TradeCityPro | SUI Eyes Breakout with Bullish Momentum Rising👋 Welcome to TradeCity Pro!

In this analysis, I want to review the SUI coin for you. It’s one of the Layer1 projects in the crypto space, currently ranked 13 on CoinMarketCap with a market cap of $13.66 billion.

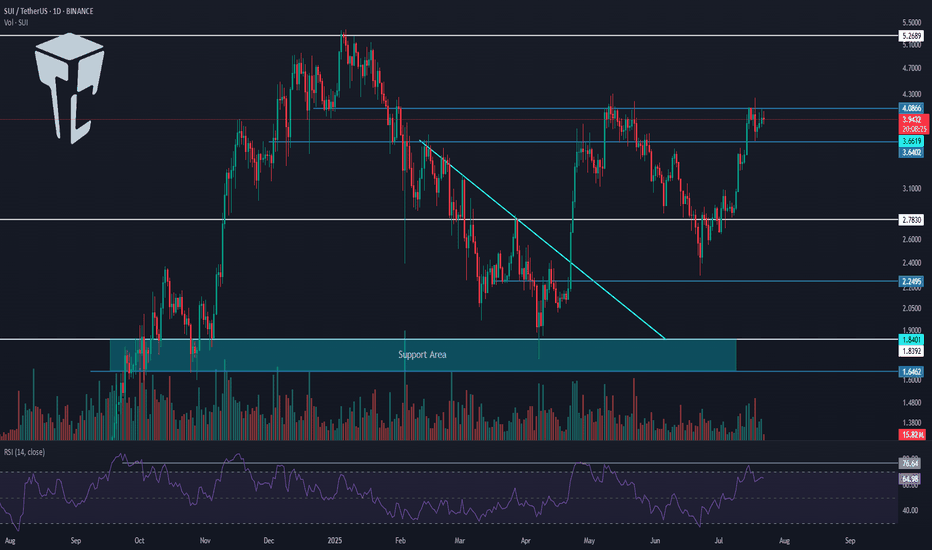

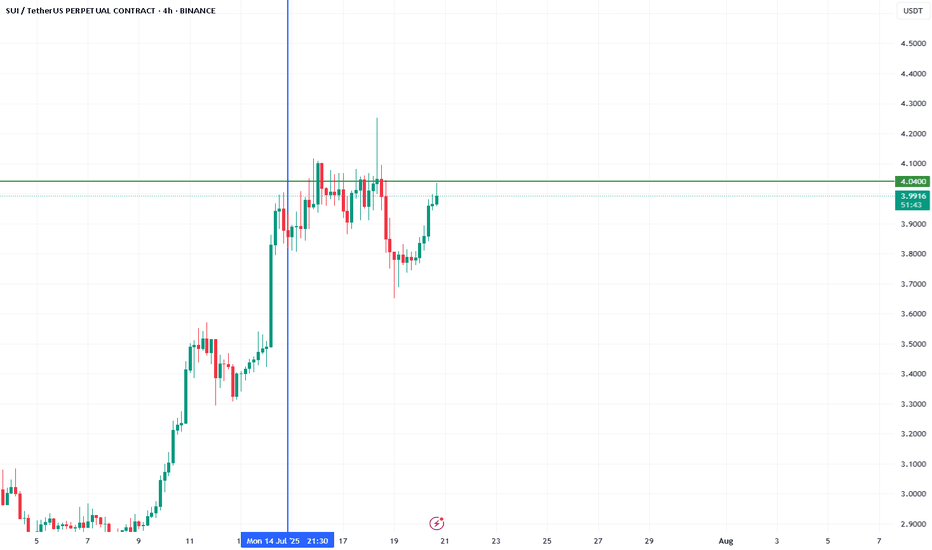

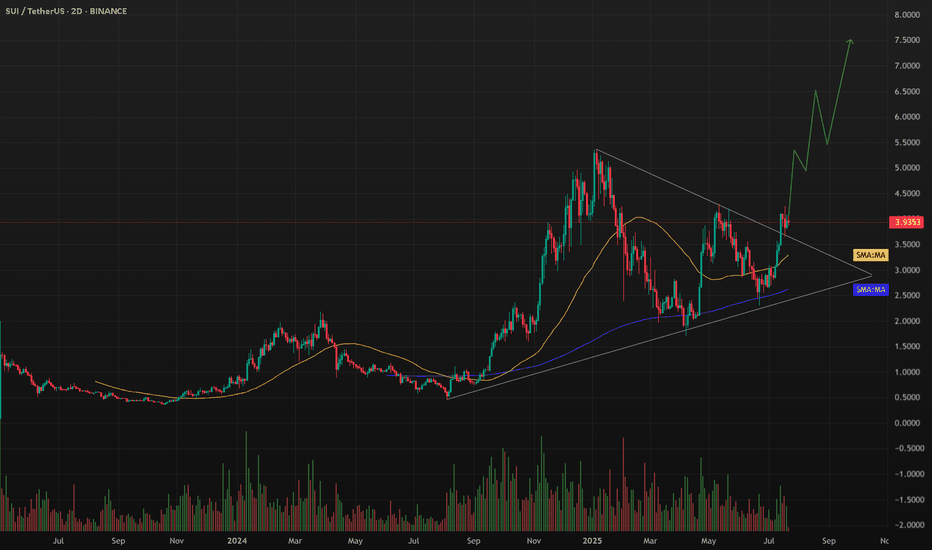

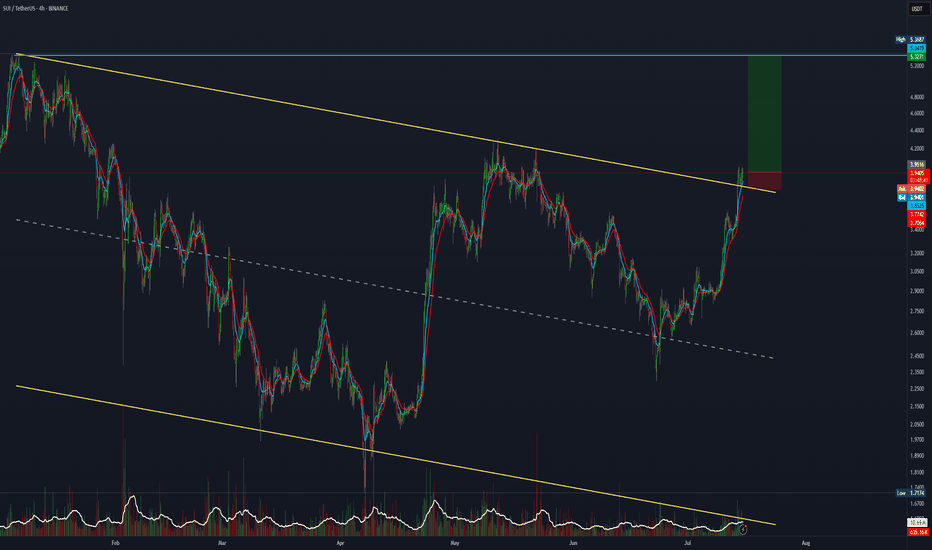

📅 Daily Timeframe

On the daily timeframe, a lot has changed for SUI since the previous analysis. After breaking the descending trendline, it has started a new bullish trend.

✔️ In the first bullish leg after breaking the trendline, the price reached the 4.0866 zone, and now after a correction, it’s moving upward again.

📈 The 4.0866 level is a very important resistance. In fact, we can draw a resistance range between 3.6402 and 4.0866, as the price tends to behave erratically within this zone.

⭐ Currently, the price has re-entered this range and if 4.0866 is broken, the bullish wave could continue. The first target for this wave could be 5.2689.

🔼 So, if 4.0866 is broken, I highly recommend opening a long position, because if the price truly breaks this level (and it’s not a fake breakout), then the minimum target would be 5.2689.

📊 If the buying volume continues to increase as it is now, and the RSI breaks above 76.64, the chances of breaking 5.2689 will also rise, and the price may even set a new ATH.

👀 I already have an open position on this coin based on lower timeframe triggers, and I’m currently waiting to see the reaction to 4.0866. Based on my entry, if the price moves toward 5.2689, the risk-to-reward ratio will be very high. That’s why I’ve kept part of my position open to potentially capture that move.

🛒 For spot buying, we can also use a futures strategy — meaning if 4.0866 breaks, we open a futures position targeting 5.2689, and then use the profit from that position to buy SUI in spot, gradually building our spot portfolio.

✨ If you are looking at this coin only for spot, the main trigger is the breakout of 5.2689. But be careful — if the price moves aggressively, it might not give you a proper entry trigger, and entering from that area might be difficult.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

