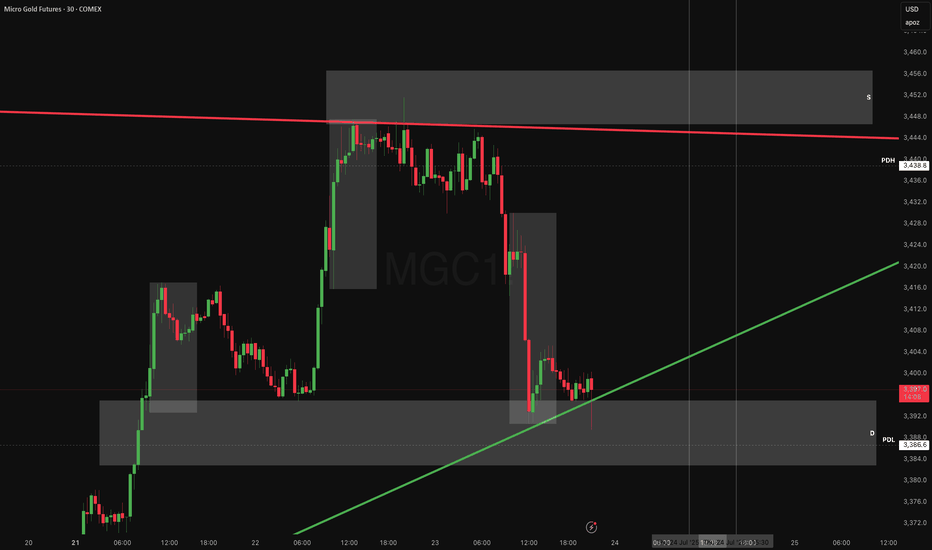

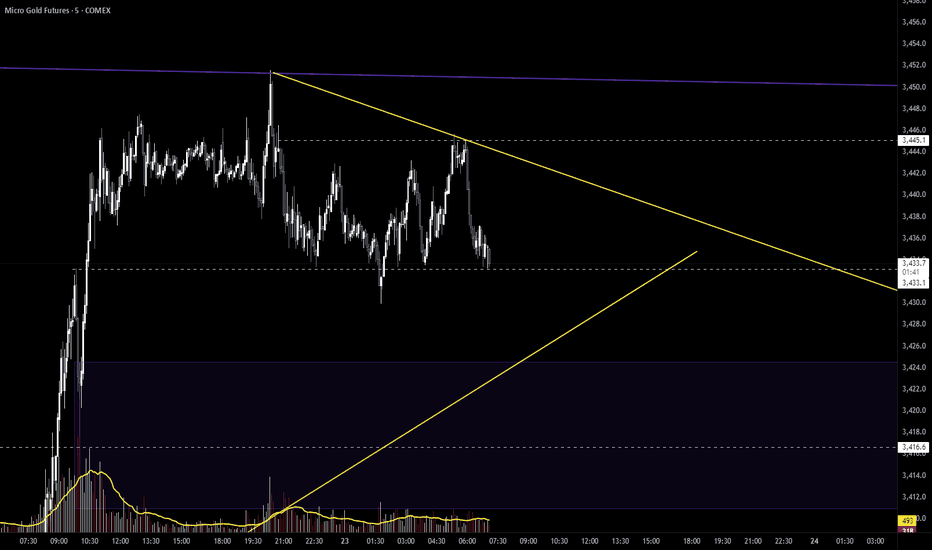

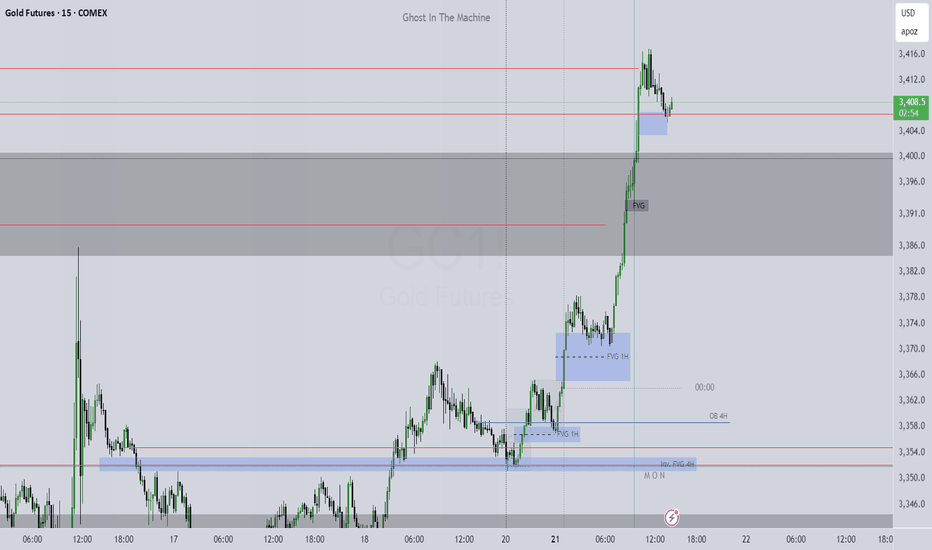

Gold Buyers Barely Holding. Sellers Licking Their Lips.The move on gold over the last two sessions has been clean, aggressive, and very telling. Price rallied hard into a well-defined supply zone between 3452 and 3460, which has acted as a sell-side magnet for the past three rotations.

We got five separate stabs into that zone, all failing to close with strength above 3444, a key breakdown level from earlier structure. Every wick above that line was absorbed classic signs of exhaustion and seller control. That was our trigger. Once price failed to hold above 3440, the sellers unloaded. And they didn’t nibble they dumped.

What followed was a single-leg, high-momentum liquidation straight into demand at 3386–3392, wiping out all intraday longs and resetting the board. Price tagged the PDL (3386.6) to the tick, then bounced not with strength, but with stability. No strong reversal candle, no V-bottom just a hold. What that tells us is: the market’s not ready to trend yet. It’s testing intent.

Now we’re coiling between key structural levels:

- Support below: 3386 (PDL), backed by previous demand zone

- Resistance above: 3405–3410 (micro range breakdown) and 3440 (PDH)

We also have a rising trend line support running up from the July 21 low price is currently sitting right on it. That’s your structural “last chance” for bulls. Break that with volume, and the entire bullish thesis collapses short term.

