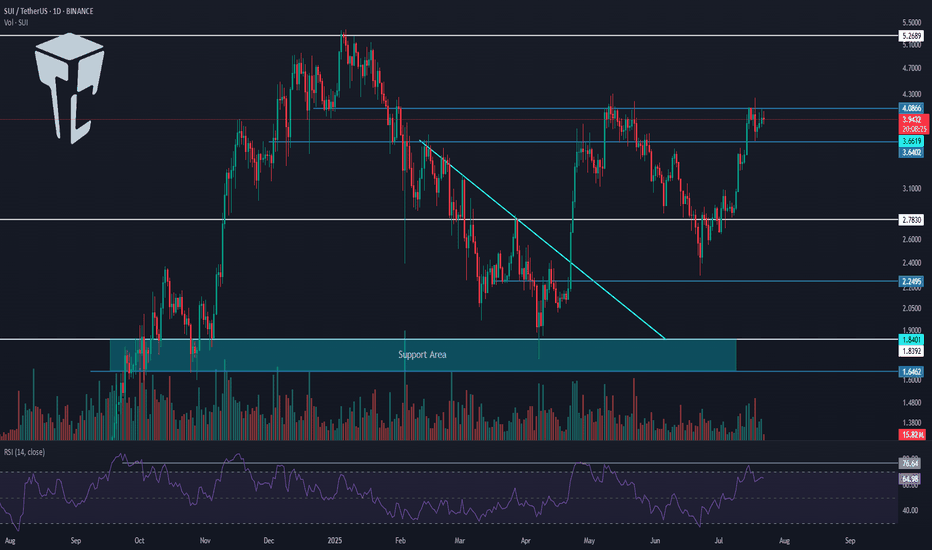

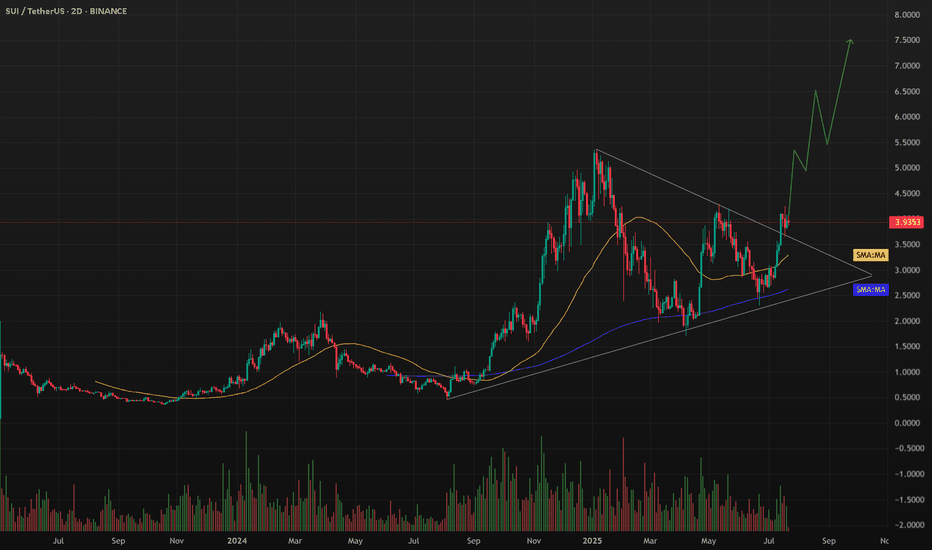

SUI to $5.31? Chart Says It’s 22% Away!SUI is shaping up beautifully on the daily chart. After spending weeks in a consolidation zone, the price has finally broken out with strong momentum and reclaimed bullish territory. The CM_EMA TrendBars are showing green, which confirms a positive directional shift. This indicates the bulls are now back in control.

The most recent breakout has pushed SUI above a key structure level near $3.93, turning previous resistance into new support. What’s impressive is that price didn’t just break this level — it retested it and bounced sharply, suggesting strong buyer interest. This kind of price action is typically seen before continuation moves.

Currently, the setup shows a clean bullish structure. Price is holding firmly above the moving average and is supported by recent higher highs and higher lows. If this momentum continues, SUI could be on its way toward the next major resistance zones, clearly marked on your chart as Profit Target 1 ($5.014) and Profit Target 2 ($5.312).

Volume seems steady, not explosive, but enough to support a sustainable climb — which is ideal for swing setups. This gives the chart a healthy look, especially in the context of the wider altcoin recovery theme.

Now, let's talk about risk. The Stop-Loss is logically placed at $3.602, just below the most recent breakout level and the prior base structure. If the price breaks below this zone, it would likely invalidate the current bullish setup.

