SOLUSDT.P trade ideas

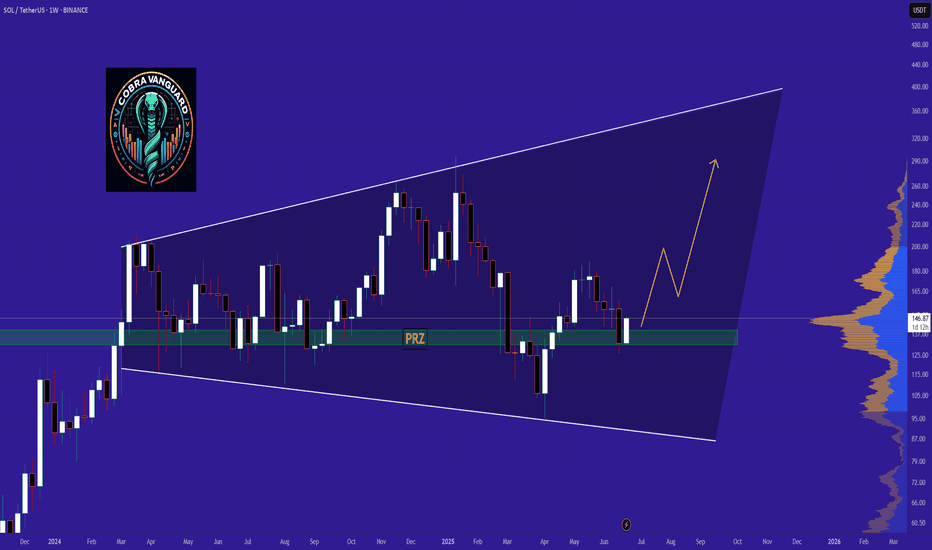

SOL Fractal long-term set up: 100% upside📈 SOL/USDT Long-Term Setup: Potential for 100%+ Upside or 16% Downside

This chart presents a Fibonacci-based technical outlook on Solana (SOL/USDT) on the daily timeframe.

🔍 Key Highlights:

Current price: $150.65

Major resistance zones: $177.12, $183.22, and $199.05

Fibonacci retracement levels (from $294.75 high):

0.618 at $171.32

0.5 at $200.08

0.382 at $222.42

Strong support at $137.97, $131.16, and $122.56

Downside risk to $126.99 (0.886 Fib) or even $105.40 (1 Fib)

Bullish target: $301.64 (+105.25%)

Bearish scenario: $126.99 or lower (-16.53%)

📊 The chart includes harmonic structures and descending/ascending channels suggesting consolidation, but the current structure could pivot into a bullish continuation if key resistances are broken.

🎯 Risk-to-Reward Ratio Favorable for Bulls: The setup offers a potential 105% upside against a 16% downside, making it attractive for medium- to long-term traders.

⚠️ As always, manage your risk appropriately and consider macroeconomic factors.

solana crazy ideaWell, I made this silly little chart for myself. I kind of expect it to follow the pattern of some bots running on Solana, at least within the range I’ve marked. But hey, it’s a bull market, and sometimes even random drawings by amateurs like me end up working out!

That said, I'm keeping my target modest — not expecting anything crazy. Stop loss depends on how Bitcoin behaves, and honestly, I wouldn’t recommend anyone follow what I’m doing. This is not investment advice, just a ridiculous idea I had.

SOL/USDT Short Setup – Targeting Range LowContext:

Price just rejected off local range high near $148 — a key resistance that has held several times historically. We’re seeing initial signs of weakness after a strong rally, with price failing to hold above resistance and beginning to break minor structure.

Setup Details:

Entry: ~$146.20

Stop Loss: ~$148.35 (above recent high)

Target: ~$141.00 (range low + demand pocket)

Risk/Reward: ~2.38R

Trade Idea:

This is a classic range play — short from top of the range, targeting the base. Momentum is fading near resistance and we have a clean invalidation just above. Price structure suggests lower highs are forming, and any further weakness should push us back into the mid-to-lower part of the range.

Buy limit 146.60 TiqGPT buy signalAnalyzing the SOL/USDT across multiple timeframes, we observe a consistent upward momentum, particularly evident in the shorter timeframes (1H, 15M, 5M, and 1M). The 1D and 4H charts show a recent recovery from a downward trend, indicating a potential shift in market sentiment or a retracement phase.

1D Chart: The daily chart shows a series of bearish and bullish candles with recent bullish activity suggesting a potential reversal or pullback from previous lows.

4H Chart: This timeframe shows more granularity in the recovery, highlighting a resistance-turned-support level around $142, which has been retested and held as support.

1H Chart: A strong bullish impulse is visible, breaking past previous minor highs, suggesting an increase in buying pressure.

15M Chart: This chart shows a continuation of the bullish momentum with higher highs and higher lows, a classic sign of an uptrend.

5M and 1M Charts: Both these timeframes show detailed price action within the bullish trend, with the 5M chart beginning to form a pullback.

