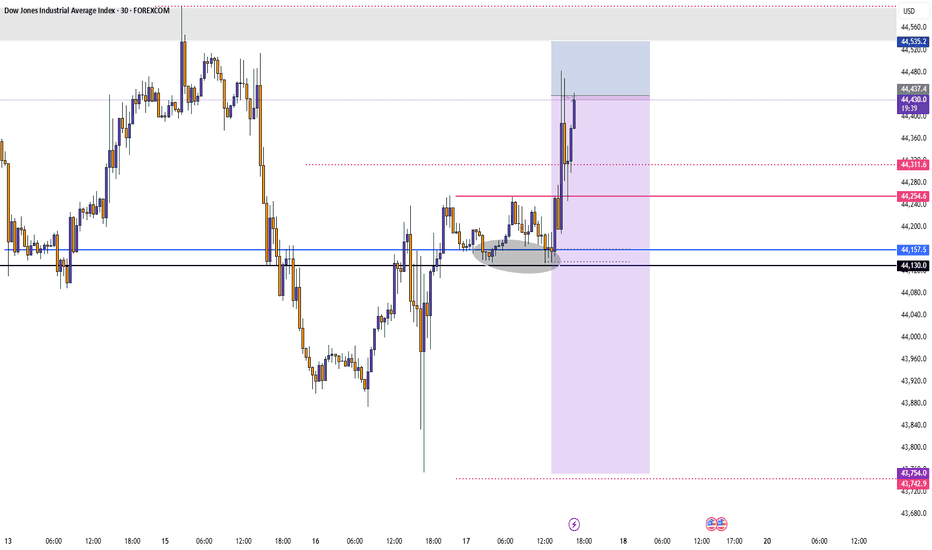

EURUSD & US30 Trade Recaps 18.07.25A long position taken on FX:EURUSD for a breakeven, slightly higher in risk due to the reasons explained in the breakdown. Followed by a long on OANDA:US30USD that resulted in a loss due to the volatility spike that came in from Trump.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

US30 trade ideas

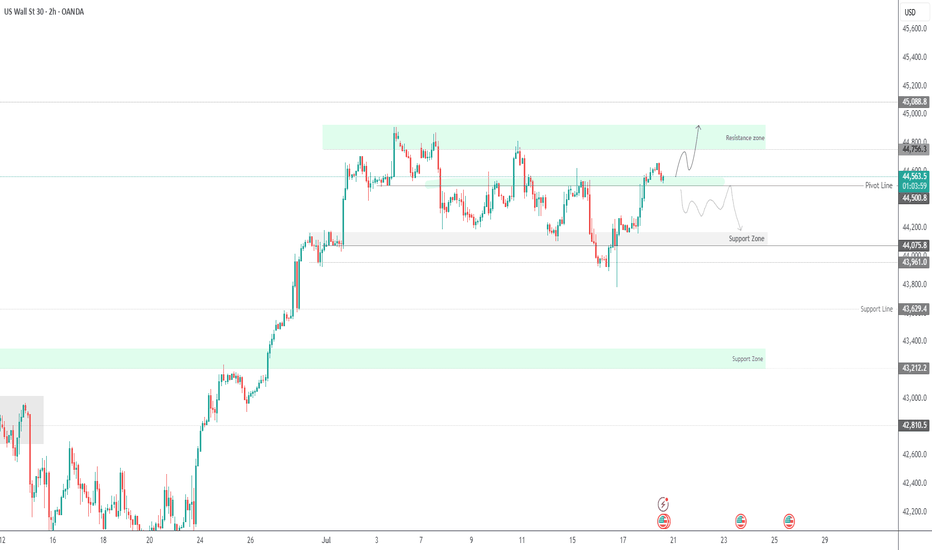

US30 Holds Above 44500 – Bullish Momentum in PlayUS30 | Technical Overview

The price action continues to reflect a bullish bias, supported by strong earnings reports and solid U.S. economic data. As long as the index trades above 44500, the upward momentum is expected to continue.

Technical Outlook:

Price remains bullish above 44500, with upside targets at 44640 and 44760.

A confirmed 1H close below 44500 would shift momentum to the downside, exposing support levels at 44350 and 44215.

