Total #002 ( Look at the Future !!! )Hello dear traders.

Good days.

First of all thanks for your comment and support.

---------------------------------------------------

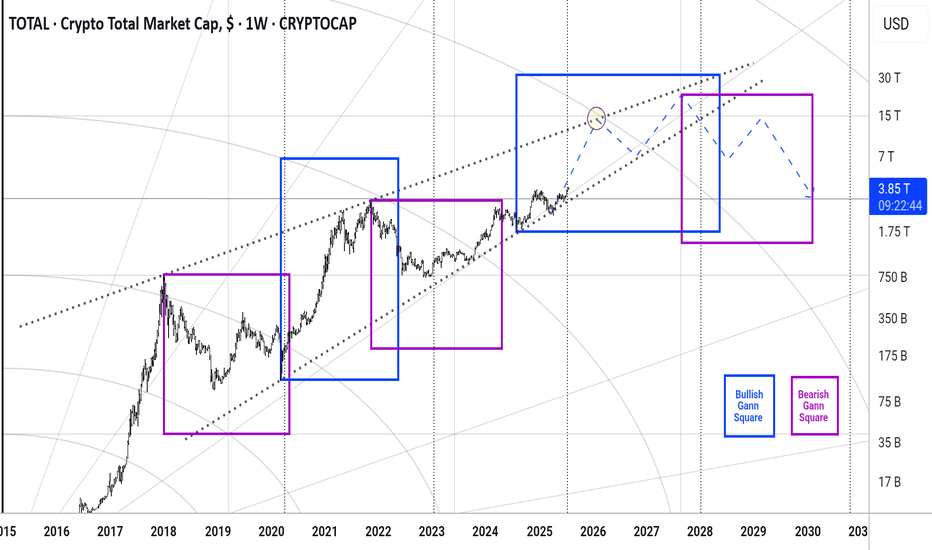

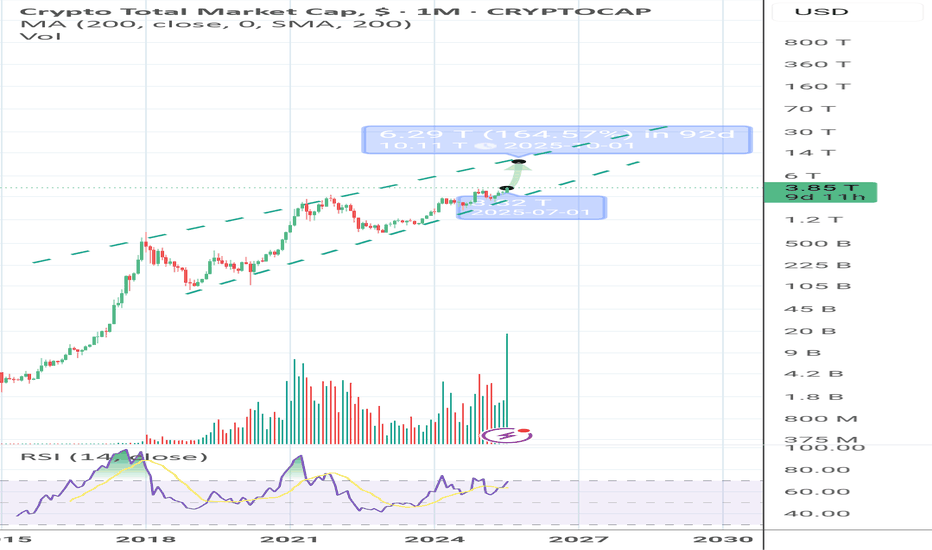

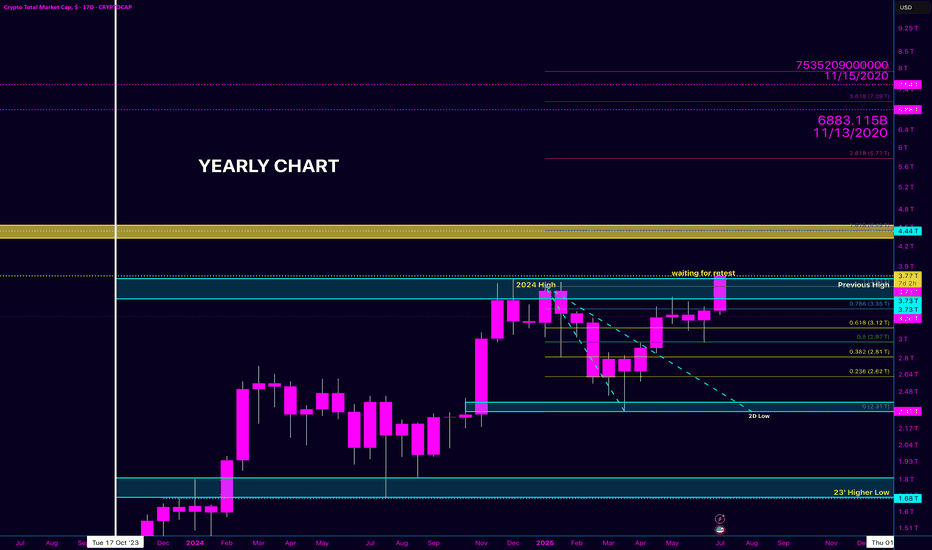

In beautiful rising wedge of total market cap , the total market in this month broken 0.5 monthly Gann Square price level which means will be ready for test and retest 0.618 for final round befor market collapse.

With refer to the daily Bullish Gann Square ( Blue Square ) and Bearish Gann Square it is expected to within a year market will grow fast .

Safe trades and good luck.

