LABS trade ideas

Patience I think medipharm is a decent company they have a lot going for them and they are on the verge of profitablity, and when call you have Pierre Poilievre in office in Canada all Canadian stocks that aren't terrible are going to be bullish for sure. My average buy in is 7 cents Canadian and if your a US citizen you can literally buy way more then canadains if you have an average salary pos. My price target is 60 cents Canadian but I know this company is going to a couple of dollars here.

GOLDEN CROSSToday, Medipharm Labs's 50-day moving average line crossed above its 200-day moving average line, forming a GOLDEN CROSS, a STRONG BULLISH signal.

Today, the stock went up by 13.33% on more than 4 times average daily volume.

Tradingview's technical analysis summary is BUY:

www.tradingview.com

GLTA!

IMMINENT GOLDEN CROSSMedipharm Labs's 50-day and 200-day moving average lines are a quarter of a penny from forming a GOLDEN CROSS, a strong BULLISH signal.

Extrapolation of these lines strongly suggests that they might form a GOLDEN CROSS this coming week.

Also, the Accumulation/Distribution indicator has clearly been trending upwards.

Tradingview's current technical analysis summary is STRONG BUY: www.tradingview.com

GLTA!

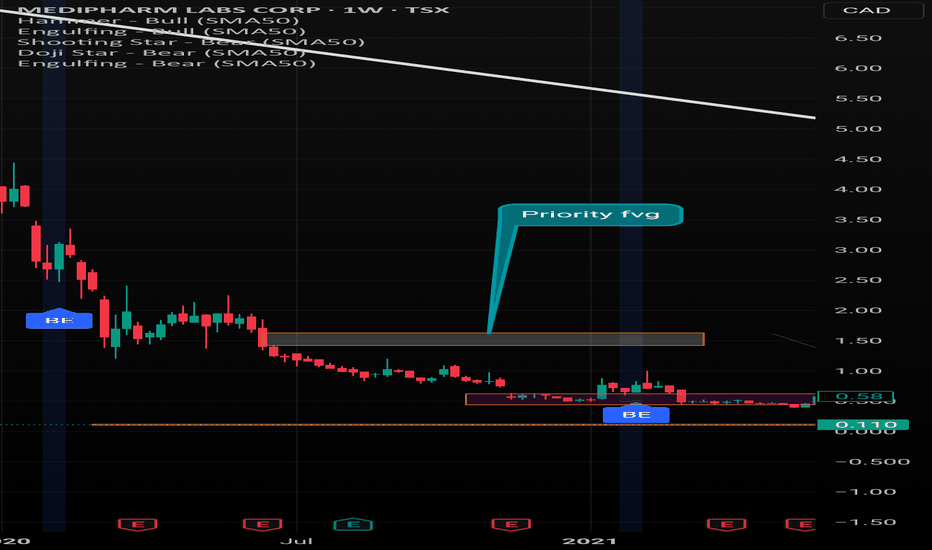

From 5.50 to under 0.50 stock, would you buy ?Read latest news here , here

Think about stock investment like America got Talent show. If a stock has good potential but lack coverage by analysts, institutional buyers, media coverage, etc, it would take some time for investors to take notice. The show or the analysts coverage, etc are the platform that sells the company, promote its USP to the millions of investors out there who have nothing but choices of companies to invest in.

Thus, someone who is able to analyse it and package it neatly in a compelling manner would help raise its profile. Not for MJ , at least for now.

Chart wise, though it has broken out of the descending wedge pattern formed in May 2019, clearly the buying power is weak and I forsee more sideway movement. The March 20 revenue data release might be a trigger or we need some positive news to drive up this stock.

I will revisit this chart again when it breaks out of 0.85 resistance level, so this goes to my watchlist for now.

Medif I currently do not own this stock but am looking to purchase soon for the potential run. I am no expert do your own reasearch , but im glad to share my opinion and input and learn together. Good Luck everyone! if you want to play it safe you can also ride it up to the 200dma if you keep an eye on it and sell when they meet in case of a rejection and a further drop in share price. Id say around (.73-.75)

CLIMBING ABOVE 50-DAY MOVING AVERAGE LINEToday Medipharm Labs climbed above its 50-day moving average line, a strong BULLISH signal. It did so by going up by 27.12% on more than 3 times average daily volume. In the process, it filled a major gap.

