SUIUSD trade ideas

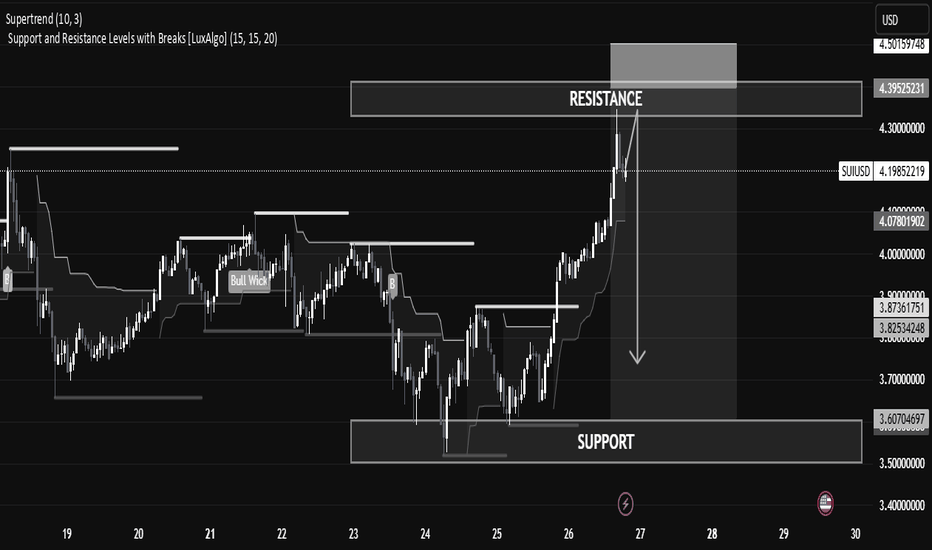

SUI/USD Technical Analysis – Potential Reversal Zone IdentifiedSUI/USD Technical Analysis – Potential Reversal Zone Identified

The current SUI/USD price action shows a strong bullish impulse reaching into a well-defined resistance zone, suggesting a potential pullback or reversal in the short term.

🔍 Key Levels

Resistance Zone: Between 4.30 – 4.39 USD, currently being tested after a strong bullish run. This is a historical supply area where price previously reversed.

Support Zone: Found between 3.60 – 3.70 USD, where price consolidated and accumulated before initiating the current rally.

Current Price: 4.2044 USD, slightly below the resistance zone, showing early signs of rejection.

📊 Technical Indicators & Structure

Supertrend (10,3): Bullish signal still active, suggesting trend strength, though traders should be cautious near resistance.

Break of Structure (BoS): Clean upward breaks suggest buyer dominance, but profit booking or sell-side liquidity may emerge near resistance.

Volume & Momentum: Impulse candles show strength, but volume tapering near resistance could indicate exhaustion.

📘 Educational Perspective

This setup highlights the importance of trading within key zones:

Buying at support, where demand is strong.

Monitoring resistance for signs of exhaustion or reversal patterns like wicks, doji, or bearish engulfing.

Risk Management Tip: In such cases, aggressive traders might short from resistance with tight stops, while conservative traders wait for confirmation (e.g., break and retest of the support or resistance).

SUI — Structured Dip Buy Zone You Shouldn't IgnoreSUI has been technically clean, with well-respected Elliott Wave counts and fib levels.

As the broader market dips, it's time to look for sniper long entries and SUI is setting up beautifully for one around the $3.50 zone.

🧩 Key Confluence Zone: $3.50

This level offers a high-probability buy zone, backed by multiple layers of technical confluence:

0.786 Fib Retracement: $3.5029

1.0 Trend-Based Fib Extension: $3.5036

Previous Trading Range POC: $3.4675

Previous Weekly Open (pwOpen): $3.494

🟢 Long Trade Setup

Entry: ~$3.500

Stop-loss: $3.4675

Target (TP): $3.85+

R:R: ~1:3

🛠 Indicator Note

In this analysis I'm using my own indicator:

➡️ DriftLine — Pivot Open Zones

It helps identify key market opens (daily, weekly, prior), which often act as magnet levels and reaction zones.

