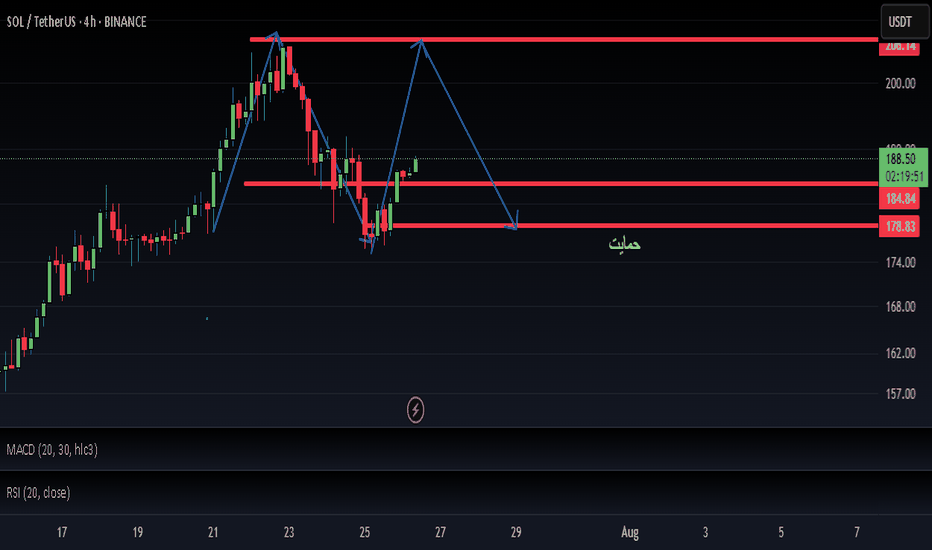

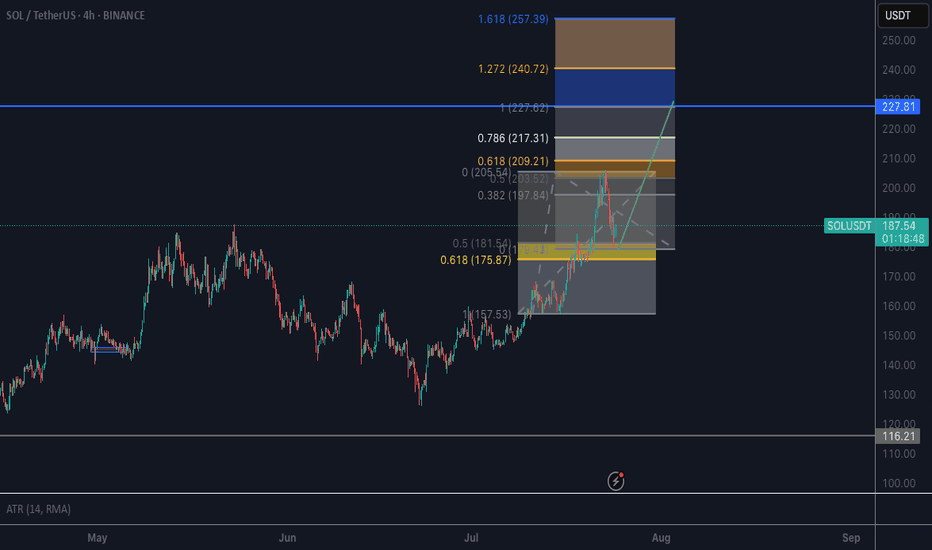

SOL/USDT – Daily Chart | Long-Term Fibonacci Sell SetupSOL has completed a strong bullish leg and is now reacting from the 0.236 Fibonacci retracement level at 188.63. A sell setup is developing based on this resistance zone and weakening momentum.

🔻 Trade Plan:

Sell Stop: 188.63

SL: 209.49

TP1: 176.93 (38.2% Fib)

TP2: 166.53 (50% Fib)

📉 RSI at 61.02 shows early signs of a bearish divergence. If price loses momentum at current levels, this setup could offer a solid retracement trade toward the mid-Fibonacci levels.