SOLUSDT 1D📈 #SOL – Bullish Flag Setup on Daily

Solana has formed a bullish flag on the daily chart — a continuation pattern that often leads to strong breakouts.

Currently, the price is trading above the midline of the flag and testing the daily MA100 as dynamic resistance.

🚀 If #SOL breaks above the MA100 and the upper boundary of the flag, the next targets are:

🎯 $157.51

🎯 $167.25

🎯 $176.98

🎯 $190.84

🎯 $208.49

📌 Watch for:

Breakout confirmation with strong volume

Retest of breakout zone for safer entries

⚠️ Risk Reminder:

Always use a tight stop-loss and apply solid risk management to protect your capital.

SOL is missing only one thing for the price to explode⚡️ Hello everyone! I decided to update my idea a little and take a closer look at the 4-hour timeframe on SOL.

After closing the gap from below, the price is now trying to consolidate at key levels of 141-150. If it fails, the nearest strong support is at 133.

📈 At the same time, the price has entered the buying range. This is a signal for position traders to accumulate positions.

⚙️ Metrics and indicators:

Money Flow - divergence with price. While the price fell from 300 to 140, liquidity remained virtually unchanged and is in a neutral zone.

Liquidity Depth - there is increasing liquidity at the top. On the daily timeframe, there is already an almost 5-6 times overweight in shorts. On the 4-hour timeframe, it is currently almost x2. And as we know, the price moves from one liquidity zone to another.

📌 Conclusion:

SOL continues to see liquidity inflows and huge demand. However, there is still one catalyst missing for a powerful price breakout: an ETF on SOL.

Institutional inflows into SOL are precisely the factor that could be the key piece of the puzzle for the next leg of the trend.

Have a great weekend, everyone!

bitcoin update right so this is what im seeing, the chart showing right now

a pullback to 102800 approx is absolute for a healthy change in trend. this pullback is backed by 3 points,

1 no such volume in the pole and flag pattern breakout

2 liquidity which works as a magnet is more in down, market will eventually make a new ATH but it wont make that ath until grabbing all the liquidity and leaving retailers in fear.

3 we're at a good strong resistance and the daily close today was showing sign of weakness and possible change in trend.

a short with sl above 109000 can be done,

wont short eth but i have some alts in mind with some scalp short chances

ethfi, cake, aave, link. trading in alts are risky so make your own judgement, im no financial advisor

thanks

SOL/USD🔹 Trend direction

Current short-term trend: down

Price below key moving averages:

SMA50 (green) ≈ 154.84

SMA200 (blue) ≈ 168.79

Price ≈ 142.49 – below both, confirming weakness.

🔹 Supports and resistances (key levels)

✅ Supports:

142.00–143.50 – current level where price is struggling (multiple price reactions).

131.00 – strong support, last low (June 18).

119.00 / 116.00 / 113.00 – next supports from previous consolidations.

95.61 – deep support if market breaks down.

❌ Resistances:

148.00–150.00 – local resistance, coinciding with the red SMA (short-term resistance).

154.84 – resistance (SMA50).

162.00 – resistance (SMA200).

183.00 – main resistance from the May peak.

218.55 – very strong resistance from March.

🔹 Technical indicators

📉 MACD:

MACD line < signal, negative histogram → bearish signal.

No signs of bullish strength.

📉 RSI:

RSI ≈ 41.31 – close to the oversold zone, but not there yet (below 30).

RSI trend also downward.

🔹 Formations and trend lines

Broken support line after the April-May bullish structure (white trend line).

The previous bearish trend line (yellow) was broken in April, but the momentum did not hold.

A lower high and lower low may be forming now – a classic bearish structure.

🔹 Potential scenarios

🔻 Bearish:

Breakout of 142 → test of 131 → possible drop to 119/116.

Staying below SMA50 and MACD still negative = high chance of continuing declines.

🔼 Bullish:

Recovery of 148–150 needed → only then a chance to test 154 and SMA50.

RSI close to oversold = possible local technical bounce, but not reversing the trend.

📌 Conclusions / Summary

General trend: Bearish (down).

Sentiment: Negative, no confirmed signals of strength.

If level 142 breaks - next test will be at 131.

A strong breakout above 150-154 is needed to talk about a change in structure.

SOL/USDT – Breakout Play in Progress | Accumulation Before ExpaN📍 Overview:

SOL has successfully broken out of a major descending trendline that has been acting as resistance since mid-June. Price is now consolidating above that line, forming a tight accumulation zone — a classic pre-breakout setup.

🔍 What I'm Watching:

Price is currently holding within a sideways range (highlighted in purple).

The previous downtrend line may now act as support — I'm watching closely for a retest of that trendline.

Moving averages are curling upward, signaling a shift in trend.

Volume has declined during consolidation — which often precedes a strong move.

📈 Potential Setup:

A breakout from this accumulation box could trigger a strong bullish continuation, possibly toward the next supply zone around $150–$154.

If price breaks down from the box, I’ll look for a trendline retest as a second chance long entry.