GD1! trade ideas

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

GOLD - GC | Weekly Recap & Plan 13.07.2025🟡 GOLD (GC) Weekly Recap & Outlook

Symbol: GC1!

Date: Week of July 8–12, 2025

Timeframes Used: 4H, Daily, Weekly, HTF structure

🔍 What Happened Last Week?

Gold saw a strong rejection from a confluence of two HTF trendlines, signaling resistance.

But that move was absorbed by:

🟦 Daily Demand (blue zone)

🔵 Daily Swing Liquidity (blue line)

This builds a bullish structure on the daily chart.

🧭 Scenarios I'm Watching

Scenario 1 — Minor Pullback:

🔹 Price may revisit the Daily Gap (pink line) and find support for continuation.

Scenario 2 — Deeper Pullback:

🟣 Price could retrace into the HTF bullish trendline (purple) before resuming upside.

🗞️ Bonus Macro Scenario: Powell Resignation?

There are growing rumors that Fed Chair Powell might resign this week.

📈 If that happens, I expect strong bullish momentum in Gold —

→ very limited retracement, and

→ potential straight breakout into new highs.

🎯 Targets for the Week:

✅ 1st Target:

W C DOL (purple line) → acts as a primary take profit area.

✅ 2nd Target (Expansion):

EQHs / DOL (extended purple levels)

Game Plan:

Watch for LTF confirmation on both retracement zones.

Maintain bullish bias unless Daily Demand fails.

If Powell resigns, be ready for breakout setups.

Gold vs UNI – Is UNI in the Early Stages of AccumulationThis comparison between Gold (MGC1!) and Uniswap (UNIUSDT) on the weekly timeframe suggests that UNI could be in Phase 1 of a buy program, similar to how gold accumulated before its major breakout.

📌 Key Observations in the Chart Comparison:

PHASE 1: The Accumulation Zone (Green Highlighted Area)

Gold went through a long accumulation period (2013–2017), trading in a sideways range before its parabolic impulse leg kicked in.

UNI is currently in a similar consolidation phase, potentially in the early stages of accumulation.

The monkey face + pointing emoji suggest a "stealth phase" where most retail traders remain unaware of the underlying accumulation.

Old High & Market Structure

Gold formed a major high, crashed, and accumulated before breaking out.

UNI also reached an all-time high (~$44), crashed, and is now ranging in what looks like a potential accumulation phase.

Similar structural formation suggests UNI could be following gold’s footsteps.

Impulse Leg & Breakout Potential

Gold’s first major breakout came after a long accumulation, followed by a massive impulse move (Phase 2).

If UNI is mirroring gold, the next breakout could start the impulse leg leading to a retest of old highs and beyond.

Standard Deviation Extensions (STDVN) – Potential Price Targets

Gold reached 0.5 and 1 STDVN levels after its breakout, which became short-term targets before continuation.

If UNI follows a similar trajectory, targets could be $44.77, $64.98, and eventually $85+ if the accumulation plays out.

🔮 What This Means for UNI?

Early accumulation phase means the smart money is likely positioning.

Price compression leads to expansion—UNI could be preparing for an explosive move.

Similar to gold, UNI could break above accumulation and enter Phase 2, targeting 0.5 and 1 STDVN levels.

If UNI truly follows gold’s structure, long-term price discovery is on the table.

🚨 Lord MEDZ Trading Perspective

"Not financial advice, but let’s keep it real…"

Gold showed the exact same pattern before making a historic move. UNI is mirroring the early accumulation phase.

This is the shakeout before the breakout. Smart money is accumulating while retail panics.

Patience = Wealth. Stay ahead of the crowd.

🚀 UNI could be setting up for something massive. 🚀

Gold will continue with its bullish breakoutLooking for new highs to be made. Price has pushed bullish as trump started talking about the tariffs early today. Even though they are not supposed to discuss till the 9th. We can get a early move for the week. Monitoring the price action to see if I can get in where I fit in!