Watch for breakdown confirmation and manage risk accordingly.

SOLUSDT trade ideas

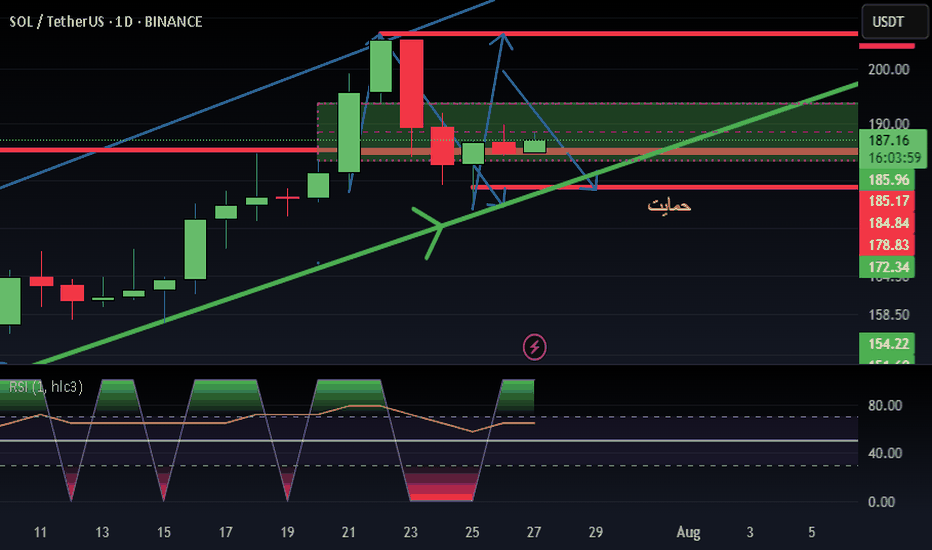

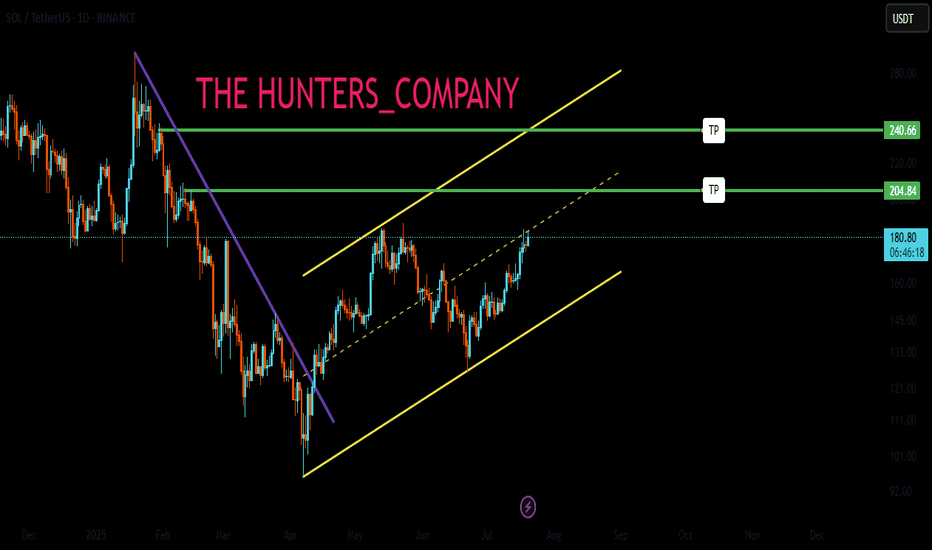

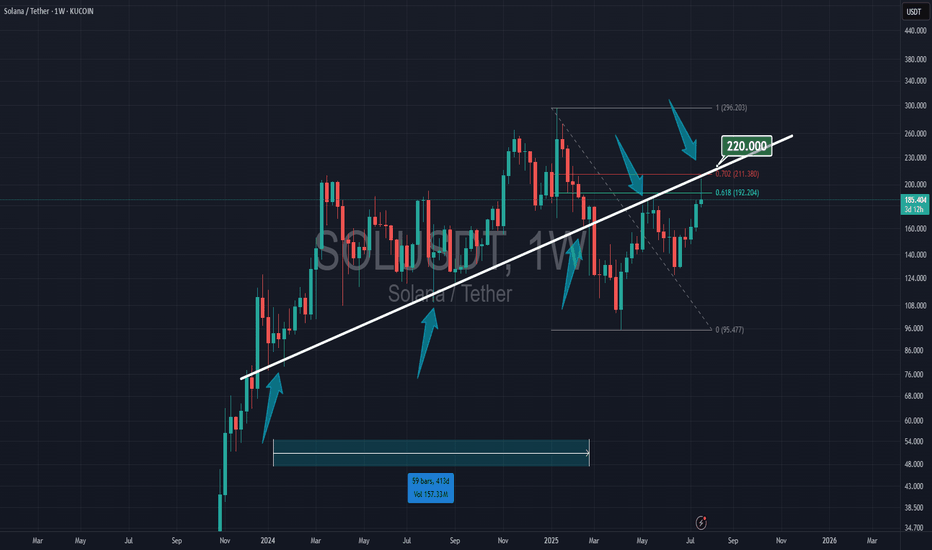

SOL 1D – Range High Rejected… Again?Solana just tapped major resistance — the same level that’s capped every rally since early 2024. This is now the third clean rejection off the $200 zone, and the structure couldn’t be more clear:

– Long-standing range between $115 and $200

– Previous rejections at the top led to full retracements

– This latest attempt? Rejected again — for now