SUIUSDT trade ideas

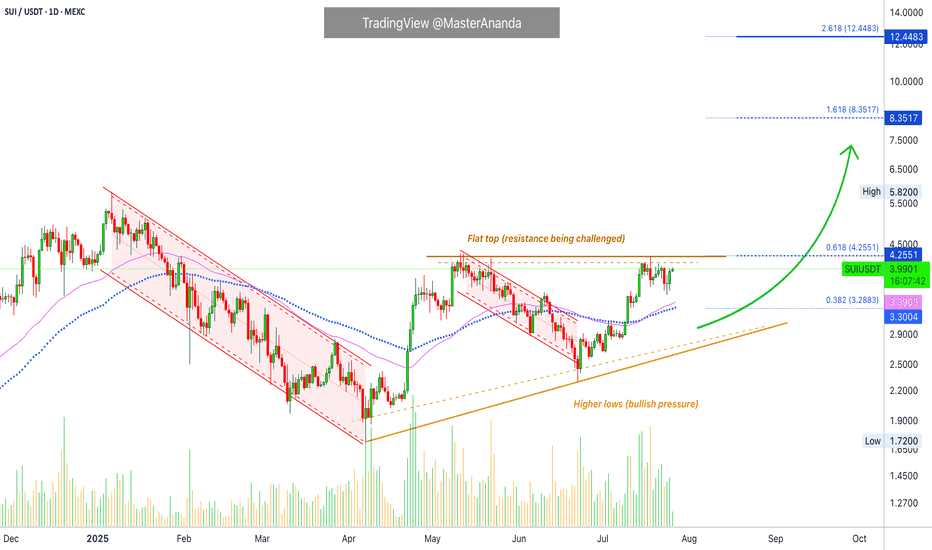

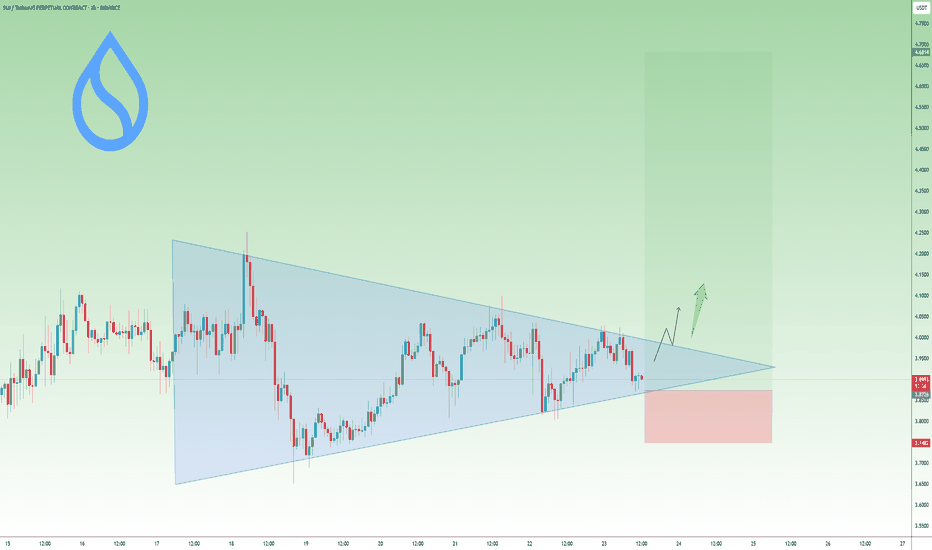

SUI – Preparing for a Breakout? Symmetrical Triangle in PlaySince the beginning of the year, SUI has been consolidating inside a classic symmetrical triangle — marked by higher lows and lower highs, a sign of tightening price action and growing pressure.

This kind of structure doesn’t last forever.

Usually, it ends with a strong breakout — especially if supported by volume.

🔍 What to watch:

- A break above the upper trendline could trigger a strong move, with potential targets in the $5 area and even a new ATH, if altcoins enter a real revival phase.

- On the flip side, $2.80 remains the key support level.

As long as it holds, bulls remain in control of the structure.

📍 My game plan:

I’m watching the $3.25 area as a potential buy zone —a great spot inside the pattern, offering tight risk and strong upside if the breakout comes.

Until then, it’s all about patience.

Pressure is building. The triangle is tightening.

And the market is waiting for a reason to move.

SUI - Just one step away from the explosion!The last candle on the daily chart just confirmed a BOS (Break of Structure) — a clear and strong sign of bullish continuation for the asset.

✅ This is a textbook entry for a long position.

🎯 Next target: $5 — and so far, no bearish signs in sight.

Best regards,

Ceciliones 🎯

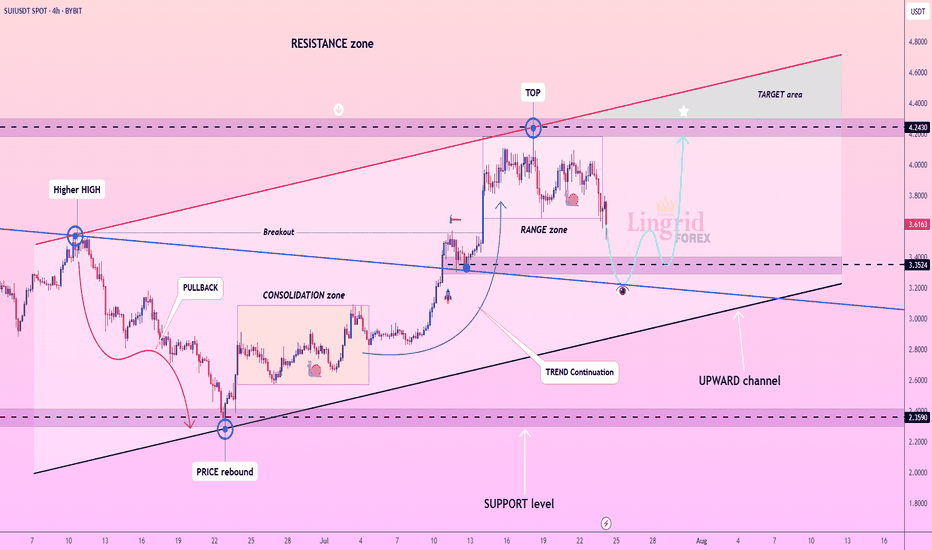

Lingrid | SUIUSDT Buying Opportunity from Support ZoneBYBIT:SUIUSDT is pulling back from the recent range top after testing the resistance zone and is approaching the key breakout area. The structure shows an upward channel with a prior consolidation breakout and an ongoing corrective retracement. As long as the price holds above the confluence zone near 3.35, the bullish structure remains intact. Broader momentum supports trend continuation toward the upper resistance boundary and the target area.

📉 Key Levels

Buy trigger: Break above 3.75 with volume

Buy zone: 3.25 – 3.35

Target: 4.24

Invalidation: Break below 3.22

💡 Risks

Breakdown below channel support would flip structure bearish

Fading volume on bounce may signal exhaustion

Broader market weakness could suppress upside momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