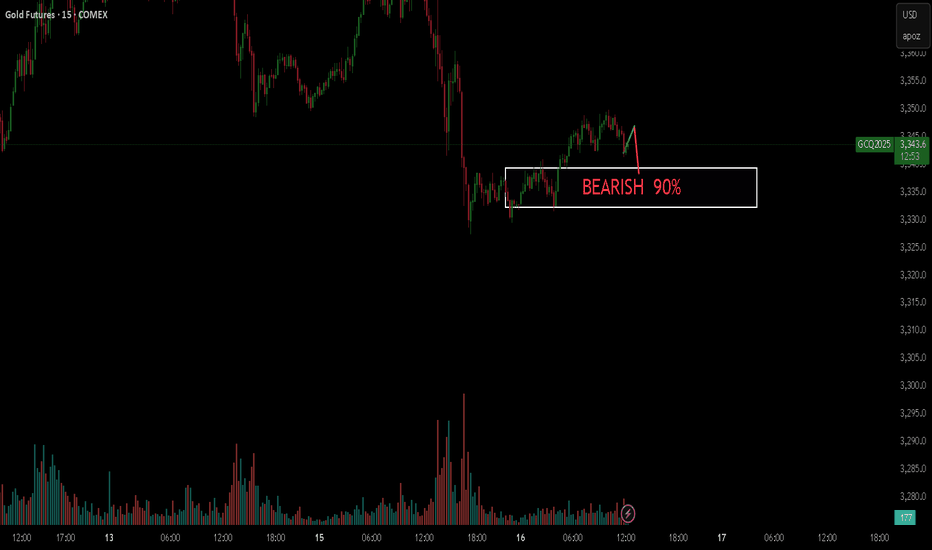

Gold Short Source, Trust me bro.

I mean well its in a downtrend and the price just keeps hitting lower, the 4h reacting very bearishly and the 1 day also didnt say much more than daily downtrend (recently).

So i think i have good confidence in this trade as i took the long pullback trade yesterday and the price showed that its respecting my analysis, so i would assume this will work out.

$GC / $MGC /Gold - Elliot Wave Analysis - Weekend Update - 7/6Hello fellow gamblers,

As we prepare for a new trading week, I revisited my EW count and was able to come up with 2 scenarios to present to you today.

- For our bullish scenario, I am looking for a break above 3418 and my next target will be at the 3574 - 3525 range.

- For our bearish scenario, I am looking for a break below 3283 and my next target will be at the 3086 - 2846 range.

- Price went through a consolidation as we closed last week's candle, and we are now at POC.

- Levels to Watch: 3418, 3363, 3283

Gold Futures (GC1!) – Accumulation Brewing? Major Move IncomingGold has been stuck in a tight range since April, and to me, this looks like a textbook accumulation zone forming on the daily chart.

Price is coiling within a defined box, showing signs of both strength and weakness — classic behavior before a manipulative move (fake breakout) followed by distribution (true direction). This is where many traders get trapped, chasing the first breakout — only to get caught before the actual move begins.

I’m not committed to a direction yet, but here’s my roadmap:

🧠 First breakout = likely trap (manipulation)

🧭 Wait for confirmation of rejection/failure, then prepare for the real move out of the range

This kind of price behavior often precedes explosive volatility, so I’m watching closely for:

False breakouts above or below the box

Volume spikes or traps

Shift in market structure on lower timeframes

📍 No trade for now, but I’ll be reacting — not predicting.

What’s your bias? Do you think the breakout will hold or fake out?

Gold Between Trade Optimism and Economic Concerns

Gold is declining for the second consecutive session, although it remains above the critical psychological level of $3,300 per ounce in early spot trading this morning.

Losses in the precious metal come amid renewed optimism over potential trade agreements that could de-escalate the global trade war, alongside upbeat sentiment regarding the strength of the U.S. economy following last Friday’s labor market data.