TOTAL trade ideas

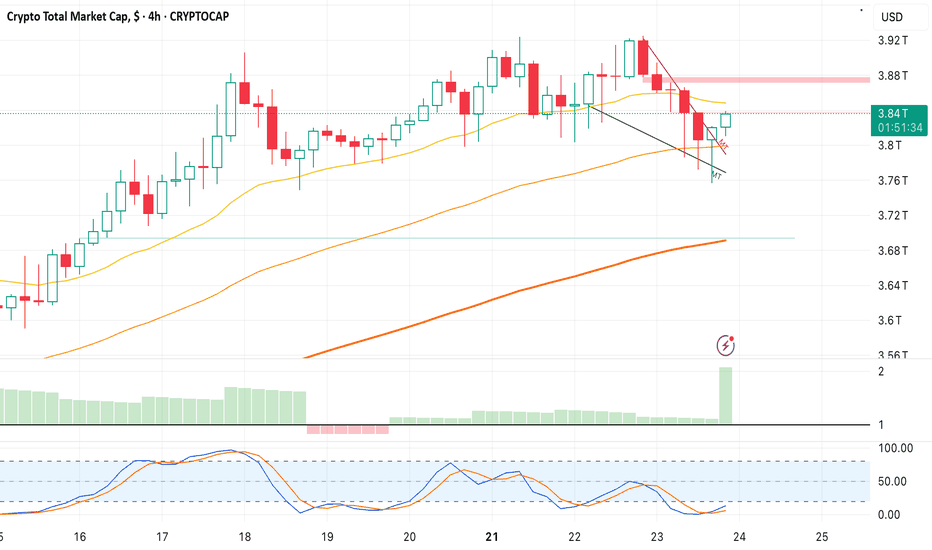

TOTALCRYPTO MARKET CAPAs we can see the curve support has been broken but this can be a fake move ( manipulation zone ) and we can be manipulated further more till the next rectangle box as mentioned on the chart. Or you can say its a retracement as per previous market action we are the 50% of the previous downfall and exactly from 50% we got some bullish momentum but still the retest of the 50% has not been done so we cannot trust this zone. Let the price retest the zone and than we will have a clear path to upside.

My analysis is till the level i marked for now.

We are Bullish until we have some serious break down with strong red candles.

MARKETS week ahead: July 27 – August 2Last week in the news

Trade tariff (un)certainties shaped market sentiment during the previous week. The US-Japan trade deal was settled which brought some relaxation among investors. The US equities continued with a positive trend, with the S & P 500 reaching fresh all time highest level, ending the week at 6.388. On the same ground the price of gold turned a bit toward the downside, closing the week at $3.336. The relaxation was evident also in 10Y US Treasury yields, which closed Friday trading session at 4,38%. BTC had a short liquidation session on Friday, shortly reaching the $115K level, however, swiftly returned back toward the $118K.

The European Central Bank (ECB) held its July meeting during the previous week, where it held interest rates steady after seven consecutive cuts, signalling a more cautious approach going forward. While its macroeconomic outlook remains unchanged, the ECB sees downside risks to growth, including global trade tensions and weak market sentiment. President Lagarde downplayed concerns about the stronger euro and minor inflation undershooting, emphasizing a data-dependent, meeting-by-meeting policy stance. Although the ECB appears comfortable with its current position, a final rate cut in September is still possible if inflation or macro data disappoint.

President Trump announced a major trade deal with Japan this week, featuring a 15% reciprocal tariff, marking a shift in bilateral trade relations. The U.S. also reached a framework agreement with Indonesia, reinforcing efforts to strengthen trade ties across Asia. Trump signalled that more deals may be finalized before the August 1 tariff deadline, including potential progress with the EU, as a meeting with Commission President von der Leyen is set for Sunday in Scotland. These developments have been well received by investors, easing concerns over trade uncertainty and potential supply chain disruptions.

China unveiled a global AI action plan at the World Artificial Intelligence conference in Shanghai, calling for international cooperation on technology development and governance. Premier Li Qiang proposed establishing a global AI cooperation organization to coordinate regulation and infrastructure, emphasizing equitable access. The plan positions China in contrast to the U.S., favoring multilateralism over America's more block-oriented approach to AI strategy. Featuring participation from over 800 companies including domestic giants Huawei and Alibaba, the conference showcased thousands of AI innovations and signals China's ambition to challenge U.S. dominance in the field.

Palantir's stock achieved a new record high last Friday, rising over 2% and lifting its market cap to around $375B. With the latest move, the company is now holding 20th place as the most valuable U.S. company. The company's shares have more than doubled this year as investors' enthusiasm grows around its AI capabilities and government contract momentum. Analysts attribute the rally to Palantir's strengthened role in AI analytics and expansion in defence-related software and data contracts.

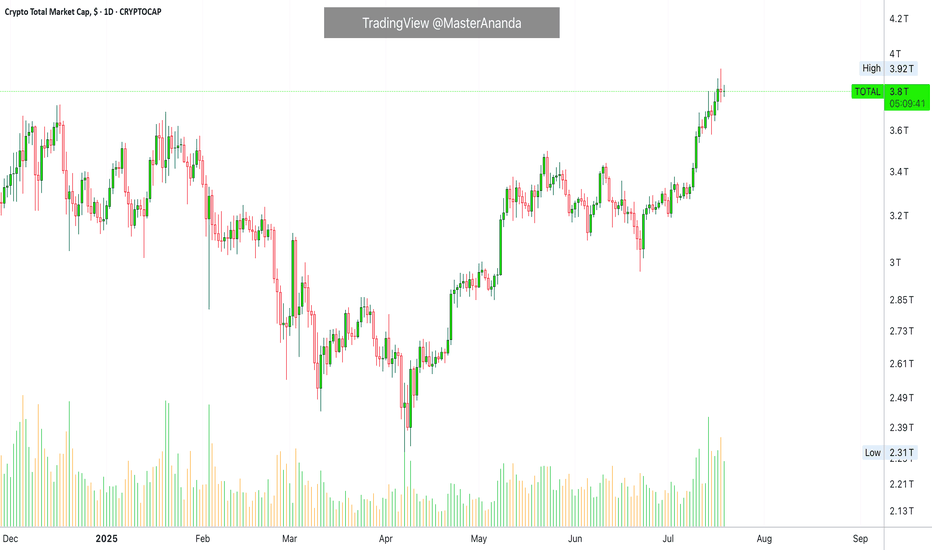

CRYPTO MARKET

The crypto market was traded in a mixed mode during the previous week. Some liquidations were made in BTC, followed by altcoins, however, there were also coins with relatively solid weekly performance. Total crypto market capitalization was increased by 1% on a weekly basis, adding total $39B to its market cap. Daily trading volumes were modestly decreased to the level of $275B on a daily basis, from $333B traded a week before. Total crypto market capitalization increase from the beginning of this year currently stands at +19%, with a total funds inflow of $600B.

