Euro Stoxx 50 - Daily - Could still capture a bit of the upsideTrade Alert

We could still catch a bit of that uprise, especially if the index moves above its recent highs of 3436.5. The move could open the path towards the 3460 level initially and then maybe testing the long-term downside resistance line, taken from the highest point of January. This is where the price could stall for a while.

On the downside, a break below the 3405 zone, could set the stage for a possible drop down towards the 3350 area, which acted as good support on the 15th of August.

Always have your SL in place.

STOXX50 trade ideas

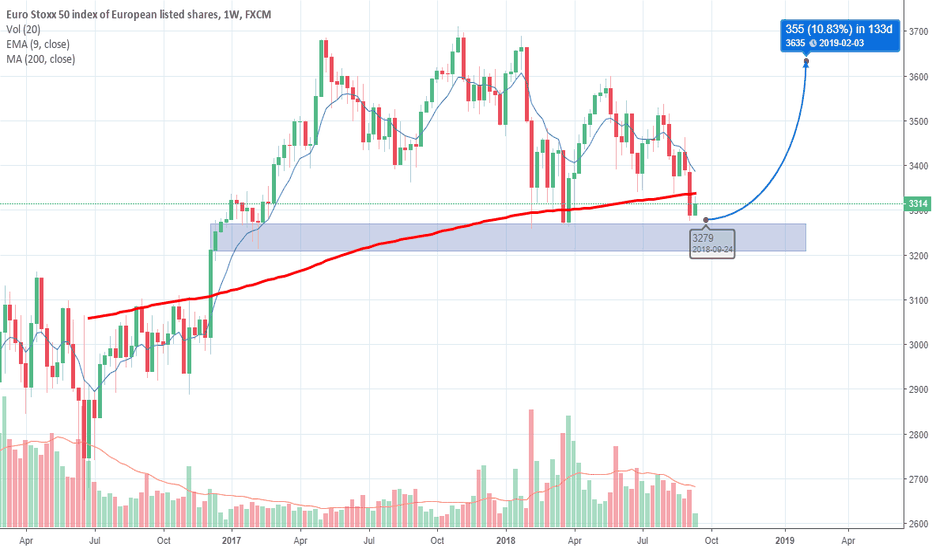

Potential SX5E Short-Term Buy Opportunity

Tested support of around 3275 points. RSI at oversold level. Possible retracement from current downtrend up to fib level of 0.236 with the target level being around 3350 points. More confirmation required but represents a potential buying opportunity in the short term.

Short Euro Stoxx 50 - Downside volitility!See confluence of 50MA (h4) , previously inflected horiz resistance & 50% retracement.

I have went short here at yesterdays open. SL placed just above market high. This will moved once I see a reaction to the downside further improving my R:R on the trade. I always place my SL's at the point where my opinion is proved wrong. If a new high is printed here then my opinion of a downside confutation is incorrect.

My target will be a retest of the local market low. We can see there is volatility to the downside here (swift moved to the downside last week followed by a weak upside move.

Zooming out to a macro view - there is a case for a larger H&S forming.

EURO STOXX in the same boat as the DAXAlmost identical setup on the EURO STOXX as on the DAX. Big short setup, first set up in a potential new bearish trend. The pattern was triggered by a nice big selloff candle, indicating strong bearish momentum. Will it continue? On balance of probability it should. Either way, I wouldnt want to hold any stake in EURO STOXX 50 or DAX at this time.

Trade safe. Trade smart.

SX%E - Long term bearish outlook - 300 point drop!Very bearish market geometry on display in the Euro Stoxx 50 chart. Bearish are certainly in control with bulls failing to create new highs this years and also a recent failed to re-enter the trading range.

P&F count for this one brings us down the 3100, this ties up nicely with a the previous horizontal resistance developed in 2016.

Good luck!

For more info on potential entry points Join my discord! discord.gg

EuroStoxx 50: I am bearish against the 3600 highComments on the chart.

The most important thing to note is that for this to play out the high must be in

By the way, another scenario that can happen is a triangle however the downmove has no discernable divisions into 3 waves. A triangle will be bullish imho

EuroStoxx below 3410/05 risks a slide to the May low at 3385/80EuroStoxx below 3410/05 risks a slide to the May low at 3385/80. A break below the 50% Fibonacci at 3374 targets 3366 & 3359/55.

Holding 3410/05 allows a recovery to 3428/30 with strong resistance at 3439/42. Shorts need stops above 3450. A break higher meets strong resistance at 3461/64. Shorts need stops above 3470.

Euro Stoxx 50 - Daily - Getting squeezed and ready for a moveTrade Alert!

We will make a difficult call here and say SELL. Certainly, for this, we will have a careful stop.

The index is really getting squeezed right now and it looks like a strong move soon is inevitable.

As always, don't forget your stops.