UNF1! trade ideas

2025-07-23 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

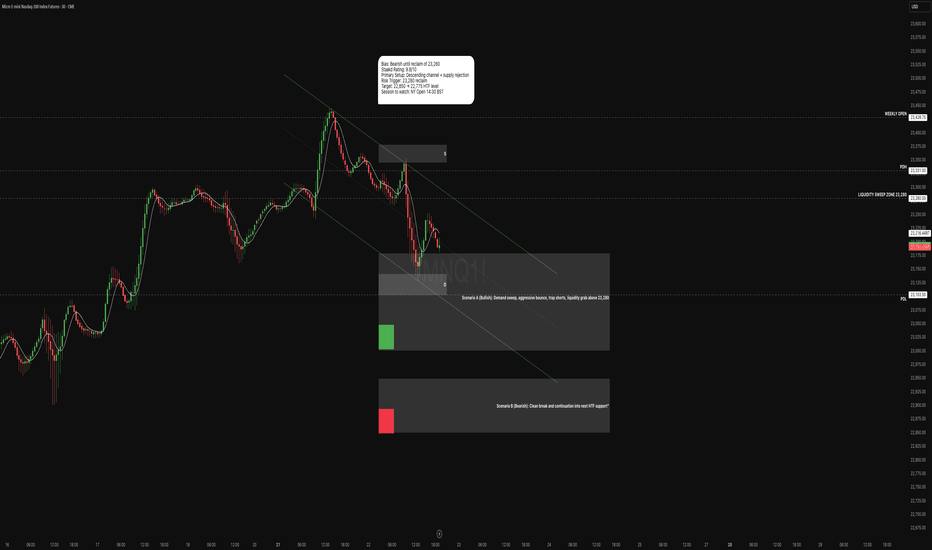

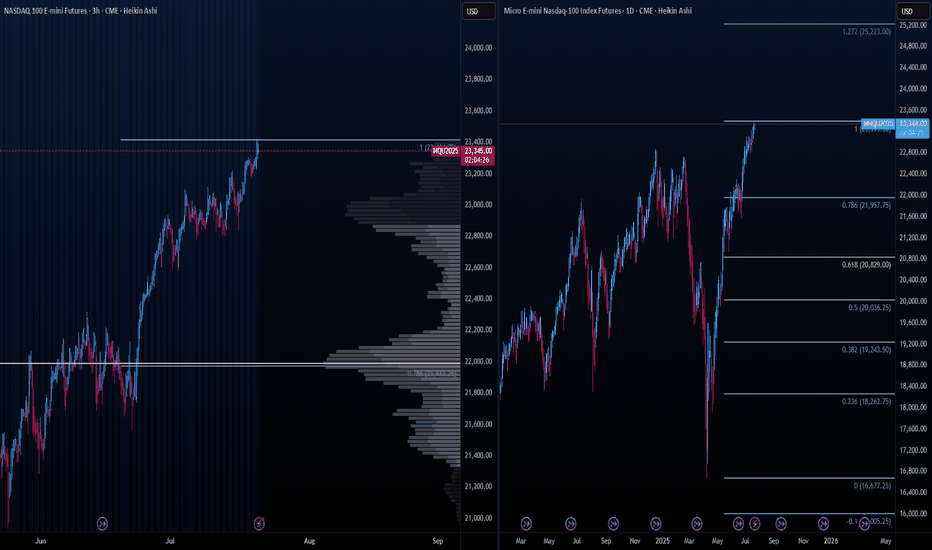

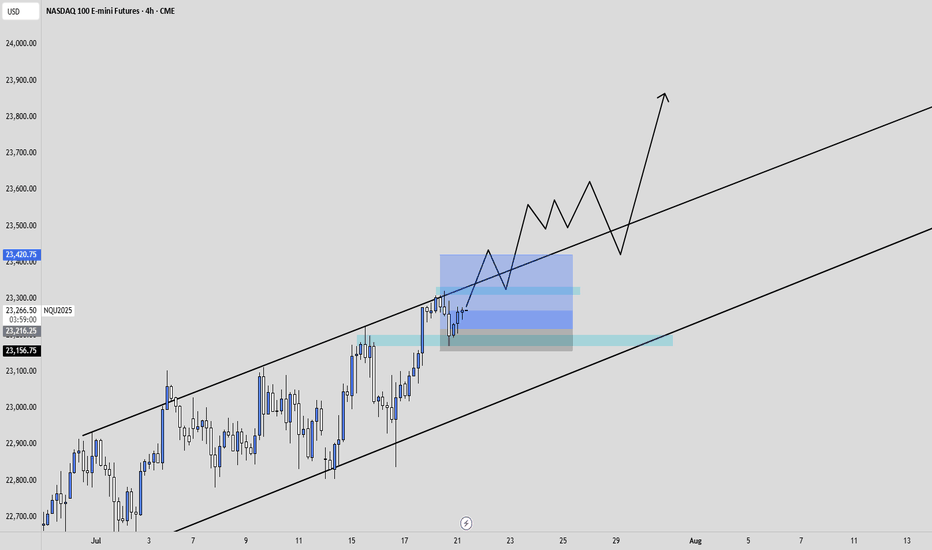

comment: Very tight channel up from 23142 but only 1 bear bar since then and in the absence of bear bars, we can only assume sideways to up movement.

current market cycle: bull trend

key levels: 23000 - 24000

bull case: Bulls want to print more higher highs. We are in this bull channel for the whole July now without breaking it and bulls now confirmed the breakout above 23100ish - 3 times. That is the 50% retracement of the last big leg up and very important. A measured move for this leg gives us 24000. Bears have tried with two decent legs to get down to 23000 and failed. I think many will give up on this after hours buying and we can have more meltup into the weekend. Anything bearish would be a big surprise.

