Synapse Short-Term Trade, To Move Next · 309% Profits PotentialLet me give you another pair that is ready to move, just in case you want to make some quick profits for the weekend (next weekend).

Good evening my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

Everything we were expecting is now becoming all true. The altcoins market is bullish and moving up. We have long-term and short-term charts. Here you have a little bit of both.

Synapse will grow long-term of course, but we will focus on a sudden jump that will be happening next. Can be tomorrow, in a few days or a week or so maximum. The chart is bullish now.

Many pairs are moving past their April's high, I take this as a very strong bullish signal. Many pairs are still trading below. I take this also as an opportunity, it means that we can buy them before the breakout and enjoy fast, easy growth. The choice is yours.

Trading above EMA8/13/21/34.

Yesterday's candle is interesting and the really high volume 8-July. Remember, high volume at low prices with marketwide bullish action and you need no more. We are bullish, bullish now, bullish later—may profits come. Thanks a lot for your continued support.

309% potential profits is the next high. A minor stop and then higher.

You can cap your earnings even sooner at 124%, 226% or wait for the full 300%. Whatever you choose is up to you. Easy win with low risk when trading spot; you can't go wrong.

Thanks a lot for the follow, the trust and your continued support.

-----

The chart also shows a rounded bottom as a lower low. The lower low is a bullish signal because all weak hands were removed. When support is pierced on a broader bullish bias this is bullish. The action is happening back above the 7-April low and this works as confirmation of the move that I am predicting now. The pierce of support is not a bearish impulse/wave but rather a stop-loss hunt event.

Namaste.

SYNUSDT trade ideas

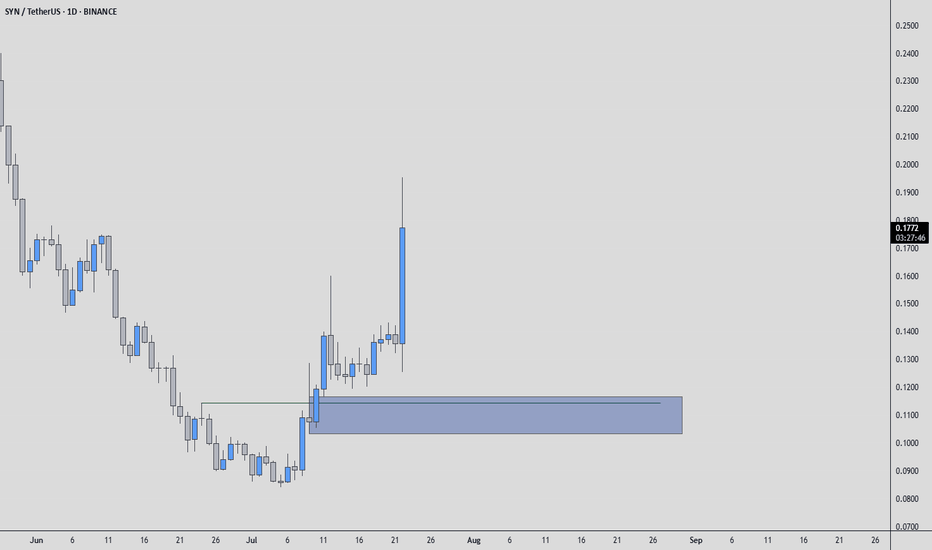

SYNUSDT: Mid-Term AnalysisPrice is rising strongly.

The blue box is a fair price to join as a buyer if the market gives it.

I’m not chasing high prices. If price returns to my blue box, I’ll watch for:

✅ Footprint absorption

✅ CDV support

✅ Structure reclaim

If these align, I’ll consider a long with clear risk. If not, I’ll wait.

The right price, or no trade.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

