Solana Moving Averages: Patience is KeySolana is trading above EMA89 while at the same time trading below EMA55, we have a mixed situation. When in doubt, stay out. Anything is possible on this chart.

There was a major correction already that lasted 84 days. Solana lost more than 65% in this correction. A -67% drop. This correction removed all gains from 2024 sending prices back below $100. This is to say that Solana already went through a full and major flush.

The market could very easily continue lower and produce a lower low compared to 7-April, a major crash leading to August and I can easily see this scenario developing. Will it develop? Is it really necessary?

I can also see a slow but sure change of course. A few days red at the start of the week, as it is usual and then Boom!, the market turns green. And it grows day after day after day. It is already happening, patience is key. Better focus on the numbers.

» If Solana trades weekly above $142, we are bullish, strongly bullish and can expect additional growth.

» If Solana moves and closes weekly below $142, market conditions still remain bullish but we can approach this pair with caution.

» On a broader perspective, any trading above $95, the 7-April low, is bullish long-term. As long as this level holds, we can expect higher prices. The last low sits at $126...

It doesn't matter how you slice it, the price is good and is more likely than not to continue to increase. Patience is key.

Namaste.

SOLUSDT trade ideas

SOLUSDT longhi Traders,

We can see that price is currently trading below a well-defined downsloping trendline.

The trendline (blue) has been tested multiple times, confirming its validity as resistance.

Price action is showing higher lows, indicating building pressure, usually a bullish sign often seen before breakouts.

The breakout seems to be happening right now, so entering the long position is justified.

Target: 184

Invalidation: daily close below the downsloping resistance trendline

Solana's fate: pump or dump ?Hello friends

You see that Solana, after its good growth, got stuck in a range and is gathering strength. Now, considering the strong upward trend of this currency, it can be said that this force can push the price upwards, but everything is possible in the market, so observe capital management and trade with your will and wisdom.

*Trade safely with us*

Lingrid | SOLUSDT possible Channel BreakoutBINANCE:SOLUSDT is showing early signs of recovery after rebounding from the 127 support zone and reclaiming structure near the 140 level. Price is now consolidating below the red descending trendline, which acts as dynamic resistance. A breakout above 145 could confirm bullish reversal and target the 159 resistance zone as indicated by the star projection. The key lies in whether buyers can sustain pressure above the 140 zone.

📈 Key Levels

Buy zone: 138–142

Sell trigger: break below 127

Target: 159

Buy trigger: breakout and close above 145 trendline

💡 Risks

Failure to hold above 140 may lead to fresh lows

Downtrend may resume if price gets rejected at 145

Low volume breakout may signal a bull trap

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

#SOL Update #2 – July 5, 2025🔴 #SOL Update #2 – July 5, 2025

Yesterday, I mentioned that Solana was at a critical level and not suitable for long or short entries. I also noted that I’d stay in watch mode and that hasn’t changed.

Right now, SOL is trying to hold above the support box, but volume remains quite low. Even worse, footprint data is showing negative pressure. If SOL loses the $144.5 level, I expect a move toward the $137–136 zone, as mentioned in my previous update.

Let’s also not forget that the $150 area is a strong resistance. At this stage, I don’t see any high-probability setup on either side. I’m still watching. No trade for now.