🎯 Trading Idea Based on Chart Setup:

• Entry: $4.213 (current zone)

• Stop-Loss: $3.602

• TP1: $5.014 — near-term resistance

• TP2: $5.312 — full extension target

• Risk-to-Reward: ~2.36 on TP2 💹

This is a favorable setup for swing traders with clear levels and a clean chart structure. The EMAs are aligned bullishly, and the breakout has followed a strong trend resumption. If the market conditions continue supporting altcoins, SUI has the potential to outperform in the coming weeks.

In summary, SUI is in a confirmed uptrend, riding strong momentum after a clean breakout. As long as price holds above $3.93 and especially above the stop at $3.60, the path of least resistance remains upward.

SUIUST trade ideas

TradeCityPro | SUI Eyes Breakout with Bullish Momentum Rising👋 Welcome to TradeCity Pro!

In this analysis, I want to review the SUI coin for you. It’s one of the Layer1 projects in the crypto space, currently ranked 13 on CoinMarketCap with a market cap of $13.66 billion.

📅 Daily Timeframe

On the daily timeframe, a lot has changed for SUI since the previous analysis. After breaking the descending trendline, it has started a new bullish trend.

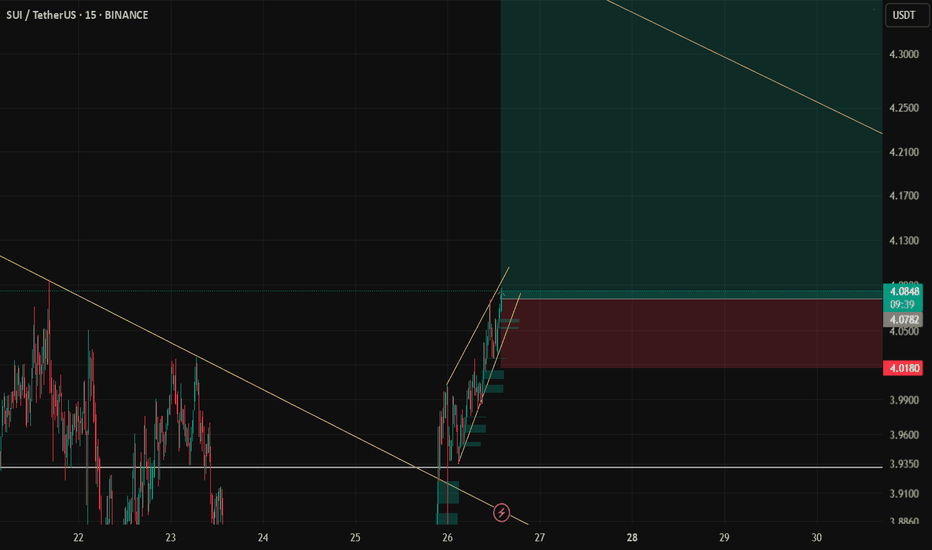

✔️ In the first bullish leg after breaking the trendline, the price reached the 4.0866 zone, and now after a correction, it’s moving upward again.

📈 The 4.0866 level is a very important resistance. In fact, we can draw a resistance range between 3.6402 and 4.0866, as the price tends to behave erratically within this zone.

⭐ Currently, the price has re-entered this range and if 4.0866 is broken, the bullish wave could continue. The first target for this wave could be 5.2689.

🔼 So, if 4.0866 is broken, I highly recommend opening a long position, because if the price truly breaks this level (and it’s not a fake breakout), then the minimum target would be 5.2689.

📊 If the buying volume continues to increase as it is now, and the RSI breaks above 76.64, the chances of breaking 5.2689 will also rise, and the price may even set a new ATH.

👀 I already have an open position on this coin based on lower timeframe triggers, and I’m currently waiting to see the reaction to 4.0866. Based on my entry, if the price moves toward 5.2689, the risk-to-reward ratio will be very high. That’s why I’ve kept part of my position open to potentially capture that move.

🛒 For spot buying, we can also use a futures strategy — meaning if 4.0866 breaks, we open a futures position targeting 5.2689, and then use the profit from that position to buy SUI in spot, gradually building our spot portfolio.