Key Levels:

• Pivot: 44500

• Resistance: 44640 / 44760 / 44920

• Support: 44350 / 44215 / 44075

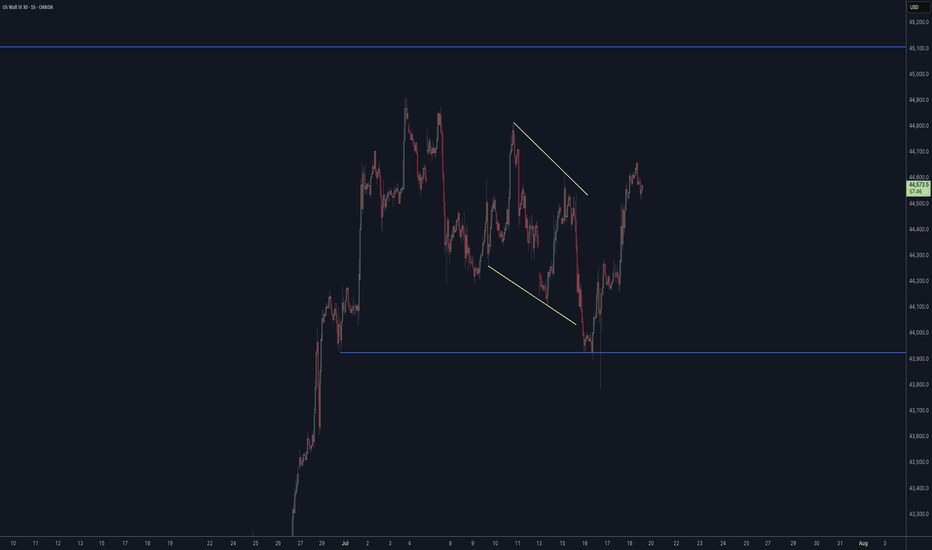

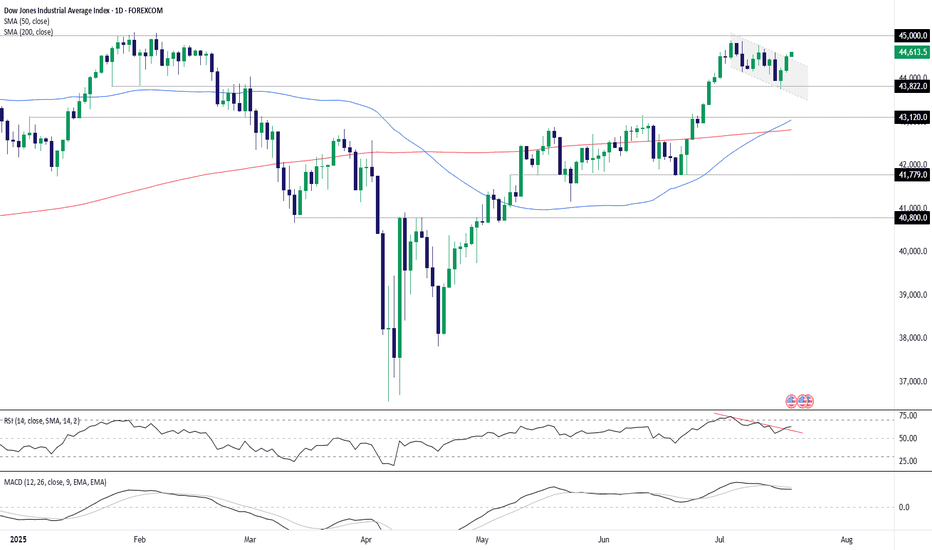

Quick take on DJIACurrently, the Dow Jones Industrial Average TVC:DJI is trading within a short-term downside channel. However, could it just be part of a correction, before another possible leg of buying? Let's dig in.

