TIAUST trade ideas

TIA | Next Altcoin to MOON ??In the macro, it's clear that TIA has been in a downward trend for an extended period of time. This means, it's a great place to buy - because the bullish cycle is up next.

In an earlier publication, I made an update about the ideal entry point for TIA:

A key indicator to watch is the daily timeframe, when the price begins to trade ABOVE the moving averages - that's when you'll have the first confirmation of a bullish turn around. It is a bullish sign to see the gradual higher lows.

Moving Averages:

TIAUSDT - analysis of the downtrend phase and potentialProject :

Celestia is one of the key players in the new generation of modular blockchain architecture. Unlike traditional monolithic solutions, it separates the execution and consensus layers. This provides flexibility, scalability, and creates the infrastructure for rollup and L2 ecosystems.

📍 CoinMarketCap: #47

📍 Twitter (X): 397.7K

____________________________________________________________

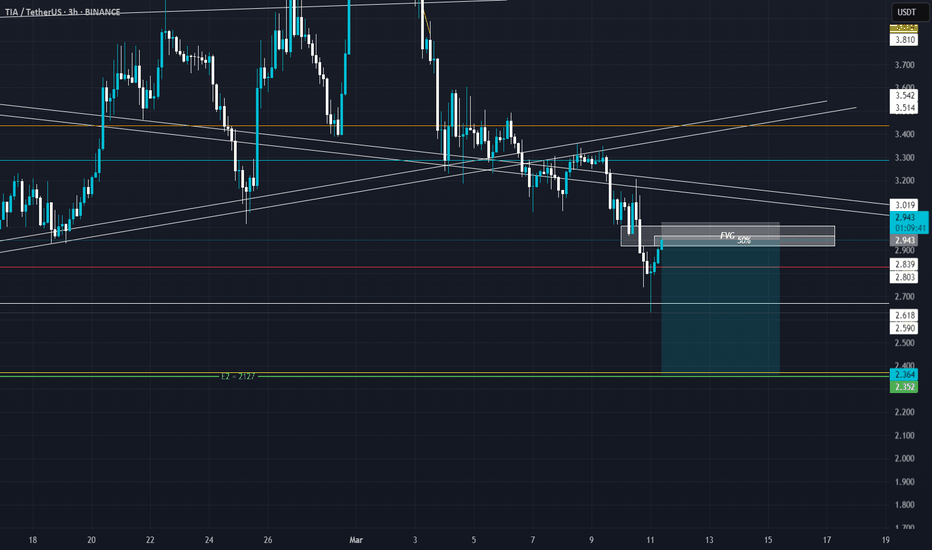

🔎 Technical picture :

I marked the Seed / Series A / Series B zones on the chart — it's clear how early investors locked in massive profits: from listing, the price skyrocketed +634%, and their returns are many times higher!)

From the current levels, the price is down ~87% from its all-time high.

Formation: the price is moving inside a large descending channel. At the same time, a potential “cup” structure and a possibly emerging ascending channel are forming.

We are close to the lower boundary of these formations — it's an interesting zone.

A final sweep/fakeout toward the lower boundary of the descending channel is possible — keep this in mind when calculating risk.

Key level: the orange trendline marks the boundary of the secondary trend. A confident breakout and hold above it would be one of the reversal signals.

____________________________________________________________

💡 General conclusions :

Liquidity — solid.

The coin is traded on major exchanges.

Trend potential is marked on the chart.

As always — everything depends on your strategy and patience.

____________________________________________________________

📌 This review is not financial advice but my personal analysis and observations on the project.