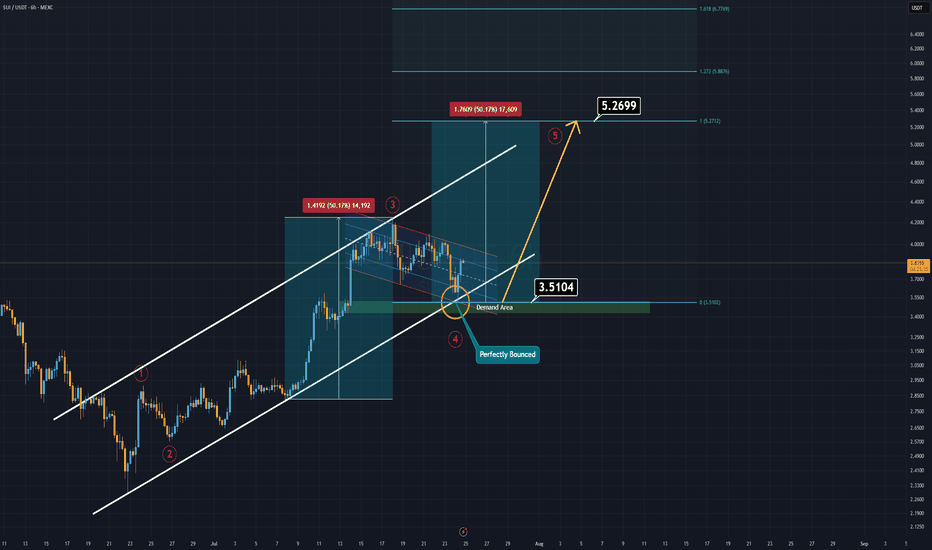

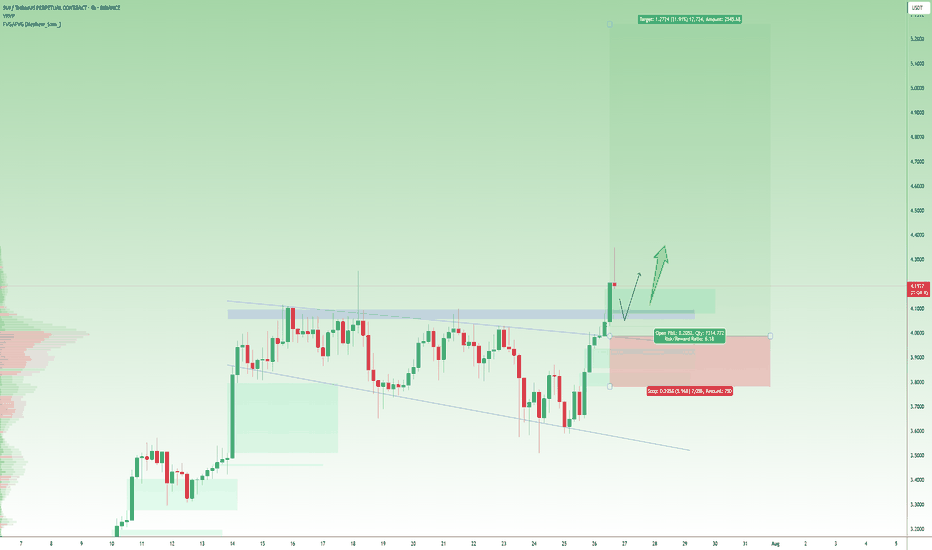

SUI Analysis (6H)If you're on the hunt for extreme risks and potentially high rewards — SUI might be calling your name.

Currently, SUI is trending within a well-respected ascending channel, and just today, it tapped both the demand zone and the lower boundary of this channel.

That’s what we call a double support, and it often signals a strong potential bounce.

SUI now appears to be forming a bullish flag pattern. If this formation breaks to the upside, it could trigger the fifth impulsive wave in line with Elliott Wave Theory.

In such a case, the main target is projected around $5.00–$5.20.

Extreme setups demand extreme conviction.

Good luck.

SUIUSDTSUI has broken out above a long-term descending trendline and reclaimed the key Monthly(2) resistance at $3.71, now acting as support. After a successful retest of this level, I’m entering a long position targeting a move toward $5.00, aligning with prior highs and the next major resistance zone. The breakout is supported by strong bullish momentum, VWAP trend shift, and confluence from Fair Value Gap absorption. My stop is placed below $3.60 to protect against a failed retest, with a favorable risk-reward setup in play.

SUI : HODL BASKETHello friends🙌

🔊We have come to introduce a signal that can be a good option for your investment portfolio.

Given that the price is in the ascending channel and has good support from buyers, it is expected that this time the price will break the middle line of the channel and move to the ceiling of the channel and succeed in reaching ATH...

Don't forget about capital and risk management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

SUI - Breakout of the yearSUI is currently trading near the resistance line. Price was reject around this resistance line in the previous pump.

- Given the current bullish market, price is expected to breakout from this resistance easily

Entry Price: 4.04

StopLoss: 3.2

TP1: 4.5059

TP2: 5.3810

TP3: 6.5106

TP4: 7.8772

TP5: 10+

Don't forget to set stoploss.