BTC had a relatively flat week, with only $3B of funds inflow. On the other hand ETH continues to perform strongly, with another week in a positive territory of 5,3%, increasing its cap by $23B. XRP did not perform well on a weekly basis, as the coin had a drop in value of 7,4% and outflow of $15B. Some of the significant weekly gainers include Litecoin, with a surge of 13% on a weekly basis, Maker was traded higher by 14%, BNB gained 7%, while Solana was higher by 5% same as Uniswap. Other altcoins were traded either with a modest drop in value or with a modest increase in value.

There has been increased activity with circulating coins. Another week in a row, IOTA is increasing the number of coins on the market by 0,8% w/w. EOS had an increase of 0,6%, same as Polkadot. The majority of other altcoins had a modest increase of circulating coins of 0,1%, including XRP.

Crypto futures market

This week the crypto futures market reflected perfectly developments on the spot market, with ETH long term futures managed to pass the $4K level.

BTC futures were traded mostly flat compared to the previous week. Futures maturing in December this year closed the week at $120.810, and those maturing in December 2026 were last traded at $127.500. At the same time, ETH futures were traded around 2,5% higher for all maturities. Futures ending in December 2025 reached the last price at $3.779, while those maturing in December 2026 for the first time ended the trading week at $4.058.

Now We WaitTrading Fam,

In my last video, I mentioned how I had been learning to trade more patiently, giving myself those high-quality, high-probability winning trades. This is a perfect time to illustrate that strategy.

With our altcoin market overheated, I am expecting more rest, accumulation, and pullback in many of our alts. The selection of even decent entries is very slim. It's time for us to sit back, wait, and let the trades come to us again.

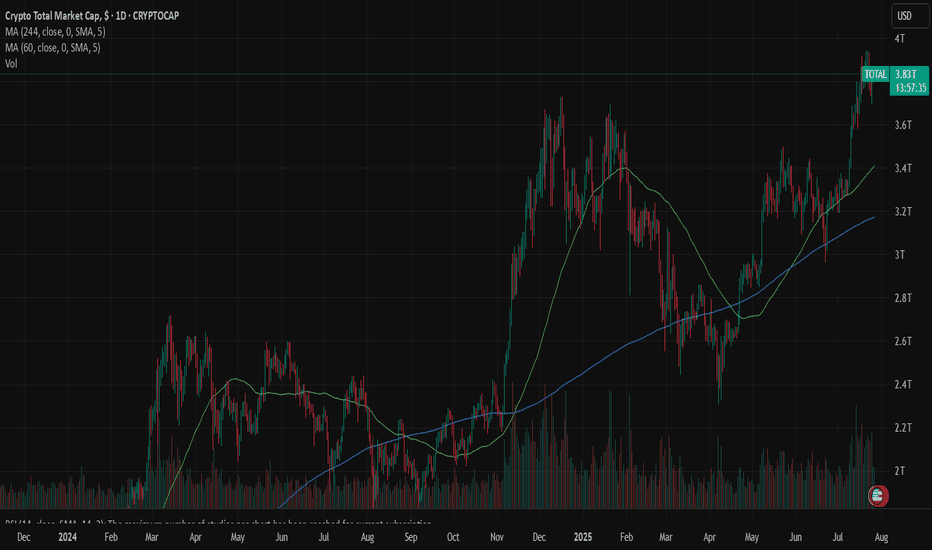

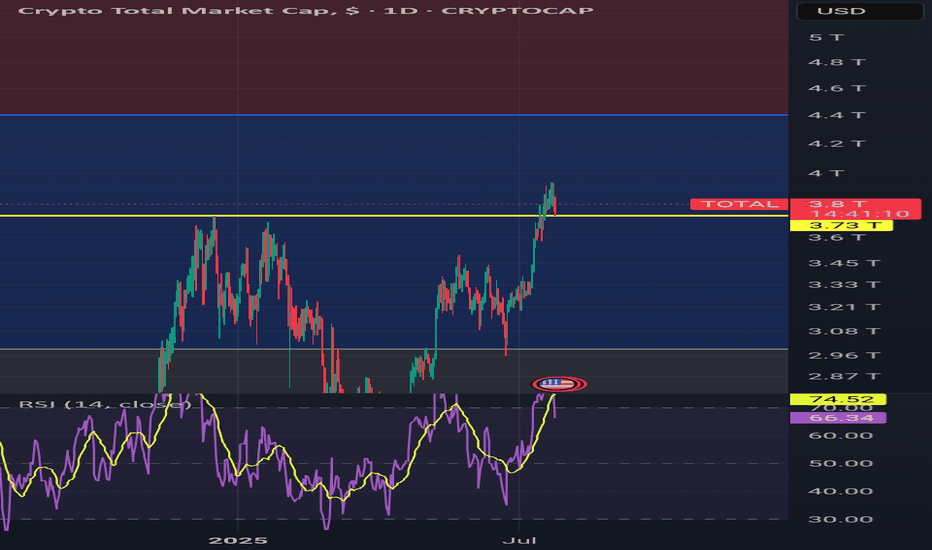

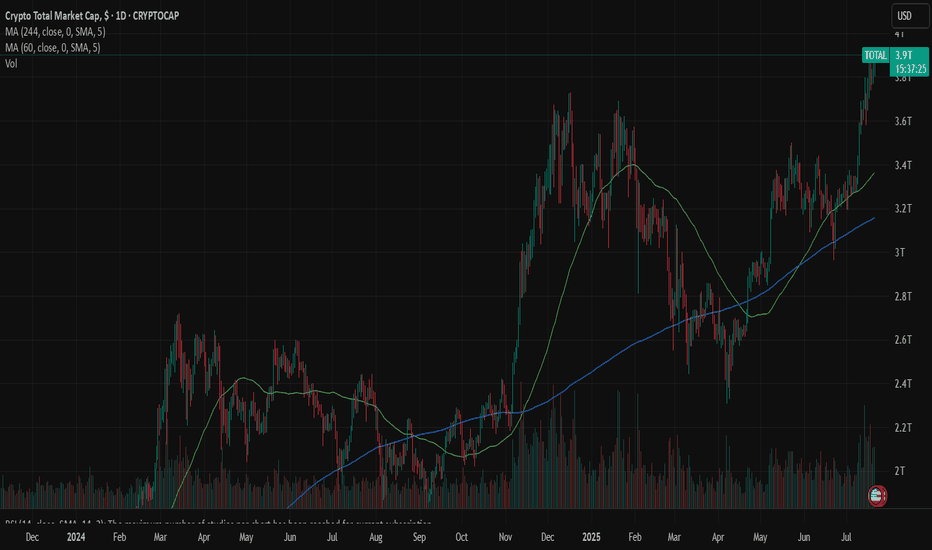

The TOTAL chart shows us more clearly what may occur. Let's discuss a few important indicators on this chart.