My Bias Breakdown

Bullish: If we get a reclaim above 3410, then I’d target a move back to 3430, with extension toward 3444 (PDH rejection area). That’s the clean rotation if bulls can generate follow-through.

Bearish: If 3385 breaks on strong momentumbthat opens up 3355–3360, which was the last untested demand from the July 18–19 base.

Neutral (Reactive) right now. This is a trap-heavy zone. Volume is thinning out, the trendline is being tested, and both sides are probing. You don’t want to front-run here. This isn’t trend continuation yet it’s a chop filter before the next directional leg.

Key Contextual Notes

3455–3460 supply was the origin of the last two major reversals this isn’t a random level. Expect traps and stop hunts up there again if price rotates back.

3386–3392 demand has been respected across multiple sessions but it's getting tested more frequently, which means it's weakening. If it breaks clean, the unwind could accelerate.

This is a two-sided market right now. It’s not breakout season, it’s reactionary playbook time. Let the levels guide the setup, not emotion.

Trade Plan (for experienced hands only)

- Long bias: Only on 30m close above 3410 with decent volume target 3430–3444. Stop under 3385. Risk tight; momentum must confirm.

- Short bias: Rejection candle or sweep/failure at 3440–3445 OR breakdown and retest of 3385 target 3355. Invalidation on reclaim above 3410.

This is where traders get chopped to pieces, in the middle of a post-liquidation coil sitting between unfinished business above and fragile demand below. Don’t be that trader. This is where you observe, wait for intent, then strike. Trading is about timing, not guessing. Let the next move come to you. We’re ready either way.

GO1! trade ideas

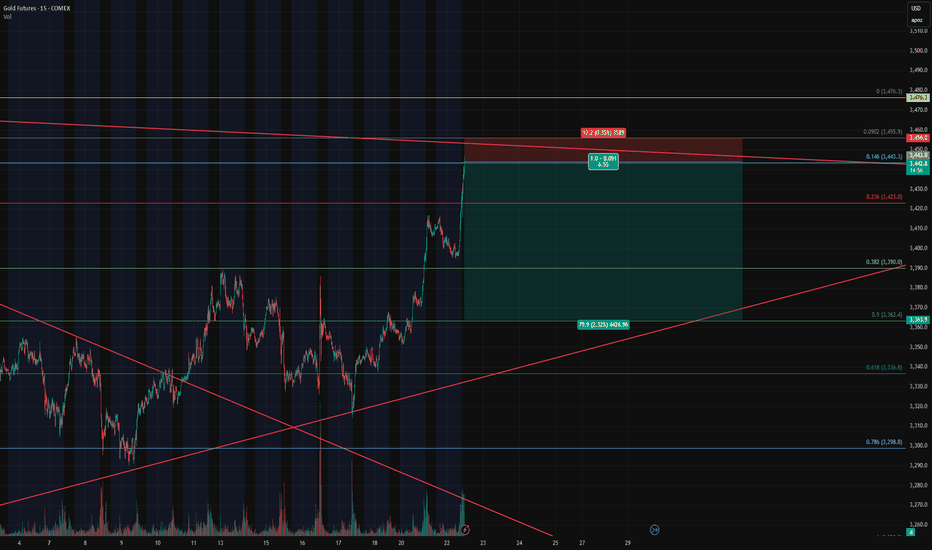

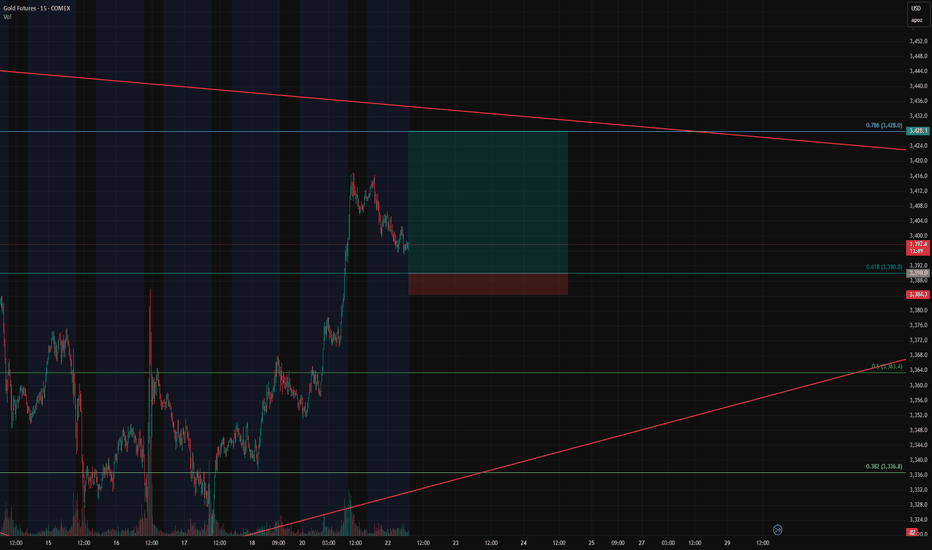

Gold Futures – Closing Longs and Flipping Short at Key Fib🔴 Gold Futures – Closing Longs and Flipping Short at Key Fib Confluence

Instrument : Gold Futures – COMEX ( COMEX:GC1! )

Timeframe : 15-Minute

New Position : Short

Entry Zone : ~3442

Target : ~3362

Stop Loss : ~3458

Risk/Reward : Approx. 6.5+

Setup Type : Reversal from Overextension / Fib Resistance

💡 Trade Recap & Strategy Shift

We’ve officially closed both our recent long entry and our larger swing long position, locking in substantial profit on this move off the 0.618 retracement.

Now, we’re flipping short based on the following:

Price reached the 0.146 Fib extension from the previous retracement leg, a level often overlooked but powerful when confluence lines up.

Trendline resistance from the upper channel has been tagged.

Momentum is showing early signs of stalling after a strong vertical push — textbook overextension.

The rally into this level lacked divergence or structural buildup, increasing the chance of a snapback.

🛠️ Short Setup Details

Entry: 3442 (after signs of exhaustion near Fib confluence)

Target: 3362 (prior structure + 0.382 retracement)

Stop Loss: 3458 (just above high / resistance zone)

Risk/Reward: 6.5:1 — excellent profile for a countertrend play.