Stay tuned for more updates

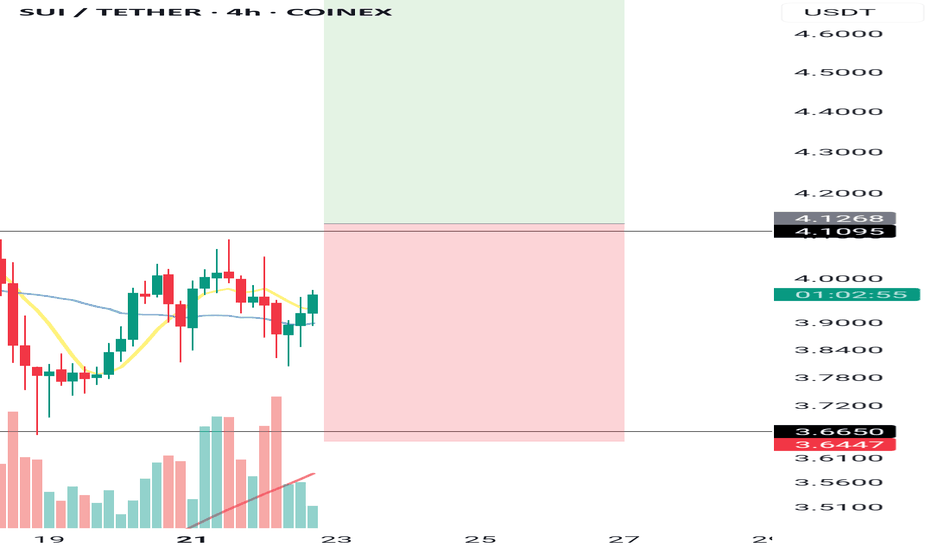

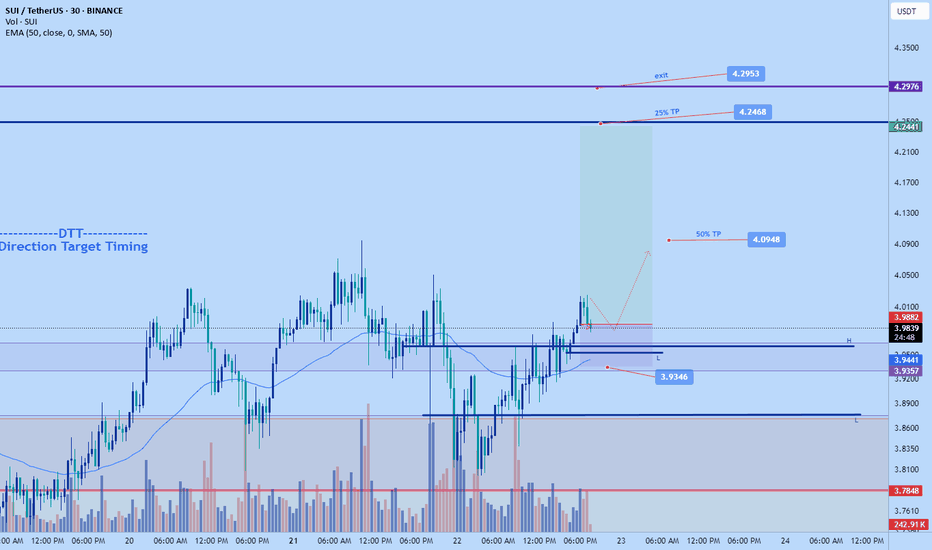

Technical Analysis – SUI/USDT long position (4H Timeframe)

🚀 Technical Analysis – SUI/USDT (4H Timeframe)

🗓 Date: July 22, 2025

📌 Suggested Entry:

$4.12

🎯 First Target:

$5.10 – Risk to reward ratio ≈ 1:2 ✅

🛑 Stop-Loss:

$3.60

---

🔍 Entry Conditions:

✅ If there is strong volume and momentum:

Enter on breakout of the $4.12 level in the 1-hour timeframe

🟡 If the move is slow and volume is low:

Only enter after a candle closes and holds above $4.12, preferably in the 4-hour timeframe

---

📊 Macro Structure Analysis:

🟦 SUI/BTC:

Still in an uptrend with higher highs and higher lows ⬆️

But early signs of trend weakness are showing ⚠️

📈 BTC Dominance (BTC.D):

❗ If 61.31 breaks → stop-loss might be triggered

✅ If 60.42 breaks → supports holding the long position

🌐 TOTAL2 (Altcoin Market Cap):

If it breaks above 1.55 → confirms long entry ✅

💵 USDT Dominance (USDT.D):

Currently in a key zone between 4.26 – 4.14

If a red candle breaks 4.14 🔻 → strong bullish sign for altcoins and a good setup for a long on SUI 💥

---

🎯 Final Strategy and Personal Plan:

I will only enter the trade if all of the following are true:

1. Macro indicators are in favor of altcoins ✅

2. Strong volume and momentum come into the market 🔥

3. Breakout of $4.12 happens with strong and sharp candles 🚀

If the move is slow or macro signals are weak ❌,

I will cancel the trade and ignore the setup.

---

📵 Invalidation:

If SUI can’t break above $4.12, even when macro indicators are bullish, and the market lacks momentum.