✨ If you are looking at this coin only for spot, the main trigger is the breakout of 5.2689. But be careful — if the price moves aggressively, it might not give you a proper entry trigger, and entering from that area might be difficult.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

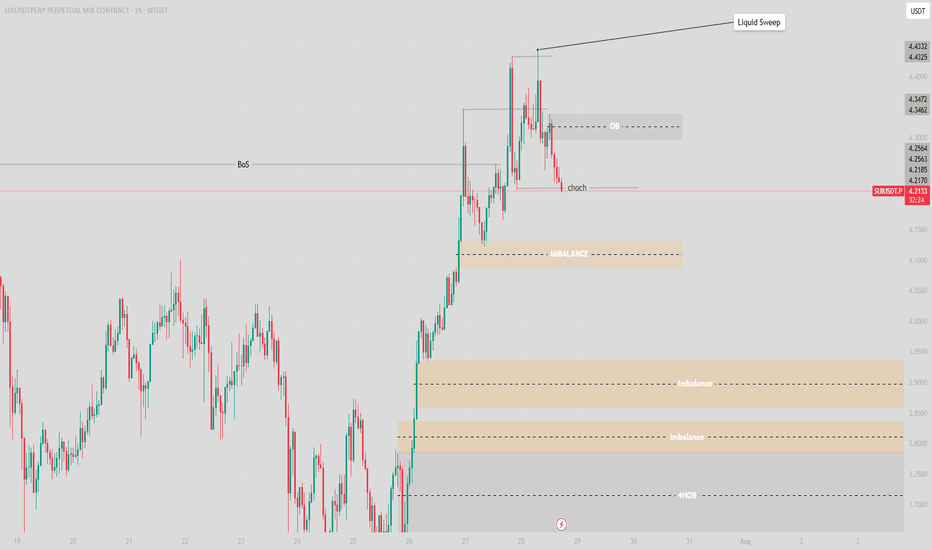

SUI Hits Key Liquidity Zone After – Correction Ahead?SUI has been climbing steadily inside a well-structured ascending channel for the past few weeks. The recent breakout above the $4.30 resistance zone – which was a key liquidity level – seems to have swept stop-losses and trapped late buyers.

🔎 Here's what we're watching:

- Price broke out of the ascending channel briefly and rejected from the upper parallel.

- The breakout above $4.30 was likely a liquidity grab (buy-side liquidity taken).

- Price is now pulling back, showing signs of distribution below resistance.

📉 Expecting a correction toward the lower channel line as price seeks rebalancing.

🧠 Strategy Notes:

- No reason to long here unless price reclaims $4.35 with volume.

- Ideal buy zone is near the midline or lower channel.

- A break below the channel could signal deeper correction toward $3.60 or lower.

📊 Always respect risk – don’t chase after price in these zones.

📡 Analysis by CryptoPilot – navigating the market with precision.

#CryptoPilot #SUI #SmartMoney #LiquidityGrab #CryptoTrading #TrendChannel #Altcoins

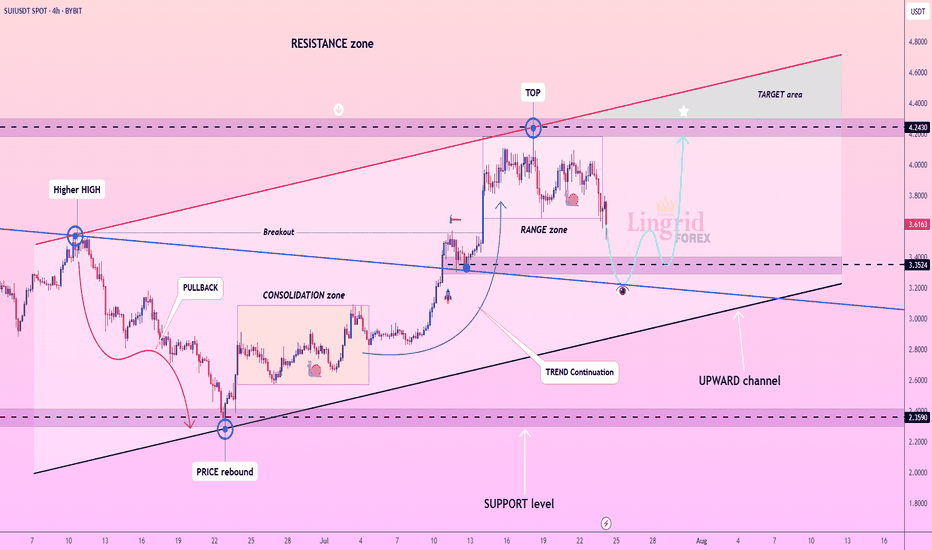

Lingrid | SUIUSDT Buying Opportunity from Support ZoneBYBIT:SUIUSDT is pulling back from the recent range top after testing the resistance zone and is approaching the key breakout area. The structure shows an upward channel with a prior consolidation breakout and an ongoing corrective retracement. As long as the price holds above the confluence zone near 3.35, the bullish structure remains intact. Broader momentum supports trend continuation toward the upper resistance boundary and the target area.

📉 Key Levels

Buy trigger: Break above 3.75 with volume

Buy zone: 3.25 – 3.35

Target: 4.24

Invalidation: Break below 3.22

💡 Risks

Breakdown below channel support would flip structure bearish

Fading volume on bounce may signal exhaustion

Broader market weakness could suppress upside momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

SUI | Spot Buy Zone for PullbackPrice has pulled back after a local top and is heading toward a clear demand zone.