📌 Watch For

A break below 3390 will be key confirmation of momentum shifting back down.

Failure to hold 3442 on a retest will invalidate the short and re-open the door for a squeeze higher to 3476/3480.

With trend exhaustion in sight and high confluence resistance overhead, we’re taking the opportunity to pivot short — fully aware of the volatility this region can bring.

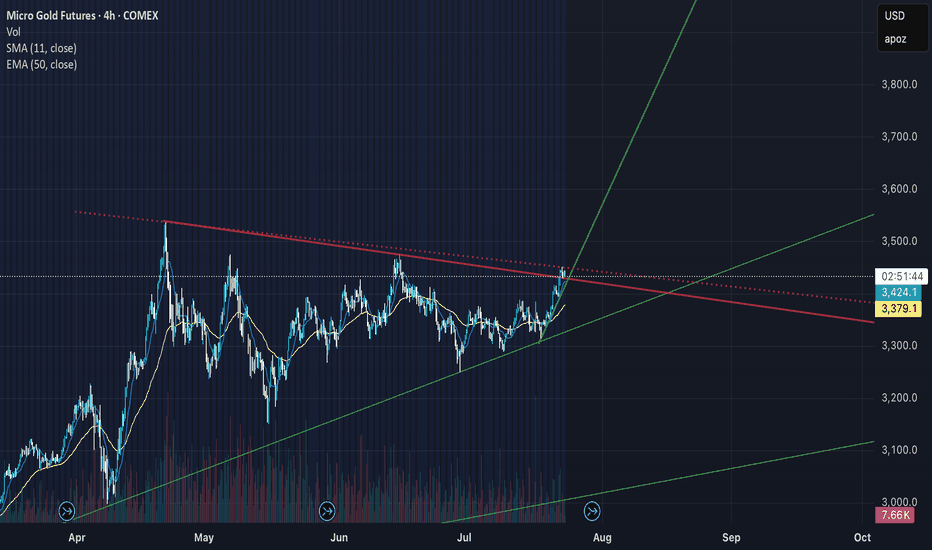

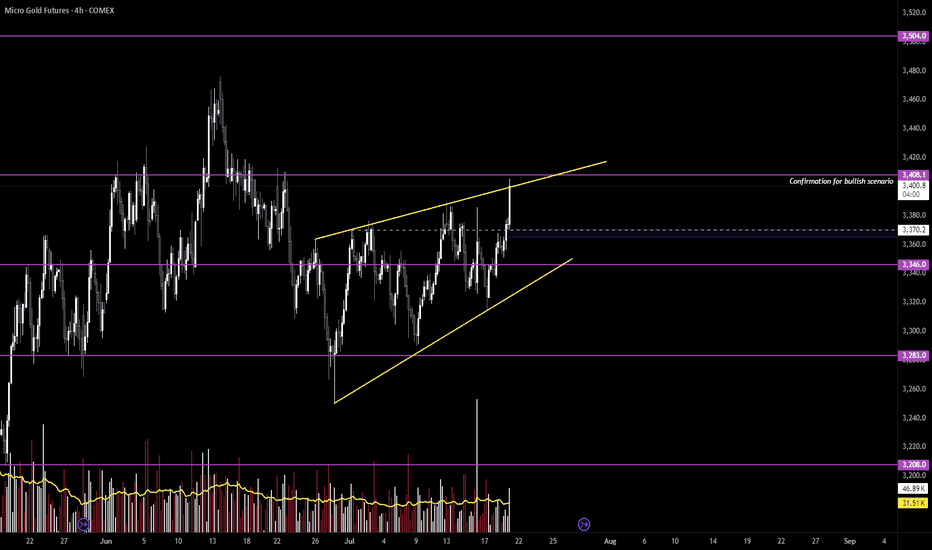

GC Outlooklooking to for a continuation into 3390. then look for a retracement back towards the 50 ema. this will set up a push to the previous all time high. now keep in mind the fluid dynamic of the market based on the ever changing fundamental landscape, tariffs and other news that can shake the market. but the over all picture remains very bullish for gold

