TEVA trade ideas

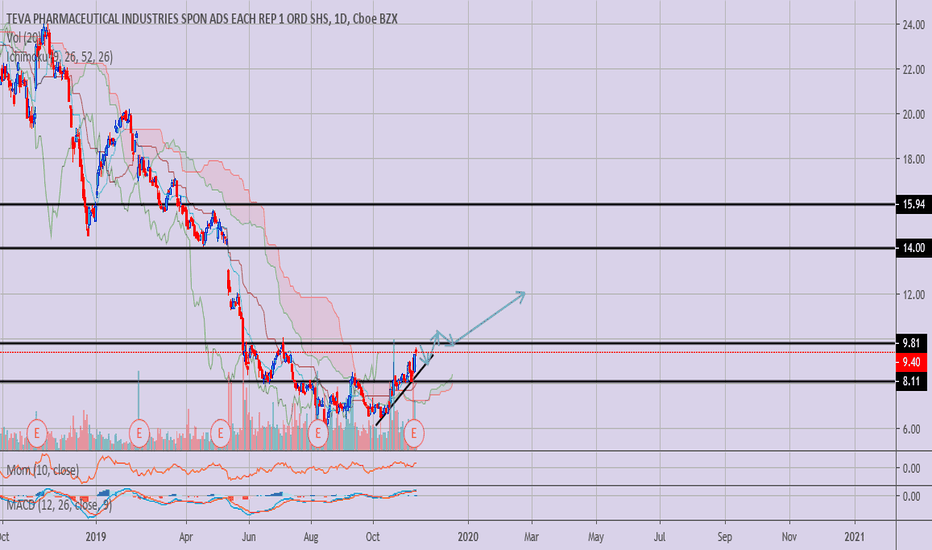

Broke golden cross / broke resistensGolden cross was made, broke strong resistens and closed over 9.45 ish ( closed over 10 )

RSI over 0,50 ( higher highs - higher lows )

bullish engulfing was made yesterday

daily timeframe

I opened a buy

Open : 10,05

SL : 09,50

TP : 12,00

im new here and this is my 2 end post - please do say your opinion

Teva Pharma Bullish trade Entry level $10.34 = Target price $11.50 = Stop loss $10.00

Teva Pharmaceutical Industries Ltd. is a global pharmaceutical company, which engages in development, production and marketing of drugs, generic drugs, over-the-counter drugs, active ingredients for the pharmaceutical industry (APIs) and therapeutic products. It operates through two segments: Generic Medicines and Specialty Medicines. The Generic Medicines segment includes chemical and therapeutic equivalents of originator medicines in a variety of dosage forms, including tablets, capsules, injectables, inhalants, liquids, ointments and creams. The Specialty Medicine segment engages in the provision of core therapeutic areas of central nervous system medicines. The company was founded in 1901 and is headquartered in Petach Tikva, Israel

TEVA - WEEK CHART

Hi, today we are going to talk about Teva Pharmaceutical Industries and its current landscape.

The opioid crisis has been plaguing the U.S at the most for nearly two years now. With scary numbers like the record of 47,600* overdose deaths caused by opioids in 2017 but the number seems to start slowdown since 2018 were the war against opioids gained some traction.

In the justice field, some companies have already faced some sort of rebuke for involvement and even a bit of responsibility for the opioid crisis. For example

*Jun 2019, Insys Therapeutics Inc. had to file for bankruptcy after being convicted for conspiring to bribe doctors to increase opioid sales, ending up in a deal with the federal government of $225 million.

* Aug 2019, Johnson & Johnson was obligated to pay $572 Million, as Oklahoma ruled that the company intentionally played down the dangers and oversold the benefits of opioids.

* Oct 2019, Johnson & Johnson was once more condemned by two counties of Ohio to pay $20.4 million, with the accusation of having helped the opioid crisis to spread.