If bulls want to flip the script, they’ll need a confirmed breakout with volume and a clean retest. Otherwise, this chart is screaming “range still intact.”

Until proven otherwise, this zone remains supply-heavy. Keep your risk tight — the next leg could move fast.

#Solana #SOL #RangeTrading #ResistanceZone #CryptoAnalysis #TechnicalBreakdown #QuantTradingPro #PriceAction

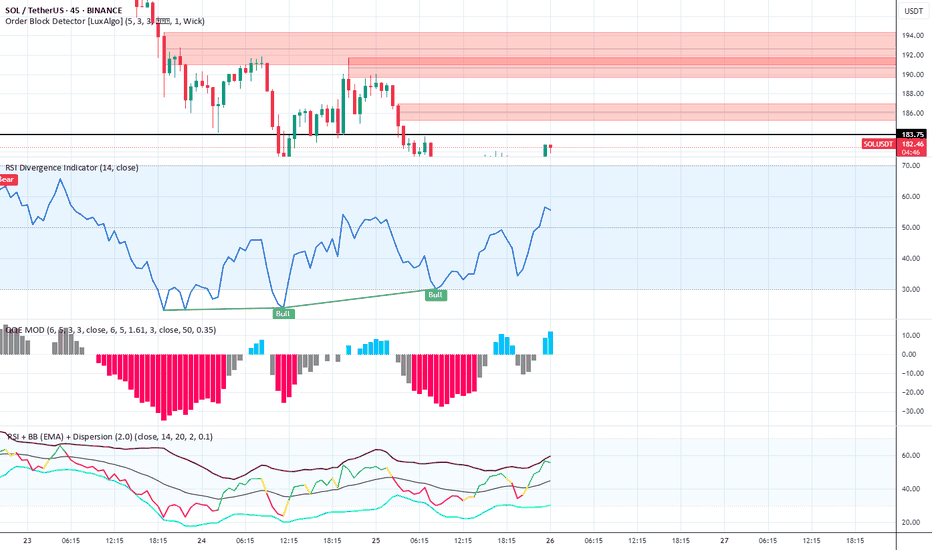

Vijay D - Smart Order Block + RSI Divergence Reversal SuiteIndicators Used in the Setup

Order Block Detector

Settings: (5, 3, 3), 1 Wick

Function: Highlights institutional order blocks to identify high-probability supply/demand zones.

