TRUMPUSDT trade ideas

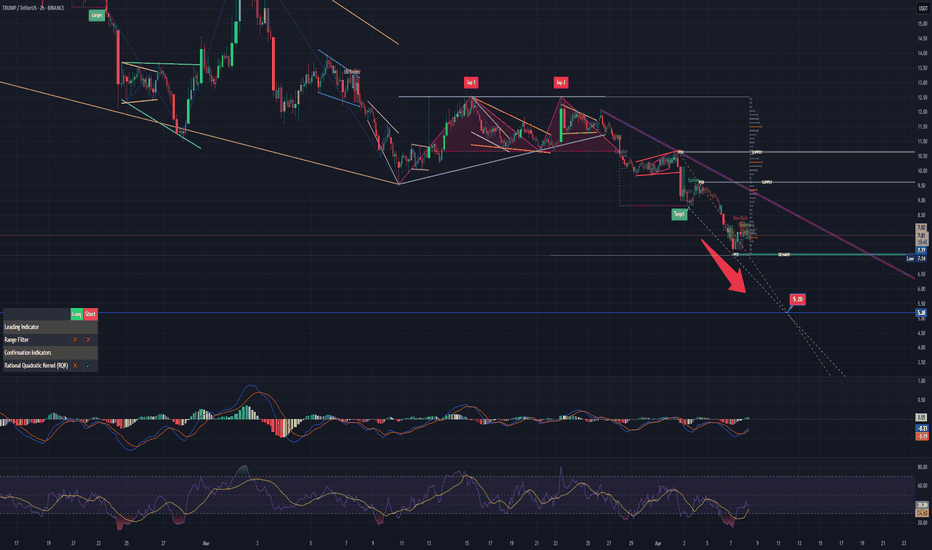

TRUMP/USDT 4-2025🚀 TRUMP/USDT - Accumulation Holding Zone 📊 – TRUMP has spent 13 days holding the weekly low around $7, showing strong resilience—even after a major unlock event (~20% of circulating supply). This price action suggests potential accumulation, and if the $7 level continues to hold, an upward movement may follow.

Breakout Targets:

$9.5 🟢 (TP1)

$10.5 🟢 (TP2)

$12.5 🟢 (TP3)

Panic Key (SL):

Daily or weekly close below $7 🔻 (Invalidation of this bullish view)

Note:

This is not financial advice but a reading of market structure and price behavior. Always do your own research and manage your risk.

We ask Allah to reconcile and repay. 🙏

Weekly trading plan for TRUMPMarked the important levels in this video for this week and considered a few scenarios of price performance.

Write a comment with your coins & hit the like button, and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades! MURA

$TRUMP LONG $TRUMP 4H LONG

The asset retains a pronounced upward dynamics, which opens opportunities to consider long positions.

The expected test of the designated zone of interest (POI) may act as a trigger for the continuation of the upward momentum.

Target benchmarks: $8.71, $8.85, $9.09, $9.64.

Trump's official hits $8—25% bounce expected to $10.30 soonHello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Trump's official 🔍📈.

In recent months, Trump's official has undergone a sharp and unusually volatile decline—a move I had anticipated with precision, projecting the drop to the $8 level. While further downside risk cannot be ruled out, I currently expect a short-term technical rebound, potentially offering a minimum upside of 25%, with a near-term target around $10.30. This scenario reflects a tactical opportunity amid broader bearish momentum.📚🙌

🧨 Our team's main opinion is: 🧨

Trump's official plunged just as I predicted to $8, and while more downside’s possible, I’m eyeing a short-term bounce toward $10.30—about 25% upside.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

$TRUMP token Crumbles as Major Support Breaks, Is an ATL Next? TRUMP, the meme token inspired by former President Donald Trump, is currently priced at $7.52. The token has gained 5.03% in the last 24 hours. Its market capitalization stands at $1.5 billion, with a daily trading volume of $415.5 million, a drop of nearly 60.12% in the last 24 hours.