The 90-day suspension of tariffs imposed by the administration of President Donald Trump is set to expire on Wednesday, but it could be extended at least until August 1, according to statements from both the president and Treasury Secretary Scott Besant.

Both the United States and its allies and trade rivals appear eager to reach an agreement. China and the U.S. are moving to implement the framework of a previously reached trade deal by reviewing the export restrictions imposed on one another. Meanwhile, European officials stated last week that a draft agreement with the U.S. may be near, aiming to maintain base tariff rates at just 10%, according to The Wall Street Journal .

Markets appear largely unbothered by trade developments, given the flexible and seemingly open-ended deadlines and the lack of major surprises, according to analysts cited by Reuters . This easing of concern may lead gold to gradually lose the risk premium it had gained from fears of a global trade war.

Still, those concerns could return swiftly if negotiations fail and heavy tariffs are reinstated. The Washington Post reported that a potential U.S.-Vietnam trade deal may anger China and, in turn, reduce the likelihood of a broader deal between Beijing and Washington.

Additionally, the prolonged uncertainty itself may start to weigh on the U.S. economy, which could, over time, rekindle demand for gold as a safe-haven asset. The Editorial Board of The Journal noted cracks in the U.S. labor market that lie beneath the better-than-expected headline figures released Friday. The report revealed weak hiring in key private sectors, a decline in manufacturing employment, and a drop in labor force participation to its lowest level since 2022.

The Editorial Board called for dissipation of uncertainty around trade policy to encourage private sector hiring, as companies remain hesitant amid the current indecision in the White House. Another report from The Journal also warned that prolonged uncertainty could weaken the U.S. dollar, delay corporate investment and spending, and dampen business confidence.

On a related front, The Journal’s chief economics commentator Greg Ip criticized what he called “fiscal dominance” under Trump, where the Federal Reserve may be pressured to lower interest rates to ease the burden of the rising deficit caused by tax cuts. He warned this could undermine economic strength and increase inflation in the long run.

In my view, the early signs of a deteriorating U.S. fiscal position could become one of the key long-term drivers of sustained gold gains—even if markets remain complacent for now and equities continue climbing to record highs. This would not reflect an economic cycle, but rather a deeper shift in market fundamentals characterized by eroding confidence in the U.S. economy and its currency.

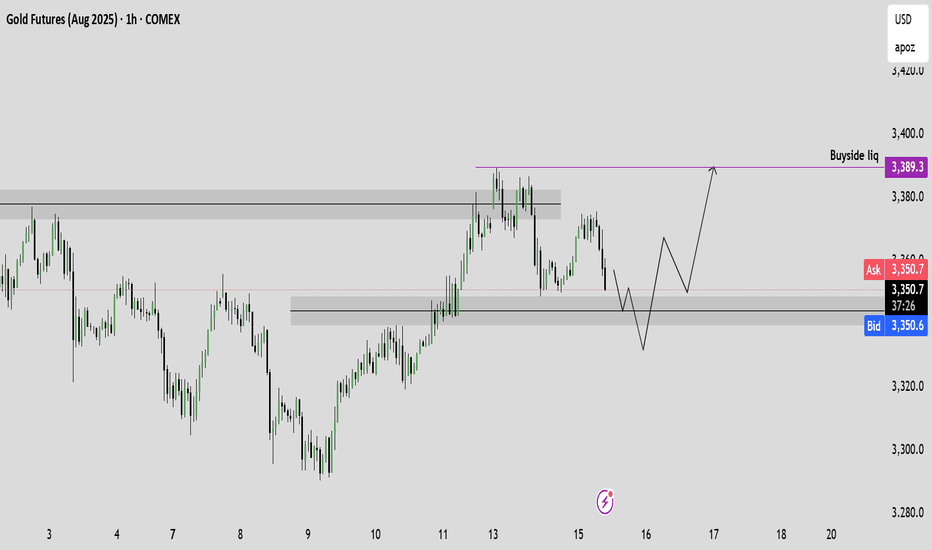

Mixed market for GOLDHard to frame an idea for gold because the dxy looks strong and gold looks strong as well, indicating to me a mixed market. Sitting on the sidelines for gold is probably the better bet right now because we just had a sweep of buyside liquidty and tapped back into a daily fvg. Notice the candles, and how they didnt close above the swing high. So because gold looks bullish and dxy looks bullish, im not interested in gold for tuesday trading. But if i had to pikc, we continue up for gold and attacck that buyside/ eqaul highs