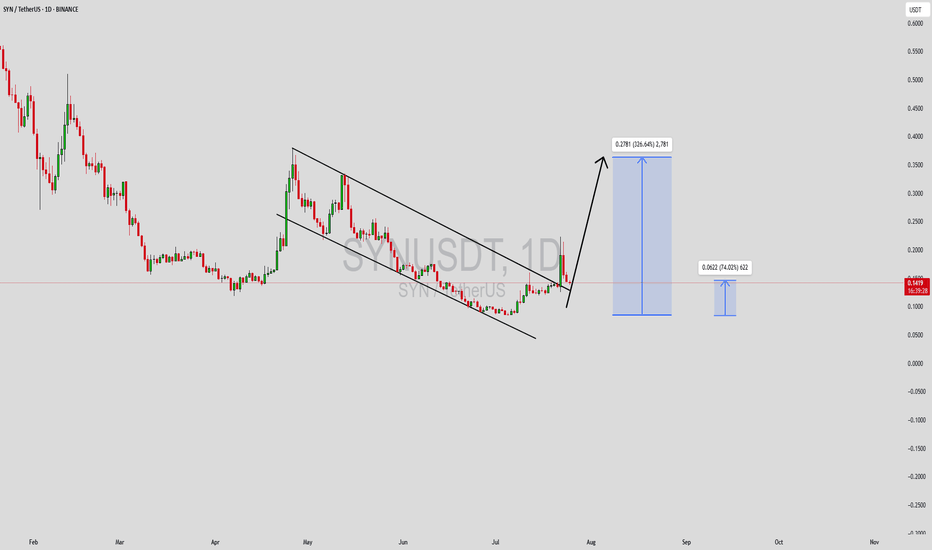

SYNUSDT Forming Falling WedgeSYNUSDT is currently exhibiting a falling wedge pattern, a classically bullish structure that often precedes a breakout to the upside. This setup forms when price action contracts between two downward-sloping trend lines, indicating a slowing of selling momentum and the potential for a strong reversal. As SYNUSDT trades within this narrowing range, increasing investor interest and a notable uptick in volume suggest that a breakout could be on the horizon.

A falling wedge pattern, when supported by good volume, often signals accumulation by smart money ahead of a bullish reversal. With SYN (Synapse) being a prominent player in the cross-chain interoperability and bridging space, the project continues to attract both retail and institutional attention. The expected gain of 290% to 300% aligns with previous breakout behaviors seen from similar wedge patterns in SYN’s trading history. As the crypto market gradually recovers from recent volatility, assets with solid use cases and active development teams are likely to outperform—and SYN fits that profile.

Technical indicators such as RSI and MACD are showing early signs of a reversal, supporting the bullish bias. A confirmed breakout above the upper trendline with a sustained volume increase could trigger a swift rally, reclaiming previous resistance zones and offering traders an attractive risk-to-reward ratio. The 4H and daily charts suggest momentum is building, which makes this a key watchlist candidate in the short term.

With its real-world utility in DeFi infrastructure and increasing partnerships, SYN is becoming a cornerstone for multichain liquidity transfers. SYNUSDT may be poised for a meaningful upward move if this falling wedge pattern completes successfully.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SYNUSDT Forming Falling WedgeSYNUSDT is showing a classic falling wedge pattern, which is widely known as a strong bullish reversal signal in crypto technical analysis. This pattern suggests that the downtrend might be coming to an end, and the recent uptick in trading volume adds further confidence that a breakout could be imminent. With an ambitious expected gain of 290% to 300%+, SYN is positioning itself as a potential high-reward opportunity for traders who are ready to act early on a trend reversal.

The Synapse protocol, which powers SYN, continues to expand its cross-chain interoperability solutions, attracting fresh investor interest. As DeFi users and protocols seek seamless asset transfers across different blockchains, Synapse’s technology stands out, driving long-term growth potential for its token. The increased developer activity and expanding partnerships contribute to a solid fundamental backdrop that supports this optimistic technical setup.

From a technical standpoint, traders should keep a close watch on the resistance line of the falling wedge. A confirmed breakout with strong volume could act as a catalyst for rapid price movement toward the target zone. Patience and good risk management will be key, as such large percentage gains often come with significant volatility.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

On-Demand Analysis: $SYN/USDTThis 6H chart shows a drop from around 0.1138 to a low of 0.0840 recently, but it’s now up 23.8% in the last 24 hours due to a technical rebound, whale accumulation, and market-wide liquidity inflows—despite lingering delisting risks!

The tiny dip (-0.30%) today might just be a pause.

A falling wedge pattern is forming—could be a sign of more gains!

Crux:

Support Zone: A strong base is at 0.0900-0.1000, where buyers might step in.

Resistance Level: The next big test is at 0.1100-0.1138 break that, and it could rise!

Falling Wedge: This pattern, with its narrowing lines, often signals a bullish move if it breaks above 0.1138.

Momentum: The uptrend has steady volume, boosted by whale activity and liquidity inflows, though delisting risks linger

Timeframe:Watch the next few days for the wedge to break out

Possibilities:Bullish Move: A jump above 0.1138 with good volume could push it to 0.1300 or more

Bearish Drop: A fall below 0.0900 might take it back to 0.0840—stay careful!

Safety Tip: Set a stop-loss below 0.0900 to stay safe.

SYN | Expected 25% Gain!!!Technical Analysis Update

A parallel channel breakout and retest has been confirmed on the daily timeframe✅, indicating a potential massive bullish rally. We anticipate a 25% bullish wave in the coming days. 🎯🚀

Trading Strategy

- Entry: Consider long positions

- Stop-loss: Set at 0.1834, just below the support level

- Risk-reward ratio: 1:3

Trading Reminder

- Assess your risk and calculate potential losses before entering any trade.

- Trade wisely and only enter positions that align with your strategy and risk tolerance.

- Stay calm and avoid impulsive decisions driven by FOMO. Trading is a long-term journey.