First of all, we see my indicator popped a BUY signal right around 3T. We had a safe bet at that point; we were going to see quite a bit of buying action in the altcoin space. Indeed, we did. The altcoin market increased by about 25 percent and went all the way to 4T, at which point the sellers came back in. Now, we are in the middle of a little bit of a pullback, and I think there could be more to come. I am expecting at least a touch of that rising 50-day SMA, currently at 3.4T.

Supporting my thesis here are the crossover of the RSI to the downside of its 14-day MA, the MACD cross, the Chalkin money flow decrease, and the HMV indicating high volume during these sell-offs. Leverage is being liquidated. This is healthy!

It is possible that the total market cap could drop even further, all the way down to that 3.24T PoC on the VRVP. That is where we see most of our volume in alts has occurred. Keep these two targets in mind. Once hit, I will begin looking for more trade entries once again.

✌️Stew

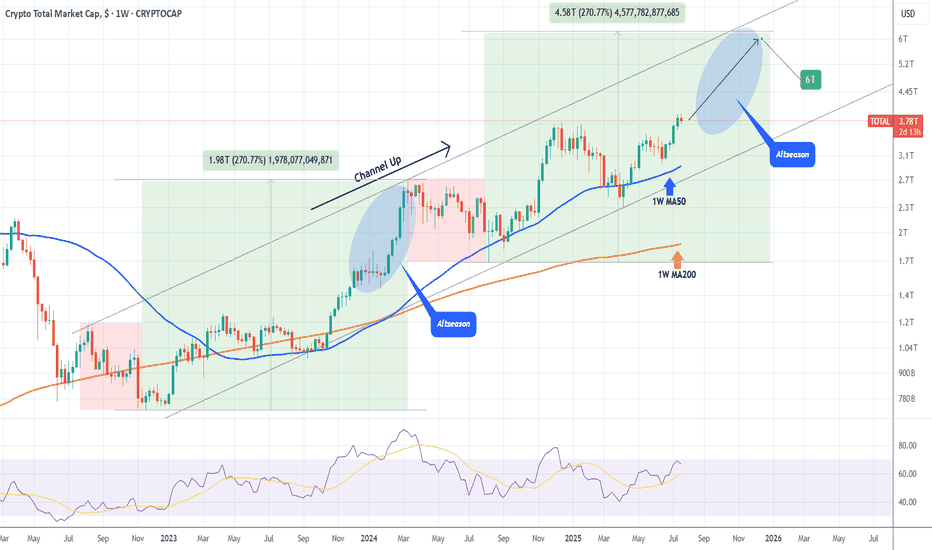

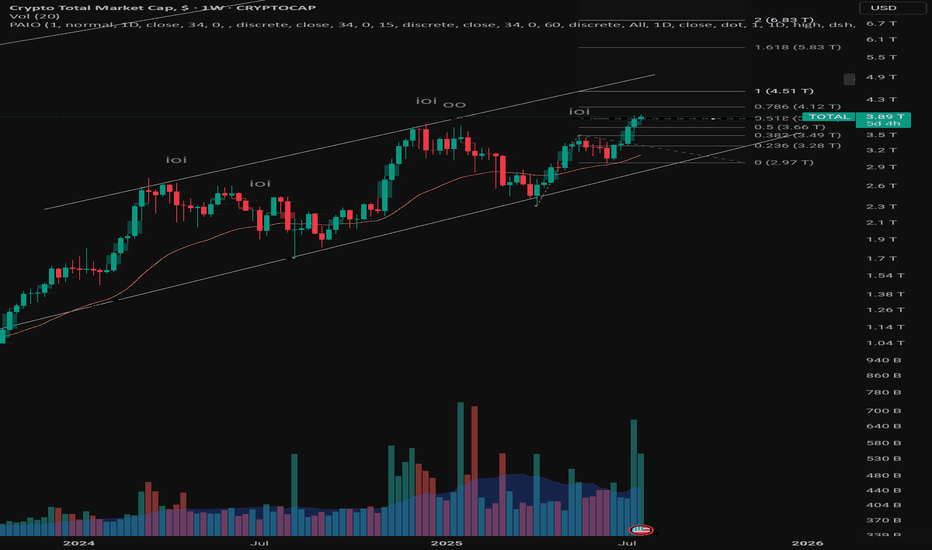

TOTAL CRYPTO MARKET CAP expected to hit $6 Trillion!The Crypto Total Market Cap (TOTAL) has been on a Channel Up since the 2022 market bottom and since the April 07 2025 Low (Higher Low for the pattern), it's initiated the new Bullish Leg, already turning the 1W MA50 (blue trend-line) into Support.

As long as this holds, we expect it to complete a +270% rise from the August 05 2024 Low, similar to the Bull Cycle's first Green Phase, and reach at least a $6 Trillion Market Cap!

More importantly, we expect this final part (blue ellipse) to be what is commonly known as an Altseason, where the lower cap coins show much higher returns and disproportionate gains to e.g. Bitcoin.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

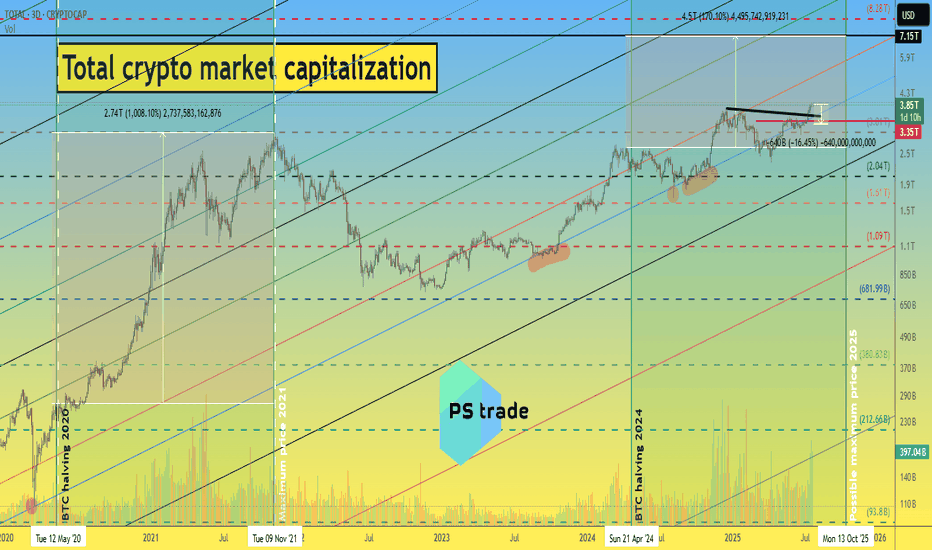

What to expect in the crypto market until 2026 ?!📈 Today, we will look at the graph of the total capitalization of the cryptocurrency market, as well as the implementation of our ideas from 2022 to 2025.