TradingView's technical analysis summary is BUY:

www.tradingview.com

This stock has a consensus price target of $1.98:

www.marketbeat.com

That is more than 167.56% higher than the current price of $0.74.

GLTA!

This may be the bottom of LABSLooking at the weekly we can see there is a bullish divergence and there seems to be another one forming on the daily. Looks like a great recipe for a technical bottom. Of course this trade will largely depend on the earnings. breaking of this trendline would be extremely bullish and picking some up may be aggressive but extremely rewarding. with such a small current market cap this could easily 5x.I do like the management.

LABS.TO - Filled the gap. $2.50 price target from Canaccord.LABS presents a very good entry near .84 gap fill. Canaccord analyst has revised the price target to $2.50 after EU deal announcement and the company continues to produce excellent news flow. Strong support in the low .80s. Gap above at 1.69. Positive MACD divergence. Sector is finally turning bullish. I like this setup.

LABS - On serious reversal watch for descending wedge breakCannabis sector reverses this will reverse hard MM's left big gaps above that would see 3-4x return when descending wedge is broken. Low risk at these levels imo and very high reward. Currently depressed in a depressed sector that has huge growth prospects.

MEDIPHARM LONG SETUPLooking at a potential low risk high reward play here.

Although i pointed out the previous bull run above, I don't expect anything close to that happening at all.

We are currently under a death cross and earnings are coming up, note it usually dumps at earnings after all-time-highs.

This is a company I am looking at long-term though so I will buy small at this level only because of the number of opportunities in the market right now, but will essentially look out for lower prices and possible bullish divergences in which case I would up my bet.

Any rally here I would anticipate a breakout and continuation possibly to that .618 fib level which seems to be respected a lot throughout this bear market, and just so happens that the 50MA is lining up with it as well.

Not investment advice, just my opinion on the market. Safe trading, cheers.

LABS Earnings Next WeekWhat's in store for Q4 earnings? I have no idea. I do know that I like LABS a lot. As with my other favourites, solid fundamentals and high growth potential. Fell right through my target - I ended up buying twice - and then bounced nicely.

I am looking for a short term, sustained bounce towards $3.35 level, then gather some strength before moving higher again. If the broader markets continue to recover, I see LABS as a winner. If broader markets go for another round of selling, I believe my investment is safe here.

A growth stock with some value.

LABS Regression Trend| Higher Low| Key ResistanceHello Traders!

Today’s chart update will be on LABS – Canadian MJ – which has been trading in a clear regression trend, close to testing upper resistance, is a break imminent?

Points to consider,

- Clear bear trend

- Support provided by 50 MA

- Regression trend resistance to break

- Stochastics in lower regions

- RSI respecting trend

- Volume below average

LABS bear trend has been putting in consecutive lower highs, with a first higher low coming to fruition, a trend change may be probable.

Support is currently being provided by the 50 MA, all averages will eventually need to hold LABS when testing key resistance. The Regression trend resistance is a staunched area that LABS must close above to register for a probable trend change.

Stochastics are in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the upside. The RSI is respecting its trend line, currently neutral, not at extreme ends. LABS volume needs to stay above average for continued follow though when breaking levels.

Overall, in my opinion, a break and close above key structural resistance will confirm a trend change. LABS, does need to increase volume otherwise a rejection at currently trading level will become more probable.

What are your thoughts?

Please leave a like and comment,

And remember,

“Trading effectively is about assessing probabilities, not certainties.”

― Yvan Byeajee

Great risk to reward + time playJust a simple play in an upwards channel

Only issue I have is is that there is rejection on the bottom of the channel.

Taking a closer look we see some bullish

divergence meaning it wants to go in.

I would not enter the trade until I see it enter back into the channel and it has a nice wick on the hourly indicating clear rejection of bottom of the channel. A nice risk to reward play that can take as little as 5 days to complete!