➡️ You can use it for free — just check out my profile under “Scripts” and apply it to your charts.

💡 Pro Insight: Build Trades Where Tools Agree

A single level is just noise. But when fib retracements, extensions, POCs, opens, and price structure all line up — that’s where conviction trades are made.

The more overlap, the more likely the market reacts — this setup shows just that.

Final Thoughts

SUI is approaching a technically rich zone around $3.50, and this could be one of those low-risk, high-reward long entries if confirmed by price action.

With a clean invalidation and 1:3 R:R, this is the kind of setup you want to plan — not chase.

Set your alerts, stay patient, and trade with structure. 🚀✍️

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

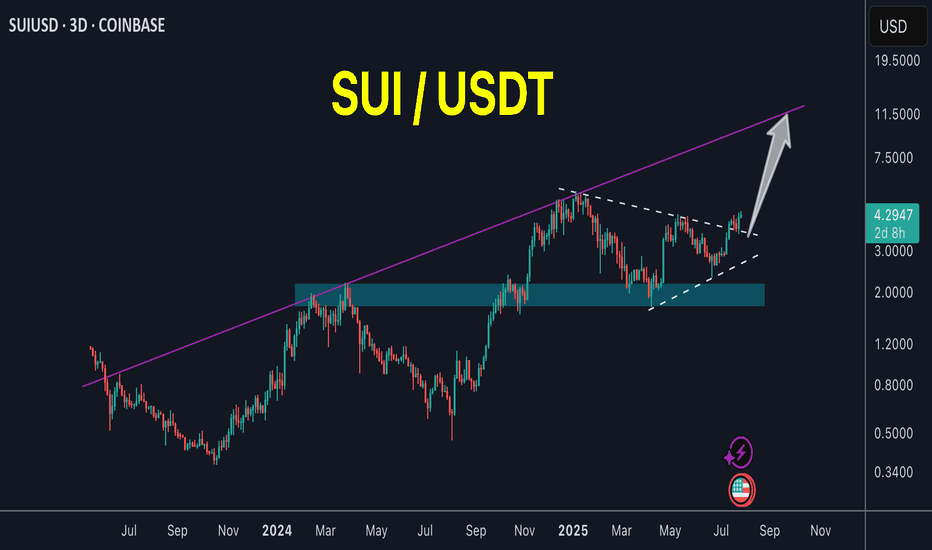

SUI/USDT – Symmetrical Triangle Breakout in PlaySUI has officially broken out of a multi-month symmetrical triangle on strong momentum. This structure has been building since early 2024 and now looks ready for continuation.

Key Notes:

Breakout confirmed above trendline resistance with strong volume.

Reversal signals on the 1D and 4H timeframes aligned before the move.

Pullback toward the breakout zone is possible before continuation.

Upside Fibonacci-Based Targets:

PT1: $5.32 (+27%)

PT2: $6.53 (+47%)

PT3: $7.60 (+75%)

If the breakout holds and momentum continues, these levels offer a solid roadmap for potential long-term gains. Watching how price reacts around the $4.30 resistance will be key.

Not Financial Advice – For educational purposes only.

