CRON trade ideas

CRON - Will it have an extended 3rd wave?Still on track. The purple line shows an approximate trail for CRON. Today is a nice strong up day. This could just be the first of many strong waves in an extended 3rd wave pattern... time will tell.

I have been bullish on this stock since last year. After the initial pop, we sold for a double. Then we didn't chase it, we "retraced it" to give us another 2nd chance to get in as shown by the little green buy zone.

Looks like now we'll soon finish this first wave 1 of 3. In the next month or so we should see another retracement of this recent wave 1 of 3 move.

That would be another 3rd chance for those that want to get in.

If your in now, just stay on for the ride. This could be a nice 10-20 bagger :)

CRON new ATH has little followthrough FridayCRON bulls hav e een happy the past few weeks but Friday's new All time high had little followthrough and should leave bulls cautious after a 70% bounce. Watch for Friday's low to hold, the break of which would signal consolidation is underway and bulls would then look to form a higher low and have another attempt at resistance.

C(h)ronos - the god of well-timed tradesCronos, the cannabis company has showed recently a lot of momentum. Stock market rally is of use here. But as the market looks like if it is wondering about its next move, this stock looks like it is poised to go down. It has a history of pullbacks whenever it crosses upper kelt. I believe there may be a pullback to around 13.63-12.85 within a couple of days. However there is a chance on trend continuation if the price breaks 17.72 on big volume.

A lot depends also on the greater market. If it falls or stays flat, I expect the stock to fall, if it ramps up, the stock may stay flat or go slightly up but not for long.

$CRON Breakout Above 52 week highs!I've identified a significant support at 12.90 and resistance at 15.22. $CRON is trading in an upward channel since Christmas. Intraday high Friday already tested the 52 week high. I project that we will pull back and consolidate for a breakout above $15.22 and run up: possible as high as $17 next week. I see a lot of momentum behind the cannabis sector and this stock in particular.

CRON Cup and Handle - Watching for breakoutI have been playing with options for CRON for a little and personally I like the company a lot and see tons of potential for future growth.

A textbook cup and handle pattern forming on the 1h. RSI and MACD showing signs of upward momentum but volume is lower than I would like.

If it is able to break out I can see this going to $16 and I have a target of at least $20 by year end.

CRONOS GROUP, CRON, Bull Run Once Support Has Been Tested!Self explanatory chart....Bull Run coming with three possible upward movements at key support levels which can be supported by the 50, 100, and 200 day EMA's ranging from the next week to next month. Win, win, and win situation!

Get into the Canadian Weed market now while the U.S. market tanks in 2019.

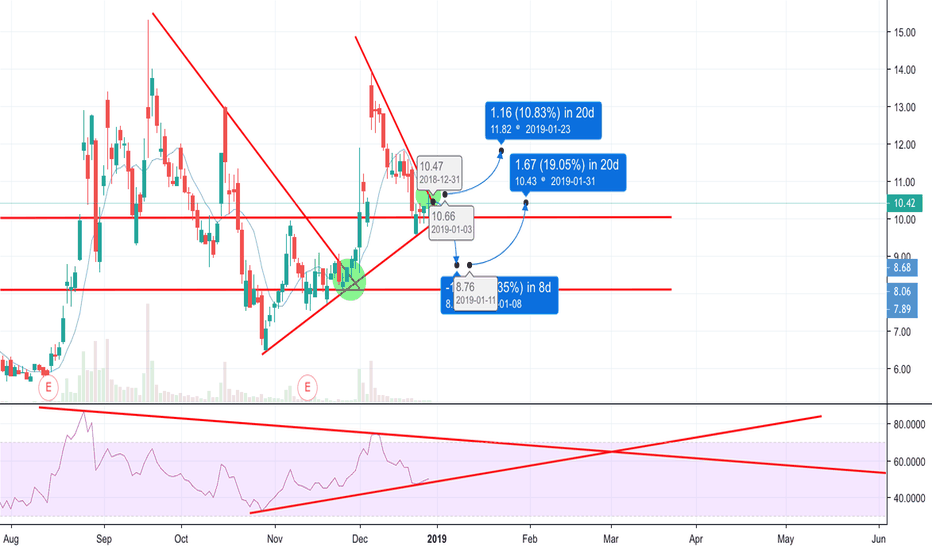

CRON, Medium, 8 - 16 January Support and 5th Wave Confirmation!I looked once last time after utilizing the 50, 100, and 200 moving averages and adding a massive Elliot wave that encompasses months worth of price movement. The good news is that no matter how you look at it, this stock is bouncing predictably off of the upper and lower price channel and showing a general positive movement. Those 50,100, and 200 EMA's along with the historical support levels all line up to show that we are nearing the bottom of our consolidation and that the green or blue wave (4) patterns and subsequent (5) are the likely scenario during the month of January. We'll know by mid-month!

G'luck!

CRONOS, Medium, Key Support Levels Support A Bull Run!Pretty self explanatory chart....we are approaching our first key support level...if we break below it then the 2nd scenario would play out, etc.

Yes, in every scenario it is a Win, Win. Stay in the Canadian Weed Market. If you aren't in it yet, GET IN!

The majority of U.S. stocks will be impacted over the entire 2019 during the massive upcoming DJIA correction.