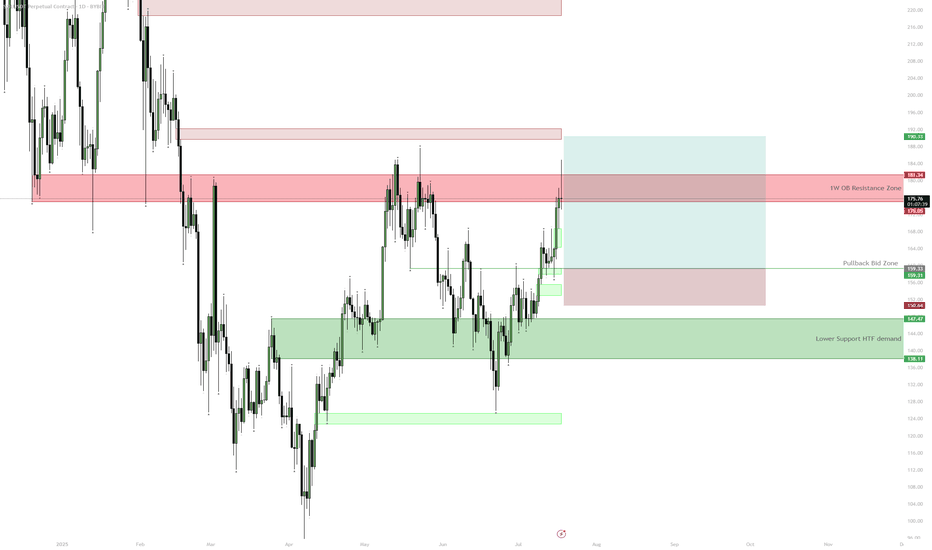

SOL — $180 HTF Resistance | Consolidation ExpectedSOL is approaching a key HTF resistance zone at $175–$181 with 1D RSI close to overbought. Unless price cleanly breaks above this area, a pullback to $160 or even the $138–$147 demand zone is likely before further upside. The setup provides a better risk/reward for longs on pullbacks after consolidation rather than chasing at resistance.

SOL/USDT | Next Bullish Leg Ahead if Key Support (READ)By analyzing the Solana chart on the daily timeframe, we can see that today the price climbed to $184, almost hitting the next target at $187, before facing a correction. It is currently trading around $176. If Solana manages to hold above the key support zone between $168 and $174, we can expect the next bullish leg to start, potentially extending up to $227. The previous analysis remains valid, with the next upside targets at $187, $220, and $263.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

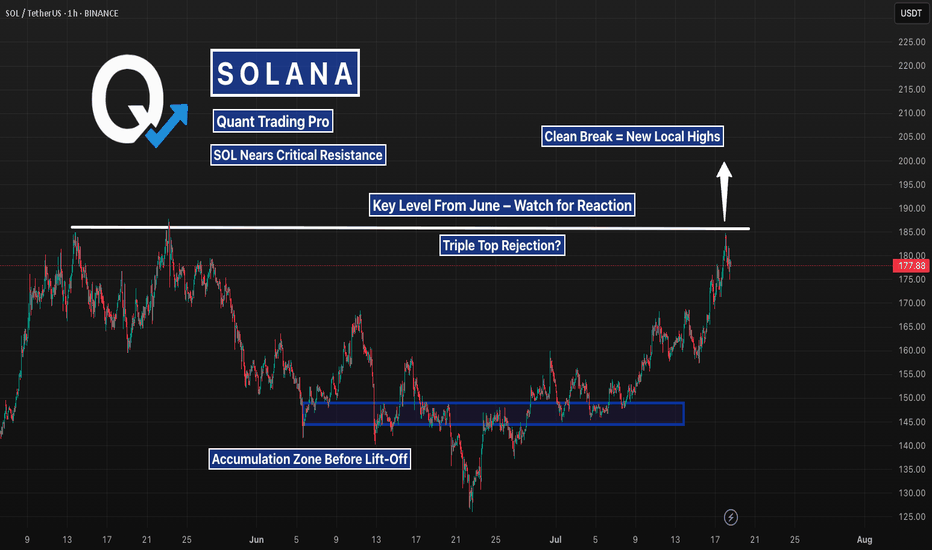

Solana Testing the June Breakdown Level — Decision TimeAfter weeks of slow grind, SOL is now pressing into a level that triggered a major selloff in June. A clean breakout here could flip momentum hard — but if buyers stall again, a short-term double top could catch late longs off guard. Watching $185 closely.