At that time, the cryptocurrency market was in a total depression, there was no talk of BlackRock or MicroStrategy buying cryptocurrencies, and we stubbornly wrote that this was the bottom... and then a miracle happened)

During this time, the total capitalization of the crypto market grew 5 times from $800 million to $4 billion.

ℹ️ You can find all posts in the channel by searching by date:

1️⃣ 18.11.22 - “How much can the crypto market capitalization grow by the end of 2025?”

The growth momentum is slowing down, but the following ideas give hope.

2️⃣ December 30, 2022 - “Plans for 2023-25”

If we are to believe this fractal, which has been working for over 2.5 years, then all the most interesting things are still ahead.

3️⃣ 29.02.2024 - “What to expect from the crypto market in 2024-26”

At the beginning of 2024, the previously published fractal was slightly adjusted to the market situation.

4️⃣ 04.03.2025 - “The total capitalization of the crypto market is on the verge of a foul.”

Then, despite the market depression and a lot of negative news, the total capitalization still managed to stay above the blue trend line.

📊 Cryptocurrency market capitalization as of 22.07.25:

◆ Bitcoin - $2.36 trillion

◆ Ethereum - $442 million

◆ Ripple - $206 billion

◆ SOL and BNB - $110 billion each

◆ USDT and USDC - $162 billion and $65 billion, respectively.

In total, this is $3.45 trillion out of $3.89 trillion of the total crypto market capitalization.

♎️ Too much capital is concentrated in the top 7 projects; we need a process of capital flow and the launch of exponential growth. Especially since all of the above fractals “suggest” that the time has come and anything is possible.

🔃 The total capitalization of the crypto market must continue to remain above the blue trend line, i.e., it cannot be adjusted by more than -13-16% to $3.25-3.35 trillion.

Roughly speaking, the price of CRYPTOCAP:BTC cannot be adjusted by more than -10% due to its high dominance at the moment. (Such an adjustment of the #BTCUSDT price fits into the scenario we published a few days ago.)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

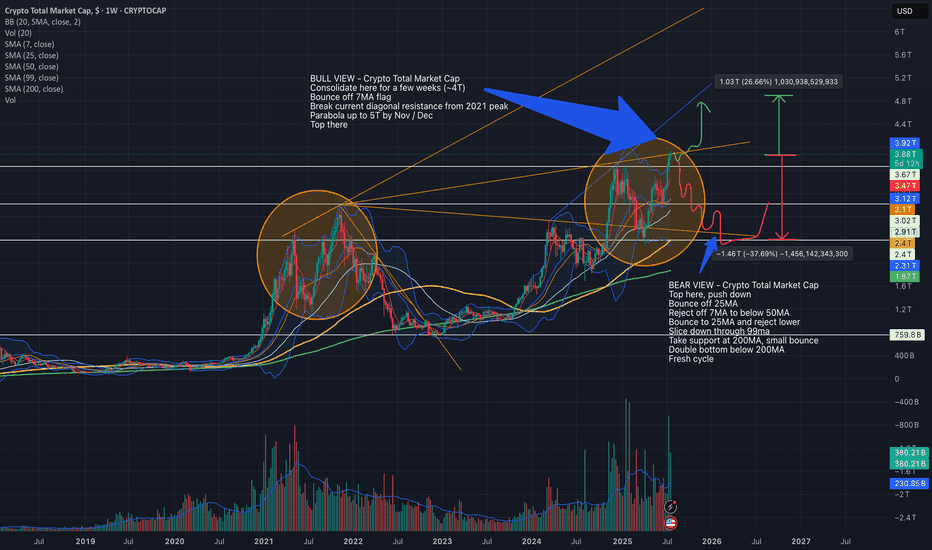

Bull and Bear Cases for Crypto Total Market Cap as of July 2025This chart outlines my views of where Total might go in the next few months - considering both Bull and Bear possibilities.

We are in a similar spot to 2021 peak at the moment, but still not as euphoric so it's a toss up as to which direction Total may move.

Current Total Market Cap - ~4T

Bull Case - Crypto Total Market Cap:

Consolidate here for a few weeks (~4T)

Bounce off 7MA flag

Break current diagonal resistance from 2021 peak

Parabola up to 5T by Nov / Dec

Top there

Bear Case - Crypto Total Market Cap:

Top here, push down

Bounce off 25MA

Reject off 7MA to below 50MA

Bounce to 25MA and reject lower

Slice down through 99ma

Take support at 200MA, small bounce

Double bottom below 200MA

Fresh cycle

These are just ideas. The future doesn't mimic the past but it does move in a mathematically sound manner. TA accuracy in forecasting can be affected by several real-world events, specially considering how volatile the world is at the moment.

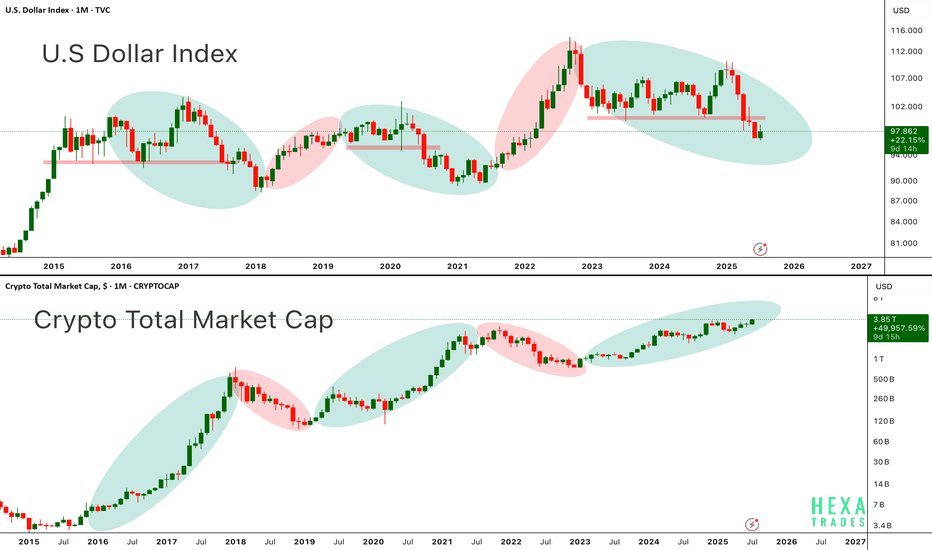

DXY vs. CryptoAbove chart highlights the long standing inverse correlation between the U.S. Dollar Index and the Crypto Total Market Cap a relationship that has guided the macro trend for Bitcoin and altcoins since 2015.

