TPLM1! trade ideas

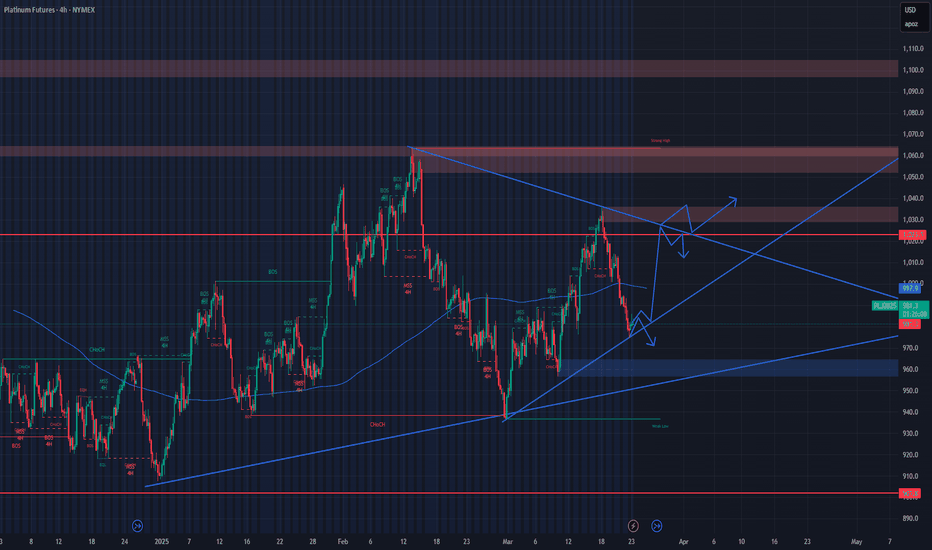

Is Platinum About to Explode? Imminent Rally!Platinum (PL1!) is currently in a technically and macroeconomically compelling setup. After a prolonged consolidation between 872–921, price has reacted strongly, forming a clear accumulation pattern supported by institutional positioning and favorable seasonality.

📈 1. Technical Analysis: Accumulation and Potential Breakout

The weekly chart shows a strong demand zone that has been defended multiple times over the past year. Following a deep pullback in April, price has formed a harmonic compression structure and broke to the upside with conviction. The area between 1010 and 1040 stands out as the first major historical supply zone — previously rejected but now looking increasingly vulnerable.

📉 2. COT Report: Institutions Repositioning Long

The COT data as of April 22 shows a clear increase in long positions from commercial traders (+1,177 contracts), while non-commercials maintain a net long bias. Total open interest rose by over 1,500 contracts — a strong sign of renewed speculative interest in Platinum.

✅ Conclusion

Platinum is showing strong confluence across technicals, institutional positioning, and historical seasonal behavior. The probability of a bullish extension in Q2 2025 is high. This is a setup worth watching closely in the coming days.

it may be a huge sell coming up from the trade entry, stop loss it may be a huge sell coming up from the trade entry, stop loss and my poteniel TP shown on the analyse as I would prefer do not marking a TP and use a trailing SL and keep my SL and TP fllowing up the trade as I keep my capital safe and put my SL on BE entry to avoid LOSSES ^_^

Platinum Range/Short IdeaAlong with the fundamentals supporting a weaker PL and no significant change in daily warehouse stock data for Platinum and Palladium. A neutral or slightly bearish approach might be the way for today.

Platinum Demand Breakdown (approx):

Sector Share (%)

Auto (catalysts) ICE ~35–40%

Jewelry ~25–30%

Industrial (chem, glass, petro) ~20%

Investment ~5–10%

Other (medical, etc) <5%

Supporting news:

- Used Car Sales Are At Their Strongest Since 2021

- The United States saw strong automobile sales in March as consumers rushed to buy before tariffs would kick in but the outlook looks gloomy afterwards. POOR SALES EXPECTED AFTER NEAR-TERM BUMP. ( My comment: Those cars were build months/year ago car manufacturing cutting production already)

- Major car brand cuts production of popular model in response to Donald Trump's harsh auto tariffs