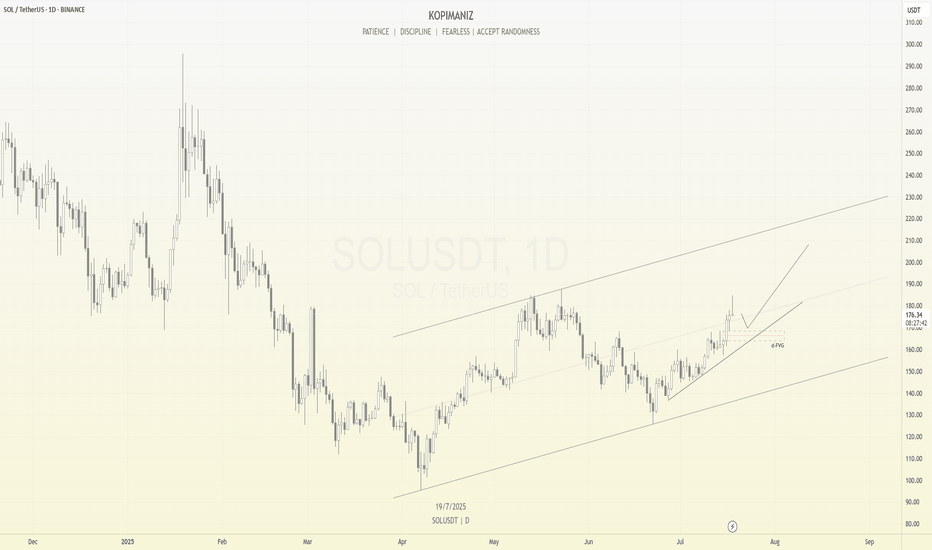

SOLUSDT – Healthy Pullback Before ContinuationSolana has shown strong bullish momentum recently, breaking out of a consolidation range and trending upward within a clear ascending channel.

However, in the short term, I expect a minor correction as price is likely to revisit the Fair Value Gap (FVG) zone marked around the $160–$165 area. This would be a healthy retracement within the trend and could provide a solid base for continuation toward higher targets.

If price respects the FVG and the lower trendline, SOL could resume its bullish move, potentially aiming for the $200 level and higher within the channel.

Key levels to watch:

FVG support zone: $160–$165

Resistance target: $200 – $220

Waiting for a pullback to enter on strength. Trend remains intact as long as the channel holds.

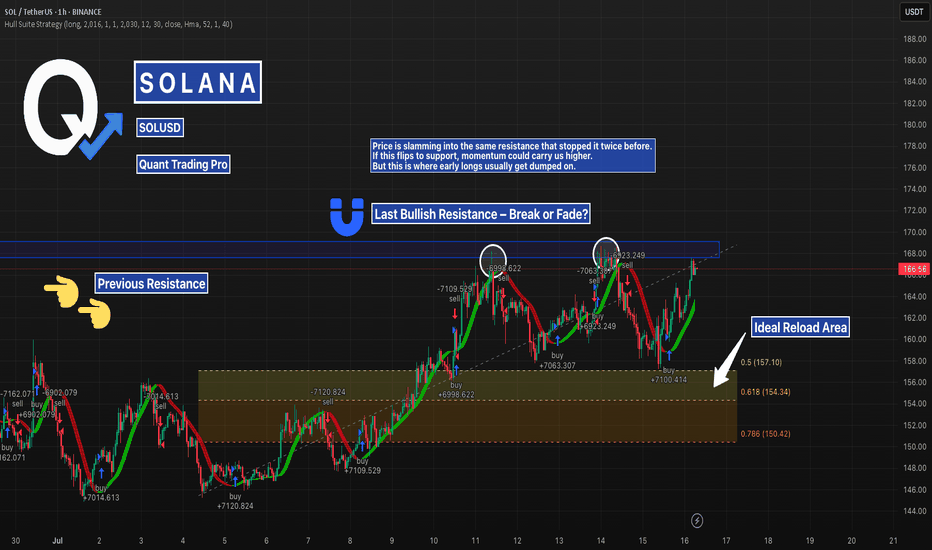

SOL Back at the Same Level It Dumped From — But with BackupSOL is right back where the last major dump started — but the structure this time is way cleaner. Higher lows, trendline support, and strong momentum behind the push.

If it clears this zone, we could see fireworks. But don’t fade resistance this thick without confirmation.

#Solana #SOLUSD #CryptoCharts #BreakoutWatch #ChartAnalysis #TrendlineSupport #CryptoTraders #QuantTradingPro #TradingView

SOLUSD – Big Test at Local Resistance | Fib Reload if RejectedSolana just tapped into prior resistance from July 13–14, a level that previously rejected price.