in the first chart, When the dollar weakens (green ovals), crypto tends to rally. When the dollar strengthens (red ovals), crypto markets usually experience corrections or prolonged bear markets.

In the second chart, each period of dollar weakness aligns almost perfectly with explosive crypto upside seen in 2017, 2020–2021, and now potentially again in late 2024 through 2025. Conversely, periods of DXY strength (2018, 2022) coincide with crypto market downturns.

Currently, DXY is entering a downward phase, while the crypto total market cap is pushing higher, now above $3.8 trillion suggesting that a new leg in the crypto bull cycle may be underway. Bitcoin and Ethereum have historically performed best when DXY trends lower, as liquidity shifts into risk-on assets.

Key Points:

-DXY and crypto market cap show a strong inverse macro relationship.

-DXY in a clear downtrend from 2024 highs supportive of further crypto upside.

-Crypto Total Market Cap approaching all-time highs suggesting broad market strength.

-Potential for BTC > $150K and ETH > $6K+ if this macro divergence continues.

-This setup resembles early 2020, right before the massive crypto bull run.

If the dollar continues to weaken structurally, crypto markets led by Bitcoin and Ethereum could see accelerated momentum, pushing into parabolic territory by late 2025.

Cheers

Hexa🧘♀️

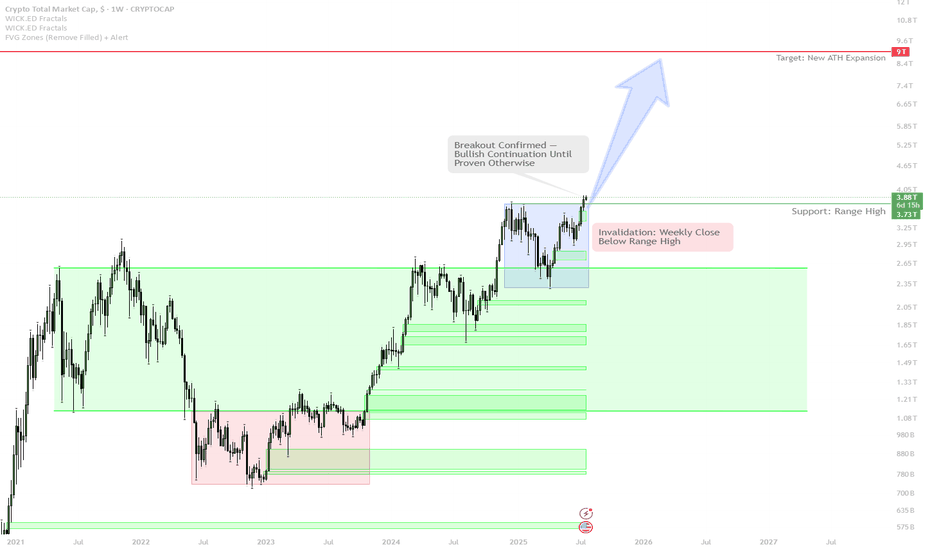

Total Crypto Market Cap: Weekly Breakout Signals Bull Run Contin

The weekly candle has closed above the key range high — this is a major bullish signal, similar to the breakout seen in early 2021.

As long as price remains above this breakout level, the scenario is a continuation uptrend — expect further expansion and strong price action.

If the market fails and closes back below the range high, the breakout will be invalidated — this would signal a potential range or pullback phase.

Current strategy is to trade with the trend:

Hold spot exposure and add on confirmed breakouts.

Do NOT short without a clear breakdown and structure reversal.

If a failed breakout occurs (weekly candle closes back below range high), take profit quickly and switch to risk-off mode.

Market psychology: Most buyers hesitate at lows, but FOMO after a strong move is classic. The disciplined approach is to buy the setup, not the hype.

This is a textbook technical breakout with historical precedence for explosive upside. As long as Total Market Cap holds above the range high, the path of least resistance is up. Attempting to fade the breakout is risky unless there is a clear weekly close back below the level. Trend continuation is favored until proven otherwise. The correct approach is to stay with the trend and manage risk only if a breakdown occurs.

MARKETS week ahead: July 20 – 26Last week in the news

Resilient inflation and the jobs market in the US supported further investors sentiment, bringing equities to higher grounds. The new all time highest level was reached by the S&P 500, which is closing the week at 6.296. The US Dollar gained in value during the week, however, the price of gold remained relatively flat, closing it at $3.349. Strong macro data decreased expectations among market participants over the Fed's rate cut, bringing 10Y US yields down to 4,42%. The new Genius Act was passed in the U.S. House, supporting the price of BTC to hold at higher grounds, above the $118K.

The U.S. economic data in focus last week was led by June inflation figures. Headline inflation remained relatively stable, rising 0.3% for the month and 2.7% on a yearly basis, both matching market expectations. Core inflation came in at 0.2% for the month and 2.9% annually, slightly below forecasts by 0.1 percentage points, though still elevated. The Producer Price Index (PPI) was flat in June (0.0%), with core PPI also unchanged. On an annual basis, PPI rose by 2.3%, and core PPI by 2.6%. Meanwhile, retail sales in June outperformed, climbing 0.6%, well above the expected 0.1%. Another positive news came from the University of Michigan preliminary Consumer Sentiment Index for June, where five-year inflation expectations eased to 3,6% (down from 4% posted previously), while one-year expectations declined to 4,4% from the previous 5%. Resilient macro data decreased market expectations over the potential Feds rate cut in September to 50% from previous 70%, as per data shown in CME FedWatch Tool.