---

📣 If this style of analysis helped you, don’t forget to follow ❤️

Leave a comment and share your thoughts 💬

And if you found it useful, hit that rocket so we can fly 🚀

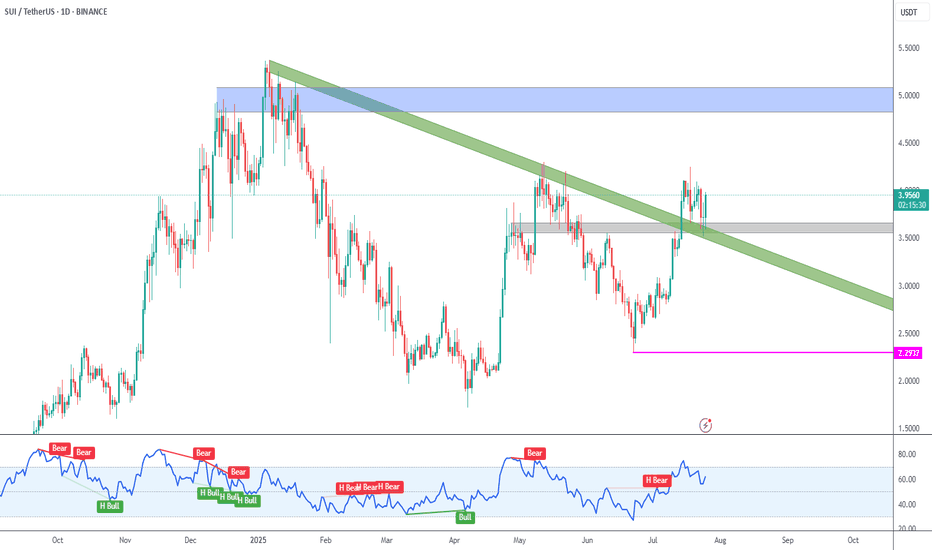

SUI/USDT - Testing the Top of ValueSUI is back in focus as price pushes into a critical zone of resistance that has capped previous rallies. With key moving averages reclaimed and volume shifting in favour of bulls, the question now is simple - can it break free, or is this another trap before rotation lower?

Let’s break down the current structure and what comes next!

SUI is trading at a critical inflection point after staging a strong recovery off the March and April lows . The broader context shows a market transitioning from a bearish phase into a more constructive accumulation structure. The recent price action has been guided largely by reclaiming key areas of previous acceptance and value.

However, sellers are still active at the upper bounds of this range. The next few sessions will determine whether SUI transitions into full breakout mode or requires further consolidation below resistance.

⦿ Volume Profile

The Value Area Low (VAL) is anchored around $1.62 . This area marked the exhaustion point for sellers, triggering the current recovery leg.

The Point of Control (POC), which represents the highest traded volume zone, sits at approximately $2.27 . This zone acted as a magnet for price through May and June and is now firmly reclaimed, reinforcing its importance as a structural support.

The Value Area High (VAH) comes in at $3.82 . Price has recently reclaimed this level, which suggests buyers have shifted control of the auction. Acceptance above the VAH often implies that the previous range is no longer valid and a new range expansion could be underway.

⦿ Key Technical Insights

Several technical levels align with this recovery. The 200-day MA and the anchored VWAP from the all-time high converge between $3.00 and $3.50. This area has been successfully reclaimed and held, adding further conviction to the bullish case.

Above current prices, $4.12 represents the Yearly Open and a clear horizontal supply level. The market has shown hesitation here, as expected. The price action suggests sellers are attempting to defend this zone, but the overall structure remains bullish as long as higher lows are maintained.

Support levels to monitor include $3.82, the Value Area High, and $3.50, where both the VWAP and the 200-day Moving Average provide dynamic support. Below that, the POC at $2.27 remains a crucial level of last defense for bulls.

⦿ Market Structure

Structurally, the market has transitioned from a downtrend into a rounded bottom formation, which typically precedes more sustained uptrends. The higher low structure since the March lows confirms this shift. The recent push above both the POC and VAH further validates the strength of this reversal.

Volume has supported this breakout. We saw clear expansion through the $3.00 handle, suggesting conviction among buyers. The visible consolidation just below $4.12 reflects natural supply pressure but not yet evidence of distribution.

⦿ Scenarios to Consider

1. Bullish Scenario:

If buyers manage to establish acceptance above $4.12, particularly with daily closes through this level, the path higher opens cleanly. The low-volume node between $4.12 and approximately $5.00 suggests limited resistance in this zone. Price could expand swiftly toward $5.36 to $6.00 as a first target.

2. Healthy Pullback Scenario:

Should price reject the $4.12 zone, a pullback toward $3.82 or even $3.50 would be healthy and expected. As long as the structure of higher lows remains intact and price holds above the reclaimed POC at $2.27, this pullback would likely serve as a base for the next leg higher.

3. Bearish Breakdown Scenario:

A sustained loss of $3.00 would be the first real warning sign for bulls. Breaking below the POC at $2.27 would suggest a failed breakout and could see the price cycle back toward the lower end of the volume profile, targeting $2.26 or even the Value Area Low at $1.62. However, given current strength, this scenario looks less likely unless broader market sentiment shifts.

I’m primarily focused on bullish scenarios or potential pullbacks, as the current market looks stronger compared to a few months ago. I believe we’re likely to see some decent long opportunities moving forward.