TIA ( SPOT)BINANCE:TIAUSDT

TIA / USDT

(4H + 1D) time frames

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

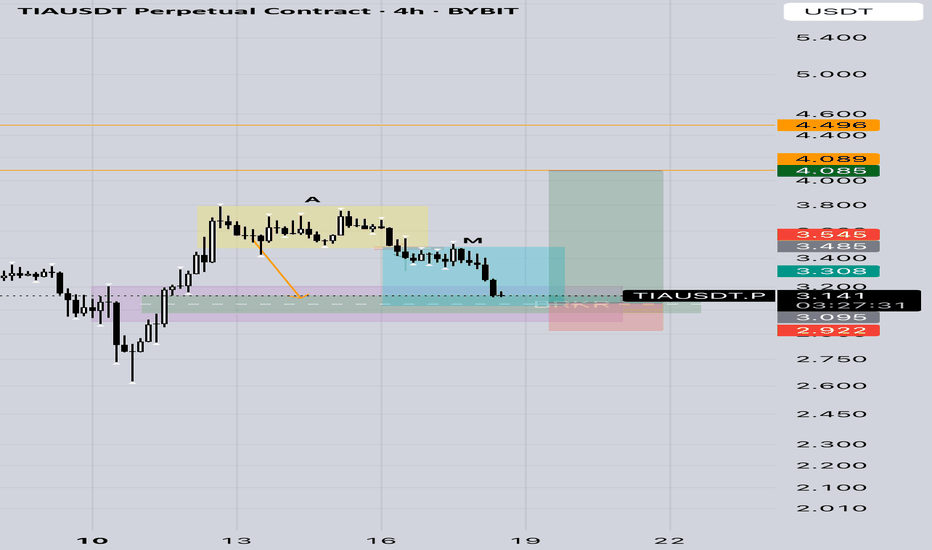

TIA: 40% Crash in Sight – What's Next?TIA recently lost its strong $4 support, and that level is now acting as resistance. For the past two months, the price hasn’t been able to climb back above $4, leaving us with one burning question: Is more blood on the table?

Broken Support: TIA has given up its $4 support, which now serves as resistance.

Looking at November 2024: The low from November 2024 was around $1.9. Revisiting that level could provide us with a high-probability long trade.

Trade Setup Opportunity

Entry Point: Set an alarm for the $1.9 low. A successful bounce here would signal a potential long trade opportunity.

Target & Reward: With the goal of targeting the $3 level, this trade could offer a risk-to-reward ratio of at least 5:1.

Implication: If the $1.9 level is revisited and holds, we could be looking at a scenario with roughly 40% more downside in the current trend—but also a setup for a low-risk long if the bounce holds.

TIAUSDT: Ascending triangle formation!!Join our community and start your crypto journey today for:

In-depth market analysis

Accurate trade setups

Early access to trending altcoins

Life-changing profit potential

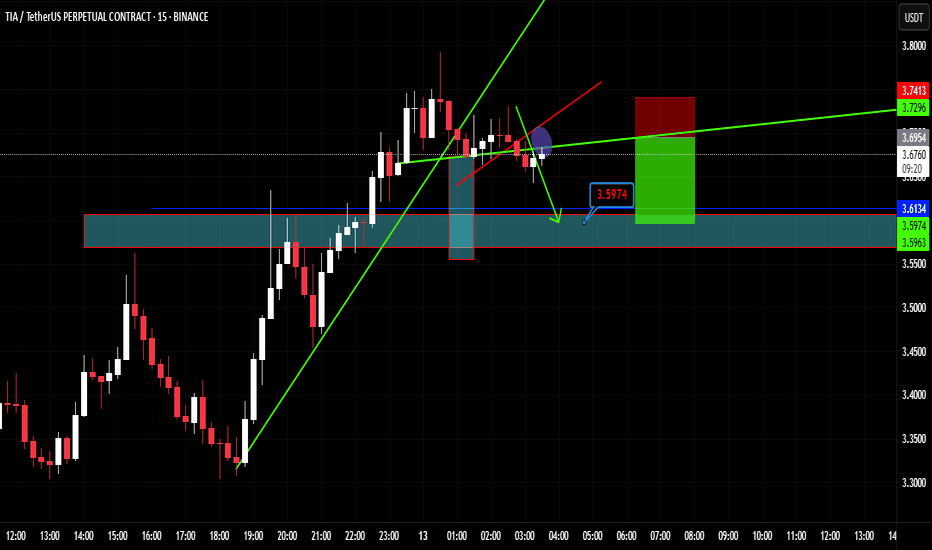

Let's analyze TIAUSDT on LFT:

TIA is in an ascending triangle, facing $3.67-$3.72 resistance. A breakout targets higher zones. A drop below $3.42 after triangle breakdown signals bearish mode. Watch for price action at these key levels for trading decisions.

