TPLM1! trade ideas

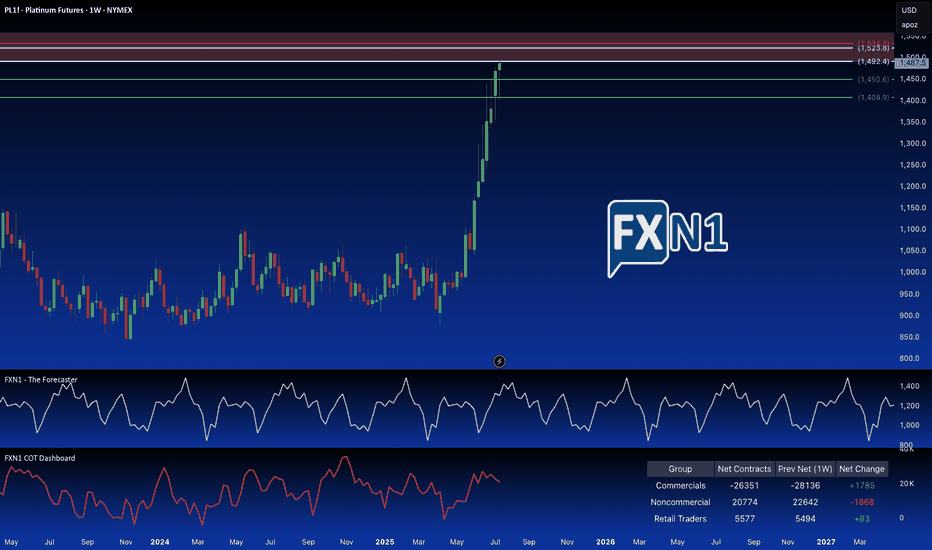

Platinum: Breaking the Supply Barrier?I'm adding a second Platinum position. Price has hit a strong weekly supply area, also a significant monthly supply zone. I'm anticipating a reversal here, as non-commercial holdings are decreasing, and seasonal patterns suggest a potential trend change. To further capitalize on potential upside, I've placed a pending order above the primary supply zone, at a slightly higher, but still relevant. These are older, established and fresh supply zones.

(Note: Reducing the chart size may help to better visualize the long-term significance of these overlapping areas.)

✅ Please share your thoughts about PL1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

From Sweep to Slaughter, Bear Setup EngagedOk a little late but I saw this and thought I'd share. Price has swept liquidity above the prior range high and failed to close strong. Structure is now rejecting under micro trend EMAs, breaking the local trend line and forming a short-term bearish momentum bias into the IFV zone. This is a short-term bearish play following a liquidity sweep at key highs targeting rebalancing zones below while the broader uptrend remains intact.

Setup Breakdown:

Entry: 1440.3

SL: 1486.0

TP1: 1390.0

TP2: 1360.0

RRR: 2.3 (TP1) / 3.7 (TP2)

Confluence Stack:

Liquidity Sweep confirmed rejection from upper QPOI (1450–1480). Breaker Block Formed, post-sweep, price lost momentum and slipped below Micro Trend (EMA9). The Structure Guard has broken the 21 EMA and diagonal trend line now acting as dynamic resistance. IFV Zone is unfilled there is a clean inefficiency still open below with a high-probability magnet zone. Defined invalidation above swept highs, preserving capital integrity

Labels Used:

Liquidity Sweep – Engineered exit at top-side trap

Micro Trend – 9EMA, broken with momentum

Structure Guard – 21EMA + trend line intersection, acting as a flip zone

IFV Zone – Target area for rebalancing and fair value return

Price Inefficiency Zone – Swing support for a extreme retest

This setup aligns with typical post-sweep reversal behaviour seen in thin commodity books. Short into structure with clearly defined risk, targeting the inefficiencies below. If TP1 breaks cleanly, runners to TP2 offer major extension potential into institutional rebalance levels.

What I'm Watching:

EMA resistance holding = active setup

Daily close below 1390 = continuation confirmation

Aggressive shorts could trail stop once 1410 is lost intraday

Staakd Rating:

Edge: ★★★★☆

Risk Profile: Moderate

Setup Type: Liquidity Reversal > IFV Rebalancing

Running this short? Scaling in from lower TFs? Let’s compare triggers drop your setups.

How much higher for Platinum futures In this video I look at the current price of platinum on a higher tf and forecast where I believe the cool down to this rally might begin.

Using tools like the fib extension, volume profile and speed fan we are able to highlight a major reaction zone ahead at $1600 region .

Set alerts at these key levels for what might prove to be a solid short entry or a rejection , retest and claim for higher levels like the 1.618 ext .

PL to 1200 Platinum has made a massive upwards move in the last 2 weeks. It has not tested my original $1400 price target but got pretty close. The large upwards move has formed a beautiful trend line with more than 3 touch points which has now been broken. I am looking for price to fall back to $1200 price level in the short term.

In the long term its possible to see $1400 I won't be looking for that unless is breaks this new downwards trend forming.

