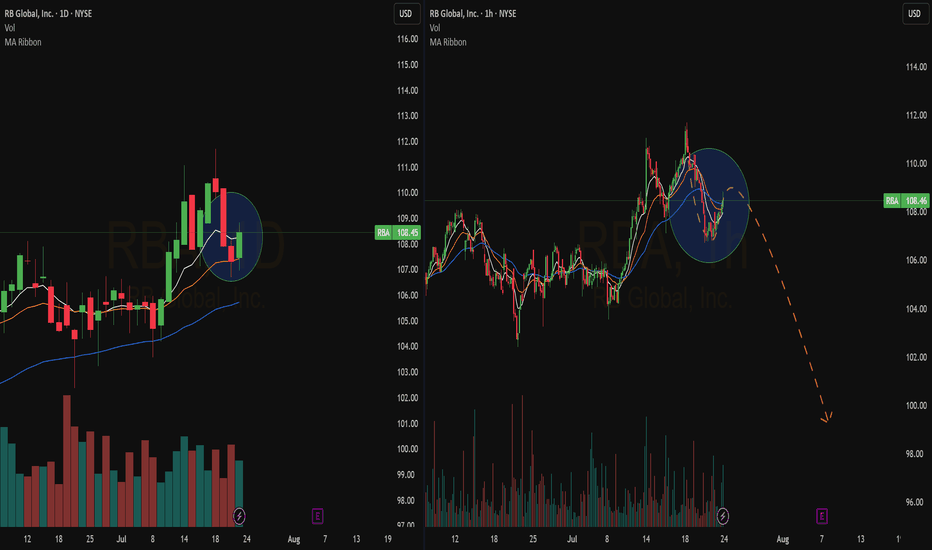

RBA trade ideas

Obscure? Yes. But its returns should not be ignored.I went long RB Global at the close today. Zoom out and you'll see a pretty beautiful chart for a company nobody reading this has probably ever heard of. It's been in a nice uptrend for the past 2 years and just put in an all time high a week ago, so it has good momentum. Obviously, it's also trading above its 200d MA. It has support right here, as well as about 6% below where it's at now, but I'm betting it won't need that.

The last 20 times this setup has occurred, going back to early 2021, all 20 were wins. The average gain was 2.46% in an average of 1.85 trading days (31x the long term average daily return of the market as a whole). Maybe even more impressively, none of those trades would have closed in more than 4 trading days, and that only happened twice. 11 of 20 closed in one trading day. 25% of the trades netted 4% or more, with the largest win being 10.7% in a single day.

The setup doesn't usually continue for more than one day, but if it does, I will add to my position. My plan is to close on the first profitable close, provided the gain is substantial enough. I may hold longer, and if I do, I may close intraday (especially right at the open if it's a strong open on the day following its FPC.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

A Little LongHaving taken the profit of y short Idecided now to take a little long position. The upward movement since April 4th has been sufficiently retraced and the After-Easter corrective decline could not continued up to now. We are holding above the MA.

I don't expect to much but I see the chance of a retest of the Mid April highs or even the March high again.

A New(Exhausting?) HighAfter the November/December high it had looked like a coming correction.

But then the February saw the price bounce back towards a new high,

As the price had not been corrected for 10 months this may bee seen as an exhausting spike.

The market is long and no new players may come in. The spike may have exhausted and a profit taking may set in within the next few weeks.

RBA: $771 Million in Block Trades Suggests a Big MoveRB Global ( NYSE:RBA ) has been largely rangebound this year, but has been on a recent run to the upside.

However... In the past 4 days, about $773 million in RBA closing print block trades arrived.

These 4 prints are of the largest NYSE:RBA block trades of all time.

Does this mark the end of NYSE:RBA 's run, or has a player arrived to take this higher? 🤔

Began Buying Yesterday RBASlow and steady buying this daily. Lil dividend cherry on top.

Like what I see and love Ritchie Bros. I drive by and see a yard full of heavy equipment... a week later empty... more.... empty.... MONEY IS BEING MADE!

little to no debt... RBA is positioned very well in the coming years.

As always good health, wealth, and best wishes to all!

BUY signals for Ritchie Bros AuctioneersIndicators as MACD and Stochastics are showing Buying signals for #RitchieBrosAuctioneers with both indicators crossing lines in the 3h and 1day time frame.

On the fundamental analysis #RBA is showing strong financial numbers, low debt and beating EPS.

This company is in one of the sectors that performs well during economic crisis.

CUP WITH HANDLE AND HIGH VOLUM BUY RBA 44.98$Upslope Capital recently released its Q2 2020 Investor Letter, a copy of which you can download here. The Fund returned 1.2% net of fees for the June quarter, as compared to the 23.9% return of the S&P Midcap 400 ETF and 8.1% return of the HFRX Equity Hedge Index. You should check out Upslope Capital’s top 5 stock picks for investors to buy right now, which could be the biggest winners of the stock market crash.

In the said letter, Upslope Capital highlighted a few stocks and Ritchie Bros Auctioneers Inc (NYSE:RBA) is one of them. Ritchie Bros Auctioneers Inc (NYSE:RBA) operates the world's leading marketplace for heavy equipment. Year-to-date, Ritchie Bros Auctioneers Inc (NYSE:RBA) stock gained 4.4% and on July 21st it had a closing price of $42.69.

NET MARGIN ABOUT 12%

1% CAPITAL

RBA 200 day moving average buy!RBA has had quite a few big swings! recently, RBA has bounced off 200 day MVA and I am trading for a bounce!

My indicator is barely in the green zone which shows that the overall trend is still bullish but barely (haha pun) ....

If RBA bounces from here, could see big profits ahead.