MARKETSCOM:US30

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

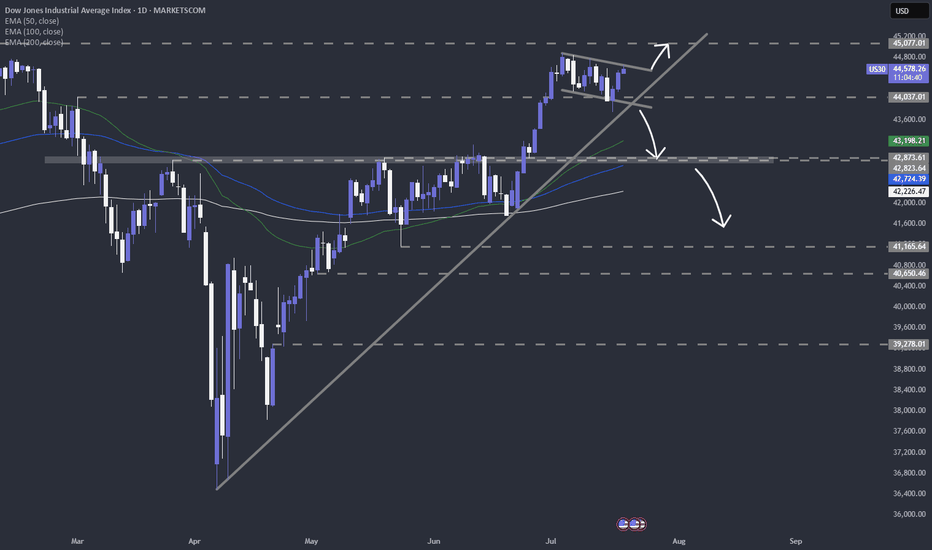

Dow Eyes 45000 After Bullish BreakoutThe U.S. 30 contract has broken topside from a short-term bull flag, reinforcing the broader uptrend and putting 45000 resistance back in focus.

Traders looking to play a continuation can consider longs with a tight stop beneath for protection. A break of 45000 may trigger a fresh burst of upside momentum, putting big figures above in play.

Bullish price momentum is also building again, adding to the case for upside.

Good luck!

DS

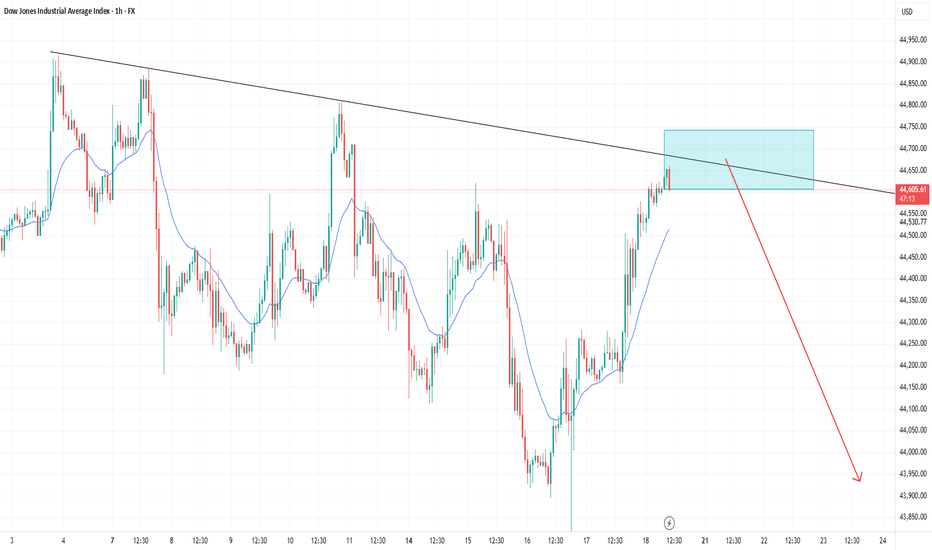

US30: Absolute Price Collapse Ahead! Short!

My dear friends,

Today we will analyse US30 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 44,459.35 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

Dow Jones Industrial Average (DJI) – 1H Chart Analysis 1. Structure: Broad Range Consolidation

Price remains within a wide horizontal range between 45,137 resistance and 43,792 support. This shows indecision and distribution at highs.

2. Key Rejection Zone

The yellow zone around 45,001–45,137 acted as a strong supply area. Multiple rejections indicate heavy selling interest here.

3. Mid-Zone Compression

Current price is hovering just below 44,765 resistance — acting as a decision point. Break above it may retest the supply zone; rejection could send price lower.