Entry: CMP to $3.55

SL: close below $3.42

Target:

$4.09

$4.48

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments and feel free to request any specific chart analysis you’d like to see.

Happy Trading!!

TIAUSDT – Weak at Key Weekly Level! More Downside Ahead?TIAUSDT – Weak at Key Weekly Level! More Downside Ahead?

“This chart looks weak—momentum favors the downside. But is there a bounce first?”

🔥 Key Insights:

✅ Sitting at a Critical Weekly Zone – A breakdown here could be brutal.

✅ Momentum Looks Bearish – No real strength from buyers.

✅ Only Considering Low-Risk Buys – Fibonacci Green Zone (0-0.5) is the ideal cheap area.

💡 The Smart Plan:

Looking for a Break & Retest Downward – If support cracks, shorts become clear.

Small Risk Buys from the Fibonacci Zone – Only for aggressive traders.

CDV & Volume Profile Must Confirm – No buyers? No trade.

“Weak price action, heavy risk. Only the right levels matter here—watch closely!” 📉🔥⚠️

A tiny part of my runners;

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

TIA | PERFECT Bottom??In the macro, it's clear that TIA has been in a downward trend for an extended period of time. This means, it's a great place to buy - because the bullish cycle is up next.

Trend based indicators are great to identify the immediate predominant pressure on the chart, in this case, bearish. A "Buy" signal in the weekly timeframe would be the first step in the right direction (reversal).

Trend Based Indicator:

Another key indicator to watch is the daily timeframe, when the price begins to trade ABOVE the moving averages - that's when you'll have the first confirmation of a bullish turn around.

Moving Averages:

______________________

BINANCE:TIAUSDT

Breaking: $TIA Surges 17% Eyeing A Move to $5 The first modular blockchain network that enables anyone to easily deploy their own blockchain with minimal overhead by rethinking blockchain architecture from the ground up broke out of a falling wedge patten soaring 17% albeit the crypto market is highly volatile with CRYPTOCAP:BTC reclaiming the FWB:83K pivot.

Celestia Network Native token ( LSE:TIA ) has shocked the mainstream crypto market after breaking out of a falling wedge escaping the gasp of the support point holding it at the $2 zone.

With building momentum, LSE:TIA is eyeing a move to the $5 zone should it break the $4 resistant zone a move to the $5 target isn't far-fetched. With the Relative Strength Index (RSI) at 58, LSE:TIA is poised for a bullish run should the crypto market stabilize.

Celestia Price Live Data

The live Celestia price today is $3.74 USD with a 24-hour trading volume of $220,357,891 USD. Celestia is up 17.41% in the last 24 hours. with a live market cap of $2,091,803,371 USD. It has a circulating supply of 558,964,944 TIA coins and the max. supply is not available.

Celestia TIA price analysis🟣 For the second day in a row, the LSE:TIA price is showing growth

But would we risk buying OKX:TIAUSDT now - rather no than yes...

🟡 Above the orange trend line, purchases will be safer.

🟢 And during the $3 retest in the blue scenario, it's even safer)

Although, in the medium term, seeing #Celestia at $9 again is more than a realistic task.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

TIA Trade Setup: Potential Double Bottom FormationWith seller exhaustion possibly setting in, TIA is shaping up for a double bottom formation. If price deviates from launch levels and confirms a market structure shift, we could see a strong upside move.

🛠 Trade Details:

Entry: Around $4.00

Take Profit Targets:

$5.50 (First TP - Key Resistance Zone)

$7.10 (Second TP - Breakout Level)

$9.00 (Third TP - Full Expansion Target)

Stop Loss: Below $3.00

Keeping an eye on volume confirmation and resistance reclaim before full conviction. 🚀

TIA short back to $3.00I just now opened a short trade on TIa. Am anticipating a big drop back to $3.00 this weekend and right here where am shorting might be the top.

This setup however isnt' in full alignment with my DTT strategy. Direction, Target and Timing.

I still would need to wait a bit for the perfect timing scenario to to playout but I identified some other confluences that suggest i could make an exception here and enter so using a bit of discretion, we'll see how it plays out. Am still confident in the setup.

TIA LONG ALL trading ideas have entry point + stop loss + take profit + Risk level.

hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Please also refer to the Important Risk Notice linked below.

Disclaimer