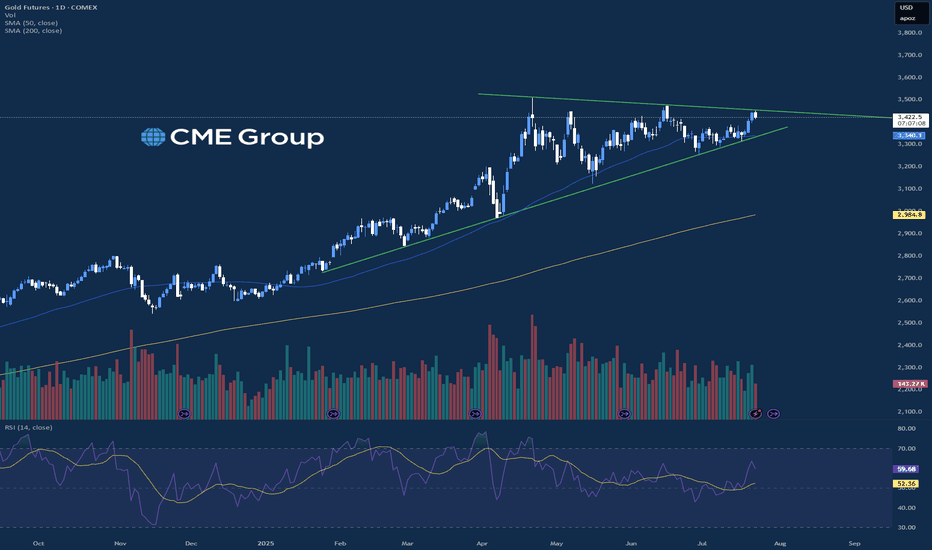

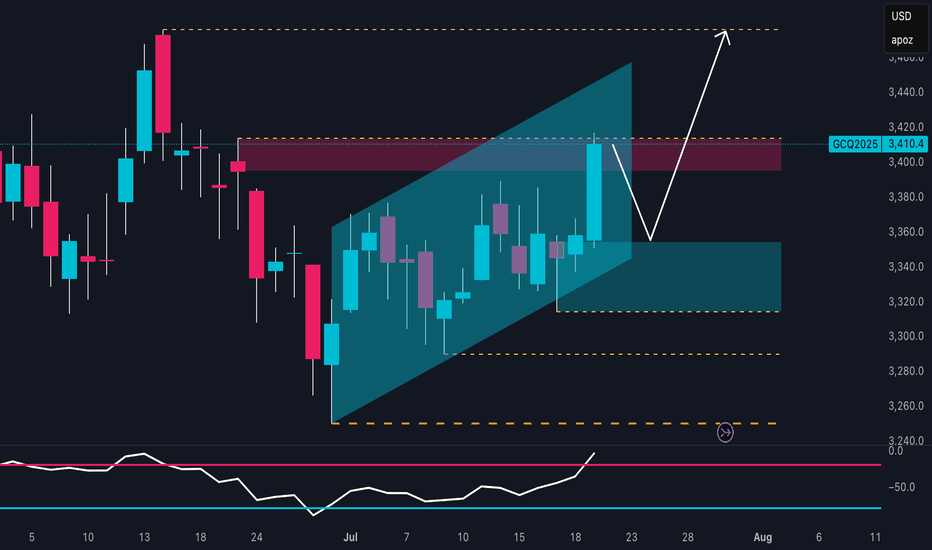

Gold to $3700 - $3800the price of gold has finally broken out of a long standing symmetrical triangle and an established 2 touch point trendline. It is currently consolidating above the broken trendline. If a 4H candle closes above the red dotted trend line we could see a massive pump up. If price closes below green upwards trendline then strategy is invalidated and reassessment needed. This is a long hold trade idea

Precious Metals Pushing HigherMarkets were mixed across the board today with the precious metals leading the charge higher on the session. Gold, Silver, and Copper all traded higher again today with Copper being up near 1.5% and Gold and seeing slight gains. Copper and Silver are similar in the fact that they are more industrial metals and are affected by global manufacturing demand and overall costs more than Gold is. On July 8th, Copper saw a 13% move to the upside to a new all time high price, and Silver also made a new all time high today which brings a lot more attention to these markets.

Along with that, there is still significant tariff uncertainty that has been driving Copper and Silver higher relative to Gold. The Gold market is still moving higher overall but has stalled out slightly since the new all time high from April. Outside of the metals, there are critical earnings reports coming out tomorrow looking at Google and Tesla that may add significant volatility to the equity indices for the rest of the week.

If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

*CME Group futures are not suitable for all investors and involve the risk of loss. Copyright © 2023 CME Group Inc.

**All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

$GC / Gold Update - A New Entry - 7/23Hello fellow degenerates,

Our next target is above 3504 and we are currently in a quick ABC retracement.

- I am looking for an entry in the 3424.6-3411 range.

- This is a wave C so we could see an ABC or a ABCDE pattern forming.

- Levels to watch: 3433.1, 3424.6, 3416.6, 3408

$GLD / $GC – Gold Poised for Breakout as Hard Assets FlexAMEX:GLD / SET:GC – Gold Poised for Breakout as Hard Assets Flex

Gold is setting up for a major breakout, and the broader market is finally catching on to the hard asset trade. Whether it’s inflation ticking up or the never-ending government deficit spending, the market is starting to signal something big.

🔹 Macro Tailwinds:

Inflation pressures + record deficit = a perfect storm for gold.

The dollar is under pressure — metals ( AMEX:GLD , AMEX:SLV , SET:GC ) are responding.

This theme isn’t going away anytime soon.

🔹 Technical Setup:

AMEX:GLD and SET:GC (Gold Futures) are coiled tightly just under breakout levels.

Volume is steady, and momentum is building under the surface.

A move through current resistance could send this entire trade into overdrive.

🔹 My Positioning:

1️⃣ Options: Long AMEX:GLD calls with 1-month expiration — slow mover, but clean structure.

2️⃣ Futures: Trading SET:GC contracts on the breakout side.

3️⃣ Silver Exposure: Still holding partials in AMEX:SLV — it’s following gold’s lead but with more juice.

Why I’m Focused Here:

This is not a one-day theme — hard assets are becoming a rotation trade.

If this confirms, we could see multi-week upside in precious metals.

It’s rare to get clean technicals that align this well with macro.

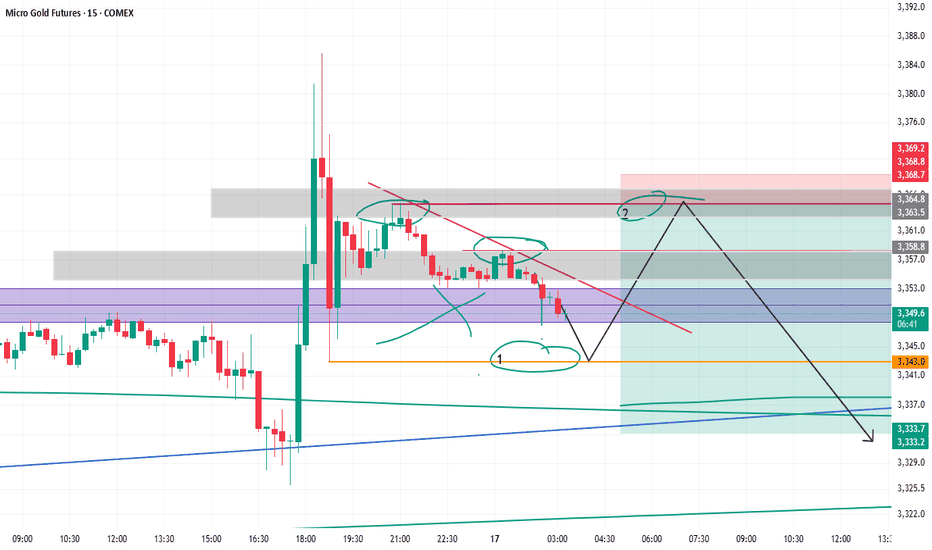

Gold short Read this clearly, my confidence in this trade is 3 out of 10.

Use very small size on this trade, as iam not sure at all that this is even the right thing to do.

The chart is messy, and there is consolidation is going on.

if the price didnt make it to nr 1 circle, dont worry about it. The most important thing is the close below the FVG.

Also confirm on lower time frame to see how the price reacts to the entry levels. If anything is going to happen, is going to happen at those levels.

