About DAX Index

The German stock index DAX 30 (GER30) was introduced under "DAX" on July, 1st in 1988 by the Frankfurt Stock Exchange. It consists of the 30 largest companies listed on the Frankfurt Stock Exchange based on the market capitalization and liquidity. The trading hours for the Frankfurt Stock Exchange take place from 9:00 a.m. to 5:30 p.m. CET. The DAX30 is usually reported as a performance index, which means that the dividends of the companies are reinvested. In a price index the corporate distributions remains disregarded (this can be seen e.g. in EUROSTOXX50). If a company wants to be included in the DAX, it must be listed in the Prime Standard, it has to be traded continuously in Xetra and have at least a free float of 10 %. Additionally, the company must have a registered office in Germany or the main focus of its traded volume in shares is in Frankfurt and the company has a seat in the EU. Based on market capitalization, the five biggest German companies listed in the DAX 30 are Bayer (BAYN), Daimler (DAI), Siemens (SIE), Allianz (ALV) and BASF (BAS). The development in the DAX is often seen as an indicator for the development of the German economy. As a result, the DAX can be seen as a proxy for European economic health since the German economy accounts for almost one third of the total value of the Eurozone economy. The DAX 30s counterparts in Europe are the CAC 40 in France and the FTSE 100 in Britain.

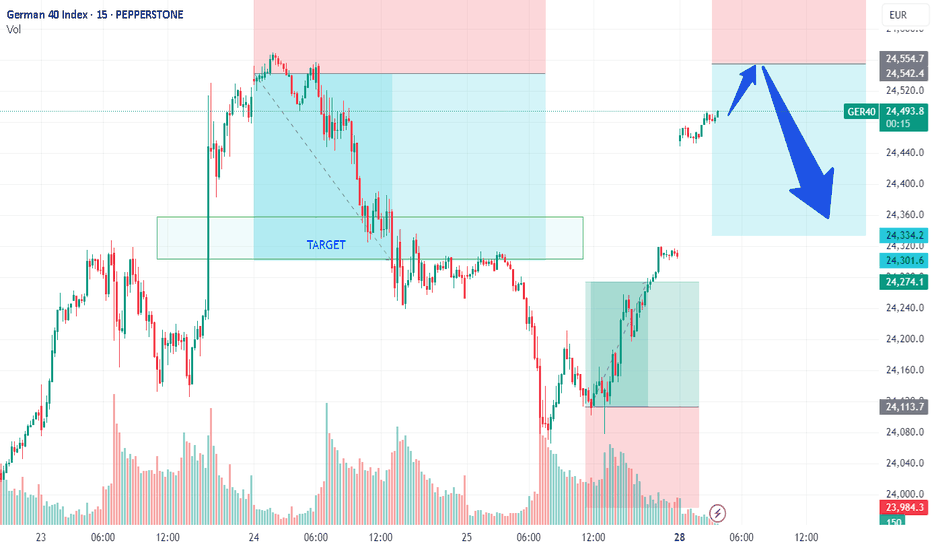

DAX / GER - ANOTHER ROUND OF ENTRY LONGTeam, we have successfully short DAX.GER earlier today with more than 300 points. both target hit

However the market has exceeding the dropping. We decide to go LONG

at the price range 23964-23945

With STOP LOSS at 23865-82

Once the trade hit above 21030-45 - BRING STOP LOSS TO BE

Target 1 at 2108

DAX: Local Bearish Bias! Short!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 24,252.78 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmati

GER/DAX - TIME FOR RECOVERTeam, this morning, the DAX target hit our target 1, we took some profit, we set a stop loss at BE, and it got stopped out

Time for us to re-enter the DAX again at 23880-23855

STOP loss 23780

Once the price move at 23950 - bring STOP LOSS TO BE

Target 1 at 23985-24015

Target 2 at 24065-24096

lets

DAX sideways consolidation support at 24070The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 24070 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24070 would confirm ongoing up

GER30 H4 | Bearish reversal off pullback resistanceBased on the H4 chart analysis, we can see that the price rises towards the sell entry, which acts as a pullback resistance that lines up with the 50% Fibonacci retracement and could potentially reverse to the downside from this level.

Sell entry is at 23,935.46, which is a pullback resistance that

DAX/GER - PREPARE TO SHORT on DAX market opening Team,

We all know that the European Union and the United States agreed on Sunday to a broad trade deal that sets a 15 per cent tariff on most E.U. goods, including cars and pharmaceuticals.

The 27-nation bloc also agreed to increase its investment in the United States by more than $600 billion abov

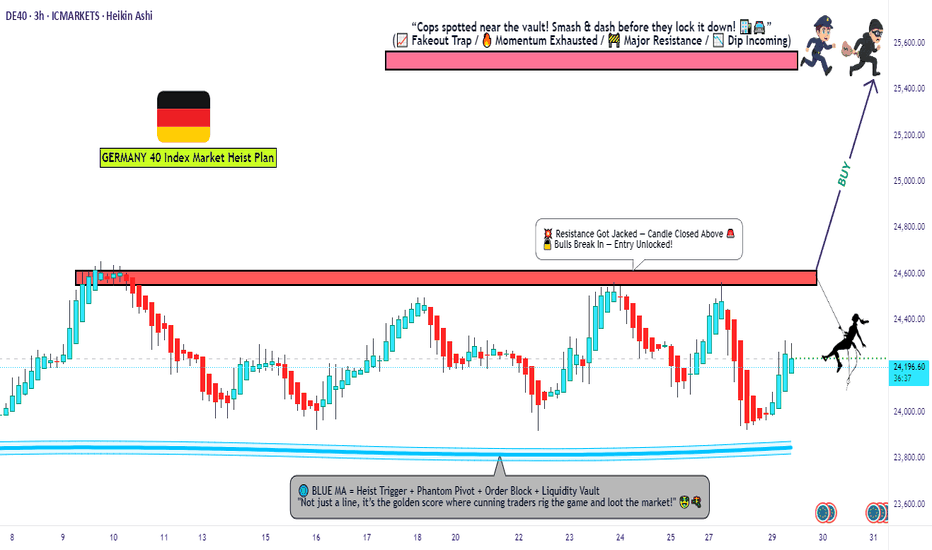

DE40 Breakout Robbery – Bullish Setup Revealed!💣 DE40 / GER40 INDEX BREAKOUT RAID 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Robbers, Money Makers, and Chart Bandits 🕶️💰💣,

We’re rollin' out our latest Thief Trader Heist Plan based on laser-sharp technical + fundamental recon 🧠💼 on the Germany DE40 / GER40 Index. It’s time to ge

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

DAX Index reached its highest quote on Jul 10, 2025 — 24,654.12 EUR. See more data on the DAX Index chart.

The lowest ever quote of DAX Index is 7,968.40 EUR. It was reached on Mar 19, 2020. See more data on the DAX Index chart.

DAX Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy DAX Index futures or funds or invest in its components.