Chart Insight: Multiple bearish order blocks marked in red between $186–$194, confirming strong overhead resistance. Price is reacting at the lower boundary (~$183.75), showing signs of rejection.

RSI Divergence Indicator (14)

Settings: 14-period RSI

Function: Detects bullish and bearish divergences between price and RSI.

Chart Insight: Bullish Divergence identified — price made a lower low while RSI made a higher low, signaling a potential trend reversal or bullish bounce.

QQE MOD

Settings: (6, 5, 3), Smoothing: 6.5, RSI Length: 14

Function: A momentum oscillator derived from RSI with smoothing and histogram representation.

Chart Insight:

Histogram flipped from red (bearish) to blue (bullish).

Bullish transition suggests increasing momentum in favor of bulls.

TSI – BB (EMA) + Dispersion

Function: Combines True Strength Index with Bollinger Band (EMA-based) and dispersion overlays.

Chart Insight:

TSI is rising toward midline with narrowing dispersion bands.

Indicates a potential volatility contraction before an expansion — likely upside if TSI crosses above signal.

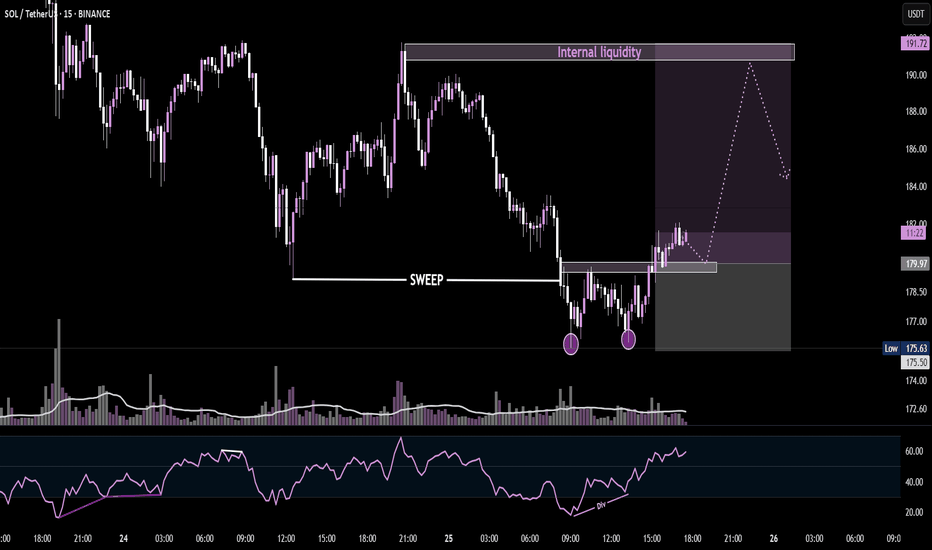

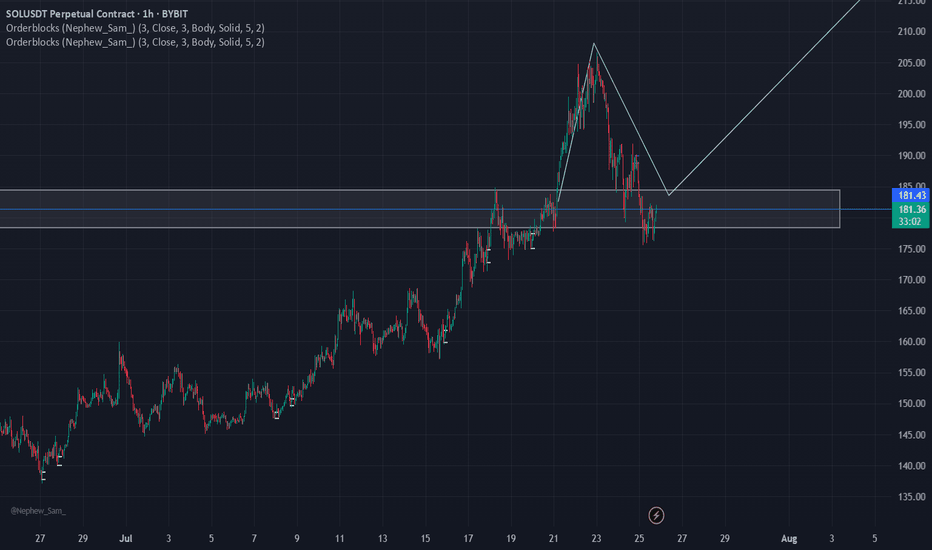

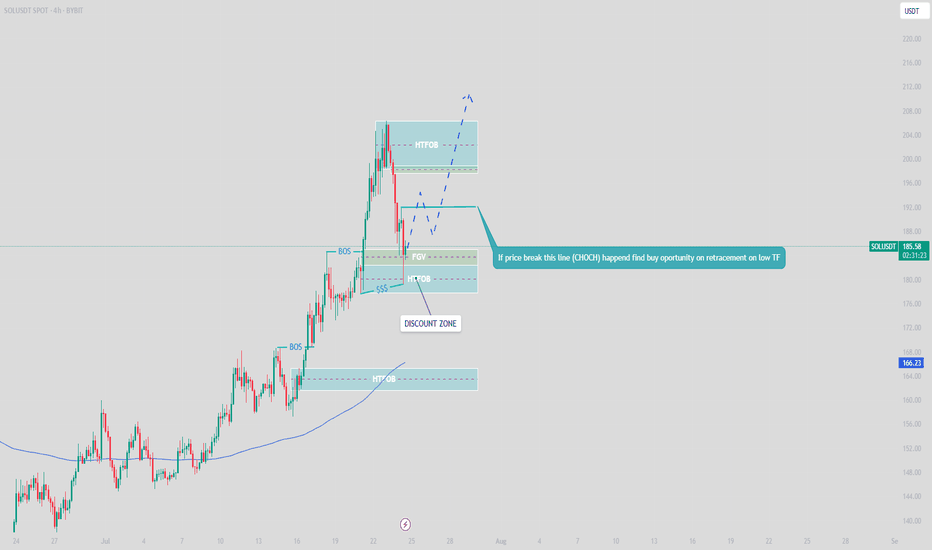

#SOL/USDT coin market structure analysis#SOL

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 175, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 174.

Entry price: 181.

First target: 187.

Second target: 195.

Third target: 205.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

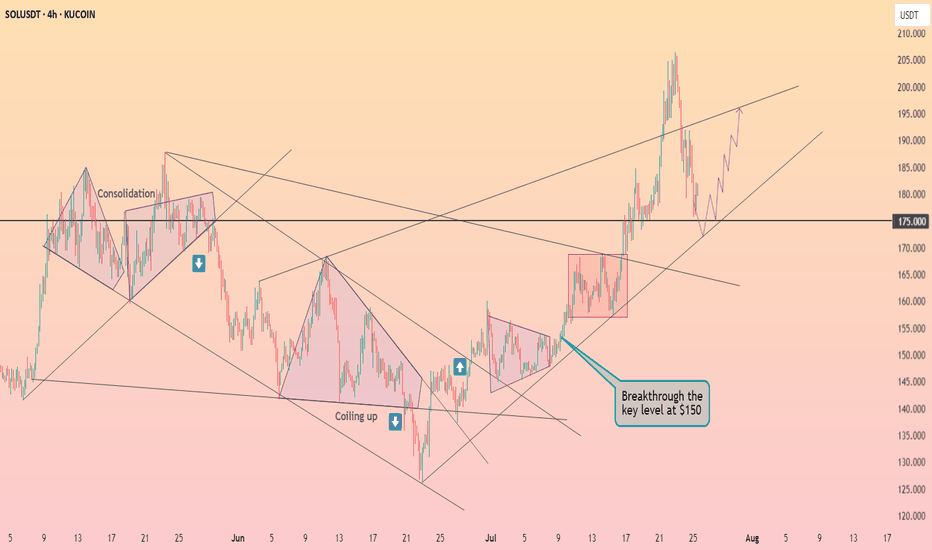

SOLANA UPDATEHello friends🙌

📉Given the decline we had, you can see that buyers came in and supported the price and were able to change the trend and create an ascending channel.