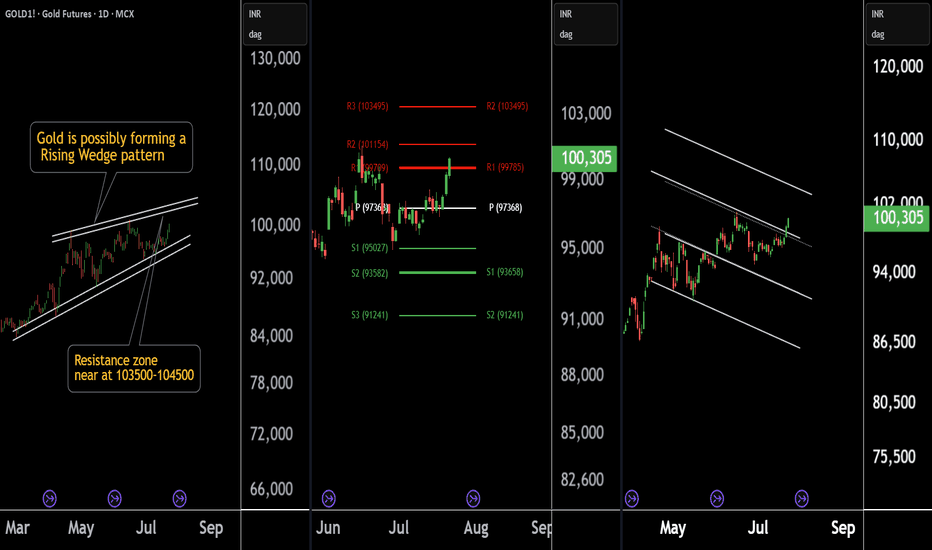

Gold at a Crossroad: Long or Short? Key Levels in FocusThere are three chart of Gold .

Gold1! is forming a Rising Wedge pattern, with resistance positioned between 103500-104000 levels.

Gold1! is facing Pivot Point resistance around the 103500 level, indicating potential supply pressure.

Gold1! is approaching the parallel channel resistance, and the upside move is nearly complete in percentage terms, with resistance around 103800-104000.

if this level sustain then we may see first of all higher prices then again fall in gold1!

Thank You !!

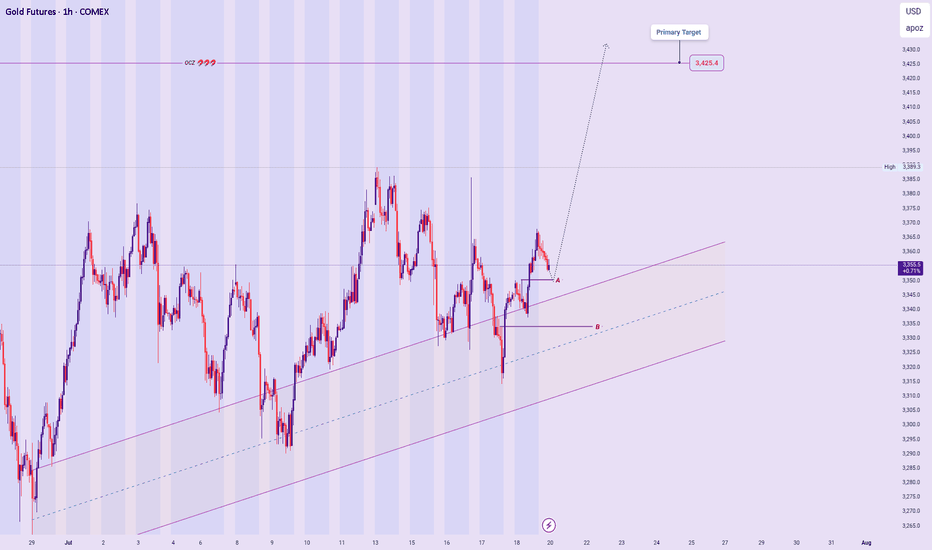

XAUUSD – New Week Technical Bias (Market Open)

Bias Overview:

Current outlook remains aligned with previous bullish analysis, supported by the broader Ascend Sequence on higher timeframes.

Price Expectations:

Anticipating a micro decline toward Price Zone A as a potential springboard for a bullish continuation.

While less likely, a deeper pullback into Price Zone B may occur before the rally unfolds — still within acceptable structure for HTF bullish intent.

Execution:

Will rely on micro-timeframe confirmations and reaction behavior within these zones to finalize entry decisions following market open.

Invalidation will be break and bearish structure below the ascending sequence Channel.

Summary:

Maintaining bullish bias while awaiting refined entry opportunities at defined price zones. Structural invalidation remains below key support and Sequence Line levels.

[b ]🔒 Disclaimer:

This analysis is for educational and strategic insight purposes only. It is not financial advice. Always manage your own risk and confirm with your personal trading plan before executing trades.