Will The new Week kick off more bullish Pressure for GOLD?looking for more bullish activity this week but need to sit on my hands for now to see if they establish a Low for the week first. Once we see that and start to see HH's made then we can consider a entry to get in on the move. I cant rush it though. Have to be patient.

Buying the Dip or Catching a Knife? My Gold Setup Explained.Entered a long position on XAU/USD from the 1H demand zone following sharp intraday selling into a key support level. With gold hovering near $3,300 and a significant testimony from Fed Chair Powell on deck, the setup aligns with both technical rebound potential and fundamental uncertainty that could fuel upside.

The goal here is to play the liquidity vacuum left after aggressive positioning was cleared, with tight invalidation and asymmetric reward.

Technicals:

• Entry aligned with prior price inefficiency and confluence of multiple demand zones

• 1H structure shows clear deviation below the range with immediate buy-side response

• EMA channel flattening, indicating potential compression ahead of expansion

• First target: $3,352

• Risk-managed with defined stop-loss below $3,260

Execution Note: This is not a “hold forever” trade. It’s an opportunistic reaction to unwind + sentiment imbalance.

Fundamentals

• Gold saw a 25% surge in 2024 due to safe-haven demand and dovish policy, but enters 2025 under pressure from:

▫️ A strong USD

▫️ Higher cost of carry

▫️ Speculators taking profit

• Fed policy remains the core variable:

▫️ A hawkish tone from Powell could weigh on price

▫️ Rate cuts would likely revive bullish momentum

• Central bank demand remains supportive

• Geopolitical tensions (Russia-Ukraine, Israel-Iran) could trigger safe-haven bids again.

Bearish headwinds:

• Waning bullish momentum per RSI divergence

• Reduced rate cut expectations post-election

• Powell’s testimony could revive volatility either way.

This is a short-term tactical long, not a macro bet. With sentiment temporarily overextended and key support defended intraday, this is a high R/R window to exploit Powell-related volatility.

Let’s see how price reacts into $3,350+. Any sustained strength there would open room toward $3,400, while failure would confirm a retest of $3,260s.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Gold Futures BOS does Bearish move might steps in?There is a breakout of the EMA with confirmation of rising Volume, which indicate a strong short position also with NFP shows strong job claims that's why we anticipated a fall in gold, especially for those who want to enter lastly you should consider waiting for a pullback to catch the second move. Follow GoldenZoneFX For more content and valuable insights.

Gold May Find Support From These Various FactorsGold May Find Support Amid Concerns Over U.S. Debt Sustainability, Economic Weakness, and Renewed Geopolitical Tensions

Gold prices are holding steady today, near $1,353 per ounce in spot trading, in what is expected to be a low-liquidity session due to the early closure of U.S. markets. This follows three consecutive days of gains.

The yellow metal’s subdued movement comes as markets await key labor market data that may offer further insight into the health of the U.S. economy, especially after the recent shock from ADP figures.

Gold continues to find support from several underlying factors that could sustain its upward trend this week. These include rising uncertainty around the long-term sustainability of U.S. public finances and the risk of renewed conflict in the Middle East.

Concerns over U.S. fiscal stability have intensified following the introduction of the “One Big Beautiful Bill Act,” which combines tax cuts with spending reductions. In an opinion article for The New York Times , former Treasury Secretaries Robert Rubin and Lawrence Summers warn of the bill’s potentially severe consequences, including persistently high interest rates, reduced business confidence, falling investment, and the risk of a financial shock that markets may struggle to absorb. This could also leave the economy more vulnerable to economic and geopolitical threats.