Platinum Futures (PLN2025) Platinum Futures (PLN2025), I identified a powerful tactical insight: the 10:00–11:30 AM CST window, known as the “Decision Block.” This 90-minute stretch is when institutions often confirm their morning positions—either continuing trends or reversing moves to trap retail traders. During this time, volume often shifts decisively, and smart traders use tools like VWAP + ORB, RSI divergence, and volume climax to either commit to a breakout or fade the herd. This isn’t just a time window—it’s when the market shows its hand. By recognizing this window, traders can detect where volume authority shifts, confirm breakout reliability, spot hidden divergences, and time scalp or swing entries with precision. Understanding and leveraging this block transforms your trading from reactive to strategic.

Bollinger Bands Signal Potential Breakdown in Platinum Futures

Price is currently testing the midline of the Bollinger Bands (blue line), which often acts as dynamic support/resistance.

The recent price rejection at the upper band and subsequent drop toward the midline suggests a potential continuation to the lower Bollinger Band (~940-950 range) if bearish pressure continues.

Increased volume on recent down days suggests strong selling pressure.

Resistance: ~1030-1050 (recent highs, upper Bollinger Band).

Support: ~940-950 (lower Bollinger Band, previous consolidation zone).

If price fails to hold above 980-990, further downside to ~950 is likely.

Acw platinum analysis for week starting 23rd Feb 2025Using previous price action 2020 Feb

We use the acw bar pattern strategy to future forecast price action in platinum

‘Should the market break previous lows and continue downward pressure, this hints that price might repeat Covid crash scenario

That said history doesn’t repeat itself but it rhymes in the same rhythm

Let time be the judge of this chart

Acw lifestyle

It’s the best or nothing

Accuracy comes standard

Weekly Market Forecast: PLATINUM Is a BUY!This forecast is for the week of Feb 10-14th.

As the Monthly and Weekly timeframes show, this market is in a ranging consolidation. So the strategy is to buy at the lows and sell at the highs until there is a definitive breakout on either side.

With price having swept the lows of the consolidation, it makes sense price will be heading to the buyside liquidity next.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Platinum Verging on Historic Breakout PL1!Bullish divergence in on-balance volume along with sustained price-suppression have put platinum on breakout watch as we see strength in so many other commodities.

Notably, volume has expanded meaningfully in the platinum futures market, and tariff tantrums may be the nail in the coffin as far as keeping a lid on price..

Open Trade y Esperar que pasa. I opened this trade without clearly thinking, inspite of drawing clearly what I charted. So I kinda felt forced left a huge opening, and went super heavy. So the next analisis is what I should´ve done. We see that in a higher time frame we have a clear downtrend; so we are expecting a couple of things. Either this upward move is just a retest of previous lows to se if it continues breaking so we should be careful of the upper lightblue line (a support transformed to resistance after broken). So right now we have an open position with a stoploss at an exact 1:1 RR to see what happens also we are waiting for a low to form a valid trendline going up. For this strategy since it is a 2 Touch point trandline we use a support as confirmatión for the change of trend. We expect to at least hit the higher time frame downtrend. NOW WE WAIT AND SEE WHAT HAPPENS.

WE CLOSE IF:

1. It hits and the upper resistance and gets rejected.

2. It hits stoploss at 1:1 RR

3. It breaks our uptrend trendline.

Platinum Next to Rally? - After Gold and SilverThese are the percentage gains of the three precious metals. We can see that gold and silver have performed well over the past two years, but platinum has not.

Historically, we can observe that precious metals tend to move in tandem, with their troughs and peaks occurring around the same time.

Will platinum eventually follow gold and silver? And why is it underperforming?

Platinum Futures & Options

Ticker: PL

Minimum fluctuation:

0.10 per troy ounce = $5.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

PL 01/06/2025I am going to be using the 4 hour chart from now on. As of 1/06/2025 we can see how PL is going to be making a decision about hitting the next resistance or going to fall past support again in the channel for a possible pull back. Let's see how tomorrow goes team always do your own research before making any financial decision.

PLATINUM Weekly Forecast: Bearish! Look for SHORTS!Keep an eye on this one, as it makes its way down to 911.7.

I'm looking for the highlighted lows to be swept this week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.