Invalidation is below 23250ish.

bear case: Bears tried and failed again. Everything is bought. 1h close below 23250 would certainly stop the max bullishness but bears are really not doing much. We are almost printing daily new ath. Focus on longing pullbacks until the bull channel is broken.

Invalidation is above 24000.

short term: Bullish on any pullback until it stops working.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Long 23200 has been profitable since Friday.

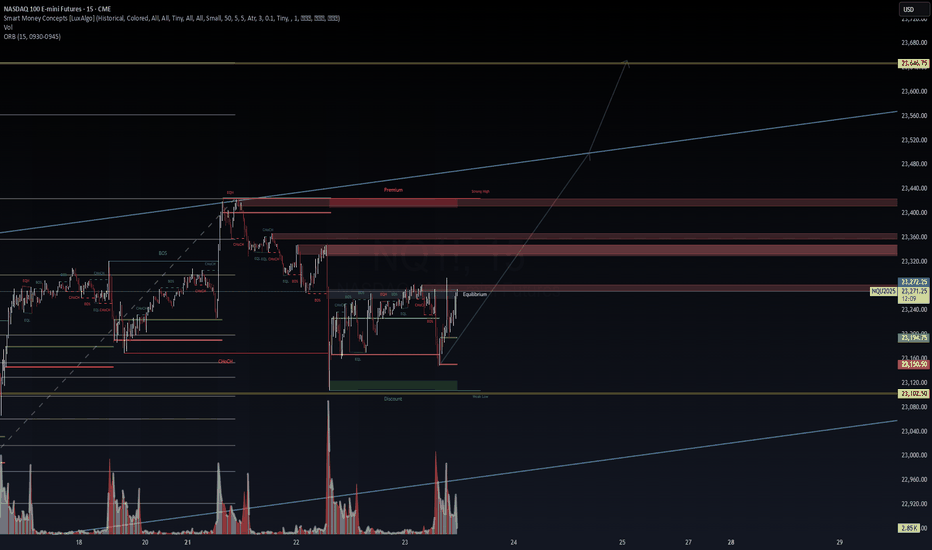

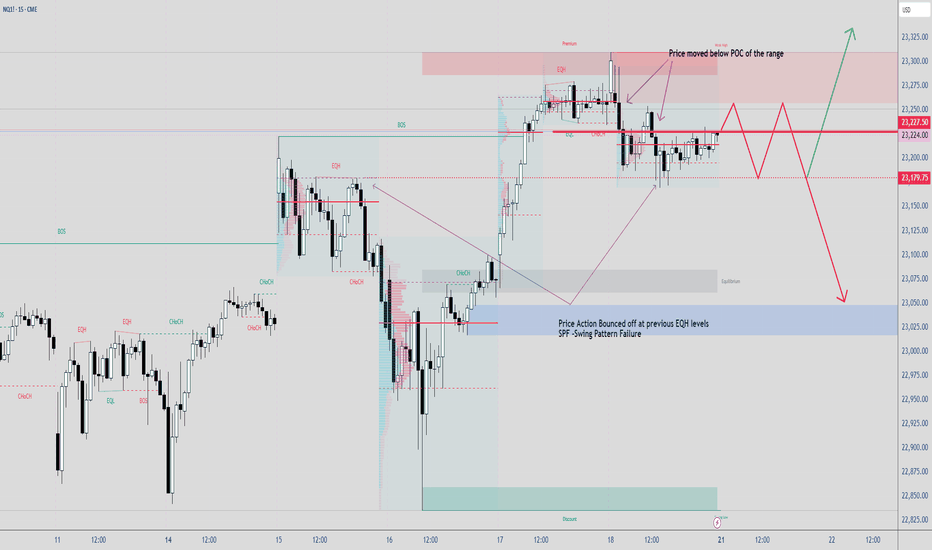

NQ1! | VolanX SMC Playbook | July 23, 2025🧠 NQ1! | VolanX SMC Playbook | July 23, 2025

📈 Chart Thesis:

Price has reclaimed equilibrium after engineering liquidity below the weekly low and rebalancing from the discount zone. We now sit above internal BOS (Break of Structure) with signs of continuation toward premium inefficiencies.

🔍 SMC Read:

ChCh (Change of Character) and BOS clusters confirm internal accumulation.

Liquidity sweep at the EQD (Equal Low/Discount) and reclaim of the OB signals strength.

Volume shows commitment on upward drive—aligns with algorithmic intent.