Platinum Market Alert: One-Day Reversal in Play On Friday, the platinum market printed a key day reversal — a classic signal that a short-term correction may be underway.

🔍 In our analysis posted Thursday, we highlighted the 55-hour moving average as good place to place a stop level in a runaway market. Fast forward to now: that level has been decisively broken, along with a drop below the cloud on the hourly chart.

⚠️ This breakdown increases the probability of a near-term correction.

Stay sharp. Manage your risk. Markets are talking — hope that you are listening!

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

"Runaway Market? Here’s Where to Put Your Stop"Today we’re diving into what to do with your stops in a runaway market 🚀📈

Just 4 days ago, we talked about the platinum market breaking higher — and wow, what a move it’s made since then. So, the big question is:

👉 Where do you place your stops now?

Here’s my approach:

🔍 First, I check the long-term time frame. We're heading toward 1348 — that’s the 2021 high, and likely a profit-taking level.

📉 Then I drop into shorter time frames — hourly, 30-min, 15-min, even 5-min if needed.

I’m currently eyeing the hourly chart, where the 55-hour moving average (green line) has done a solid job supporting the rally. It's sitting at 1227 — a reasonable area to consider for a stop, especially with little other support nearby.

Hope this helps!

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Just in Case Still Believe that Silver Will Outperfom Platinum..Platinum is still severely undervalues when compared to both Gold and Silver...If you still think Silver will move as much as Platinum in this Bull market, there is a very high probability that you will be wrong...most people think that Silver will outperform...and most people are always wrong...only a small percentage of people are right...and they will have a lot of wealth...there are more poor people than wealthy...that is how the world works...You are being brainwashed.

Platinum Futures Break Major Long-Term Down trendsToday, we're analysing Platinum Futures – and the market is showing some major technical shifts. On the weekly chart, we’ve seen a sharp rise, pushing prices to new 3-year highs.

Switching to the monthly chart, the picture gets even more compelling:

🔹 We've broken above two significant long-term downtrends — one dating back to 2008, and another from 2011.

🔹 The price has now hit the 200-month moving average at 1155. A close above this level could confirm a powerful breakout.

🔹 The measured upside target? A potential move to 1826, based on the 2020–2021 range.

In the short-to-medium term, keep an eye on these levels:

✅ Resistance at 1100 and 1348 (Feb 2021 high)

🛡️ Support ideally holds above 1081–1045 to maintain bullish momentum

📊 This is shaping up to be an exciting market with long-term potential.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

I cant believe Platinum is still this cheap vs goldPlatinum could hit its all-time high of ~$2,400/oz in 5-10 years if things line up. South Africa’s mines are struggling, so supply is tight. Demand is growing for platinum in green hydrogen tech and car parts, especially with big global investments. Plus, with U.S. debt soaring and the dollar looking shaky, people might turn to platinum like they do gold and silver to protect their money. If electric vehicles don’t cut demand too much and the economy stays decent, platinum could soar to $2,400 by 2030-2035.

Im long a bunch, and will sell portion along the way up to get my basis out and ride the rest for free.

Like if you agree!

Platinum to $1400? Platinum has broken out of a multi year downwards trend line accompanied by a large spike volume. It was consolidating for a couple months before the most recent move up and now we are consolidating again. Right now it is holding above the previous high of the last consolidation and I believe it is prime for takeoff to prices not seen since 2022. If price breaks back below the green safety line reconsider strategy but as it stands I am still bullish. Given all the tariff whipsawing and Trump wanting to impose a 31% tariff on South Africa (where the largest amount of platinum comes from) in conjunction with the MAGA plan of bringing car manufacturing back to the states. Platinum is bound to have higher demand to be used in catalytic converters.

How can I be late to the platinum bull era?How can I be late to the platinum bull era when the party hasn’t even started?

The rocket-ship moments for platinum lie ahead—not behind us.

There’s no need to front-run anything.

No pressure. No rush. Just readiness.

Wait.. where did I read something similar before... again!

Secular Bull Market in Platinum is ImminentOne of my higher conviction boomer plays of the next few years is long platinum. A variety of fundamental reasons why a secular bull run is potentially beginning but suffice to say it is a deeply hated and ignored asset trading roughly around production cost for over 10 years now. This has built a liquidity base of long term holders that can serve to propel a major advance. A defensible floor below current prices with powerful upside potential = tremendous upside asymmetry.

Data going back over 150 years shows the platinum/gold ratio is the cheapest since Civil War era; a time where the metal had no industrial use. Historically, platinum has always followed gold for each of its secular bull markets with some lagging period at first - the current lag the most dramatic in decades. It has the attention of very few investors, with ETFs seeing net outflows in recent years as a sideways market frustrated any steadfast believers.

Futures breaking out to new 3 month highs today. If we can convincingly clear $1,070 I believe the breakout has high likelihood of seeing substantial follow through and is more apt to be trusted than prior attempts over recent years.