4. Demand Holding at 44,280

The strong bounce from 44,280.25 shows buyers defending this demand zone. It's the key support to watch for bulls.

5. Next Play

Bullish: Break and hold above 44,765 targets 45,001–45,137.

Bearish: Failure leads to 44,280, then 43,973 → 43,792.

Neutral bias unless a clean breakout confirms direction.

US30 DOWN FOR WHILEWe have seen dramatic gain in most of the indices and US30 being one of them, and i have been tracking it for so long and i have come with this idea from my approach. As you can see on my screen i have labeled those levels and reset to mark up the the half cycle with the aid of the TDI divergence, the last push there is the level 3 moving exactly with the divergence which indicates that the bulls are getting weak and bears are about take over and push price to the downside, so am looking to join the bears 🐻to price down for a while.

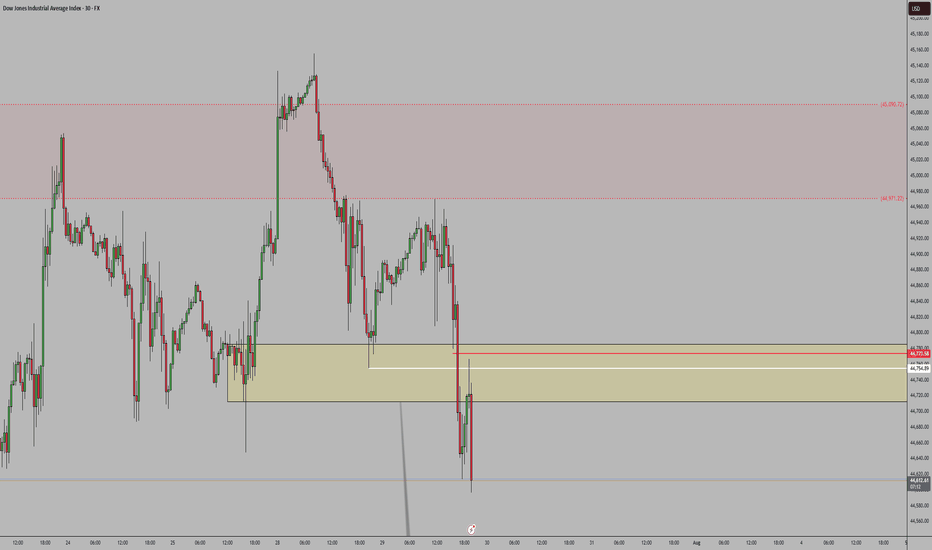

Dow Jones Index (DJI) – July 30, 2025 | 30-Min Chart Analysis

1. Current Market Structure

DJI is consolidating just below the intraday resistance at 44,777. Price is attempting to recover after a sharp drop from the 45,154 high.

2. Supply Zone Rejection

Price faced strong rejection near 45,154 and again at 44,968 — confirming this area as an active seller zone.

3. Support Zone Defense

Buyers stepped in at 44,587 and 44,403, creating a short-term demand base. These levels have provided stability for now.

4. Trend Outlook

The lower high formation and recent sharp sell-off hint at bearish pressure. Price is currently in a retracement — unless 44,968 breaks cleanly, sellers remain in control.

5. Key Levels to Watch

Resistance 44,777 → 44,968 → 45,154

Support 44,587 → 44,403 → 44,239

🔁 Bias: Short-term bearish unless price breaks above 44,968 and holds.

US30The latest COT report shows increased Non-Commercial short positions, indicating bearish sentiment among speculators. Commercial traders are also holding or adding to their short positions, reinforcing the negative outlook. Rising open interest further confirms market expectations of a decline in the US30.