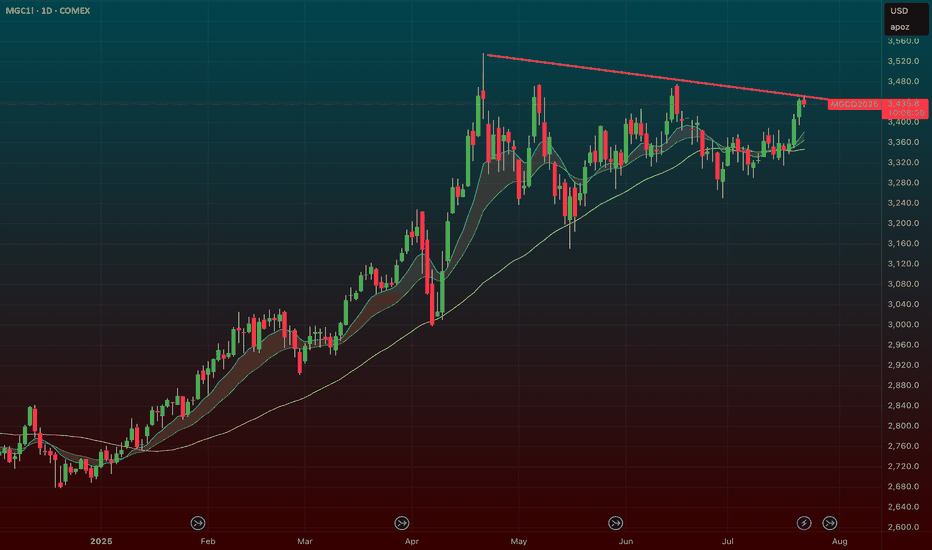

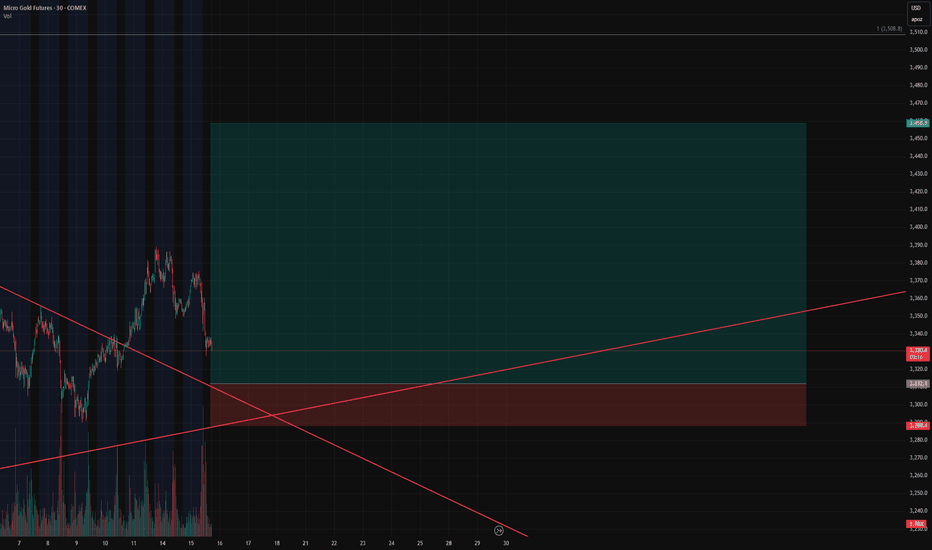

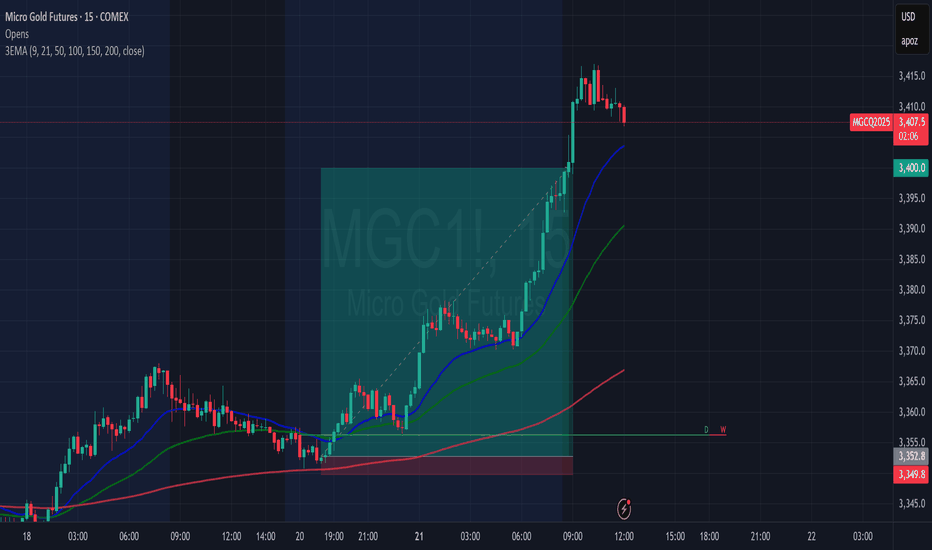

Gold Bulls Loading Up – Our Short Squeeze Trigger is Set!🚨 Gold Bulls Loading Up – Our Short Squeeze Trigger is Set!

We’re flipping the script on COMEX_MINI:MGC1! After a prolonged downtrend and textbook wedge compression, our breakout long is LIVE – but not without trapping the late shorts first.

💥 Entry: $3,312.1

🛑 Stop: $3,288.4

🎯 Target: $3,458.9

🧮 Risk/Reward: 6.19

Price just bounced at the retest of the wedge apex, and volume is confirming the move. If this holds, we’re riding momentum all the way up – and letting short pressure fuel the breakout.

📈 Trendline breached.

⏳ Time compression converging.

⚠️ If you’re still short, watch your stops!

