Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.0924 EUR

1.82 B EUR

28.15 B EUR

3.63 B

About CMOC GROUP LIMITED

Sector

Industry

CEO

Rui Wen Sun

Website

Headquarters

Luoyang

Founded

2006

ISIN

CNE100000114

FIGI

BBG000QH7L36

CMOC Group Ltd. engages in manufacturing, marketing, and exploration of copper properties. It operates through the following segments: Copper and Gold Related Products, Niobium and Phosphorus Related Products, Copper and Cobalt Products, Metals Business, and Others. The company was founded on August 25, 2006 and is headquartered in Luoyang, China.

Related stocks

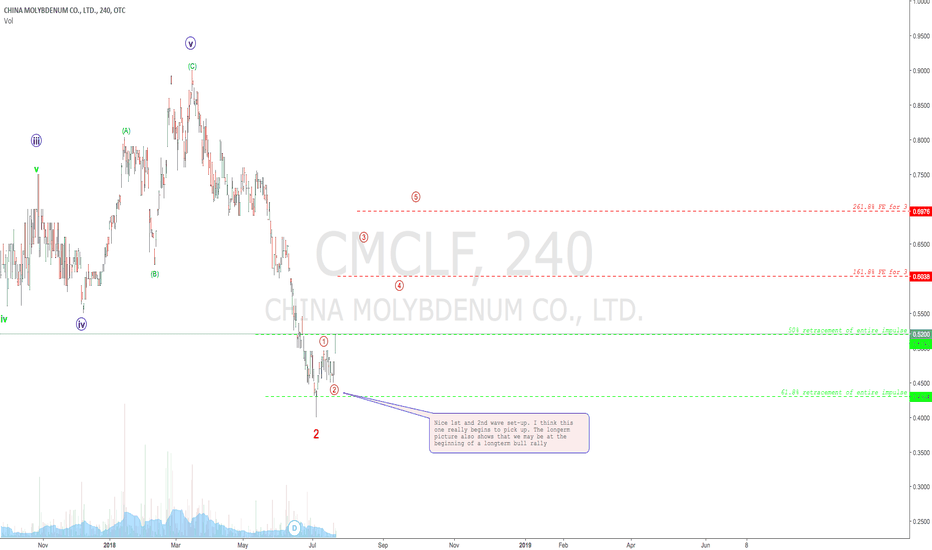

China Molybdenum Co looks like a great buyCMCLF looks substantially bullish both short term and longterm. We are also currently trading really good entry levels.

Below is the longterm picture. If we stick to this picture, trading this will provide great opportunities to scale the position size up as the play builds.

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange China Molybdenum Co. Ltd. stocks are traded under the ticker D7N.

We've gathered analysts' opinions on China Molybdenum Co. Ltd. future price: according to them, D7N price has a max estimate of 1.28 EUR and a min estimate of 0.80 EUR. Watch D7N chart and read a more detailed China Molybdenum Co. Ltd. stock forecast: see what analysts think of China Molybdenum Co. Ltd. and suggest that you do with its stocks.

Yes, you can track China Molybdenum Co. Ltd. financials in yearly and quarterly reports right on TradingView.

China Molybdenum Co. Ltd. is going to release the next earnings report on Aug 23, 2025. Keep track of upcoming events with our Earnings Calendar.

D7N earnings for the last quarter are 0.02 EUR per share, whereas the estimation was 0.02 EUR resulting in a 16.62% surprise. The estimated earnings for the next quarter are 0.02 EUR per share. See more details about China Molybdenum Co. Ltd. earnings.

China Molybdenum Co. Ltd. revenue for the last quarter amounts to 5.86 B EUR, despite the estimated figure of 7.56 B EUR. In the next quarter, revenue is expected to reach 7.51 B EUR.

D7N net income for the last quarter is 501.08 M EUR, while the quarter before that showed 706.96 M EUR of net income which accounts for −29.12% change. Track more China Molybdenum Co. Ltd. financial stats to get the full picture.

China Molybdenum Co. Ltd. dividend yield was 5.29% in 2024, and payout ratio reached 40.49%. The year before the numbers were 3.97% and 39.76% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 8, 2025, the company has 12.32 K employees. See our rating of the largest employees — is China Molybdenum Co. Ltd. on this list?

Like other stocks, D7N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade China Molybdenum Co. Ltd. stock right from TradingView charts — choose your broker and connect to your account.