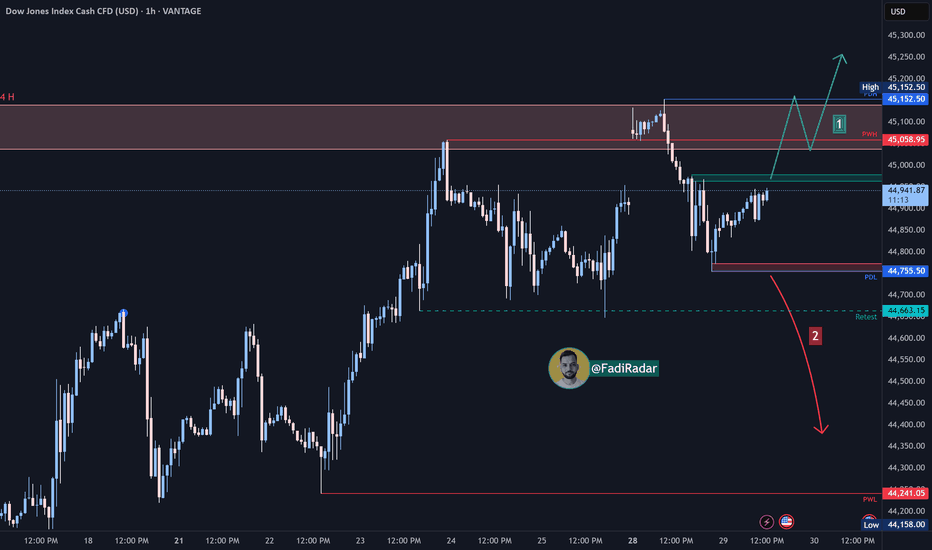

Dow Jones Index Analysis (US30 / Dow Jones):🔹 The index completed the expected correction and successfully retested the PDH level at 44,750 USD.

1️⃣ If bullish momentum leads to a break and close above 44,970 USD, the price is likely to form a new high or retest the previous peak.

2️⃣ However, a break and close below the 44,760 USD support could trigger a decline toward 44,660 USD.

🔻 A confirmed break below that level may resume the bearish trend and open the way toward 44,250 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

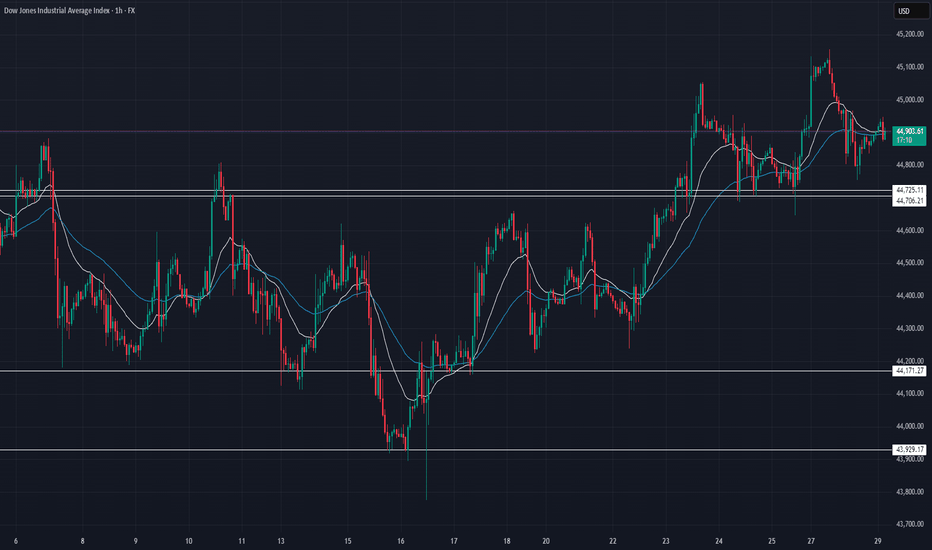

US30 Technical Breakdown – 07/29/2025📍 US30 Technical Breakdown – 07/29/2025

US30 is consolidating after last week's bullish breakout. It failed to hold above 45,100, rolled over, and is now ranging between 44,725 support and 45,000 resistance.

Currently sitting at 44,900, price is coiling just below key resistance. The market is waiting for a catalyst—either to reclaim 45,000 or dump back into the 44,700s.

