcing the bearish thesis initially outlined by the harmonic pattern. The second peak failed to break the macro descending trendline, and the price is now trading back below the 100% Fibonacci retracement of the XA leg.

This double top adds structural confirmation to the harmonic C-point rejection:

Volume remained lower on the second peak

RSI on the 30m chart printed a lower high while price matched previous highs — a textbook bearish divergence

PVT continues to flatten despite price volatility, suggesting a lack of bullish conviction

Price is now slipping below 143, and bearish momentum is building.

SOL/USDT – Bearish Harmonic Completion Near 144–145The 2H chart shows an extended X‑A‑B‑C‑D harmonic structure (an extended Bat/ABCD). Leg XA was the initial down-leg (from the recent swing high down to A), AB was a corrective pullback, and BC retraces sharply into the 88.6–100% zone of XA (around $144–$145). In a classic Bat/ABCD, the CD leg often completes near an 88.6% retracement of XA, so this C zone is a potential reversal point (PRZ). Importantly, C also sits on the chart’s long-term red descending trendline – a confluence of fib and trendline. A break below this level would “validate the bearish harmonic pattern,” with the downtrend line amplifying selling pressure. The projected D-point is ~$122.63 (late June/early July), which coincides with the lower green channel support on the chart.

Harmonic pattern (2H SOL/USDT): XA and AB moves set up a deep BC up into the 88.6–100% fib zone (around $144–145) at C. This confluence of fib levels and the macro descending trendline makes C a strong Potential Reversal Zone (PRZ). The CD leg targets ~122.63, aligning with lower channel support (green). Across timeframes the momentum is waning into point C. RSI is rolling over – price made a lower high while RSI failed to confirm (a classic bearish divergence). Meanwhile, the PVT (Price Volume Trend) line has flattened even as price crept higher, indicating the rally is not supported by volume.

Volume patterns also signal distribution: rallies into C have occurred on declining volume, a textbook sign that buying interest is drying up. Wyckoff distribution theory notes that as a top forms, “rallies during this stage often show lower volume” and ensuing drops on higher volume. In short, weakening RSI, a flat PVT, and thinning volume all confirm the selling pressure around $144–$145, consistent with a bearish reversal at C. Momentum and volume (15m SOL/USDT): RSI has peaked lower while price nears $145, and PVT has flattened (highlighted). Rallies into C come on lower volume, matching Wyckoff distribution cues. These divergences suggest the upward move into C is exhausted.

Trade Plan & Risk Management

Entry: Short initiated at $145.00 (near the PRZ around C).

Stop Loss: $146.20 (just above the red trendline and invalidation of point C).

Take Profit Targets:

TP1 : $129.00 (minor fib support, ~61.8% retrace of the last swing).

TP2: $122.63 (harmonic D projection and channel support).

TP3: $120.00 (extension to lower channel boundary).

Confirmation: Watch for a break of the short-term support at ~$139.50 for added conviction before letting profits run.

Note: A short position was opened at $145. This outline is for informational purposes – it is not financial advice. Trade with proper risk management.

Each target corresponds to technical levels (fib retracements and channel support). The first target aligns with a ~61.8% retracement (common fib TP level), and the final targets sit on the longer-term channel floor. If price breaks under $139.50, it would further confirm the bearish thesis.

Possible retest of 130$ support line incomingLooking at the downtrend (shown in orange) the 130$ support line will probably be retested again. When we hold the same support line, we can expect another retest of 146$. Hopefully with a good result 🚀! Anyway, I am buying some more if this will happen (going long from 130$) because there was enough volume at that level.

SOLUSDTCryptocurrency Futures Market Disclaimer

Trading cryptocurrency futures involves high risks and is not suitable for all investors. Cryptocurrency prices are highly volatile, which can lead to significant gains or losses in a short period. Before engaging in crypto futures trading, consider your risk tolerance, experience, and financial situation.

Risk of Loss: You may lose more than your initial capital due to the leveraged nature of futures. You are fully responsible for any losses incurred.

Market Volatility: Crypto prices can fluctuate significantly due to factors such as market sentiment, regulations, or unforeseen events.

Leverage Risk: The use of leverage can amplify profits but also increases the risk of total loss.

Regulatory Uncertainty: Regulations related to cryptocurrencies vary by jurisdiction and may change, affecting the value or legality of trading.

Technical Risks: Platform disruptions, hacking, or technical issues may result in losses.

This information is not financial, investment, or trading advice. Consult a professional financial advisor before making decisions. We are not liable for any losses or damages arising from cryptocurrency futures trading.

Note: Ensure compliance with local regulations regarding cryptocurrency trading in your region.

#SOLANA - Pivot Point is $154.20Date: 16-06-2025

#Solana Current Price: 156.37

Pivot Point: 154.20 Support: 150.28 Resistance: 158.15

#Solana Upside Targets:

Target 1: 162.49

Target 2: 166.84

Target 3: 171.58

Target 4: 176.32

#Solana Downside Targets:

Target 1: 145.92

Target 2: 141.56

Target 3: 136.82

Target 4: 132.08

SOLUSD – Reversal Ignition ZoneSOL printed a textbook reversal. After getting slammed down to $126, it found strong support and printed a clean stair-step rise back into $134. Momentum is solid, and higher lows are stacking. The $132.50–$133.00 region now acts as demand. If price pulls back slightly and holds, expect a measured move toward $135.50–$136.50.

Solana Next Buying Zone on WatchCRYPTO:SOLUSD is correcting the 5 waves advance from April low within a 3 waves ZigZag structure and as price slipped to a new marginal low beneath last week’s support, signaling potential weakness toward equal legs area$122 - $111 before buyers look to step in again.

Keeping an eye on reactions in this zone—could set up for a bullish reversal once demand kicks in!