$SYN Bullish Prediction! Weekly chartGreetings to all traders,

I would like to bring to your attention a potentially lucrative bullish opportunity that has emerged in the market. The initial psychological resistance level is situated around the $1 mark (0.618 Fib), while a more substantial weekly and daily resistance zone can be found between $0.55 and $0.58 (0.216 Fib). Notably, the weekly volume candle recently reached an unprecedented high, which strongly suggests the potential for further upward momentum. This observation further reinforces the notion that the recent price action is not a deceptive "fake-out" candle.

Furthermore, the $1.46 zone (1 Fib) presents an intriguing target. Should a general bullish impulse or bullish bull wave materialize, we may witness price action extending beyond this level.

I hope this analysis provides valuable insights for your trading endeavors.

SYN ANALYSIS📊 #SYN Analysis : Update

✅ Here we can see the price is around its major support zone. Falling wedge pattern is forming and 2 times bullish move from the same support point. We would see a good breakout soon and achieve our targets

👀Current Price: $0.4542

🚀 Target Price: $0.9700

⚡️What to do ?

👀Keep an eye on #SYN price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#SYN #Cryptocurrency #TechnicalAnalysis #DYOR

SYN/USDTKey Level Zone : 0.6350-0.6450

HMT v3.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

SYN/USDTKey Level Zone : 0.6180-0.6250

HMT v3.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

SYN about to trap some bullsWe've entered the orange structure and overshot our normal target due to consolidation in the B phase. However, the red sequence started prematurely, turning before reaching the reversal zone. This suggests the current structure may not follow typical patterns.

The forming green structure, with constantly lower lows in the X phase, is concerning, especially given Synapse's relatively new data and the untested equal lows acting like a magnet for liquidity.

Given my outlook on Bitcoin falling further, I expect the green structure to fail and the range low to be taken out before any bullish structures form. So, I'd advise caution: wait and see how the market reacts at the range low. Once we see a bullish structure, then it's time to trade. For now, patience is key.

Synapse (SYNUSDT) Primed for the Next Big Move🚀 Synapse (SYNUSDT) Primed for the Next Big Move? 🌉

Hey, fellow traders and Synapse enthusiasts! Let's break down an intriguing setup for SYN/USDT on the 9-hour chart! 📈

Current Price: $0.5882

💥 Resistance Ahead? We’re keeping a close eye on the resistance zone (R) just above $0.59, as breaking past this level could open up the door to our potential Take Profit 1 (TP1) at $0.8326. This range holds substantial liquidity and could set the pace for a bullish breakout.

🔥 Target Levels:

TP1: $0.8326 – First milestone, where momentum may consolidate.

TP2: $1.0143 – Strengthening buyer interest.

TP3: $1.25 – Eyeing mid-level resistance for the next phase.

TP4: $1.60 – 🚀 Moon mission confirmed?

📉 Pullback Potential: There's notable support around $0.55, giving SYN a solid foundation for any retests. Key long-term holders and smart money may be accumulating here. A dip could be a smart entry for risk-managed positioning.

🧠 Projection Confidence: Moderately Strong – aligning with historical support zones, Fibonacci levels, and volume trends.

Is this the moment SYN climbs the ladder of price targets, one by one? Stay tuned as the Synapse ecosystem evolves. Watch for confirmations, and always remember – good risk management is key! 🛡️💪

$SYN - Sign of strength in progressSeems to be the sign of strength move here on LSE:SYN , with a measured move from the ascending triangle on our daily, that would take you into the top of the range.

Typically this is where you would expect a partial decline / consolidation while supply is absorbed.

Assuming this is correctly identified, you would expect a second test of the range high which confirms the partial decline, and statistically favors a breakout there after.

You would expect to see rising volume and strength into the second test, and escape velocity taking you into extension levels.

The measured move finds confluence with the 1.618, and could very well be where we end up in time here.

SYN is also getting ready to partySYNAPSE is getting stronger today and with this happing - a bullish signal emerged

If we take a look at the prior green candles from feb2024 we can see it like to go up fast.

Targets on chart

For any questions just leave a comment 🌟

About SYN

Securely connect every blockchain

Synapse is comprised of a cross-chain messaging framework and an economically secure method to reach consensus on the validity of cross-chain transactions, enabling developers to build truly native cross-chain apps.

Powering the most popular bridge

Synapse Bridge is built on top of the cross-chain infrastructure enabling users to seamlessly transfer assets across all blockchains. The Bridge has become the most widely-used method to move assets cross-chain, offering low cost, fast, and secure bridging.

Deep Liquidity

Swap native assets using our cross-chain AMM liquidity pools

Wide Support

Access over 16 different EVM and non-EVM blockchains with more integrations coming soon

Developer Friendly

Easily integrate cross-chain token bridging natively into your decentralized application

SYYUSDT STRONG BUYY!!!"I am analyzing the potential price movement of SYN/USDT. Based on recent trends and indicators, I see a potential upward trajectory. My target price (TP) is set at 1.87, which aligns with key resistance levels. I will continue monitoring market conditions to adjust the target if needed."

STRONG BUY !!!