📊 Current Market Behavior:

🔄 Sideways consolidation

📉 Lower highs forming below 45,100

🧱 Strong support building at 44,725

⚠️ No strong momentum yet – patience is key

📌 Key Levels:

🔹 Resistance Zones:

45,000 → Intraday ceiling

45,100–45,160 → Recent high/rejection area

45,250 → Breakout expansion level

🔹 Support Zones:

44,725–44,700 → Crucial support for bulls

44,600 → Mid-range support

44,171 → Demand floor

🧠 Bias:

🔄 Neutral to Slightly Bearish Intraday

Price stuck between 45,000 resistance and 44,700 support

Bears in control unless we break & hold above 45,000

Look for signs of momentum at open

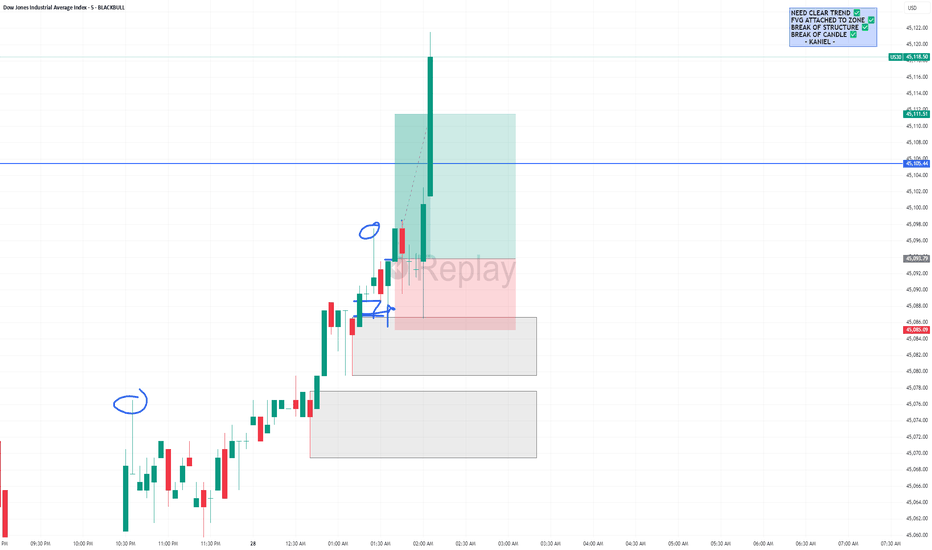

US30 5M DEMAND SETUPPrice was in a clear bullish trend, consistently printing higher highs. Two demand zones were formed, followed by a clean break of structure. I anticipated a reaction at the most recent demand zone and entered on a strong rejection candle, leaving the wick in zone. Execution was on the break of candle with initial targets set at recent highs. However, unexpected momentum drove price beyond target, allowing me to secure a solid 1:2 R:R. Trade managed with discipline and am satisfied with the outcome.

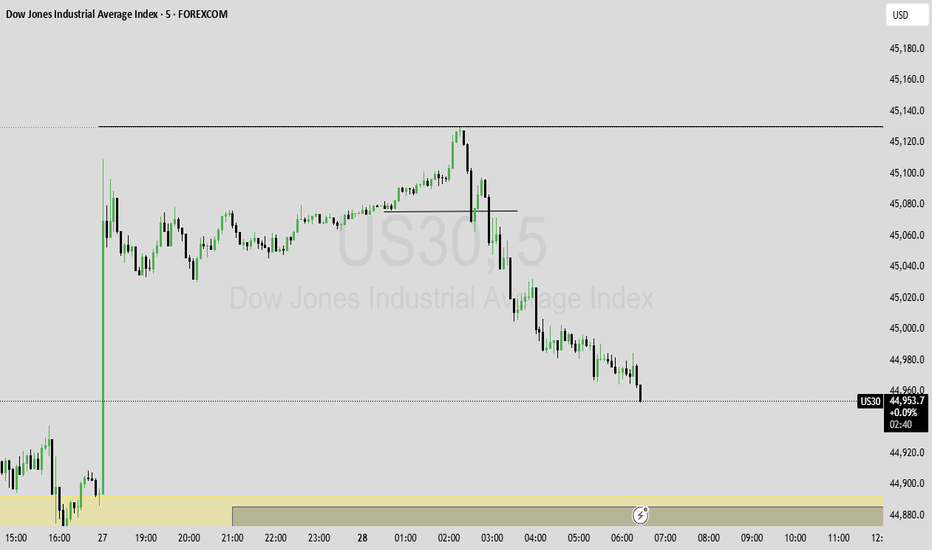

US30 Market Breakdown – 07/28/2025📍 US30 Market Breakdown – 07/28/2025

US30 just broke above the prior key zone at 44,950–45,000 and tapped 45,160+ before showing some rejection and pulling back to 45,000.