📊 Key Zones:

Support (Reclaim Confirmed):

23,150.50 (ORB Low)

23,102.50 (Weekly Low - Discount Level)

Resistance / Target Clusters:

23,360–23,440: Supply + SMC Breaker Zone

23,646.75: Extended target (Premium High / Measured Move Completion)

🚀 Trade Idea:

Bias: Bullish

Entry Zone: Retest near 23,195–23,220

Stop: Below 23,140

Target 1: 23,360

Target 2: 23,646.75

Risk-to-reward: ~1:3.5+ | Confirmation preferred via retest and OB hold

⚙️ VolanX Protocol Overlay:

DSS Signal Score: ★★★★☆

Catalyst Monitor: Watch upcoming earnings, FOMC minutes preview leaks, and AI sector flows

Narrative Control: Tech resilience + dovish repricing fuel continuation setups

📢 Disclaimer: This post is for informational and educational purposes only. It does not constitute financial advice.

#NASDAQ100 #Futures #SMC #VolanX #WaverVanir #DSS #LiquidityTheory #VolumeProfile #MacroAI #NQ1! #AlgoTrading

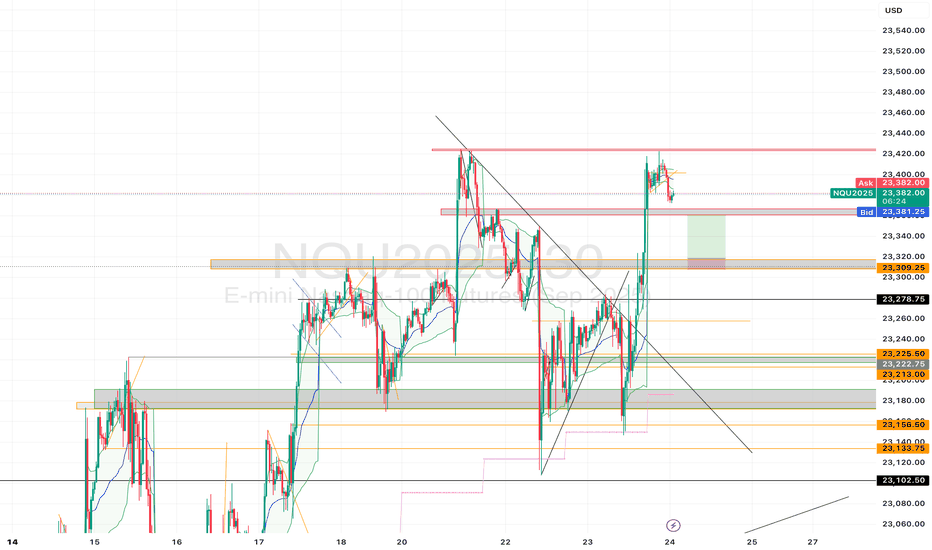

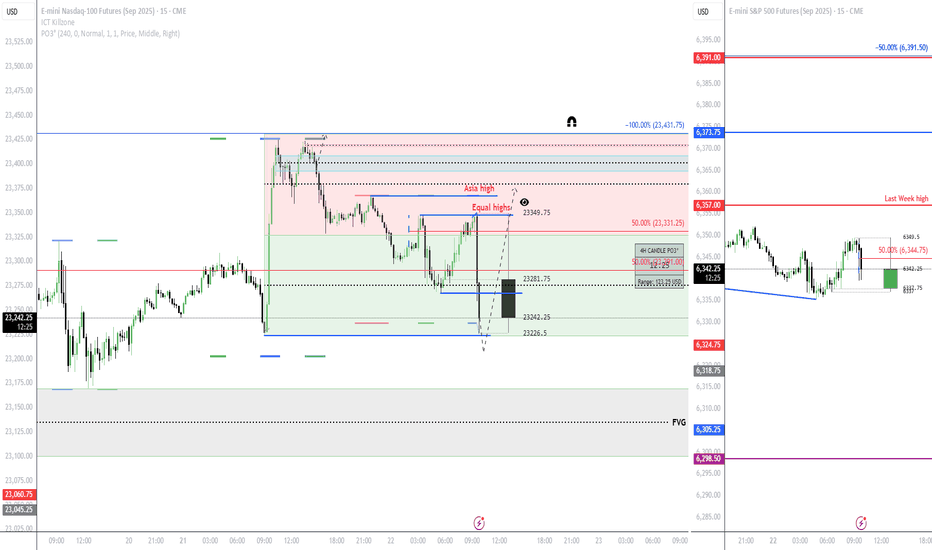

$NQ Supply and Demand Zones 7/23/25www.tradingview.com

This SEED_ALEXDRAYM_SHORTINTEREST2:NQ chart is posted for my YouTube community.

The 1HR S/R level is holding price down well for now and we have tapped into the 4HR supply 2x so far. We have built up support that can use as potential bounce levels if* respected, but price needs to reclaim the S/R level and show higher lows. If not, a continuous close at lower lows with rejecting support at demand can show price dropping to 22830-23000 zones. The 4HR demand below has also been tapped into multiple times, so it's only a matter of time before it can no longer hold up (it's pretty much invalidated at this point lol).

