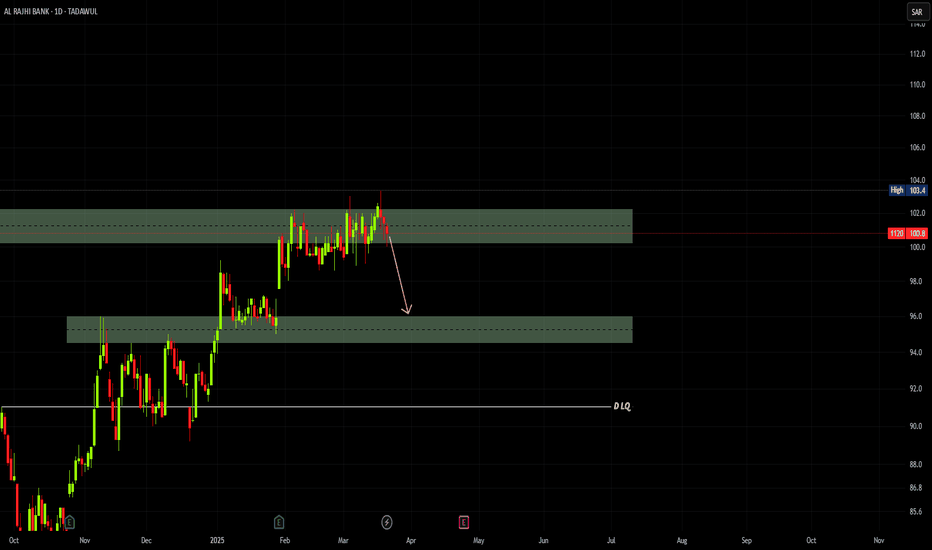

1120 IS GOING TOWARDS 82.6AL Rajhi is one of the stocks most of people buy,

I have read in a group yesterday that it's a golden oppoertunity to buy it now, but if we have a look at the chart, we'll see the opposite, the price just made a reversal as you can see, now it is heading towards 82.6 AT LEAST , don't rush and bu

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.35 SAR

18.69 B SAR

60.14 B SAR

3.91 B

About AL RAJHI BANK

Sector

Industry

CEO

Walid bin Abdullah Ali Al-Moqbel

Website

Headquarters

Riyadh

Founded

1957

ISIN

SA0007879113

FIGI

BBG000FBK1L0

Al Rajhi Bank engages in the provision of banking, financing, and investment services. It operates through the following segments: Retail, Corporate, Treasury, and Investment Services Brokerage, and Other. The Retail segment includes individual customer deposits, credit facilities, customer debit current accounts, fees from banking services and remittance business. The Corporate segment incorporates deposits, corporate customer deposits, corporate credit facilities, and debit current accounts. The Treasury segment provides treasury services and portfolios. The Investment Services and Brokerage, and Other segments incorporate investments of individuals and corporate in mutual funds, local and international share trading services, and investment portfolios. The company was founded in 1957 and is headquartered in Riyadh, Saudi Arabia.

Related stocks

1120 IS PREPARING AN ENTRYDear Saudi Traders,

Been a while since I last posted, and here I am now with the pdates on the market.

We're all aware of the American-Saudi Business situation and how it affected the markets last week, yet we don't know for how long it will last and how lower the markets will get.

However, TASI

1120 STILL PREPARING TO COME LOWERDays ago, I posted that 1120 will come lower, and still it didn't since it kept consolidating in the LQ we have at 102.2-100.2, we'd expect the price to come at 96.0 for a LQ Grab before continuing going higher.

Meanwhile my clients and I are holding on 3 stocks which I will share to the public as

DONT BUY 1120 YETSome days ago, I posted not to buy 1120, and still some of you texted and argued about it, if you really are an investor you won't just throw your money away on Stocks.

However, you will get a consultation to know how the movement of the market is, how the market is reacting to the level it is in..

NOT A GREAT TIME TO BUY 1120A month ago, I posted to close 1120 at 100.2 in case you're a buyer, some of you did indeed listen, some others managed to text me and argue about what I posted, and now you got the proof of what I was saying.

Now you'll wait for the price to come down to l96.0, there we can decide how the market w

ANALYSIS ON 1120I received texts about 1120 if you can buy or no especially after the last reports, you can see that the price came and broke the LQ level we have at 94.5-96.1 and now it is heading towards the LQ zone at 100.2.

I told my clients to sell at 94.5 where we have the LQ zone as a safety exit, but the p

UPDATE ON 1120A month ago, I posted not to buy on 1120, and still some texted me and complained, after that it went higher they bought and now they're in losses.

The price is still consolidating on its range, it came up to the liquidity zone to grab it, now it reversed again to go lower.

If you are a person wh

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS303853022

RAJHI SUKUK 25/30 MTNYield to maturity

4.93%

Maturity date

May 19, 2030

XS276120590

RAJHI SUKUK 24/29 MTNYield to maturity

4.83%

Maturity date

Mar 12, 2029

ALRJF5580516

Al Rajhi Sukuk Limited 4.75% 05-APR-2028Yield to maturity

4.71%

Maturity date

Apr 5, 2028

YD22

AL RAJHI SUKUK LTD. 4.92% SUK SNR 03/06/2030Yield to maturity

—

Maturity date

Jun 3, 2030

ALRJF5809924

Al Rajhi Tier 1 Sukuk Limited 6.375% PERPYield to maturity

—

Maturity date

—

ALRJF5981522

Al Rajhi Tier 1 Sukuk Limited 6.25% PERPYield to maturity

—

Maturity date

—

See all 1120 bonds

Frequently Asked Questions

The current price of 1120 is 94.75 SAR — it has increased by 0.26% in the past 24 hours. Watch AL RAJHI BANK stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on TADAWUL exchange AL RAJHI BANK stocks are traded under the ticker 1120.

1120 stock has fallen by −1.30% compared to the previous week, the month change is a −0.21% fall, over the last year AL RAJHI BANK has showed a 11.73% increase.

We've gathered analysts' opinions on AL RAJHI BANK future price: according to them, 1120 price has a max estimate of 121.70 SAR and a min estimate of 91.00 SAR. Watch 1120 chart and read a more detailed AL RAJHI BANK stock forecast: see what analysts think of AL RAJHI BANK and suggest that you do with its stocks.

1120 reached its all-time high on May 9, 2022 with the price of 117.40 SAR, and its all-time low was 4.20 SAR and was reached on Mar 3, 1999. View more price dynamics on 1120 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1120 stock is 1.23% volatile and has beta coefficient of 0.91. Track AL RAJHI BANK stock price on the chart and check out the list of the most volatile stocks — is AL RAJHI BANK there?

Today AL RAJHI BANK has the market capitalization of 379.00 B, it has decreased by −1.36% over the last week.

Yes, you can track AL RAJHI BANK financials in yearly and quarterly reports right on TradingView.

AL RAJHI BANK is going to release the next earnings report on Oct 27, 2025. Keep track of upcoming events with our Earnings Calendar.

1120 net income for the last quarter is 5.80 B SAR, while the quarter before that showed 5.64 B SAR of net income which accounts for 2.80% change. Track more AL RAJHI BANK financial stats to get the full picture.

AL RAJHI BANK dividend yield was 2.86% in 2024, and payout ratio reached 58.01%. The year before the numbers were 2.64% and 58.23% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 23.42 K employees. See our rating of the largest employees — is AL RAJHI BANK on this list?

Like other stocks, 1120 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AL RAJHI BANK stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AL RAJHI BANK technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AL RAJHI BANK stock shows the buy signal. See more of AL RAJHI BANK technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.