With fib confluence between $157–$150 below, this is a textbook setup: breakout or rejection → smart money looks for the reload.

Watching closely for structure shift before taking position.

#SOLUSD #Solana #Crypto #Breakout #SupportResistance #QuantTradingPro #TradingView

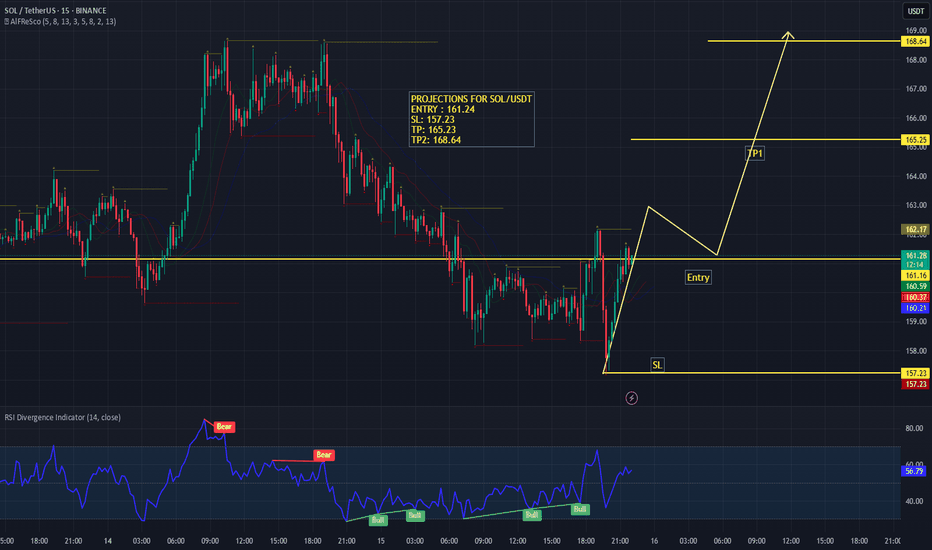

SOL/USDT – 15M Technical AnalysisSolana (SOL) is showing signs of a potential bullish reversal on the 15-minute timeframe after a sharp downtrend. Price has reclaimed key support levels and is preparing for a possible breakout.

📈 Projections & Trade Plan:

Entry: 161.24 (above immediate resistance)

Stop Loss (SL): 157.23 (below recent swing low)

Take Profit (TP):

TP1: 165.23 (near previous resistance cluster)

TP2: 168.64 (targeting the upper resistance zone)

Technical Insights:

The price has broken the descending structure and is showing bullish momentum with a clean impulse leg upwards.

A minor pullback to the entry zone would provide an optimal long opportunity before continuation towards TP levels.

Momentum Indicators:

RSI is trending upwards at 55.56, indicating strengthening buying pressure. Multiple bullish divergences can be observed, which align with the reversal thesis.

⚡ Bias: Bullish

If price holds above 161.24 and confirms breakout strength, we can expect a move toward 165.23 and potentially extend to 168.64. However, failure to hold above 161.00 may invalidate the setup.

Solana Coiling Beneath Resistance — A Breakout Could Get ViolentSolana is pressing against the upper bounds of its multi-month range, with price tightening just beneath key resistance near $180. This level has historically triggered strong sell-offs, but the rising structure from June suggests bullish pressure is building.

Momentum is elevated, but not overheated — a clean breakout above the range high could trigger a rapid move toward $200+. If rejected, eyes shift back to the $140–$120 demand zone. This is a high-stakes zone — breakout traders should be ready.

sol sell midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

HARMONIC PATTERN on Daily for SOL ?I wonder if this pattern is the one which is highlighted by our friend and chart analyst @The_Alchemist_Trader_

Let's see if it need to test one last time the support of this channel or if it will break out for the long waited rally.

Level to keep an eye :

0.5 Fib support need to hold and clean breakout of the 0.382 Fib

Indicators : RSI, volume and volatility (liquidations)