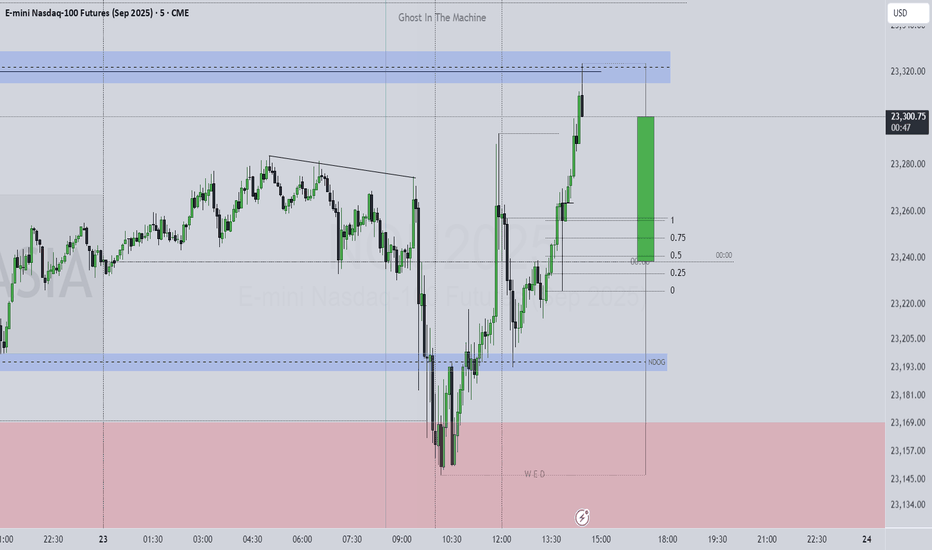

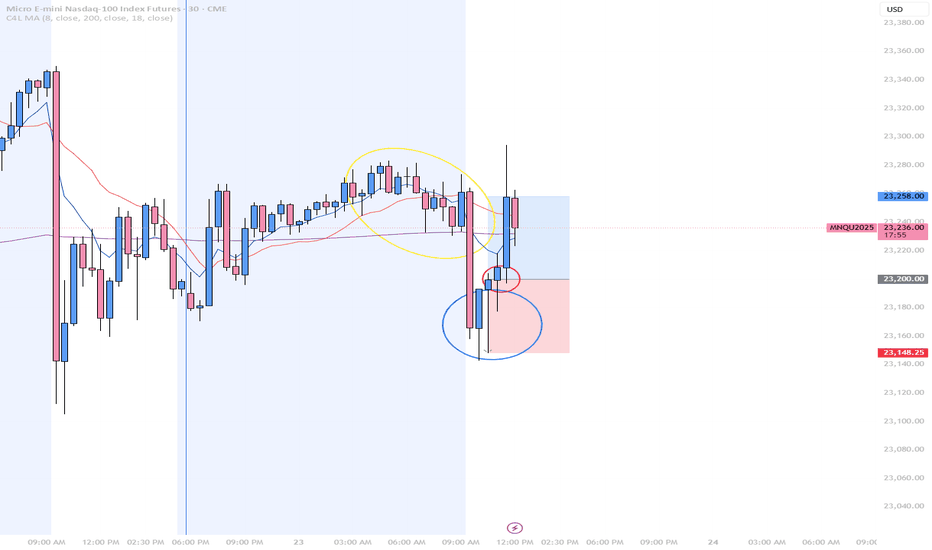

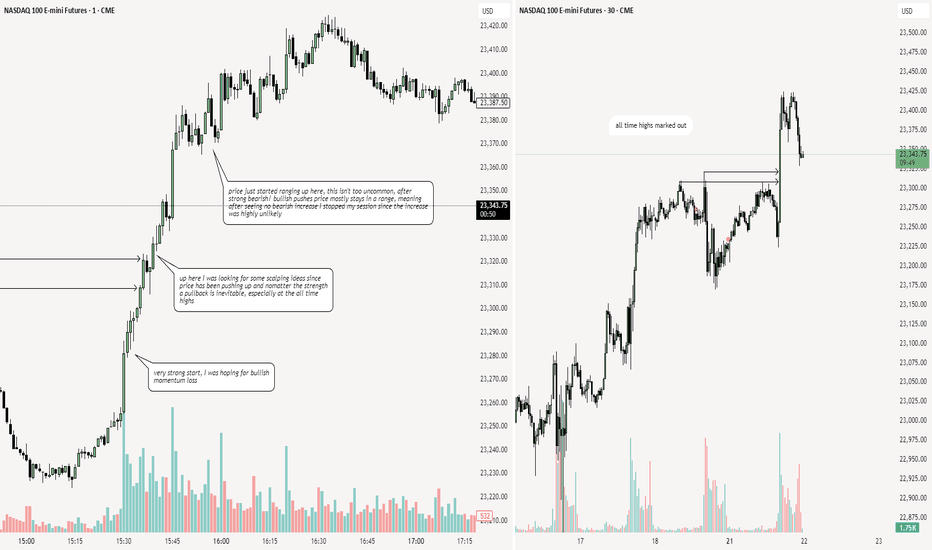

07/23 Nasdaq

The variation was present pre-open as you can see in Yellow.

The Wick rejecting the downside repeated itself twice , so I went aggressively as you can see in blue.

The volume was on my side when I open the position so there was no drawdown at least not too much.

Recap.

Wait for Variation.