Key buy area sits around $3.12, aligned with 0.618 retracement and recent consolidation.

Strong structure below—if majors keep retracing, this is where risk/reward for new spot buys becomes attractive.

Plan:

Waiting for price to reach the green zone to accumulate spot.

Invalidation below $2.80, targeting a move back toward $4.45 and higher if momentum returns.

#SUI Update #2 – July 31, 2025#SUI Update #2 – July 31, 2025

SUI has completed the correction of its last impulsive move and has started another upward movement. Although it currently appears to be a weak move, I believe it will provide around a 10% profit. As shown in the chart, I have opened a long position.

#SUI/USDT Update – Bounce Setup from Demand Zone?#SUI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 3.27, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 3.20.

Entry price: 3.38

First target: 3.58

Second target: 3.65

Third target: 3.80

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

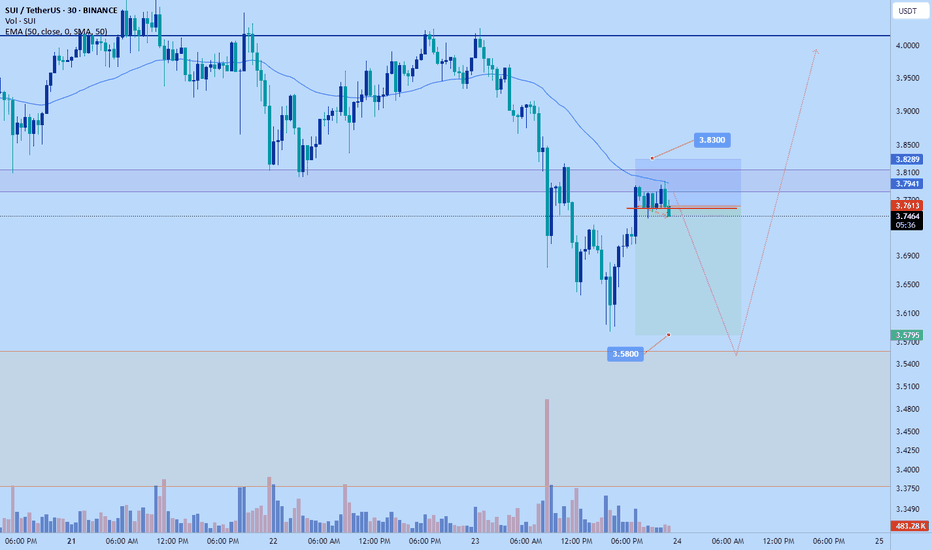

SUI/USDT Update – Bounce Setup from Demand Zone?In the previous analysis, we highlighted a short opportunity near $4.20, which played out perfectly. Now, SUI has reached a key demand zone around $3.40–$3.55, overlapping with the lower boundary of the ascending channel and a previously defined bullish order block.

🔹 Market Structure:

After breaking the bullish structure, price is now revisiting a major liquidity zone between $3.40 and $3.55.

🔹 Price Behavior:

Wicks to the downside suggest buy-side absorption and potential for short-term reversal.

🔹 Possible Scenario:

If the $3.40 zone holds, we could see a corrective move up to the supply zone around $3.90–$4.00.

📌 Key Levels:

• Support: $3.40–$3.55

• Resistance: $3.90–$4.00

❗️If the $3.40 support fails, bullish momentum will likely be invalidated in the short term.

🧠 Pro Tip (SMC-based):

When a demand zone aligns with liquidity sweep and channel support, it often becomes a high-probability area for institutional re-entries. Wait for a clear confirmation like BOS or bullish engulfing candle before entering.

⸻

🔗 Like, share, and follow for more Smart Money & Elliott Wave-based insights!

SUI 1H – Breakdown & Retest of Key Support, But Will It Reject?SUI 1H – Breakdown & Retest of Key Support, But Will It Reject or Reclaim?

Description:

SUI just completed a textbook range breakdown after weeks of sideways chop between ~$3.60–$4.10. The prior support floor has now flipped into resistance, and the recent bounce appears to be retesting that structure. If this retest gets rejected, continuation toward lower support zones (potentially $3.30 and below) becomes likely.

However, reclaiming and holding above $3.60 could trap late shorts and fuel a squeeze. Structure still favors bears for now, but it’s decision time.

📌 Breakdown structure

📌 Bearish retest

📌 Eyes on confirmation or invalidation

This is the battle zone — stay sharp.