Let me know your thoughts in the comments! 👇

⚠️ Disclaimer

As always, this post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

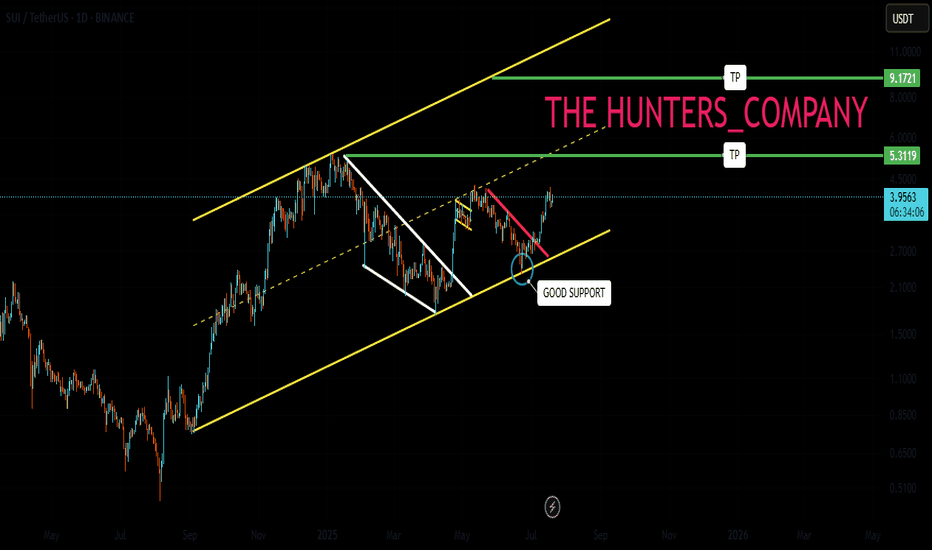

Sui Works To Break Resistance · Play To Win · No StressA flat bottom is bullish because support can be confirmed as found when sellers (bears) fail to move prices past a certain point. A flat bottom produces the double-bottom and triple-bottom reversal signals. When the bottom is flat, depending on the phase the market is going through, we can easily say bullish. A flat top is not bearish, it is a completely different story.

A flat top does not confirm resistance being found and thus a new bearish wave. We need context, it all depends on the phase of the market cycle. A flat top with a rising bottom is bullish. Resistance has been found and is being challenged. It is getting weaker because the action is converging towards the resistance point based on the rising bottom.

Here we have a flat top with a rising bottom (higher lows). The market is bullish. SUIUSDT has been bullish and growing since late 2024. This is the content we need. A bullish tendency, a rising market and resistance being challenged more than once starts to reveal a picture. Next this resistance won't have enough strength to hold. Next time SUI moves up it will continue rising to produce a new all-time high and this will unleash a price discovery phase.

SUIUSDT is trading above EMA55 and EMA89. The last challenge of resistance produced a rejection but this rejection did not lead to a test of the above mentioned support. Another signal of strength.

Sellers cannot push prices lower because buyers are active, or simply put, there are not enough sellers to start and thus the retraces become smaller and shorter. Price dynamics favoring the bulls.

The lows are getting higher, the top remains the same. When the low meets the top that is when resistance breaks. Sui is going up, it will continue to grow; the targets on the chart can be hit short-term.

There is no sense of urgency, but a major advance can be happening within days.

Are you ready to trade and hold? Prices going up aiming high trading requires no effort.

The effort is mental, the mind can be trained to succeed and avoid stress. Mental stress = lack of knowledge. If you know prices are going up and you feel certain about it, no effort is required to win because the mind doesn't have to struggle with questions relating to the strength of your position. The mind does not need to answer, should I buy or should I hold? Since you know prices are going up based on the chart, you can sit back and relax watching your profits grow. Reading relaxes the mind. Knowledge is food for the soul. The more you learn, the more you know the wiser you become. Wise means effortless. Trading can be effortless if you read the right stuff. Play to win. Plan before trading and you already won.

Answer the question before the situation shows up. That's it, you've just removed the complexity out of the game. When there is no complexity, there is no mental stress. Since you are sitting on a chair in front of a device, trading becomes effortless. To trade with peace in your mind you just need the right knowledge and that is what you are getting here. No stress.

Continue reading and watch your profits grow. Increase your peace, free up your time and enjoy better results.

Namaste.

Tension Builds on SUI Chart — Eyes on $3.85CRYPTOCAP:SUI is moving inside a symmetrical triangle pattern.

The price is getting tighter, forming higher lows and lower highs.

This usually means a breakout is coming soon.

If it breaks above the triangle with strong volume, SUI could jump to the $4.60–$4.70 range.

For now, it’s a wait-and-watch setup.

Key support is just below $3.85, staying above that keeps the bullish trend alive.

#Altseason2025

$SUI breaks out with strength!CRYPTOCAP:SUI breaks out with strength, now watching for retest!

SUI has broken above its consolidation range and key resistance zone.

Price is now pulling back slightly, and a retest of the breakout area around $4.00–$4.10 could offer a good continuation setup.

If this level holds, the next leg up toward $5.20–$5.30 is likely.

Breakdown below $3.95 would invalidate the breakout structure.

DYOR, NFA

#SUI #Altseason2025

SUI Trendline Broken

➡️ SUI has broken the green descending trendline originated on the early 2025 high.

➡️ Price is also being held by the gray support zone around 3.60.

➡️ Next target is the blue supply zone at 5.00 round number.

➡️ Invalidation is at 2.2937 (pink line), so be wary of liquidity hunts below gray support.