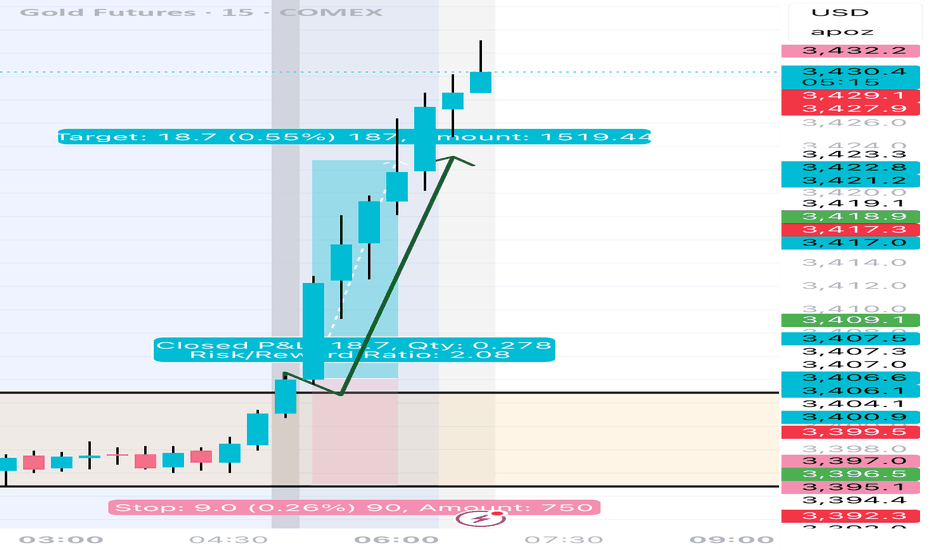

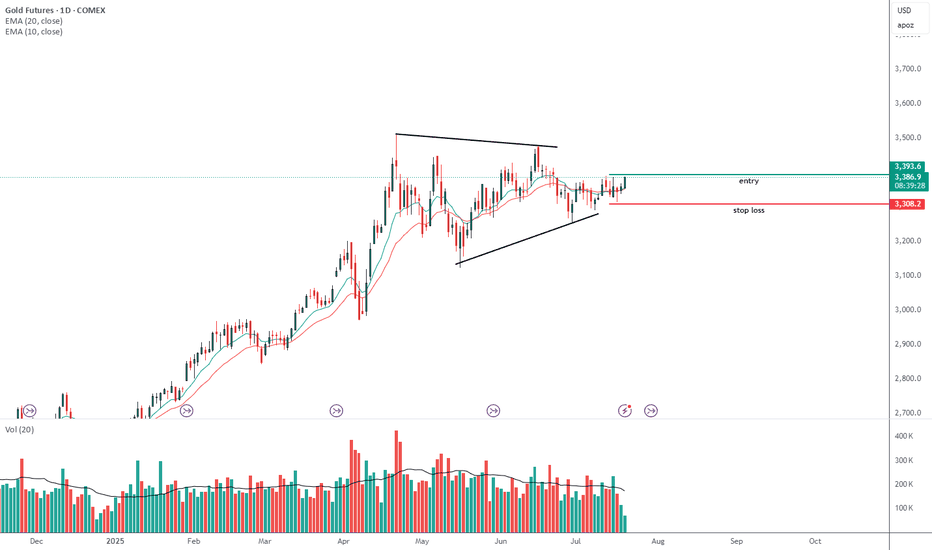

Gold Futures Long Setup – Breakout Continuation off the 0.618 FiGold Futures Long Setup – Breakout Continuation off the 0.618 Fib

Instrument: Gold Futures – COMEX ( COMEX:GC1! )

Timeframe: 15-Minute

Trade Type: Long – Breakout Continuation

Entry Zone: 3390 (0.618 Fibonacci retracement)

Take Profit: 3428 (0.786 Fib)

Stop Loss: 3384

Risk/Reward Ratio: 6.68

Setup: Bullish Flag on Retest

🔍 Trade Thesis

This trade is part of an ongoing breakout continuation strategy we've been trading, and now we're eyeing a pullback entry as price returns to a key retracement level.

Price nearly exploded through the 0.618 Fibonacci level (3390) during the prior breakout.

Now it's pulling back in a textbook bullish flag formation, suggesting healthy consolidation before the next leg.

The 0.618 retracement is aligning with previous intraday structure and trendline support — making this an ideal level to scale in.

This is a high R:R continuation play, with targets set at the 0.786 Fib level (3428) — right before macro resistance kicks in.

🎯 Entry & Exit Strategy

Entry: As price touches 3390 or forms bullish confirmation at the level.

Stop Loss: 3384 – tight and below key fib/flag structure.

Target: 3428 – based on 0.786 Fib extension and breakout continuation projection.

📊 Why This Works

Breakout behavior: Price respected the breakout impulse and retraced cleanly into a bull flag.

Fib confluence: 0.618 pullbacks are a classic entry in trending markets.

R/R of 6.68: Excellent reward profile vs. limited risk.

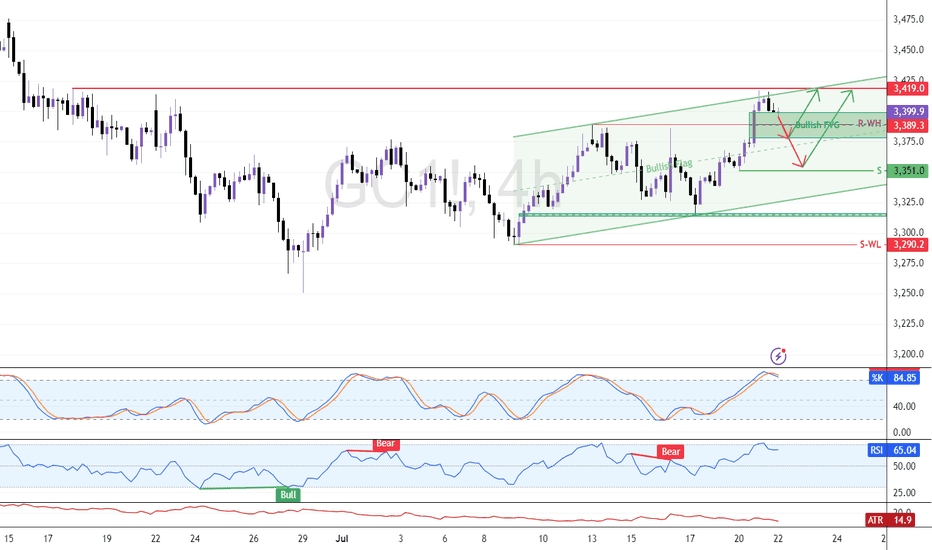

Eye These Levels to Go Long On GoldFenzoFx—Gold remains bullish but eased at $3,419.0 resistance. The Stochastic at 85.0 suggests a pullback may follow. Traders can watch support at $3,389.0 for short-term scalping.

Swing entries may emerge near $3,351.0 if bullish signals appear, such as candlestick patterns, structure breaks, or fair value gaps. Updates will follow if price reacts to these levels.