Such risks may erode investor confidence in U.S. government debt, potentially boosting gold’s appeal as a safe-haven asset even in an environment of elevated bond yields and prolonged high interest rates.

On the geopolitical front, the specter of renewed escalation in the Middle East looms, and this time, the consequences could be more severe. Amid conflicting reports and statements regarding the extent of the damage to Iran’s nuclear facilities, both sides appear to be preparing for the possibility of renewed hostilities.

Diplomatic efforts remain stalled, and hardline voices continue to call for a return to conflict. In an opinion piece for The New York Times, former National Security Advisor John Bolton described negotiations with Iran as ineffective and dangerous, calling instead for regime change and the use of force.

While previous rounds of conflict have not caused lasting damage to the global economy or energy supply chains, a new round may prove more disruptive. According to Reuters , Iran has reportedly loaded naval mines onto vessels, raising fears that it may attempt to close the Strait of Hormuz.

Such a move would cross a critical threshold and turning a contained conflict into one with global economic implications. The Strait of Hormuz handles over one-fifth of the world’s crude oil and liquefied natural gas exports.

However, Iran may avoid this step as long as its own oil exports continue flowing through the strait, as was the case during the last conflict in June.

On the trade front, there is growing optimism about the potential for new agreements that could ease tensions that have disrupted global supply chains and threatened U.S. and global economic growth. This optimism follows President Trump’s announcement of a trade deal with Vietnam.

There is also hope that progress can be made with China. Recent reciprocal steps, that involve the easing of restrictions on rare earth exports by China and some relaxation of U.S. technology export controls, suggest that the de-escalation agreed upon earlier in Switzerland could hold, potentially laying the groundwork for a broader trade agreement.

Samer Hasn

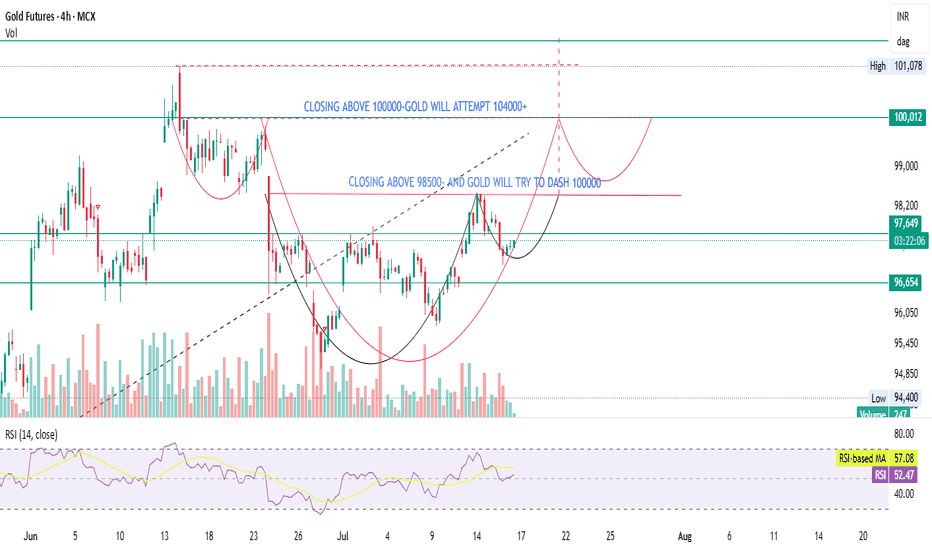

GOLD- CONTRARION OPINIONGold is forming a bullish structure, but a confirmed breakout above ₹98,500 (on volume) is essential for momentum toward ₹100,000.

If ₹100,000 is broken with strength, ₹104,000+ is a reasonable technical target.

RSI is neutral, allowing room for upside.

Watch for a volume spike and confirmation candles before entering.