Wait for the Wick to reject the Downside

Wait for the volume to go up and use the wick as a stop loss

$NQ – Liquidity Sweep & Reversal Loading? NASDAQ Futures ( SEED_ALEXDRAYM_SHORTINTEREST2:NQ ) testing equilibrium support within a clean ascending channel structure. Recent price action swept local liquidity and reacted off the 1H EQ zone. Here's what we're seeing:

🔹 Key Smart Money Concepts (SMC)

Major CHoCH → BOS sequence confirms local bullish intent

Clean reaction off EQ demand zone with volume spike (13.97K)

Multiple EQHs and BOS chains → strong institutional footprint

Price holding above higher low structure, respecting channel support

🔹 Setup Bias (VolanX Protocol)

Long bias active above 23,050

Retest of EQ zone confirms order flow shift

Target zones:

🎯 PT1: 23,250

🎯 PT2: 23,440 (Premium zone)

🎯 PT3: 23,600+ upper trendline (if macro aligns)

🔹 Macro Note: Watch for bond yields + VIX + tech earnings this week. Any surprise upside catalyst could fuel a breakout to new highs.

🧠 This setup aligns with the VolanX DSS protocol. Execution window is open. Not financial advice.

#NASDAQ #NQ #Futures #SmartMoney #VolanX #TradingView #LiquiditySweep

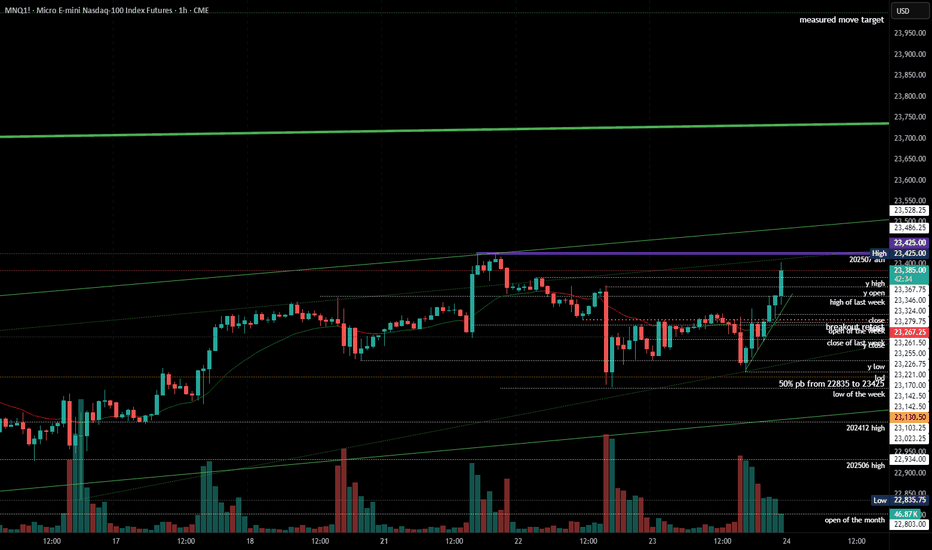

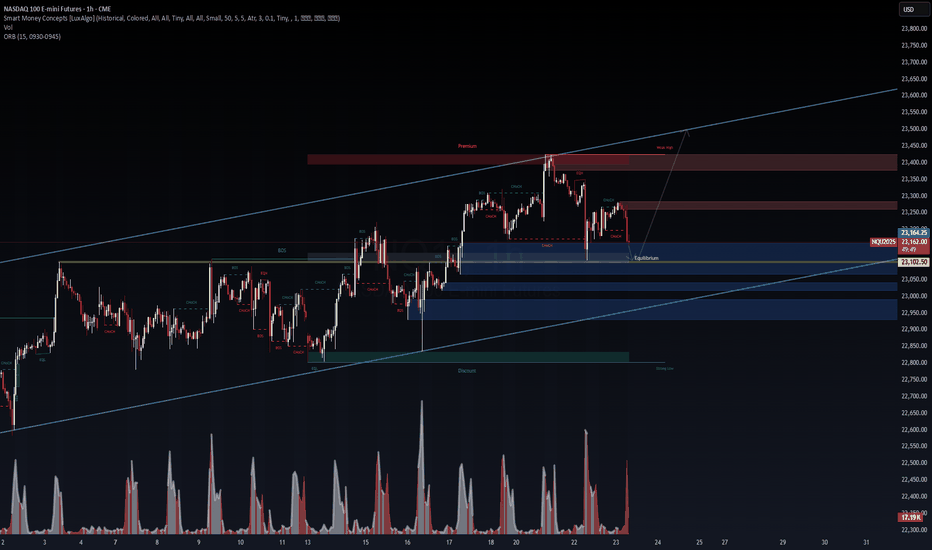

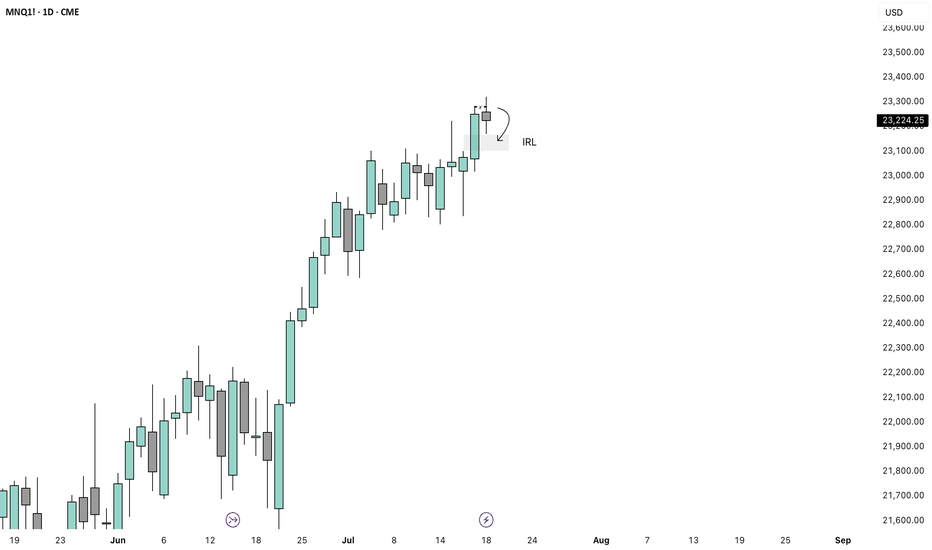

MNQ. Bear Flag Pressure Cooker. Will Demand Hold or Detonate?After last week’s strong rejection from the 23,300 supply zone, MNQ has shifted from a bullish channel into a clean descending structure. This break in character, combined with consistent lower highs and compression into a high-interest demand zone, sets the stage for a decisive move either a clean continuation lower or a fake out reversal to sweep short liquidity.