The move confirms bullish continuation—but the pullback is critical. If bulls defend 44,950–44,900, this could be a textbook higher low and launchpad for more upside.

📊 Current Structure:

✅ Higher highs & higher lows

📈 Clean break and retest of the 45K zone

⏳ Pullback in progress—watching demand areas

🧱 Resistance Zones:

45,160 → Recent local high

45,250 → Psychological resistance

45,400 → Next extension zone

📉 Support Zones:

44,950 → Breakout level (must hold)

44,800 → EMA confluence

44,600–44,500 → Demand base

📉 If price fails to hold 44,950, we could see a fade back to 44,800 or even 44,600.

📈 If 45,160 breaks, expect momentum to accelerate into the 45,300–45,400 range.

🧠 Bias:

🟢 Bullish

Structure favors continuation unless 44,800 breaks

Buy dips into demand zones

Wait for NY open confirmation for intraday momentum

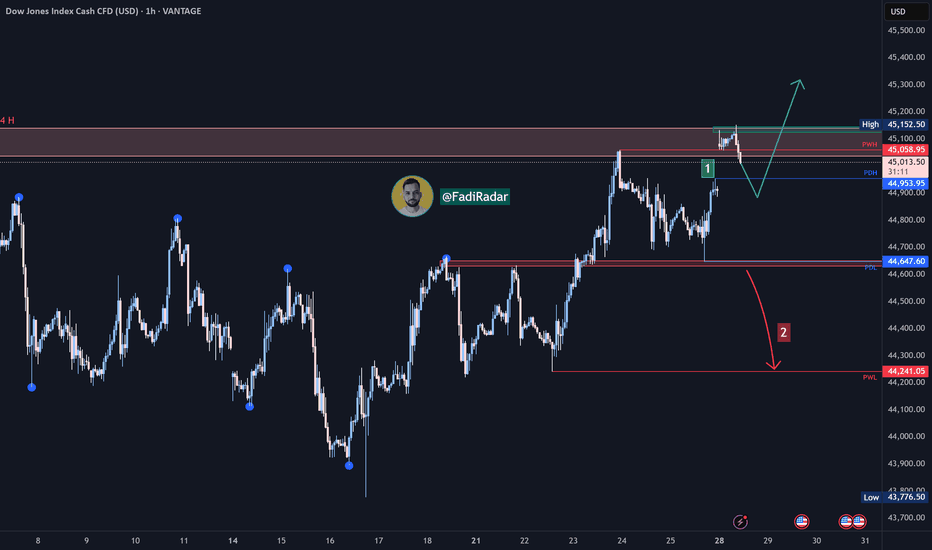

Dow Jones Index Analysis (US30 / Dow Jones):🔹 The index recently tested its all-time high at 45,152 USD, and a short-term correction may occur to retest the PDH level at 44,950 USD.

1️⃣ If strong bullish momentum leads to a break and close above 45,150 USD, the price is likely to push toward forming a new high.

2️⃣ However, a break and close below 44,620 USD could trigger a move toward 44,240 USD.

🔻 A confirmed break below this zone would resume the bearish trend and open the way toward 43,900 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

