BB trade ideas

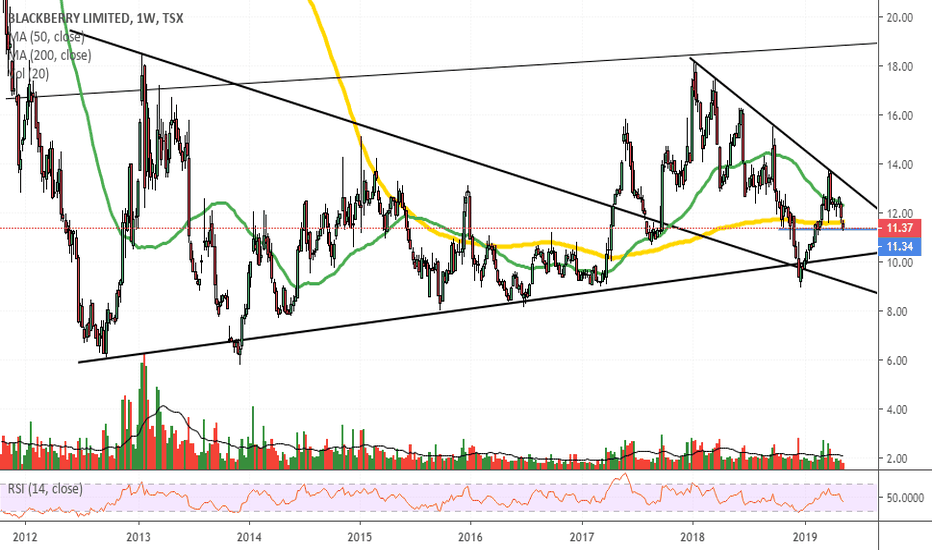

BB has compelling future. I bit.Here I have drawn a couple lines showing what look like some bullish divergences.

This stock surprises me with the lack of confidence. I feel comfortable buying here seeing basically zero pump, and what appears to be market deflation.. Im no expert by any measure, but this seems to be an excellent opportunity to buy into a company that has been making a transition from hardware to subscription software, in the late stages, and at a low price. Security is key, and if these guys can become top tier, I think market will reward for many years. They seem to be off to great start, and in diverse applications. Little trade exposure, but in position to profit from any advances that may happen.

Clearly I like them, please drop a note with your take.. no need for bashing.. i know many have been burned.

$BBNYSE:BB Cae fuerte el día de hoy donde anuncian que mejoró los estimados de ingresos. Se desploma -9% y posiblemente toque la línea de tendencia de color violeta que la utilizará de soporte. MACD indica venta con una pendiente bastante pronunciada, lo cual indicaría que seguirá cayendo luego de tocar este soporte dinámico para luego tocar mínimos en 6,57, línea de retroceso de Fibonacci de 0. Otra opción es esperar un rebote en el soporte dinámico que coincide también con un soporte estático del 31/12/2018, lo cual permitiría una corrección al alza para luego volver a testear el límite inferior del canal bajista

Blackberry needs a blowout earnings to pass resistance BlackBerry Limited BB, -0.12% (BB) today announced that its QNX software is now embedded in more than 150 million cars on the road today. This is an increase of 30 million cars since the company reported its automotive footprint in 2018.

"As this milestone proves, BlackBerry's footprint in the automotive industry has never been stronger," said John Chen, Executive Chairman and CEO, BlackBerry. "The world's leading automakers, tier ones, and chip manufacturers continue to seek out BlackBerry's safety-certified and highly-secure software for their next-generation vehicles. Together with our customers we will help to ensure that the future of mobility is safe, secure and built on trust."

THIS NEWS WAS NOT ENOUGH TO TURN THE FORTUNES OF THE STOCK AROUND, WHICH IS DOWNTRENDING AFTER A FAILED RALLY, THE $9 LEVEL HAS PROVED TO EXTREMELY DIFFICULT TO CROSS, SO IT WILL TAKE A BLOWOUT EARNINGS THIS WEEK TO GET ANY SUSTAINED UPWARD MOMENTUM.

AVERAGE ANALYSTS PRICE TARGET $10.79

AVERAGE ANALYSTS RECOMMENDATION HOLD

COMPANY PROFILE

BlackBerry Ltd. engages in the provision of enterprise software and services, which focuses on securing and managing Internet of Things endpoints. It offers a platform comprised of communication and collaboration software and safety-certified embedded solutions. The company was founded by Michael Lazaridis, James Laurence Balsillie, and Douglas E. Fregin on March 7, 1984 and is headquartered in Waterloo, Canada.

$BB BULLISH REVERSAL IN THE COMING DAY.****SCANNERS HAVE ALERTED US TO THE STOCK OF NYSE:BB WITH A POSSIBLE REVERSAL TRADE IN THE COMING DAYS. WISE TO WAIT FOR CONFIRMATION FROM STRONG VOLUME, MACD CROSS AND BULLISH ENGULFING CANDLE, RSI IS ALSO RECOVERING****** SET ALERTS FOR BREAK OF $8.50 FOR MORE BULLISH ENTRY.

BB Summer RallySmall caps appear to have broken out (IWM/$RUT), which means we'll see some money flowing into garbage small caps. If I gotta pick anything here, it's BB. Increasing revenue and they made a profit. Got hammered by lack of liquidity after earnings.

All kinds of positive TA... inverted H&S, a larger inverted H&S, cup and handle, bear flag. On top of that, positive divergence on MFI and RSI. Picked up 3k shares at closing price, thinking this heads back to $10.25 in a couple of weeks.

BB Inverted H&SIn this pumptarded market, very few stocks can justify their ridiculous P/E ratio. Bought into this yesterday for earnings, came out better than expected. I'm actually surprise this isn't up 20% already, maybe they should start selling yoga pants.

Earnings were 11 cents for the quarter, assuming growth, forward P/E would be less than 20. I'm holding this until at least $12, only 1k shares.

They don't sell any hardware any more, it's strictly software by license which is high margin.

Blackberry - Daily - Showing signs of hopeTrade Alert

Something that you don't look at very often, but still, it is good have it mind, for those who are interested.

After a prolonged decline, BB is finally showing signs of hope again, by breaking the short-term downside resistance line. Of course, this doesn't mean that the stock now will fly sky high, but to see some higher levels could be a possibility.

If the stock breaks above the 7.65 barrier, we will then aim for the 9.00 level, marked by the highest point of December 2018.

If the share price suddenly reverses back down and drops below the aforementioned short-term downside line, we will take a more neutral stand and wait for the next setup to build up.

Don't forget your SL