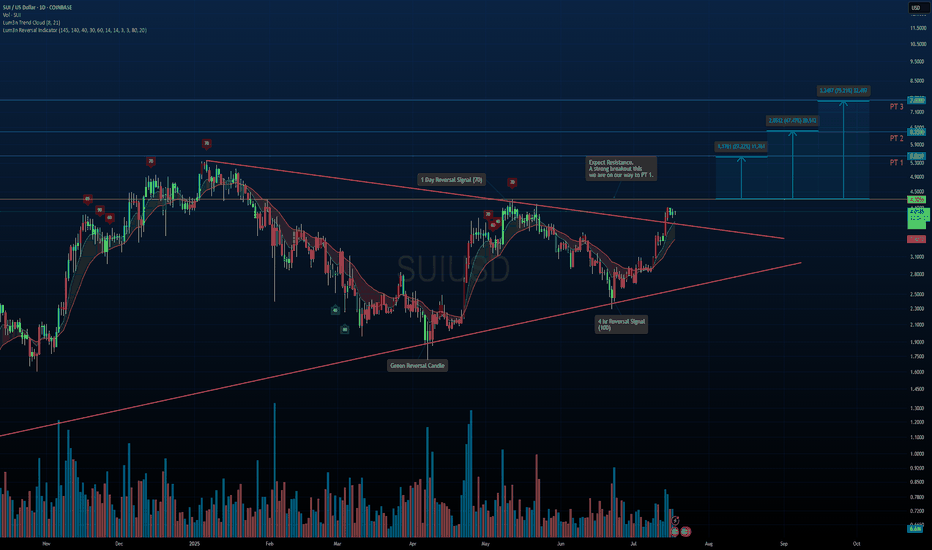

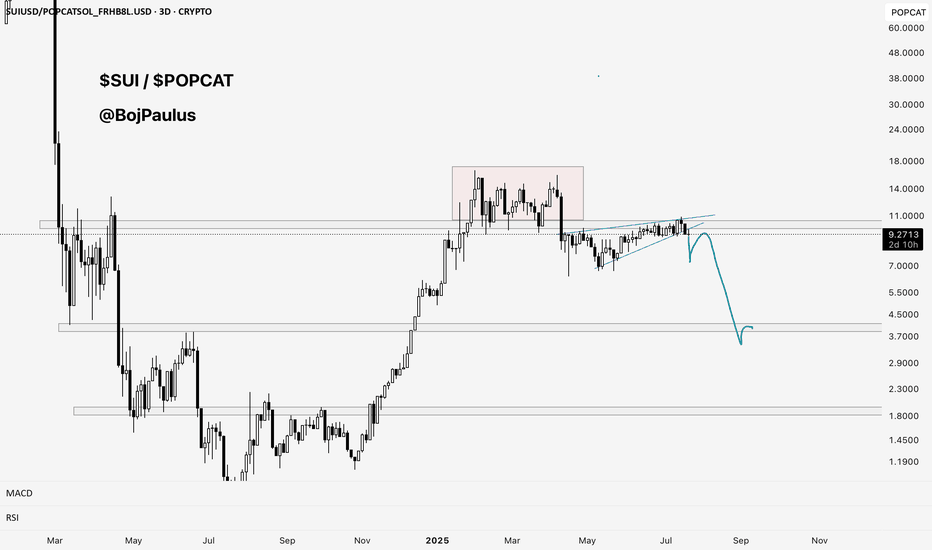

Sui next target (T2)As anticipated Sui would drop somewhere between the .2-.4 Fib (of the entire run).

As shown on the chart, Sui has hit the 3.8 Fib.

This was also expected because of the dotted yellow line indicating a breakout retest.

Also my price prediction on 7/23/25 was between $3.4 - $3.5.

So far Sui has hit my target within less than 1% @ $3.52.

Sui may bounce from here since it is in the golden pocket (red T1).

But I would not be surprised if Sui continues down to hit T2 (swipe recent low),

and liquidate the longs before starting its face melting pump upwards.