Now, the drug maker Teva Pharmaceutical is under investigation by the Federal Prosecutors in Brooklyn, into whether the company intentionally permitted that flood of opioids on the community. For now the U.S. Attorney’s Office in the Eastern District of New York it's just issuing subpoenas, but if they case sticks we might see what the murders of Julius Caesar saw, a pile of fire and anger from the people, so big that like Caesar butchers that were cast out of the city, the companies involved on this process can be drowned in liabilities and fines with the risk to be so badly damaged that may have the same fate of Insys Therapeutics Inc. The war against opioids it's just poised to grow up as every justice department across the country and every candidate that it's next to run on elections its eager to hang this trophy on the wall.

*Source: Centers for Disease Control and Prevention (CDC)

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

$TEVA bullish reversal tradePossible entry level $9.80 = Target price $11.00 = Stop loss $9.50.

Huge momentum swing in Teva, earnings may have been a disappointment but guidance and outlook turned investors bullish and may be a sign of a bottom in for the stock.

The stock is now above its average analysts price target of $8.88 so they will forced to regrade the stock, hopefully bullishly.

Alert set for break above 70 on the RSI

$TEVA Turnaround may have begun in Teva Pharmaceutical.Teva Pharmaceutical Industries (NYSE:TEVA) Q3 results:

Revenues: $4,264M (-5.9%).

Key product sales: Copaxone: $397M (-33.9%); Generics: $2,224B (-1.8%).

Net loss: ($314M) (-15.0%); non-GAAP net income: $637M (-8.2%); loss/share: ($0.29) (-7.4%); non-GAAP EPS: $0.58 (-14.7%).

Cash flow ops: $325M (-22.8%).

2019 guidance: Revenues: $17.2B - 17.4B from $17.0B - 17.4B; operating income: $4.0B - 4.2B from $3.8B - 4.2B; EBITDA: $4.5B - 4.8B from $4.4B - 4.8B; EPS: $2.30 - 2.50 from $2.20 - 2.50; free cash flow: $1.7B - 2.0B from $1.6B - 2.0B.

Eli Kalif appointed EVP and Chief Financial Officer effective December 22. He joins the firm from Flex Ltd where he was SVP Finance Global Operations, Components & Services.

Shares up 4% premarket on increased volume.

Previously: Teva Pharmaceutical EPS misses by $0.01, beats on revenue (Nov. 7)

Source Seeking Alpha

Short interest relatively high at 7%

Company profile

Teva Pharmaceutical Industries Ltd. is a global pharmaceutical company, which engages in development, production and marketing of drugs, generic drugs, over-the-counter drugs, active ingredients for the pharmaceutical industry (APIs) and therapeutic products. It operates through two segments: Generic Medicines and Specialty Medicines. The Generic Medicines segment includes chemical and therapeutic equivalents of originator medicines in a variety of dosage forms, including tablets, capsules, injectables, inhalants, liquids, ointments and creams. The Specialty Medicine segment engages in the provision of core therapeutic areas of central nervous system medicines. The company was founded in 1901 and is headquartered in Petach Tikva, Israel.

Ascending Triangle Breakout from Double Bottom for up trend ideaAfter years of going from top-left to bottom-right, there was a Double Bottom bounce with an Ascending Triangle currently sitting at the top of bounce. NASDAQ pre-market volume is quite nice, and the weekly volume has been consistent with price movement direction. The weekly EMA and SMA are moving from vertical to horizontal, the last three weekly candles are currently green, and the angle from the lowest weekly opening to the current price is pointing (from left to right) in an up direction. Good luck to all.

Long TEVA Long TEVA

I'm long 6,000 shares at $7.41 average; started accumulating July 16, 2019.

Bullish divergence on monthly and weekly time scales.

Descending triangle breakout on the daily with huge volume.

First target = $14.15 (gap that has yet to close)

Opioid lawsuits settled today and TEVA scored a huge win in the settlement.