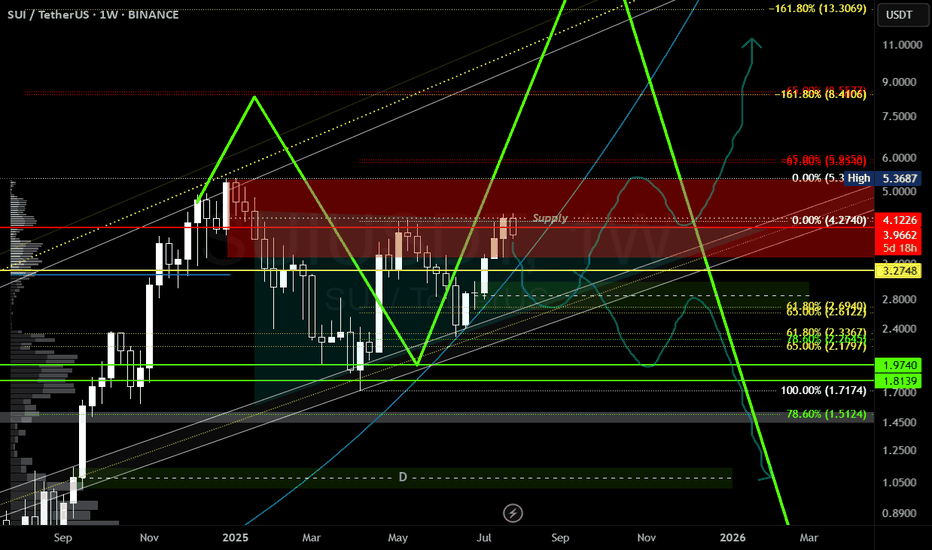

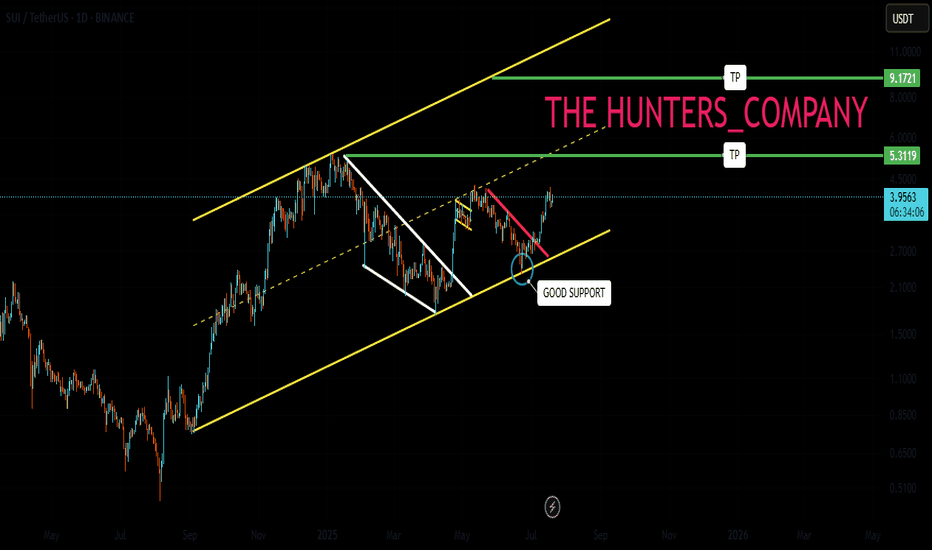

#SUI HTF Update Major update on #SUI after 6 months or so...

We have been tracking this idea since 2024, i am still biased with entire market & not looking at 2026 for ONE MORE run up, we just have few months left now & with august coming up i believe we will see one final dip before blasting everything in September. Majors topping around September & other alts like sui probably in October.

I have already updated about my positions before do check if you haven't yet.