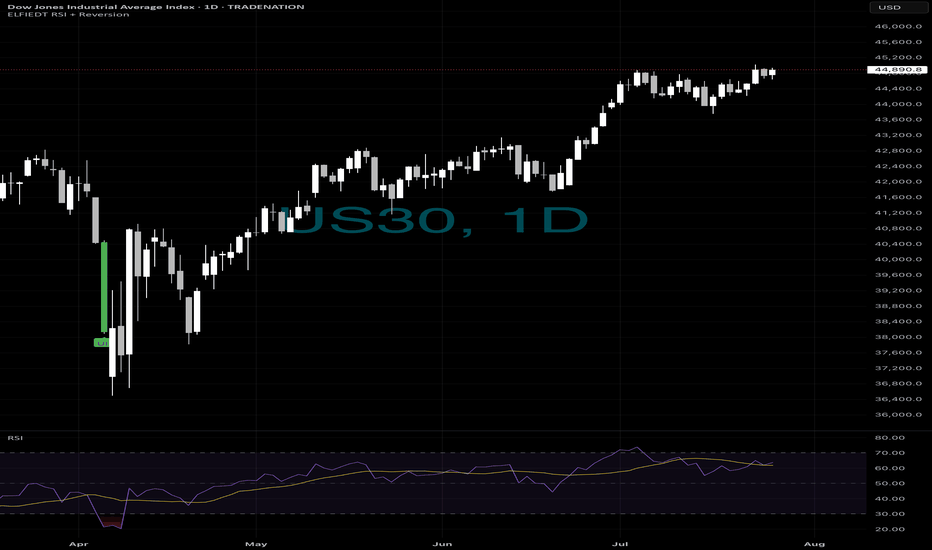

Retirement trading?🏦 LONG-TERM INVESTORS — This Was the Signal.

When fear hit the Dow in April,

most sold.

Our system?

🟢 It bought the dip — and never looked back.

That single green “UP” on the daily US30 chart caught the bottom of the move that led to 5,000+ points and counting.

⸻

This is what long-term confidence looks like:

✔️ Oversold RSI + deep structure

✔️ Clean mean reversion signal

✔️ Daily confirmation = strong foundation

✔️ No lag. No second guessing. Just one entry, held strong.

📈 From panic to new highs — all off one candle.

⸻

🧠 Here’s How Investors Can Use It:

1. Monitor daily charts on major indices

2. Wait for RSI exhaustion + reversion zone tag

3. Let ELFIEDT RSI + Reversion give the green light

4. Enter with size. Ride the trend.

This isn’t about day-trading.

This is about compound wealth with simple conviction.

⸻

💬 DM “DOW ENTRY” to get access

📲 Follow if you want less noise and more clarity

🔐 For investors who want an actual edge, not just advice

Because smart investors don’t time the market —

🚀 They follow signals with structure behind them.

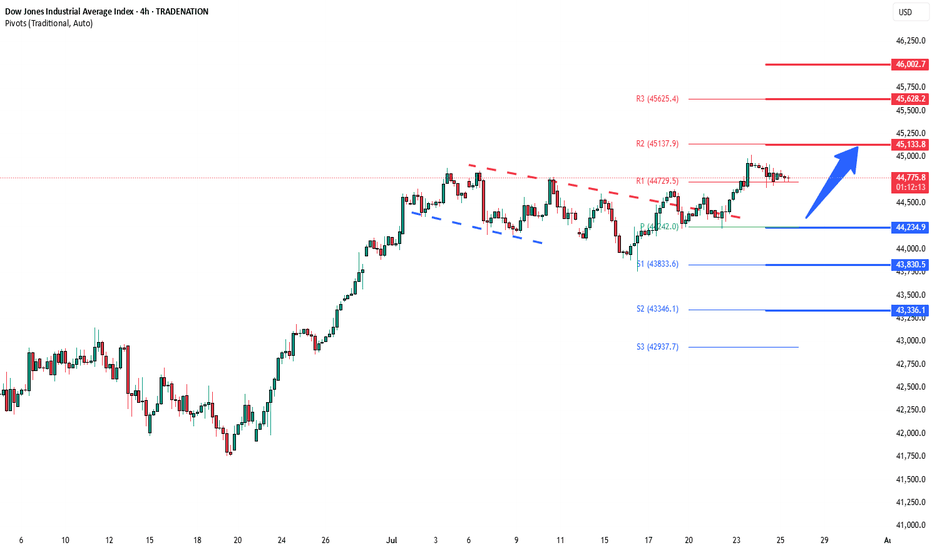

DowJones bullish breakout support at 44240Key Support and Resistance Levels

Resistance Level 1: 45135

Resistance Level 2: 45630

Resistance Level 3: 46000

Support Level 1: 44240

Support Level 2: 43830

Support Level 3: 43340

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.