Currently, price is sitting just above a demand block around 23,025–22,950, a level that previously triggered aggressive buying. The recent grind lower shows fading momentum, suggesting either a buildup of sell pressure for a breakdown or a trap being set for shorts before the next rotation higher. This area is key it either holds and we see a sharp reaction, or we slice through and flush toward the next HTF support around 22,775.

The bearish case is the cleaner of the two: price remains in a descending channel, and any acceptance below 22,950 opens the door to continuation. A clean breakdown here would confirm the bear flag thesis and likely bring in trend-followers looking for a move to retest deeper support. This path offers a clear directional bias, measured risk, and multiple levels of confluence.

That said, a bullish reversal cannot be ignored. If price sweeps the demand zone and reclaims 23,100 with strength especially during the NY open, we could see a squeeze through 23,280, tapping the liquidity resting above the descending channel. This would invalidate the current bear structure and hint at a possible return to the mid-23,400s. But for this to play out, bulls need to act fast and strong reclaiming lost structure and shifting momentum convincingly.

Contextually, this setup is loaded. The weekly open sits far above at 23,428, while last week’s highs and lows bracket the range between 23,331 and 23,101. The key inflection is clear: demand either breaks and we bleed, or it holds and we trap.

With NY Open approaching, I’m watching for a 30-minute ORB to confirm direction. Momentum and volume will be critical in confirming which scenario plays out. Until then, the bias remains bearish but flexible.

Staakd Rating: 9.8/10

Bias: Bearish below 23,100. Bullish only on reclaim and break of 23,280.

Key Trigger Zone: 14:30 BST / 09:30 ET NY Open ORB

Targets: 22,775 (bearish) / 23,450 (bullish trap breakout)