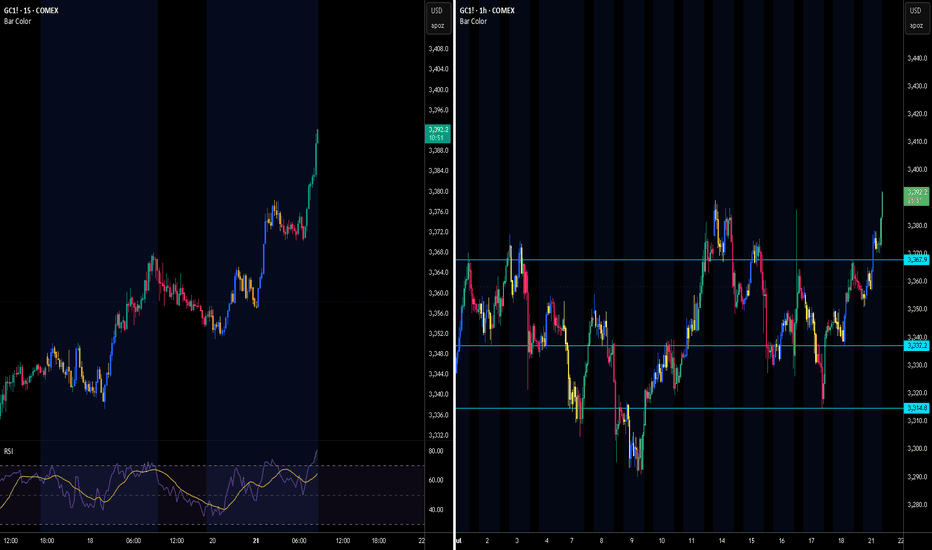

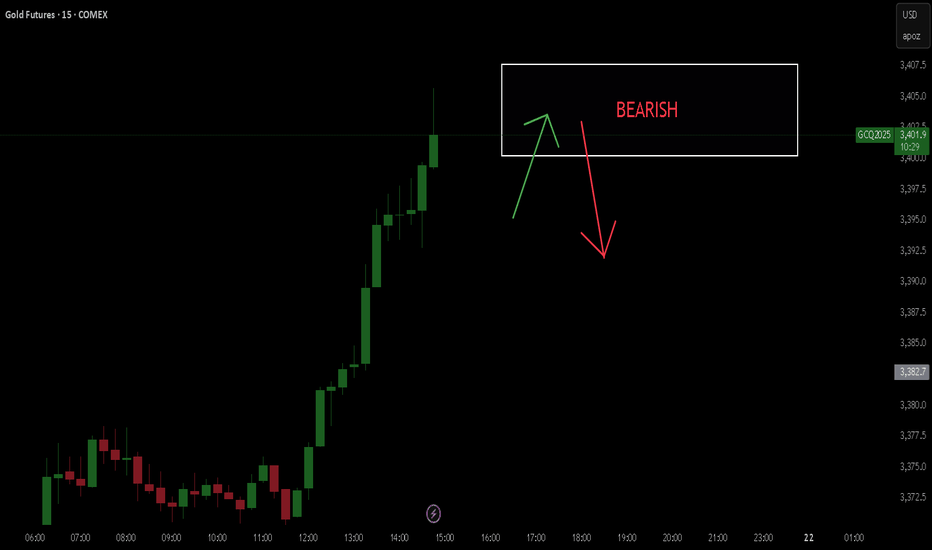

Gold Futures (GC1!)Gold Futures (GC1!) 1H – Bearish Rejection Setup

Price showed a strong bullish impulse followed by a rejection near the 3,416 resistance zone, forming a lower high and signaling potential exhaustion of buyers. After grabbing liquidity above the previous high, it failed to hold above the zone and retraced back below a key structure level around 3,406.

This setup aligns with a classic breakout and retest, now acting as resistance. I entered a short position after confirmation of bearish price action, targeting the demand zone around 3,372–3,368. Stop loss is placed just above the high at 3,416.8.

Gold Bulls Reloading? Smart Money Buys!The technical outlook on XAU/USD shows a well-defined bullish trend, developing within an ascending channel that started in late June. Price recently pushed toward the upper boundary of this channel, reaching a key resistance zone between 3,410 and 3,420 USD, which aligns with a previous supply area and significant daily structure. The reaction in this zone suggests a potential fake breakout, hinting at a short-term pullback before a continuation of the upward move.

The RSI oscillator supports this view, displaying bullish momentum with a breakout above the 60 level. However, the current slope hints at a possible minor correction before the next impulsive leg higher. The most relevant demand zone lies between 3,340 and 3,360 USD, at the base of the ascending channel—an ideal spot for buy orders to accumulate in anticipation of a move toward previous highs.

Backing this technical setup, the Commitment of Traders (COT) report as of July 15, 2025, paints a constructive picture. Non-commercial traders (institutional speculators) increased their long positions by over 8,500 contracts, while also cutting short positions by about 1,600 contracts, indicating a strong bullish bias. Commercials also increased their shorts (+16,448), a typical hedge during rallies, but not enough to invalidate the bullish structure.

From a seasonal perspective, July remains one of the historically strongest months for gold. According to MarketBulls data, over the past 2 years, gold has averaged gains of 105+ points in July, with solid returns also visible on the 5-year (+45 pts) and 10-year (+25 pts) averages. August also tends to be supportive, reinforcing the idea of a medium-term bullish extension.

Lastly, the retail sentiment is heavily skewed, with 72% of retail traders short, and only 28% long. From a contrarian standpoint, this is another strong bullish signal. When the majority of retail traders are short in a structurally bullish market, the potential for a short squeeze remains high.

GOLD - Lovers Elliott wave - looking strong Short/Medium termGOLD-----Daily counts indicate Excellent bullish wave structure.

Both appear to be optimistic and this stock invalidation number (S L) wave 2 low

target short / long term are already shared as per charts

correction wave leg seems completed (C)

Investing in declines is a smart move for short/ long-term players.

Buy in DIPS recommended

Long-term investors prepare for strong returns over the next two to five years.

one of best counter

Every graphic used to comprehend & LEARN & understand the theory of Elliot waves, Harmonic waves, Gann Theory, and Time theory

Every chart is for educational purposes.

We have no accountability for your profit or loss.

$GC/Gold Elliot Wave Analysis Update - 7/21Hello fellow gamblers,

Both scenarios that we are watching are still valid and as price approaches a confirmation level, we do gotta be aware possible fakouts as we trade inside a flag/wedge pattern.

- A rejection of 3408 could drive us towards the other end of the pattern and a possible break to the downside.

- If we do have a rejection, I will be watching for price to find support at 3370 for my bullish bias.

- Levels to watch: 3408, 3346, 3283

GOLD: Pre-market PrepSo for gold today, I see a lot of confluence around the prior week's high, prior day's high, and the prior value area high. We also had a poor high last Friday that we've clearly broken through.

Right now, we're in balance up above these key levels. My immediate plan is to continue going long up to the prior month's value area high. If we get a pullback to the confluence area, I want to take it up from there.

If the market opens and we accept back into the previous area, I'll be looking to go short from that area and take it down. That's my main analysis for gold today. Let’s trade smart, peace!