DJI trade ideas

Dowjones Short AnalysisDow is in downtrend now. I have used various technique in analysis. Sl is the rectangle top. And target is below arrow.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . Drop some feedback below in the comment!

❤️ Your support is very much 🙏 appreciated!❤️

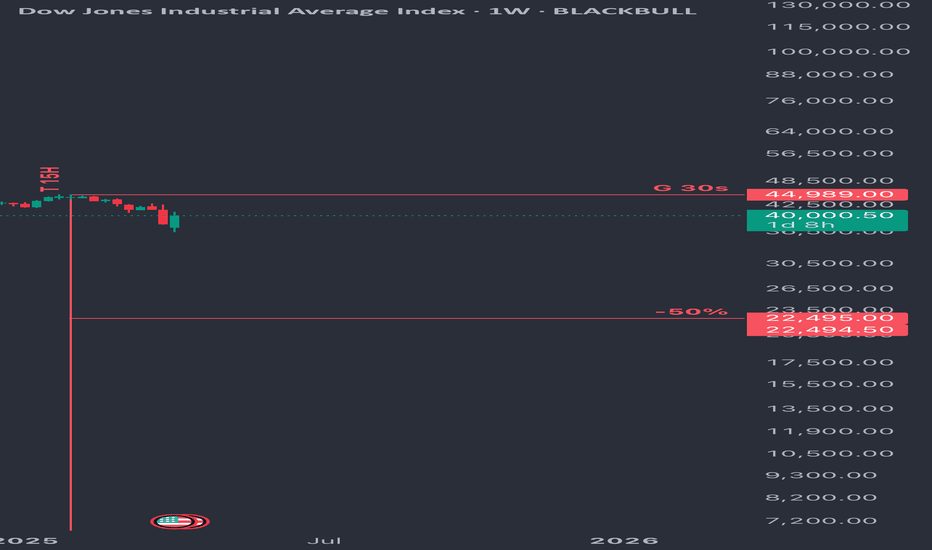

Dow Jones - Value Is The King Of 2025!Dow Jones ( TVC:DJI ) withstands all bearish struggles:

Click chart above to see the detailed analysis👆🏻

All major U.S. indices have been weakening lately but the Dow Jones is clearly the strongest of all. It seems like big institutions are shifting back to value stocks and therefore the Dow Jones remains very strong. Looking at technicals, this trend is rather likely to continue during 2025.

Levels to watch: $40.000, $50.000

Keep your long term vision,

Philip (BasicTrading)

DOW JONES: High volatility but clear picture long term.Dow Jones turned bearish on its 1D technical outlook (RSI = 40.021, MACD = -1063.380, ADX = 32.380) as it is correcting brutally yesterday's gains on uncertainty regarding the 90-day pause of tariffs. We can't overlook however the fact that yesterday's rebound happened on the 1W MA200 and at the bottom (HL) of the Bullish Megaphone. The very same sequence of events unfolded during the last big U.S.-China trade war that bottomed in December 2018. First a Channel Down bottomed on the 1W MA200 and started the Bullish Megaphone that bottomed on the 2018 trade war.

Both trade war corrections were -19% and if what follows replicates the 2019 rise, then we are up for a +35% rally. Potential TP = 49,000.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Trade Idea: US30 Short ( MARKET ) Daily Chart (Macro View):

• Bearish divergence: RSI is at 47.38 and turning down — no strong bullish momentum.

• Recent bounce is sharp but came after a massive drop, suggesting a dead cat bounce or retracement.

• MACD remains heavily bearish (-836), showing underlying weakness despite the current bounce.

• Price recently rejected a key resistance near 40,850, aligning with previous support-turned-resistance levels.

15-Min Chart (Medium-Term):

• RSI is at 78.76 — overbought territory.

• Price surged parabolically, forming potential exhaustion.

• MACD shows very high positive values (672.341), usually precedes a correction.

• Potential bearish divergence between price and MACD.

3-Min Chart (Entry Timing):

• Price has stalled at the top, consolidating after an extreme spike.

• MACD and RSI are curling down.

• Ideal for timing a short entry.

⸻

Trade Idea: SHORT US30

• Entry: 40,850 (current resistance zone + psychological level)

• Stop Loss: 41,200 (above key recent highs / invalidation of setup)

• Take Profit: 39,450 (near broken structure & moving average support on lower timeframes)

Risk-to-Reward Ratio (RRR):

• Risk: 350 points

• Reward: 1,400 points

• RRR: 4:1 (excellent)

⸻

Fundamental Context (Supporting the Short Bias):

• Dow is rebounding amid broader market uncertainty (e.g., Fed rate trajectory, inflation prints).