The Genius Act was passed by the U.S. House on July 17th, after its approval from the Senate in June. The bill represents an important milestone for the crypto market, as it sets a comprehensive federal standard for stablecoins, clearing the way for banks and fintechs to issue them under clear reserve and audit rules. Among others, it allows permitted institutions to issue U.S. Dollar-pegged stablecoins, backed 1:1 by liquid reserves such as cash or Treasuries. It also mandates strict rules for reserves, custody and consumer protection in terms of full reserves, monthly disclosures, segregation of assets and priority in bankruptcy, aimed to boost consumer confidence and financial stability.

Weekly news on trade tariffs include a report by the Financial Times indicating that the US President had intensified his trade demands on the European Union after weeks of negotiations. According to the report, Trump is now pushing for a minimum tariff of 15% to 20% on imports from the EU, escalating further trade tensions.

Effective July 23, the composition of the S&P 500 index will be adjusted. A tech company Block will be added to the index, replacing energy company Hess, which will be removed. Following the announcement, Block’s shares jumped 10% on Friday.

Denmark is the first country in the world which passed the legislation by which citizens of their country own the copyright to their own face, voice and body. With this move Denmark Government is trying to protect its citizens from AI deepfakes, and similar misuse of data, pictures and voices of its citizens, without an explicit consent.

CRYPTO MARKET

While the previous week was the one dedicated to BTC, this week belongs to altcoins, who drove total market capitalization to higher grounds. The adoption of the Genius Act by the U.S. House was the main trigger behind the strong demand for altcoins. The crypto market gained a total $181B in market cap, increasing it by 5% on a weekly basis. Out of $181B, BTC participated with “only” $11B. Daily trading volumes were also increased to the level of $333B, from around $300B traded a week before. Total crypto market capitalization from the beginning of this year currently stands at 17%, with a total funds inflow of $561B.

This week belongs to ETH and other altcoins, which were major weekly gainers. ETH managed to add $74B to its market cap, increasing it by an incredible 20,8%, reaching levels of $3,5K. XRP was also one of coins with a gain above 25%, adding total $41B to its market cap. This week, market favourite Solana added $9,4B to its capitalization, increasing its total value by 11%. BNB managed to collect new $6,3B, surging by 6,6%, while DOGE added $6,7B to its market cap, which was increased by 23%. Among significant gainers ADA should also be mentioned, with an weekly increase in its cap by $4,2B or 17%.

A relatively calmer week when coins in circulation are in question. The main weekly difference relates to ZCash which withdraws 3,8% of its coins from the market free float. At the same time, Solana was the one to increase its number of circulating coins by 0,4% this week. Algorand also had an increase of coins on the market by 0,3%.

Crypto futures market

BTC and ETH futures were moving in opposite directions during the previous week. While BTC futures had a modest drop in value for all maturities, ETH futures gained significantly. BTC futures were traded by around 0,8% lower from the week before. Futures maturing in December this year closed the week at $121.215, and those maturing a year later were last traded at $128.345.

At the same time, ETH futures marked a surge in value of around 18% for all maturities. The coin passed the $3,5K levels. December 2025 futures were closed at $3.678, while those maturing in December 2026 were last traded at $3.958.

The SqueezeWhile it is logical to assume that the bulls are the ones about to get squeezed, I am going to be a contrarian and bet on the SHORTs getting liquidated, big time.

Good afternoon my fellow Cryptocurrency trader, how are you feeling this Saturday?

Every now and then, every once in a while the market enters a fight between down and up. When tensions rise, when people become anxious, when greed is strong, that's the time for a market squeeze to develop.

Seeing how good Bitcoin is doing, the strong Ether advance, how the altcoins are moving ahead and the rest, it is easy to rationalize that the market will squeeze all the over-leveraged LONG traders. I will repeat myself again, this is a SHORT squeeze.

Let's wait and see. Prices are going up. 1 Billion in liquidations coming next.

Let the bears run. Let's us start a mini bull-run phase.

Namaste.

Market Overview 📊 Market Overview

Today, most of the action came from the top 10 coins. If their momentum slows and profits are taken, capital could rotate toward other sectors—especially Others.d, which is currently testing key breakout levels.

🔸 BTC Dominance (BTC.D)

Dominance looks like it may pause or correct here.

👉 What to do? If you're in profitable alt positions, consider using a swing trailing stop to protect your gains.

🔸 TOTAL (Entire Market Cap)

We're watching the 3.78 level closely. A breakout here would mean fresh money is flowing into the market. That’s what we need to keep this uptrend alive.

🔸 TOTAL2 (Altcoins excl. BTC)

Still looking bullish. The recent break and hold above 1.4 confirms bullish momentum and even offers a new entry trigger.

🔸 TOTAL3 (Top 10 excl. BTC & ETH)

The 982 level is our key trigger. As long as we stay above and maintain this clean bullish structure—like the last 4 candles showed—coins like TRX, ADA, and DOGE are showing great potential.

🔸 OTHERS.D (Coins ranked 10–100)

Stuck at 7.71. If top altcoins (TOTAL3 group) finish their local uptrend, funds may flow into this category next.

🔸 USDT Dominance (USDT.D)

Not much movement here. Capital is rotating out of BTC, SOL, etc.

✅ A break below 4.24 confirms continuation of the bullish market momentum.

🔸 BTC/USDT

To continue upward, we need to break 120 and 123.

Right now, many are in profit—which means profit-taking pressure might slow things down.

📉 If fresh capital enters and we break 120–123, new momentum could carry us higher.

⚠️ Entering here is risky. We might range between 115–120, which is actually good—it could build a solid base.

🚫 Even if we drop to 111, I’m not looking to short in this bullish market.

🔸 ETH/USDT

Strong uptrend continues, but no new entry trigger for now. If you're in profit, consider using a 1H swing trailing stop to lock in gains.

🔥 The market is shaping up beautifully across different sectors.

Thanks for reading!

💥 Tap the 🚀 icon if you found this helpful and don’t forget to share!

TOTAL Market Cap | Uncharted Territory AheadWe’ve officially tapped into the previous high zone that hasn’t been touched since 2017–2020 levels. This isn’t just another bullish candle — this is macro structure reawakening.

📊 Chart Context:

We’ve cleared the 2024 high.

Price has pushed into a long-standing resistance block, previously a ceiling during the last crypto cycle.