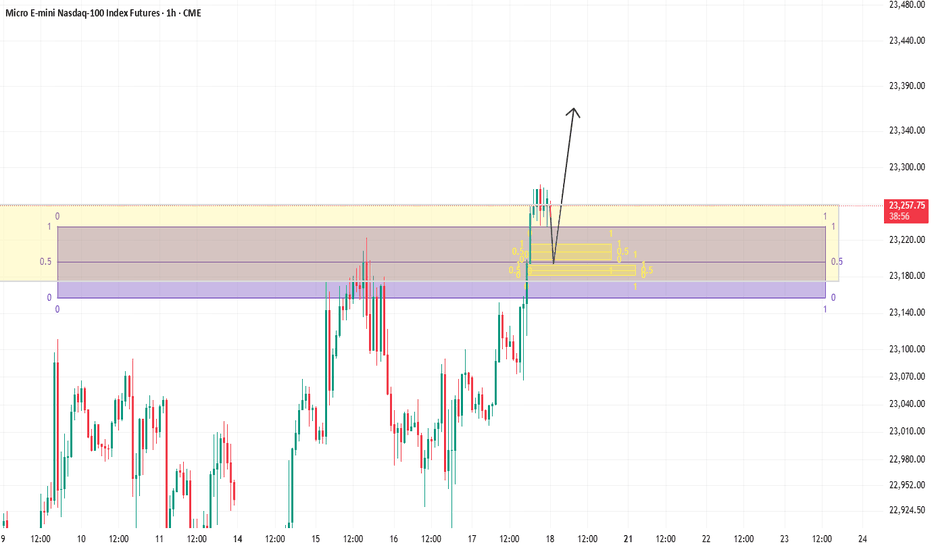

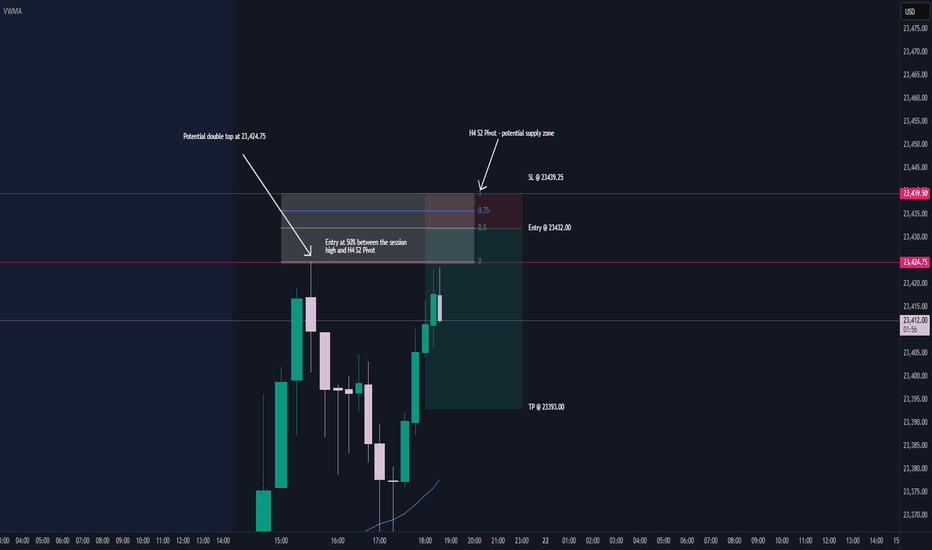

Longing NQWell, This looks like a very good long trade. But since we are over extended to the upside, i will be very careful.

use medium size to take this long.

You need to monitor the price when it enters this purple zone, and check for confirmation that the price is truly reversing from this area.

Anyways, before i enter the trade i will be updating, so make sure you check back again.

$NQ Supply and Demand Zones 7/21/25 This chart is for SEED_ALEXDRAYM_SHORTINTEREST2:NQ posting for the YT community.

www.tradingview.com

We are building more levels although we have approached and created a new ATH.

Would love to see a retest of the levels below, especially with the momentum of leaving some levels untested and untouched. We have the 50% mark at 23310 that has been left and is also an untested wick level.

We have news from Wed and on!

Looking for Entry on NASDAQ - LONG The most traded price on /NQ Futures continuous contract in June was about 22000. With this ramp today and using Fibonacci from the April low - the .786 retracement puts at exactly 22000. That is confluence - as well this volume shelf should hold price. The Dow Futures /YM have been down over the last couple of weeks, the /ES only slightly up its all divergent which means nothing except fuel for longs taking shorts out looking at technical charts.

Trade wars? Tesla or Apple earnings - both have tariff risks. When and if we get there I will be looking to get long at 22000.

There is one more thing - there remains at a virgin point of control at 22050 as well - this adds to the confluence.

Its early on this this trade idea, I've revising the fib levels daily - however today it did give me this confluence - so I'm sharing it. Its possible we go to 25000 first- but unlikely.

NQ Short Setup: Contrarian Trade into Supply ZoneDouble top forming near 23,424.75 with supply overhead at H4 S2 Pivot – 23,439.25.

🎯 Entry: 23,432.00 (mid-range)

📘 TP: 23,393.00

🔴 SL: 23,439.25

⚠️ Risky fade play against bullish earnings momentum and looming trade deal deadline.

— Tactical short. High risk, high tension. Stay sharp.

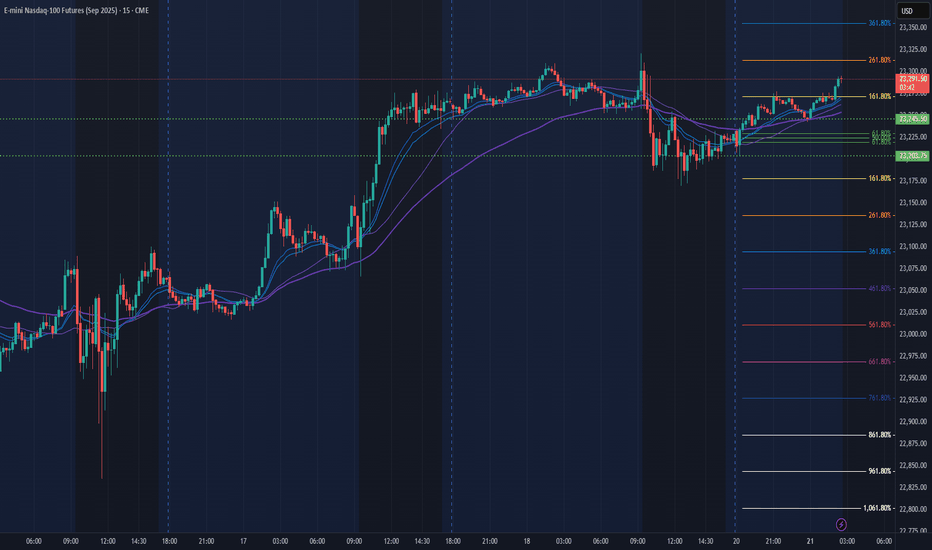

NQ Power Range Report with FIB Ext - 7/21/2025 SessionCME_MINI:NQU2025

- PR High: 23203.75

- PR Low: 23245.50

- NZ Spread: 93.25

No key scheduled economic events

In range to continue pushing ATH

Session Open Stats (As of 1:45 AM 7/21)

- Session Open ATR: 266.36

- Volume: 21K

- Open Int: 274K

- Trend Grade: Neutral

- From BA ATH: -0.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Using LuxAlgo SMC Free indicatorSometimes Indicators helps calculates the swing points without any effort especially during live trading.

POC is part of a tool called Volume Profile. In this case, Im using select Fixed Range VP to identify short term POC to see where PA can bounced from.

When markets moving sideways or in a Trading Range, PA tends to be choppy.