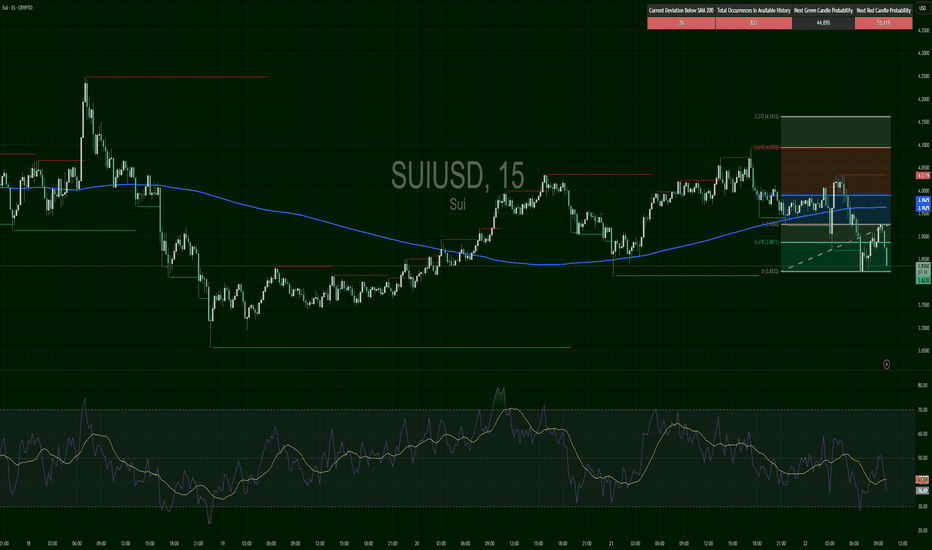

SUIUSD – Fib Zone or Fade?SUI failed a breakout at $4.05, reversed hard, and now trades near the 0.618 fib zone ($3.88). Price dipped as low as $3.82 before stabilizing. RSI curling from oversold (~30), indicating early recovery attempt. Structure still bearish unless bulls reclaim $3.96–$4.00. Risky but bounceable.

SUI Forms W or Butterfly Pattern: Potential Downward Move ExpectOn the global SUI CRYPTOCAP:SUI chart, a W or butterfly pattern is emerging, according to both patterns, the movement is likely to go down

The market is also returning to previous prices, but the liquidity gap has not yet formed on the dollar dominance chart, most likely another strait in the price of altcoins is expected, perhaps deeper than yesterday

Current price $3.83

Possible price drop with these patterns up to $3.77 or $3.67 or even lower $3.3

There is also a risk that the market will go up to $4.091

This analysis is based on the technical pattern and also incorporates AI to provide more accurate results.

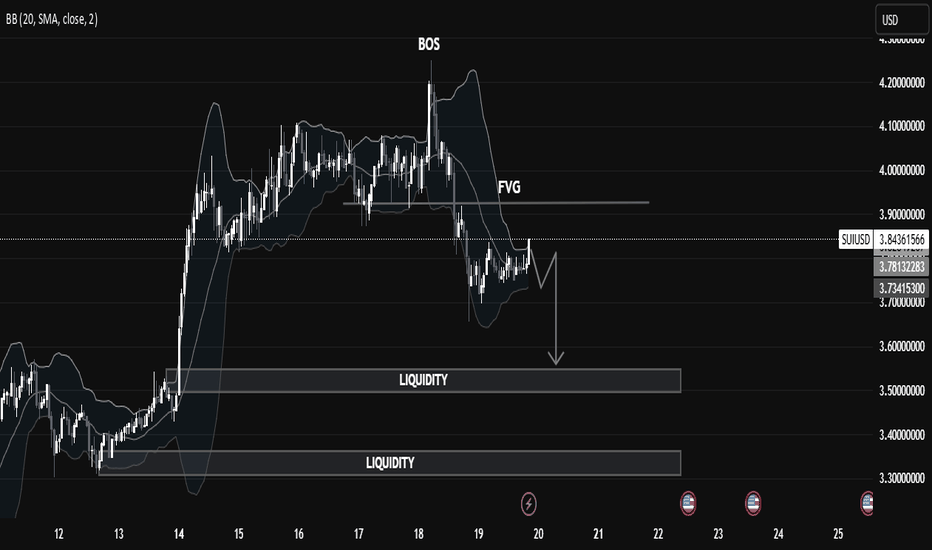

SUIUSD Liquidity Trap in Motion: Price Targeting Deeper Pools🧠 Market Structure Insight (SMC Framework)

🔍 1. Break of Structure (BOS):

The most recent BOS around the $3.95 level marked a bull trap, indicating a transition from bullish momentum to a distribution phase. This suggests institutional players offloaded liquidity at premium prices before initiating a markdown.

🕳️ 2. FVG (Fair Value Gap):

A visible Fair Value Gap (Imbalance) remains unmitigated above the current price action. This zone acted as a supply area, where price sharply moved down, leaving inefficiency in its trail—now serving as a potential point of rejection if revisited.

📌 Liquidity Zones:

Upper Liquidity Cleared: Price has swept highs before reversal (a sign of engineered liquidity grab).