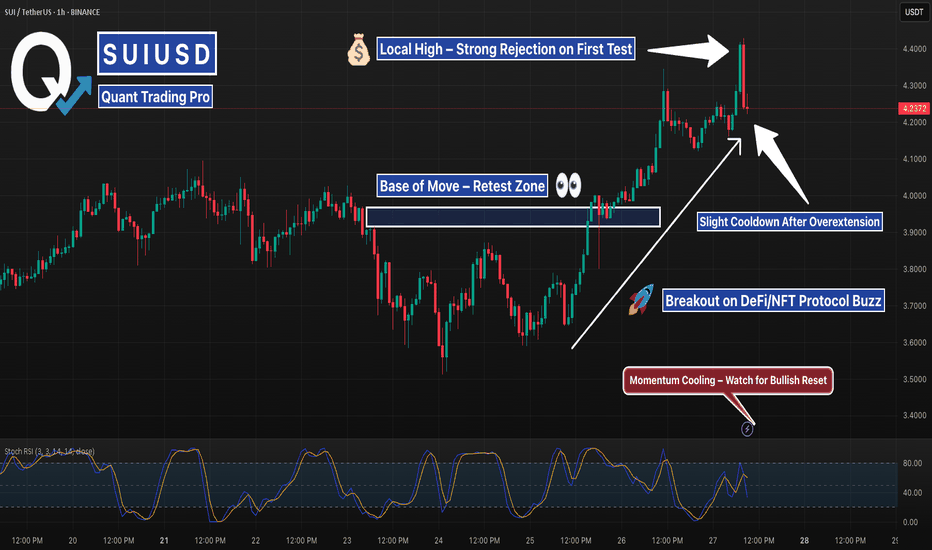

SUI Breaks Out on Hype Surge — Momentum Cooling After Sharp PumpSUIUSDT 1H chart showing a clean breakout following renewed hype around SUI’s DeFi/NFT expansion. Over the past 48 hours, SUI gained ~15% as social buzz and bullish sentiment picked up — driven by strong ecosystem growth and analysts labeling it “ready for a second wave.”

Price broke above recent consolidation around the $3.95–$4.10 zone and surged to new local highs near $4.40. However, the first test of that high was immediately rejected, with the current candle showing signs of a minor cooldown. Stochastic RSI confirms this — hinting at potential for a short retracement or consolidation before continuation.

Key levels to watch:

$4.10–$4.00 zone (potential retest support)

$4.40 high as breakout resistance

Stoch RSI reset for a second leg

If buyers step in quickly on a retest, this breakout could extend into new territory. If not, we may see a revisit to the $4 zone before any further upside.

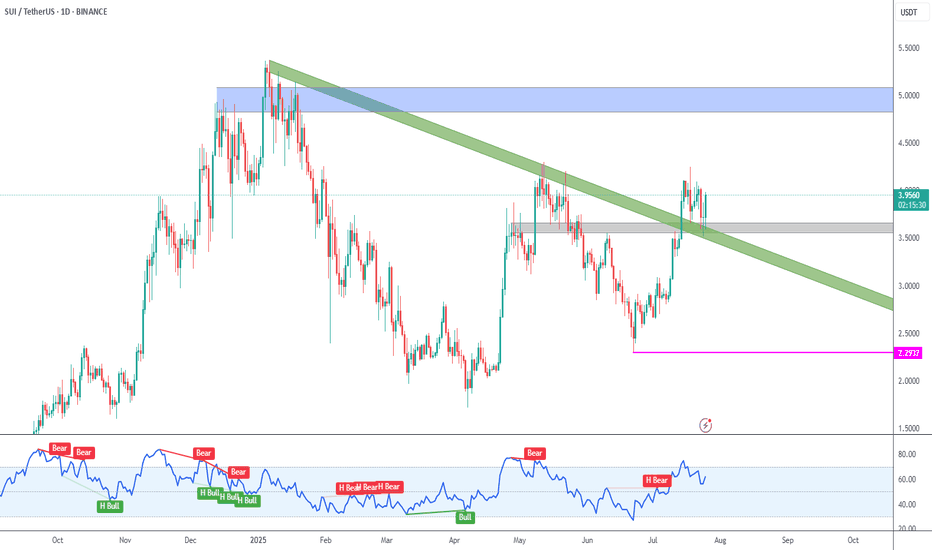

SUI Trendline Broken

➡️ SUI has broken the green descending trendline originated on the early 2025 high.

➡️ Price is also being held by the gray support zone around 3.60.

➡️ Next target is the blue supply zone at 5.00 round number.

➡️ Invalidation is at 2.2937 (pink line), so be wary of liquidity hunts below gray support.

SUI : HODL BASKETHello friends🙌

🔊We have come to introduce a signal that can be a good option for your investment portfolio.

Given that the price is in the ascending channel and has good support from buyers, it is expected that this time the price will break the middle line of the channel and move to the ceiling of the channel and succeed in reaching ATH...

Don't forget about capital and risk management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