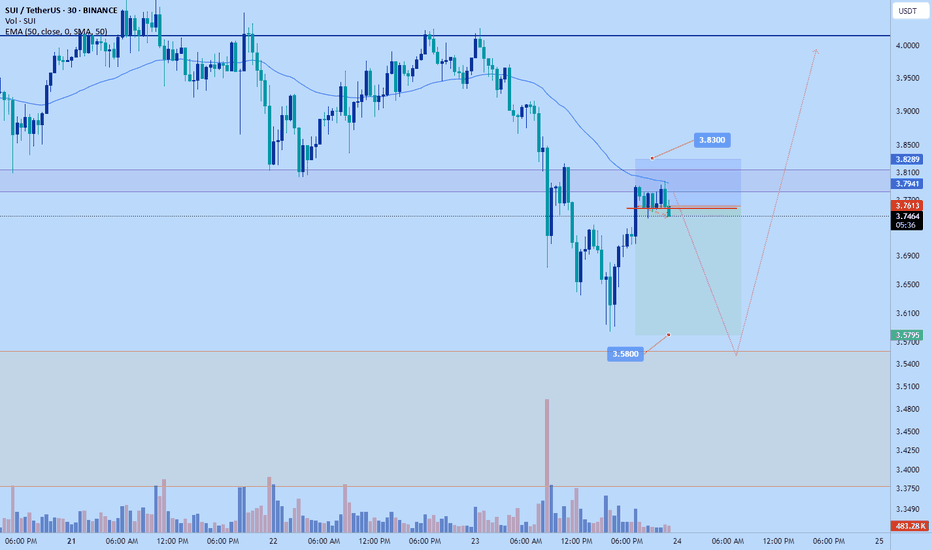

SUI - Upside continuation - with a great R/R of 26SUI has had upside buying pressure since its inception around Jun 23. I have been looking for a chance to get in and this symmetrical triangle shows it is likely to give upside continuation with a great R/R of 26.

Entry - 3.5818

SL - 3.3094

Interval 1 - 3.79

Interval 2 - 6.45

Target - 10.755

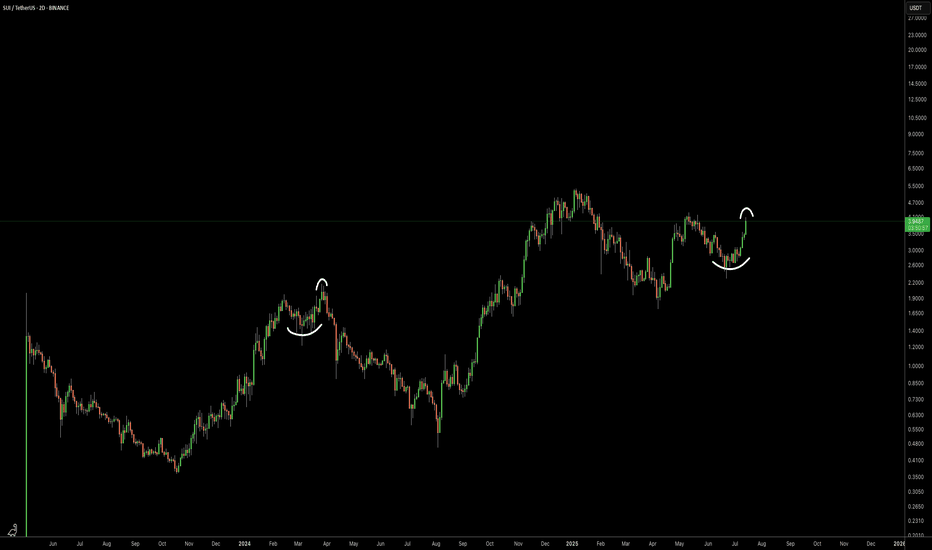

SUI/USDT Massive Cup and Handle Pattern Unfolding Is a Breakout?🧠 Technical Overview:

The daily chart of SUI/USDT showcases a textbook formation of the Cup and Handle pattern — a powerful bullish continuation signal that often precedes explosive upside moves.

The “Cup” took shape between January and July 2025, reflecting a deep rounding bottom. This indicates a long-term accumulation phase where bears gradually lose control.

The “Handle” is currently forming as a downward-sloping consolidation channel, often known as a bullish flag, which is typically the final pause before a breakout.

🔍 Key Technical Levels:

Current Price: $3.9661

Support Zone: $3.96

Major Resistance Levels to Watch:

$4.10 (handle resistance & breakout trigger)

$4.40 (local structural high)

$4.77 (previous high & fib extension zone)

$5.00 (psychological level)

$5.36 (measured move target from cup breakout)

---

🟢 Bullish Scenario: Breakout Incoming

If price breaks and closes above the handle resistance around $4.10, backed by increasing volume:

This confirms the Cup and Handle breakout.

Expect a rapid move toward $4.77 – $5.36 in the short to mid term.

The height of the cup projected upward gives a target of approximately +35% gain from breakout point.

🔔 Watch for:

Bullish engulfing candles

Volume spike during breakout

Break of upper trendline from the handle

---

🔴 Bearish Scenario: Breakdown Risk

If the price fails to hold the $3.96 support and breaks down from the handle channel:

Price may retest lower support zones near $3.60 or even $3.20

However, as long as the cup’s base at ~$2.50 holds, the macro bullish structure remains valid.

⚠️ Invalidation: A daily close below $3.60 would invalidate the short-term bullish setup.

---

📊 Pattern Psychology:

The Cup and Handle pattern reflects investor accumulation, shakeout, and renewed confidence. This is often seen in strong uptrending markets — and the current structure suggests that bulls are quietly preparing for a potential breakout.

---

📅 Timing Outlook:

Handle formations typically last between 1–3 weeks. If this timeline holds, a breakout could occur before mid-August 2025.

---

✅ Conclusion:

The technical setup for SUI/USDT is extremely compelling. With a strong Cup and Handle pattern nearing completion, and key resistance just overhead, traders should prepare for potential breakout conditions. A confirmed move above $4.10 could trigger a bullish wave toward $5.00+.

📌 Set alerts. Manage risk. And don’t ignore the volume.

#SUI #SUIUSDT #CryptoBreakout #CupAndHandle #BullishSetup #CryptoChartPatterns #AltcoinAnalysis #TechnicalAnalysis #BreakoutTrade