• No strong economic catalyst justifying a sustained breakout to new highs — suggests technical bounce rather than trend reversal.

• Rising yields or a hawkish Fed outlook could reintroduce selling pressure.

FUSIONMARKETS:US30

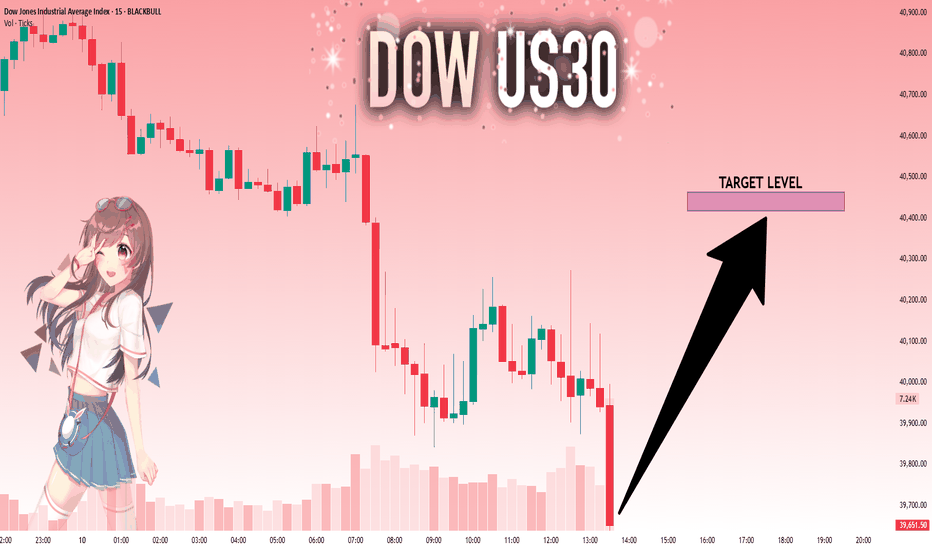

US30: Target Is Up! Long!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 39,680.80 will confirm the new direction upwards with the target being the next key level of 40,416.97 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

US30: Downtrend vs. Support Battle - What's Next?US30 Daily Analysis

Technical Outlook — 10 April 2025

Current Market Condition:

US30 is currently in a defined downtrend on the daily timeframe, characterized by a series of lower highs and lower lows. The price has recently broken down from a potential bearish wedge pattern and is trading below key moving averages.

Key Technical Highlights:

Clear bearish structure evident with consecutive lower highs and lows.

Price has broken down from a potential bearish wedge formation, suggesting further downside.

Trading below the 50-day and 200-day Exponential Moving Averages (EMAs), indicating bearish momentum.

Key Support Zones identified around $37,000 - $37,500 and $35,800 - $36,200.

Key Resistance Zones located around $42,000, $45,000, and $47,800 - $48,000.

Momentum oscillator (MACD or similar) showing bearish momentum.

Possible Scenarios:

Bearish Scenario (High Probability):

If price remains below the descending trendline (around $40,000 - $41,000) and fails to reclaim the $37,500 level, expect bearish continuation.

A confirmed break below the $37,000 - $37,500 support zone could lead to targets at the $35,800 - $36,200 support zone.

Confluence of the bearish trendline and moving averages adds to the potential selling pressure.

Bullish Scenario (Invalidation Level):

A break and sustained trading above the descending trendline and the $42,000 resistance level could signal a potential short-term pullback towards higher resistance levels around $45,000.

Strong bullish reversal signals within the $37,000 - $37,500 support zone could also indicate a potential bounce.

Important Note:

Be aware of any upcoming economic data releases that could impact US indices and cause volatility.

Wait for clear candle confirmations at key levels before initiating trades.

Implement robust risk management strategies, including appropriate stop-loss placement.

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.

Dow Jones INTRADAY oversold bounce back Key Support and Resistance Levels

Resistance Level 1: 41100

Resistance Level 2: 42170

Resistance Level 3: 42800

Support Level 1: 37554

Support Level 2: 36620

Support Level 3: 35125

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

NFP NQ / US30 advise for u read description i took this trade today early now the market should react from one of this places i mention, pls be aware never ever take the trade before NFP /15 min before / always wait NFP and market will gave u other entry after 45 to 60 min after NFP dont be gambler and put all ur heart . Wait like pro and take trade after nfp 45 to 60 min be safe much love and respect

any question fell free to ask id like to answer any Questions

DOW JONES INDEX (US30): Bearish More From Resistance

It looks like US30 is returning to a bearish trend again.

I see a strong bearish sentiment after a test of a key daily resistance.

The price formed an inverted cup and handle pattern and we see

a strong bearish imbalance with London session opening.

Goal - 39.685

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.