TRUMP was launched to commemorate Trump’s viral "FIGHT FIGHT FIGHT" moment in July 2024. That day, he survived a deadly incident and raised his fist in defiance. The moment triggered a movement that birthed this meme token. It symbolizes resilience and leadership, attracting thousands to its growing community. The token is now freely tradable on the blockchain, with increasing interest in both trading and long-term holding.

Technical Analysis: Price Faces Trendline Rejection and Heavy Resistance

TRUMP has been in a strong downtrend since reaching highs at $77. A descending trendline continues to cap upward moves, with the price breaking below key support at$12. Resistance is seen around the descending trendline and the horizontal support at $12. This level was previously a support and is now acting as a ceiling for price recovery. The daily RSI is currently at 27.19 indicating oversold conditions. This could trigger a short-term bounce toward $10–$12.

However, the trend remains bearish. The price has failed multiple times to break above the downtrend line. If the price breaks below $7 with volume, further drop could follow. A successful bounce might lead to a retest of $12.

Will Trump's break resistance or drop 26% to $8?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Trump's official 🔍📈.

Trump's official is currently positioned at the upper boundary of its descending channel. Based on technical analysis, I anticipate a further decline of at least 26%, with a target price of $8. A significant resistance level has been identified and marked on the chart. If the stock fails to break above this resistance, the downward trend is likely to continue. Investors should closely monitor price action for confirmation before making trading decisions.📚🙌

🧨 Our team's main opinion is: 🧨

Trump's stock is hitting key resistance in a downtrend, with a likely 26% drop ahead and an $8 target if it doesn’t break higher.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

Oof, we are so close I can taste itFurther indication things are moving to the downside for the next few weeks. XRP hasnt even really fallen, btc hasn't even touched $74,000 yet. And then we have trump coin, the current crypto barometer. It continues to fall as i've predicted and this is indictive the rest of the market will soon follow suit. It is tied directly to the social impression of the biggest policy maker in the world at the moment. Policy moves markets.

TRUMP & MELANIA Collapse - Sh*tcoin Reality CheckIf you had bought BINANCE:TRUMPUSDT or BINANCE:MELANIAUSDT.P at any point during the last three months, you’d likely be deep in loss within just days. These tokens, despite using the names of major political figures, followed a typical memecoin pattern:

🚀 Launch hype → 💰 Speculation → 📉 Massive dump

But here’s what traders need to remember:

🔁 These types of tokens can pump again. All it takes is a tweet, a trending news event, or a post from an influencer or celebrity—think Elon Musk. A spark like that could fuel a rally.

⚠️ However, the risk is extremely high. These projects often lack fundamentals, and the price action is driven mostly by hype and speculation. If you choose to trade them, know your risk tolerance and never overexpose your portfolio.

💡 This is the reality of memecoins. Recognize the pattern, protect your capital, and stay sober in the market.

📊 Follow for grounded insights and market wisdom—no hype, just facts. 🔔

Trump & Dump PatternHello friends.

$Trump is heavily manipulated by Donald Trump, like recently when he mentioned the coin and pumped it up on that. He has lots of coins that he wants to distribute. Since he controls the country and the narrative, this is very easy to do. All he needs is to find people willing to buy the coins by releasing some big news. As you can see on the chart, it currently looks like an accumulation area with a clear level of liquidity to sweep through at $12.45 before crashing.

Did you notice how crypto didn't plunge along with the equity market on Friday? It was a huge break in the correlation and it shows that some serious manipulation is going on for this entire market. My expectation is that this weekend there will be some massive news such as that Trump has used the government to purchase Bitcoins or a similar headline.

Onchain data shows that smart money has been accumulating millions of dollars worth of Trump here over the past 2 days and the price is already starting to rise from the lows. They definitely know something. Think about the timing of a final exit pump across the board for cryptos right into this plunge on equities. It makes perfect sense to sweep liquidity at $95,000 in that market as well and give everyone one last chance to sell their coins before Bitcoin plunges to $50,000.

TRUMPUSDT from 5$ can pump hardWe are looking for buy on this chart but price here near 10$ is not that much interesting and i think it can dump more and be range near 5$ for a months and then start of rise so one of the best buy zone for me would be after next phase of dump.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