Double Liquidity Pools Below:

First pool: Around $3.55 - $3.60

Second pool: Deep liquidity around $3.30 - $3.35

These levels are highly attractive for Smart Money to target next, suggesting continuation to the downside.

📉 Current Price Behavior:

Market is consolidating in a tight range just below FVG, signaling potential re-accumulation of sell orders.

The chart pattern suggests a potential lower high forming, likely to precede a bearish leg towards liquidity zones.

Bollinger Bands show compression, hinting at volatility expansion soon.

🎯 Trade Outlook (Not Financial Advice):

🔻 Bearish Bias:

Unless price breaks above the FVG zone with strong bullish momentum, the probability favors a bearish continuation targeting:

1st Target: ~$3.55

2nd Target (Deeper liquidity grab): ~$3.30

A rejection from FVG followed by a BOS to the downside would serve as confirmation for this bias.

📚 Educational Takeaway:

This chart is a clean illustration of Smart Money Concepts in play:

BOS > FVG > Liquidity Sweep

Price respects institutional footprints: grab liquidity, fill imbalances, then drive toward untouched liquidity zones.

Recognize market intent through structure shifts and imbalance reaction.

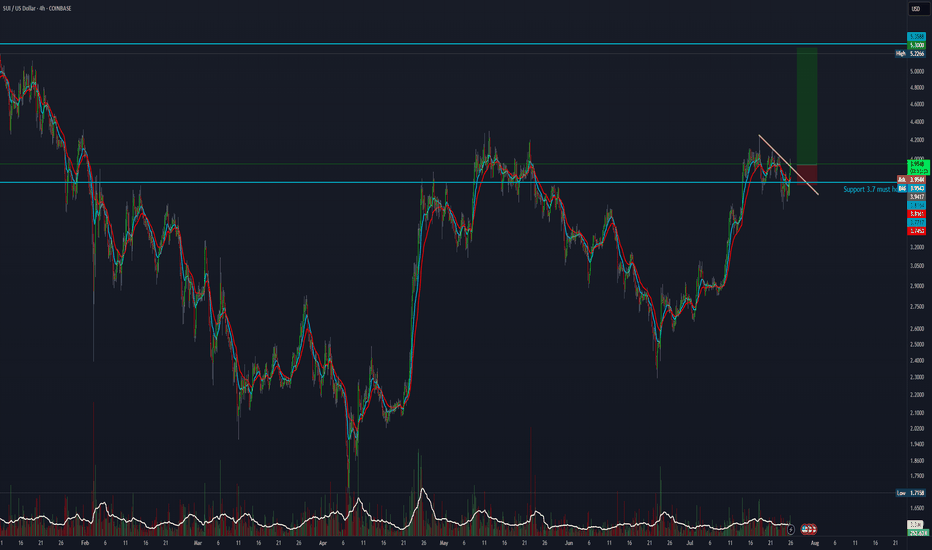

SUI - 4H Potential ReversalRight now the market is extremely hot as BTC is skyrocketing to the upside. However we are beginning to reach levels where a short term pullback could be on the table to flush out overleverage. Therefore, if a pullback does occur then these are the levels to watch.

For SUI we are seeing very early signs of a short term reversal occurring.

The first bearish signal was a 4H reversal doji followed by tweezer tops right at the psychological $4 level.

In addition to this we are seeing early signs of a bearish divergence forming. Higher high in price, lower low on our RSI. Showing that some strength of this rally might be fading.

If this reversal does occur then the $3.40-$3.60 level would be the first level to watch for bulls to hold. This could be a great level to long from in accordance to BTC maintain strength. Will also post the SUI daily chart that has confluence with this prediction as well.

However if BTC continue to reach for high and SUI reverses this bearish signal then $4.60 would be the next level followed by a test of its previous ATH.

SUI Holding Breakout – Is the ATH Next?SUI is breaking above the 0.5 retracement level after a strong reversal from the golden pocket. With price now in a clean range toward all-time highs, continuation depends on whether bulls can defend the $3.45+ area.

Momentum is high, but Stoch RSI is overbought — stay alert for either a breakout push or short-term cooldown.