Nobody knows about the future, if they claimed to know, just run away. Here are some probabilities how PA would do next.

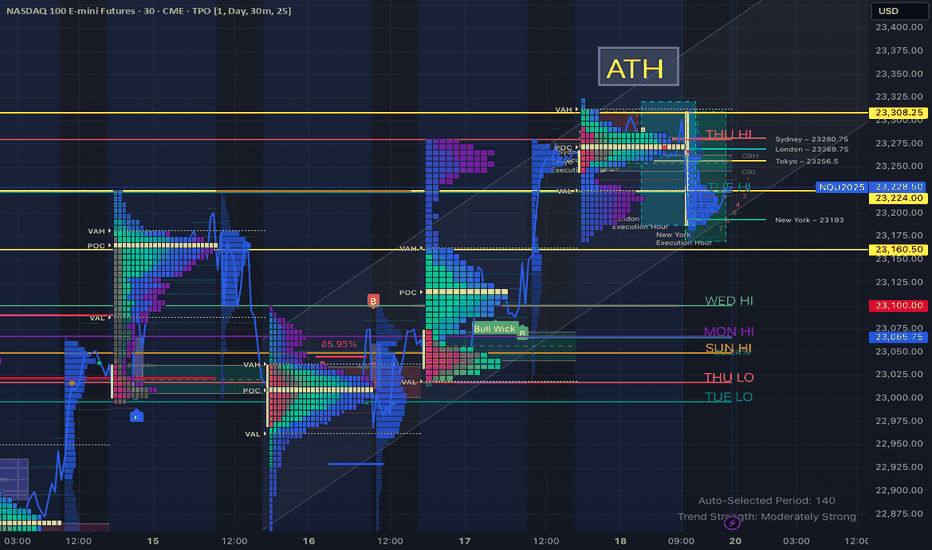

NQ2025 – Range Reclaim and ATH Test in Focus | TPO AnalysisDescription:

The Nasdaq-100 (NQ2025) is showing signs of strength after reclaiming a key value area around 23,224, with price now consolidating above the New York execution low (23,193) and the weekly value area low. Volume structure and price action suggest potential continuation toward the all-time high.

Key Technical Notes:

Range Reclaim: Price reclaimed a composite range zone (23,193–23,224), showing acceptance and strength during NY session.

All-Time High (ATH): 23,308.25 remains the upside magnet.

Initial Balance and ORL: Serving as confluence for bullish structure if retested.

TPO Structure: Value is shifting higher with poor high left above current range, increasing likelihood of continuation.

Primary Scenarios:

Bullish Continuation: Hold above 23,224–23,193 and rotate toward ATH.

Pullback Opportunity: Reclaim of NY low or session VWAP after sweep could offer long re-entry.

Rejection Scenario: Break back below 23,193 may shift control to sellers, targeting 23,160 and 23,065 support.

Support/Resistance Zones:

Resistance: 23,275 → 23,308.25 (ATH)

Support: 23,224 → 23,193 → 23,160

Lower Shelf Support: 23,100 → 23,065.75

This chart utilizes a blend of TPO analysis, intraday session levels, and volume-based structure to align setups with high-probability continuation or reversal zones.

📍#NQ #FuturesTrading #VolumeProfile #TPOAnalysis #DayTrading #TechnicalAnalysis #TradingStrategy

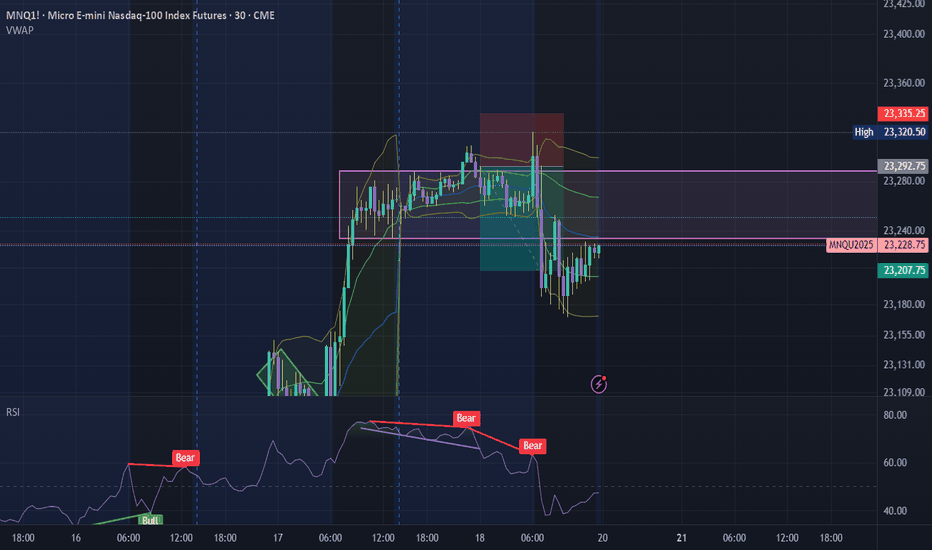

Bearish Divergence using RSIStarting to utilize RSI in confluence with market structure and FVG to create an entry and exit model. Higher highs of price action paired with lower highs of RSI values. Exit towards filling at least 50% of FVG. Don't be greedy, as price can use FVG as support/resistance.