Now holding above key Fibonacci retracement levels (0.618 / 0.786) with conviction.

Momentum is building, and the market is waiting for the retest before liftoff.

📍 Key Levels to Watch:

Retest zone: ~$3.68T–$3.73T

Macro resistance: ~$4.44T

Above that? Uncharted waters. 🚨

🧠 Sentiment & Thesis:

The narrative is shifting.

Bitcoin dominance is stalling.

Altcoins, especially utility tokens like XRP, are showing signs of awakening.

If TOTAL holds above $3.7T on the retest, this could trigger a massive capital rotation across the board.

🔮 Big Picture:

This move could mark the beginning of a new supercycle. We’re no longer looking back — we’re staring directly at the void above. Volume, structure, and psychology all align for a potential parabolic leg.

Let the charts speak. The market remembers. And history doesn’t repeat — but it sure loves to rhyme.

Total crypto MC - 1DThe total crypto market capitalization on the daily timeframe has formed a Falling Wedge pattern, which is typically a bullish reversal pattern. The price has broken out above the upper resistance line of the wedge, confirming the breakout. Currently, the price is undergoing a retest of the breakout level, which now acts as support. If this support holds successfully, it is expected that the market will experience an upward move in the near term, signaling potential bullish momentum.

Crypto Market Update – July 14th🔷Market Update – July 14th: Another Winning Move 🧠🔥

Another week, another breakout – and we’ve been tracking it every step of the way.

💸 Entries? Perfect.

✅ Targets? Hit.

🧠 Psychology? Nailed.

Today, we reached 122,795 , hitting a key target with precision. From there, we took partial profits — and are now watching the next leg toward 127K+ .

We’ve had 4 amazing entries lately, all executed with structure, risk control, and vision.

Today’s move? Just the latest in a series of well-calculated trades.

📉 Support now rests at 120,500 , with deeper support still valid around 114,921 .

This isn’t just a lucky guess — it’s the outcome of following levels, structure, and behavior.

But if you want to go deeper into what’s really happening beneath the surface ...

📊💸 Read the NEW Deep Dive Part III:

The Next BIG Whale Play Unfolds →

Inside it:

🐳 How the bear trap is being set

🧠 Why this is a disbelief rally

⚠️ Why shorting now = adding fuel to the fire

💥 And why this may be the first leg of a much bigger run...

Stay sharp. Stay structured. Stay ahead.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

📊💸 And don’t miss Deep Dive Part III – The Next BIG Whale Play Unfolds:

Deep Dive Part III – The Next BIG Whale Play UnfoldsDeep Dive Part III – The Next BIG Whale Play Unfolds

📍In Parts I & II of this Deep Dive, we broke down the psychology of whale behavior — from “Buy the Rumors, Sell the News” to the critical breakout zones that echoed historical patterns.

🐋 Back then, we spotted the whales' playbook early. The strategy was simple:

Buy the Rumors – Sell the News.

🧠 But now, the script has changed.

“The trap is where you’re most bored… 🌴📵

Their exit — on your liquidity — comes when you’re least ready. 💰🏄♂️💼”

Let’s break this moment down into what’s really unfolding.

We are officially entering the next stage of the cycle — not just in price, but in psychology.

This is no longer just about charts.

This is about human behavior on autopilot.

Here’s what I see happening right now — broken into three truths:

1️⃣ People Are On Holiday 🌞

From my community to the broader market, the energy is low.

People are either sunbathing on a beach or mentally checked out.

The focus is not there. The reflex to take action is dulled.

📉 The trap is where you’re most bored… 🌴📵

💰 Their exit — on your liquidity — comes when you’re least ready. 🏄♂️💼🚀

We’re seeing it unfold now:

1. Set the Bear Trap

2. Trigger the FOMO (will be down the road, yes)

3. Exit on Liquidity (the closing act of the play)

🕶️ But when everyone is away or asleep, that’s when the trap is laid.

It’s during these quiet, lazy days that the big moves get built.

2️⃣ This is a Disbelief Rally 🎢

The market trained everyone with a rhythm:

pump ➝ dump, pump ➝ dump, pump ➝ dump…

So what happens now?

People don’t trust the breakout. They’re frozen.

“We’ll dump again,” they say.

Except… what if this time, we don’t?

That disbelief becomes fuel.

It becomes hesitation — and hesitation becomes missed opportunity.

3️⃣ Bears Are Shorting Into Strength 🧨

This is key. While retail is confused, the bears are pressing in hard.

Their shorts are adding fuel to the pump they don’t see coming.

That’s why I posted recently:

“Shorting isn’t the problem. Being a psycho bear is.”

It’s not about being bullish or bearish —

It’s about timing , discipline , and narrative awareness .

Whales love this moment.

They lure in shorts, set the trap, then ignite the breakout straight into FOMO.

🧠 The Game:

Set the Trap → Trigger the FOMO → Exit on Liquidity 💥

This is what you’re seeing on the chart.

Not just price action — psychological choreography.

🕰️ In 2020–2021, we saw the exact same structure.

Part I warned about early accumulation and baiting behavior.

Part II showed how whales manipulated expectations with layered waves of doubt.

Now in Part III — the explosion few are ready for.

Zoom into the chart and it’s all there:

The curve, the trap, the trigger… and yes — the Final Boss.

🎯 The Final Boss: 6.51T

That’s the ultimate liquidity zone.

If this cycle plays out, we’re headed toward it.

“Sell the Rate Cuts” will be the new “Sell the News.”

It’s not the headlines that matter — it’s who’s left holding the bag.

🔚 Final Thought

The real exit — the one that traps most of retail — will come not when you’re euphoric,

but when you’re still saying:

“Surely we must dump now…”

So stay sharp.

Trade the chart — but don’t forget to read the behavior.

One Love,

The FXPROFESSOR 💙

Part1:

Part2:https://www.tradingview.com/chart/idea/VgMBPsp3/

The Bear Trap:

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

$TOTAL CRYPTO MARKET CAP BREAKOUT CONFIRMEDWhat a FILTHY Weekly Close back within the POI 🚀

Bulls are back in biz, for at least the next few weeks.

I’m expecting a bit of sideways chop here, and the next leg up the first or second week of August.

This is in no way, shape or form a call for “ALT SEASON”, yet.

Still need to see what happens in the next few weeks,

BUT IT LOOKS PROMISING 🙏