$SUI Wave 3 to Continue with a Strong Weekly CloseCRYPTOCAP:SUI printed a great weekly candle that will be closing today above the weekly pivot point with RSI trying to flip bullishly.

Price found support at 0.5 Fibonacci retracement and High Volume Node.

Wave 4 penetrated wave 1 which we potentially have a ending or leading diagonal Elliot Wave count limiting the potential upside with my current terminal target being around $10-13. Wave 4 could also actually be another wave 2 which would give us ridiculous targets but this is my preferred count for now.

Safe trading

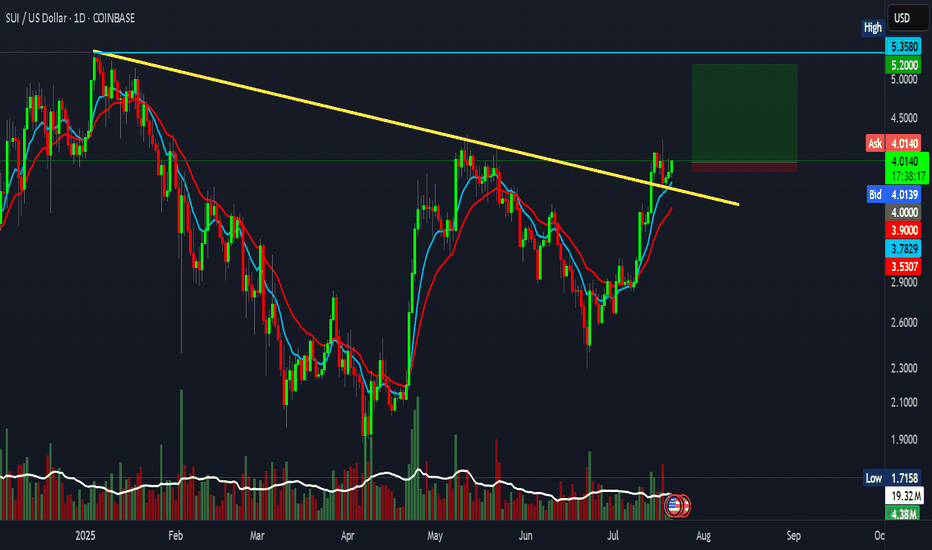

$SUI/USDT Breakout Analysis 1D Chart: SUI has broken out$SUI/USDT Breakout Analysis 1D Chart:

SUI has broken out of a clear falling wedge pattern on the daily timeframe — a bullish reversal structure. This breakout is significant, especially with strong volume confirmation and price now trading above both the wedge and the 50 EMA.

🔸 Support $3.05:

The 50 EMA aligns closely with the $3.05 level, now acting as a solid support. Retesting this area successfully would validate the breakout further.

🔸 Upside Target: $5.5

The projected move based on the wedge's height suggests a run toward the $5.0–$5.5 zone, especially if bulls maintain control.

🔸 Risk Level at $2.80:

A daily close back below the wedge and 50 EMA would invalidate the bullish breakout and suggest caution

🔸 Watch for a potential retest of $3.05–$3.20. If this zone holds, it could be a strong entry area with upside potential toward $4.0, $4.7, and $5.5 in the coming weeks.

SUI - Leading Diagonal Macro Count Analysis

From an Elliott Wave standpoint, the structure appears highly promising. The current formation allows for two plausible interpretations: either the early stages of a strong impulsive wave, or a more measured diagonal unfolding at the cycle degree. A break below the red level would decisively invalidate this count

SUI Next Upside Target🚀 After holding above the April low and completing a 3-wave pullback in wave (2), CRYPTO:SUIUSD is now advancing in a potential wave (3).

Momentum is building, and the next upside target lies in the equal legs zone at $4.80 – $5.40, which could eventually lead to a new all-time high.

$SUI Big Breakout Happening?CRYPTOCAP:SUI is smashing above triple resistance: a major High Volume Node , daily 200EMA and the daily pivot. The signal I posted in my trading signals Substack is now live, and the HBAR one is about to hit take profit 1.

Target for this rally remains $4.2 High Volume Node near the swing high.

Analysis is invalidated below the daily pivot at $2.8

Safe trading