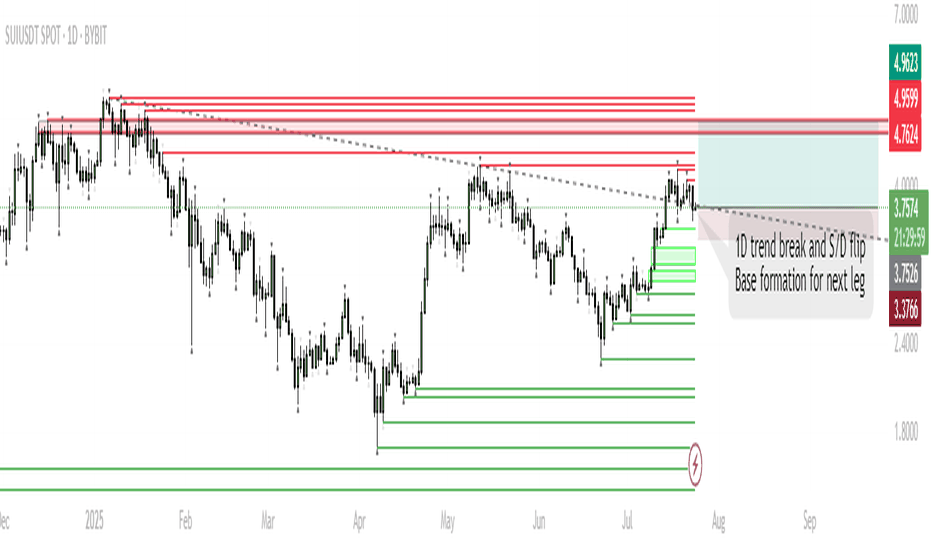

SUI – Base Formation for Next Leg HigherTrend Shift:

SUI has broken the 1D downtrend and is now consolidating above a key supply/demand zone, suggesting accumulation.

Short-Term Range:

Expect ranging/chop as price tests acceptance above broken resistance. This phase could last up to a week.

Trigger for Next Move:

Sustained closes above $4.0 will signal buyers are in control, opening the way for a move higher.

Targets:

If the base holds and SUI establishes above resistance, the next push is toward $5.10–$5.40 (previous highs/ATH zone).

Invalidation:

A sustained move below $3.37 would invalidate the bullish base thesis and open the door for deeper retrace.

SUI has flipped its 1D trend and is now consolidating above a key S/D level. Historically, such consolidations above reclaimed resistance often precede strong trend continuation. While a short-term range is likely as the market digests recent gains, the structure favors an eventual push toward previous highs and potentially new ATHs in August. Patience during this ranging phase is key; the setup remains bullish unless price falls back below $3.37.

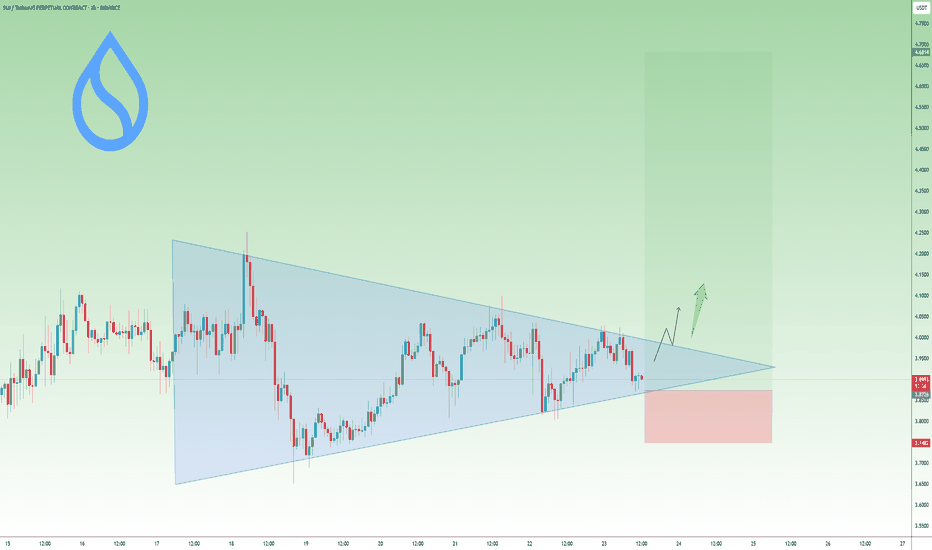

Tension Builds on SUI Chart — Eyes on $3.85CRYPTOCAP:SUI is moving inside a symmetrical triangle pattern.

The price is getting tighter, forming higher lows and lower highs.

This usually means a breakout is coming soon.

If it breaks above the triangle with strong volume, SUI could jump to the $4.60–$4.70 range.

For now, it’s a wait-and-watch setup.

Key support is just below $3.85, staying above that keeps the bullish trend alive.