📈Now, considering that the price is hitting higher ceilings and floors, we can expect an ascending wave until the ceiling of the channel.

Don't forget risk and capital management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

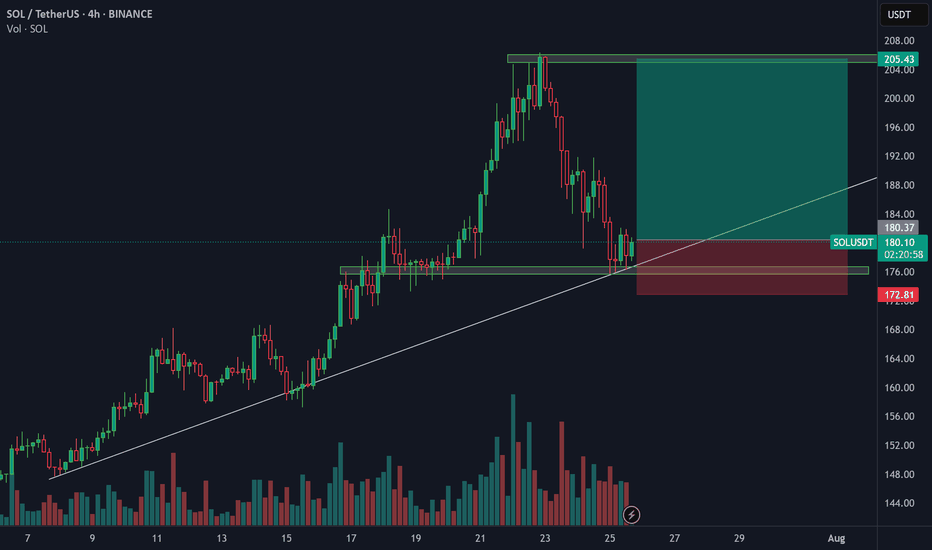

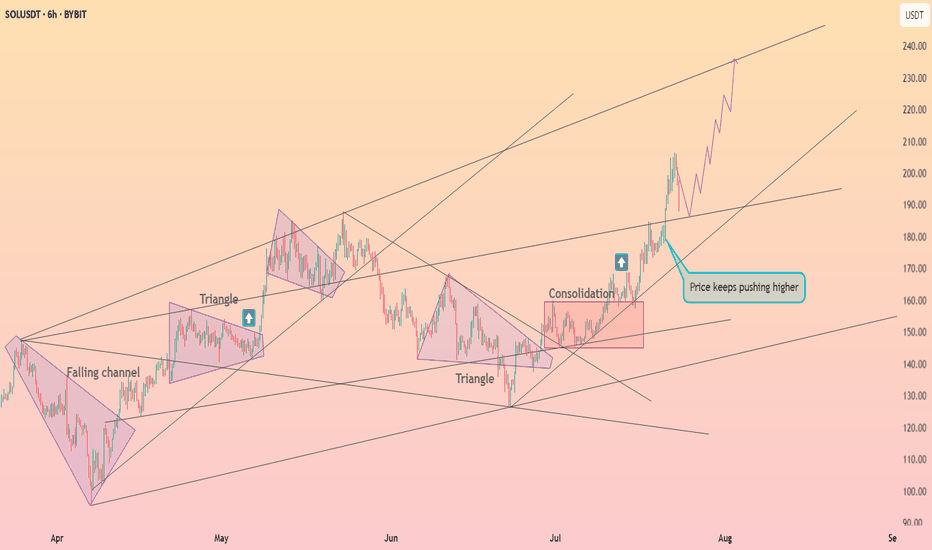

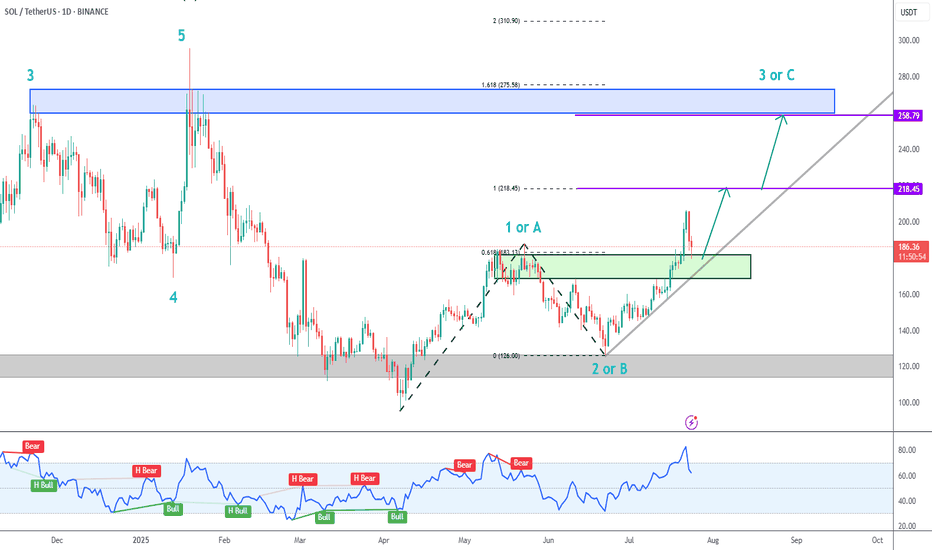

SOL Uptrend Update➡️ Solana has been correcting for the last couple of days, but the trend is clearly up.

➡️ There are 2 confluence factors that should give price support: the gray ascending trendline and the green zone.

➡️ Initial Targets (purple lines) are:

218.45 (100% extension)

258.79 (beginning of blue potential supply zone)

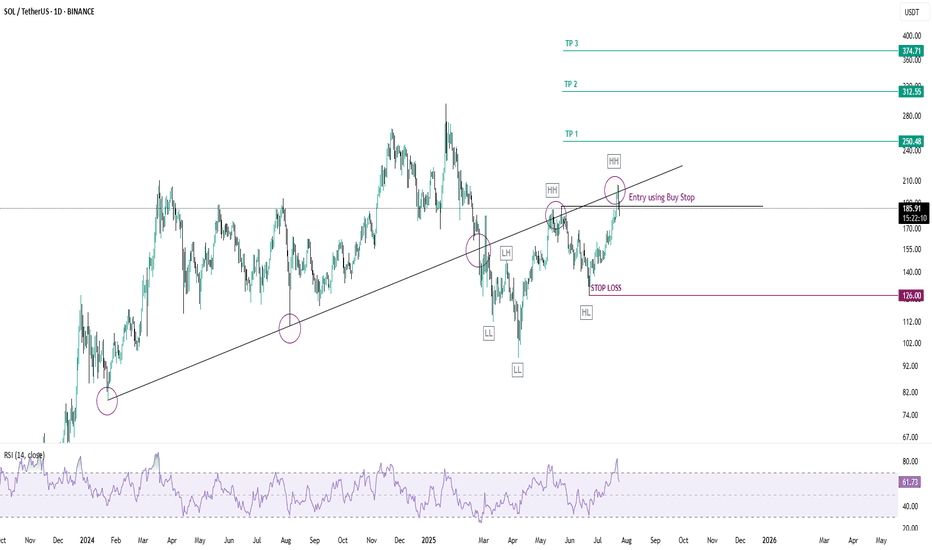

SOLUSDT-LONG IDEASOLUSDT has broken its trendline toward downside and now the structure is broken forming a higher highs and higher lows and reason behind its rejection is trendline but the structure is clearly bullish, trendline has gotten tapped two time now it has become weak take your entries using buy stop order it will give you great return again its a positional trade so if you have patience only then take this trade it will not gonna boom overnight stop loss entry and take profit points are mentioned in the chart.