#Altseason2025

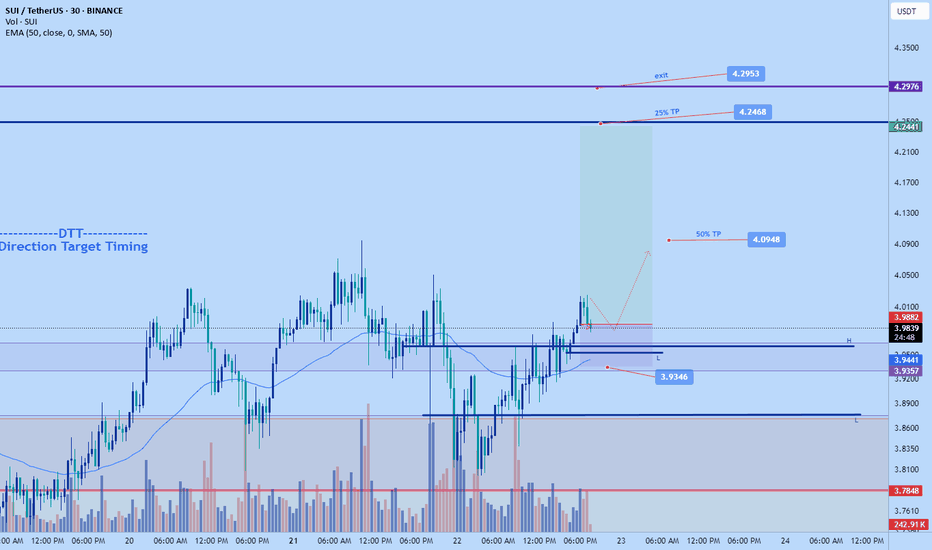

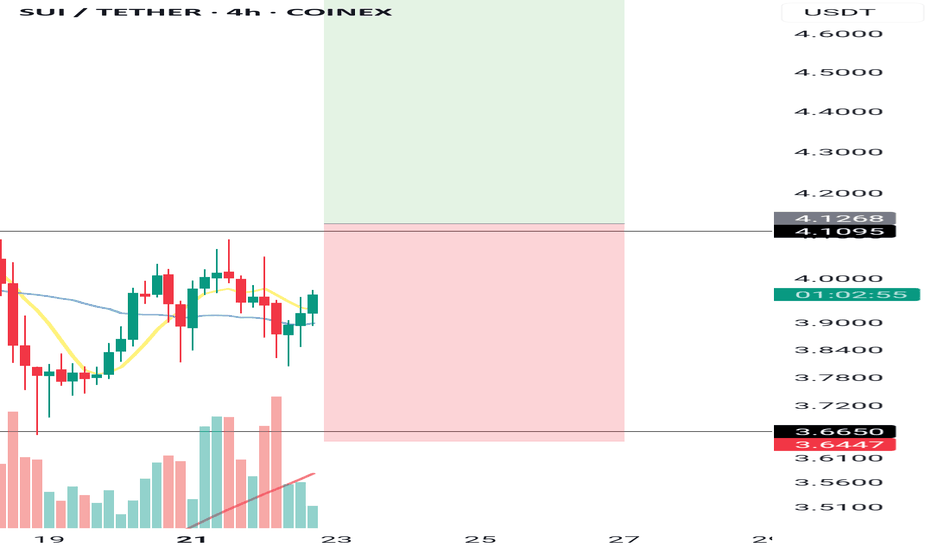

Technical Analysis – SUI/USDT long position (4H Timeframe)

🚀 Technical Analysis – SUI/USDT (4H Timeframe)

🗓 Date: July 22, 2025

📌 Suggested Entry:

$4.12

🎯 First Target:

$5.10 – Risk to reward ratio ≈ 1:2 ✅

🛑 Stop-Loss:

$3.60

---

🔍 Entry Conditions:

✅ If there is strong volume and momentum:

Enter on breakout of the $4.12 level in the 1-hour timeframe

🟡 If the move is slow and volume is low:

Only enter after a candle closes and holds above $4.12, preferably in the 4-hour timeframe

---

📊 Macro Structure Analysis:

🟦 SUI/BTC:

Still in an uptrend with higher highs and higher lows ⬆️

But early signs of trend weakness are showing ⚠️

📈 BTC Dominance (BTC.D):

❗ If 61.31 breaks → stop-loss might be triggered

✅ If 60.42 breaks → supports holding the long position

🌐 TOTAL2 (Altcoin Market Cap):

If it breaks above 1.55 → confirms long entry ✅

💵 USDT Dominance (USDT.D):

Currently in a key zone between 4.26 – 4.14

If a red candle breaks 4.14 🔻 → strong bullish sign for altcoins and a good setup for a long on SUI 💥

---

🎯 Final Strategy and Personal Plan:

I will only enter the trade if all of the following are true:

1. Macro indicators are in favor of altcoins ✅

2. Strong volume and momentum come into the market 🔥

3. Breakout of $4.12 happens with strong and sharp candles 🚀

If the move is slow or macro signals are weak ❌,

I will cancel the trade and ignore the setup.

---

📵 Invalidation:

If SUI can’t break above $4.12, even when macro indicators are bullish, and the market lacks momentum.

---

📣 If this style of analysis helped you, don’t forget to follow ❤️

Leave a comment and share your thoughts 💬

And if you found it useful, hit that rocket so we can fly 🚀